If there was a simple way to earn returns that are higher than the inflation rate everyone would have flocked to it. FDs, done in the safest banks, give interest rates that are almost the same as inflation rates. The reason one earns higher-than-FD returns is that there is a higher risk. Therefore, in investing, risk cannot be avoided but has to be managed. From amongst the choices available to retail investors, equity is the preferred asset class.

Why Equity?

Equity is one asset class that has beaten inflation hollow. Nifty, a benchmark for equity performance, has delivered a return of ~13% CAGR from 1994 to 2020 versus 7% CAGR inflation.

Investing in equity for longer periods of time ensures you earn inflation-beating returns with near certainty. When you invest for 10 years then on 9 out of 10 occasions, Equity raced ahead of inflation. The margin of the beat was also higher, which more than compensated a year when it didn’t beat.

However, good returns from equity are not guaranteed but success in stock/equity investing can be achieved by following a good process with discipline.

What is one rule a retail investor should follow?

Stay invested, earn inflation-beating returns and let the power of compounding work for you.

Why? Because One lac invested will grow to 30 lacs in 30 years at 12% returns while kept in a Fixed Deposit giving 6% interest it will become less than 6 lacs.

Higher returns can create wealth faster…only on paper

Yes, higher returns can grow the savings faster, but that’s on paper. In real life, high returns come with higher risks and withstanding deeper than market corrections from time to time. Retail investors beginning their investment journey can neither afford this kind of drop in their savings nor do they have the temperament to handle this kind of risk. So they will not be able to stay invested in a high-risk-high return portfolio.

And losing money as you begin investing can damage your confidence to invest in equity and put a premature end to it or cause you to invest less than what you can and should. And that will be a big loss.

What are the benefits of investing in Stocks?

Investing in individual stocks gives you a higher level of control over your portfolio as you can enter and exit a stock at will unlike a mutual fund. Done properly you would be invested in fewer stocks than a typical mutual fund thus earning higher returns. Since you are in control, there are no additional overheads like fund manager fees. Finally, your decisions are not impacted by external factors as is the case in a Mutual Fund, e.g. redemption pressure, large inflows, fund manager exit, etc.

Key benefits of investing in Stocks | |

| Flexibility and Control | 1. Higher control over the portfolio. 2. Can allocate more to a few stocks where investor/advisor has conviction. 3. Decisions not impacted by external factors as in an MF eg large inflows, redemption pressure, fund manager exit, etc. |

| Lesser Cost | Lower overall cost compared to mutual funds. 1. No fund manager expenses. 2. Lower churn. Can enter and exit without impact cost (adverse impact on price) usually faced when order sizes are large |

Key Challenges | |

1. Risk of capital loss 2. Stock prices are extremely volatile in the short term leading to irrational investor behaviour | |

How to invest in stocks and ensure success?

As stated earlier, success in stock investing is best assured when you stay invested for long and earn inflation-beating returns?

Here’s how you can do it: Build a diversified portfolio of quality stocks bought at reasonable prices.

Why? Because Diversified Portfolio, Quality Stocks and Reasonable Prices

- Reduce the extent of fall when the market corrects thereby minimising the chances of you getting anxious and making the mistake of exiting at the wrong time. In short, it is your best bet for staying invested.

- Enables you to earn healthy-high returns compounded over the duration of your investment.

How? Let’s start with how to identify quality stocks

Quality stock essentially means a quality company; a company that has a great business – a business that is capable of earning high profits consistently.

Great businesses have one essential characteristic and that is they have a Sustainable Moat. In the olden days, a castle used to be protected by a moat—a wide channel dug around a castle and filled with water. Wider the moat, the more difficult it was for enemies to enter and capture the castle.

For you, the castle is a company you want to invest in. And, the moat is A sustainable competitive edge that protects the company from the competition and tough economic conditions! During tough times, companies fight harder to win customers, which usually leads to a fall in prices, and thus, margins. Only a company with a wide, unbreachable moat— a competitive edge— can maintain and grow its profits even during tough economic conditions.

Is there a way to confirm if a company has a sustainable moat?

Yes. If a company has a sustainable moat it should be able to deliver healthy profits consistently. So look at its financial track record over 10 years. Why 10 years? Because, over a 10-year period, the company is likely to have experienced one full economic cycle—good & bad times; growth and recession. A business does not do well over a 10—year period just by accident! A company which has performed well over a 10-year period is most likely to have a moat.

What is a quick and effective way of shortlisting companies with a good financial track record?

Yes. Look at the returns it generates on the capital it is using; ROCE-Return on Capital Employed and whether is it generating Free Cash Flows ie the surplus money it generates for its shareholders.

Essentially every company uses capital (shareholders’ money and borrowings) to generate profits and therefore it is critical to check ROCE to know how well or efficiently it does this.

In addition to generating good ROCE, a quality company must generate Free Cash. From the Cash, it generates from its current business (Operating Cash Flow) a company may choose to invest money for future growth or require to do so. When it invests more money than it generates from its operations it is consuming cash (not generating it).

When you check a company on these two parameters over a longer period say 10 years and you see that in most years it has performed well then you can be sure that you have found a very efficiently run profitable company. This serves as a very good filter to identify investment-worthy companies.

In addition to this if you see that the sales of the company are growing then you have an efficient company that is growing; making it a very good quality company to invest in.

To learn more about this and the 5 most important financial ratios that help you identify a quality company stock with conviction read this blog: How to Choose Good Stocks: Check for Excellent Financial Track Record

What else is essential to qualify as a great business worth investing in?

In addition to a sustainable moat and its excellent track record, one more thing is essential: A Respectable Management-someone you can trust. You wouldn’t want to invest in a company whose management is infamous for giving false information, arrogance with minority shareholders, insider trading, or paying too much to themselves. You need to look for companies with a track record of good corporate governance, board credentials, transparency, and integrity.

Why is it important to buy a quality stock at a Reasonable Price?

For two reasons;

- If the market corrects, expensive stocks tend to correct more sharply as investors book profits. Also, quality stocks that face a problem, even a short-term problem corrects sharply if it is expensive. Both these situations are painful and investors can end up exiting the stock and earning mediocre to poor returns.

- Your return depends on it. Buying expensive could and mostly does lead to a situation where the stock underperforms in the medium term. And should you require money in this period you may sell them and earn mediocre to poor returns?

In contrast, when you buy a quality stock at a reasonable price you are less likely to see sharp corrections in your portfolio.

What is a Reasonable Price? How do you assess it?

Reasonable price may seem subjective and it does depend on how you make the assessment. However, an investor would consider a stock to be reasonably priced if the chances of earning the expected returns are high. So, if you expect to earn 15% CAGR then you need the price to rise at 15% CAGR and you need an assessment of whether the stock is likely to do so.

There are two basic methods used to arrive at a valuation to answer this;

- Relative Valuation which as the name suggests is a valuation based on a comparison with others eg similar companies, peers, etc, and even with the stock’s historical prices. Comparing absolute prices does not make sense as the stock’s value changes with the performance of the company. Therefore, valuation ratios such as P/E, P/B, P/Sales, EV/EBITDA, etc are used. For example, if a stock is trading at 50 and if it's earning per share, EPS is 5 then its P/E is 10. We then compare the P/E of similar companies, industries to assess whether it appears reasonably priced. If in the future its EPS increases to 10, and it is the price is 100 then as its P/E is still 10 (no change) we can conclude that the current price is in line with its historical value based on its P/E. This means that the stock price has risen at the same rate as the company’s earnings. If a stock price rises faster than the earning growth then over time it will be in the over-valued region.

- Intrinsic Valuation: In contrast to Relative valuation this method of valuation is based on estimating the absolute value of the company based on the current value of the cash flows it will generate in the future (estimated). This is done by an experienced Equity Research Analyst. So, a price close to the Intrinsic Value would be considered reasonable. For more information read (revised blog on MRP).

Both methods have their advantages and it helps to know both. Usually, if the future of the company is quite different from its past then knowing its Intrinsic Value is important to arrive at a reasonable price to pay. Also when you want to invest a large sum of money knowing both will definitely help you make better decisions and any fees you pay (very likely you will need to for unbiased advice) is likely too small (say about 1% or less of the amount you invest) and well worth it.

When you find a quality company that is fair or under-valued should you invest in it right away?

As a long-term investment, the answer is usually yes. However, we are all affected by what happens to the stock price once we buy a stock. If it falls, we get disappointed, maybe even self-critical about our decision. It’s natural and only seasoned investors can ignore it.

So, is there a way to assess whether you should act right away or wait?

Well, there is no way to do this that is 100% accurate. In the short term, the price of a stock depends on the supply i.e how many people are willing to sell at that price, and demand i.e how many are willing to buy at that price. When supply is higher than demand on a particular day the price falls and vice versa. Now, if this continues to happen in the subsequent days (when the prices are lower) then we will see a downward trend.

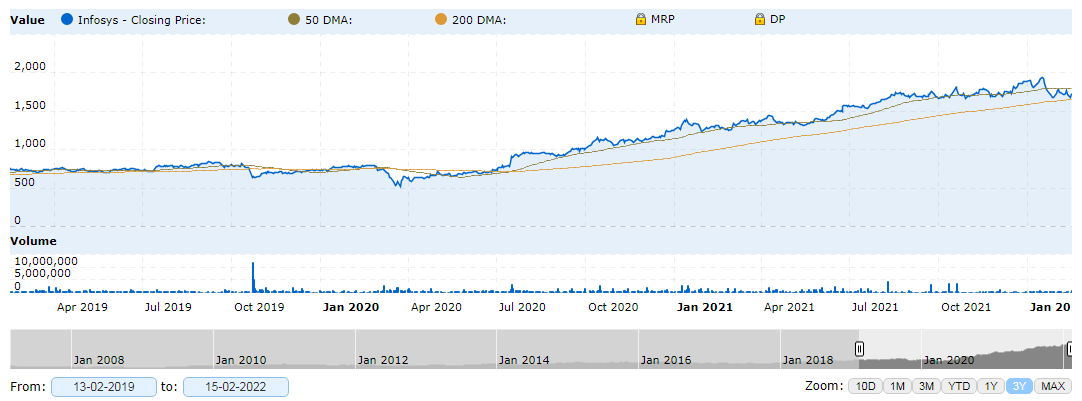

Of course, it is seldom a clear fall or rises day after day, every day and hence a moving average of a certain number of days is used to determine the trend. Short periods averages are not useful for an investor as it is still very erratic since it is strongly affected by a single day’s price. You want a clear trend that is smoother and a change that is more definitive. To take an informed decision on when to buy (or sell) 50 and 200 Days Moving Average, dma lines are useful for long-term investors.

How does the 50 and 200 dma lines help take better decisions?

The 200 dma is a slow-changing line as it is the average of prices on 200 trading days or 40 weeks. The 50 dma is relatively faster moving as it is an average over 50 days or 10 weeks. The relative positions of these two lines help us take better timing decisions though it may not be right 100% of the time.

When the 50dma lines cross the 200dma from below i.e. the prices in the more recent times are moving upwards faster than in the less recent past and hence the trend is likely to have become bullish and prices likely to rise. This is called the Golden Cross. Now if you have a quality stock that was fair to under-valued, it is likely that the prices will rise and hence you should consider making your investment right away.

If the 50 dma line crosses the 200 dma line from above (called Death Cross), it indicates a turn to the bearish side and prices are likely to fall. Here you are better off waiting as you may get a better bargain.

The trends shown by these two lines is more definitive than others but not always. In general, if the 50dma line is above the 200 dma then the ‘short’ term shows a rising price, the presence of momentum and hence you are better off taking action rather than waiting.

With this, we have completed how to identify a quality stock, assess whether it is fair/undervalued and whether you should buy now or wait for a better price.

But where will you find all the information, analysis, and tools to implement this?

MoneyWorks4me DeciZen is available to you to implement this. Just Download the app/register and you have access to everything required to make informed decisions based on the above.

It’s FREE.

See the video right now and in less than 3 minutes you understand how to use it.

[embed]https://youtu.be/6VLbrwXuC_w[/embed]

You get everything to answer the 3 essential investor questions as described above;

- Should you consider investing in a stock? You get an assessment of Quality

- How attractive is the current price? You get an assessment of its Valuation (Relative valuation over 10 years data) that tells us whether it is Under-valued, Fair valued, or Over-valued.

- Should you act now or wait? You get the Price Trend that tells you whether the ‘short-term’ price movement is Strong-buy now, Semi Strong- start buying but slowly and Weak – wait for a better price.

And more in terms of 10year X-ray, recent performance, valuation, and price charts. And these assessments are integrated into our Screener, various lists of stocks, watchlists, etc adding tremendous value in helping you make better-informed decisions with ease.

You can Download App Now

Quick Summary: Your goal of investing is to grow your saving at a faster-than-inflation rate over a long period of time because then the power of compounding will work wonders for you. Towards this, you have learned how to select quality stocks and invest in them at a reasonable price and at a suitable time.

In addition to this, you need to know how to build a diversified portfolio.

What is a diversified portfolio and why do you need it?

Suppose all your saving were only in stock/equity, are for some reason the market corrects and remains down for some time. In this scenario, your portfolio will correct sharply. But what if you need money to fund an important goal e.g. marriage during this period? You will be forced to sell some of your stocks at low prices and all the effort and discipline of investing, maybe of a few years will go waste. So, you need to spread your investments in different asset classes like equity, Debt, Gold, etc, and not put everything in equity even though it delivers the highest returns. This is one level of diversification and is called Asset Allocation.

Asset allocation is based on your risk profile and your financial plan (when do you need money in the future and how much). If most of your financial goals are more than 10 years in the future you could have a higher allocation to equity. But a good thumb rule is to invest only that money which you certainly don’t need in the next 5 years.

Why do you need a diversified stock portfolio too?

To reduce risks.

Suppose you select all the stocks which are very similar eg. all IT stock then you run the risk of poor or mediocre returns in case something goes wrong for this sector; say a US policy on visas that is detrimental to the growth of Indian IT companies.

Or if you are heavily invested in small-cap companies and the economy faces a problem and the growth slows down significantly. Chances are that if the market corrects the correction will be sharp in small-cap companies. Your portfolio will also correct very sharply and may not recover fast enough. This may cause you more pain than you anticipated and can handle leading you to exit or trim your stock portfolio at the wrong time.

Or if you build a stock portfolio with only 10 stocks, what is called a concentrated portfolio then you have a lot riding on each one of them and if any or few of them were to correct for whatever reason, you will face a sharp fall in your total portfolio. Can you handle this kind of volatility? Few can.

So how many stocks will ensure good diversification?

Volatility (the rate at which the portfolio value increases or decreases in a given period) reduces to a large extent, when a portfolio has 16 stocks, and having more than 32 stocks doesn’t materially reduce the volatility any further. So, investors must hold somewhere in the range of 16-32 stocks to get the maximum possible benefit of diversification.

And how much in each stock?

A portfolio with 16 stocks means an average of 6.25% in each stock with 32 stocks the average will be about 3%. So a good thumb rule to follow is to invest a minimum of 3% when you decide to add a stock to your portfolio and if you have high conviction thanks to the quality of the company you can invest 5 to 7% in the stock.

You can read more on this here: How many stocks to own in a portfolio?

When doing this you should ensure your exposure to a particular sector is not more than 25%.

But how do you construct a good portfolio?

Portfolio construction is as important as selecting the right stocks. Picking the right stocks is just half the battle, the other half is how to choose the mix. While there are different ways of constructing a portfolio you have to choose one that suits you the best.

Retail investors can successfully and reliably grow their savings to meet financial goals by Staying invested, earning inflation-beating, healthy returns, and letting compounding do its magic.

The primary reason why retail investors don’t stay invested is that they lose confidence when their portfolio falls sharply when the market corrects. This is amplified when their portfolio is heavily loaded with stocks that are volatile and/or correct sharply when the company performance, economy, or market falters even if it is only for the short term.

On the other hand, investors hold only large-company stocks to avoid risk and miss the opportunity of enhancing returns through high growth good-quality smaller companies.

A good thumb rule to follow is to invest about 65% in quality large-cap stocks and 35% in quality mid and small-cap stocks. A well-constructed and well-managed portfolio based on this enables you to enjoy the best of both – a strong stable portfolio that can earn high returns.

How does MoneyWorks4me help in all this?

Through Alpha, MoneyWorks4me enables you to build and manage your portfolio systematically.

Here’s how! Alpha enables you to

- Find the best stocks to invest in and start building your portfolio right away

- Benefit from new opportunities in your chosen universe or set of stocks without having to set alerts

- Sell stocks from your portfolio that may not deliver good returns in the future

- Manage the risk in your portfolio better

Through its Screener, it helps you find the best stocks to invest in right away and as and when new opportunities arise.

The MoneyWorks4Me Screener has a unique and powerful screening parameter built into it – the MoneyWorks4Me DeciZen Ratings. As mentioned earlier, every stock has been rated on Quality, Valuation, and Price Trend to answer the 3 essential stock-investing questions. And based on this they are also assigned an overall rating on a 5-stars scale.

So all you need to do is select the universe you want to explore- Indices, Sector, Industry, and Market Cap and then select the DeciZen Parameters to shortlist the best ones. For Example, you could choose the Nifty 100 index for large-cap stocks and select in DeciZen an Overall rating of 4 and above. You could further shortlist this by selecting Under-value and Fair valued stocks under Valuation. Check the list and select the ones you want to study further and add them to your watchlist.

Or you could simply select Best From Nifty 100 and get the list of the best stocks to invest in right away. And when new opportunities arise eg a stock moves from a 3-star rating to 4 stars because it is now under-valued, you get an alert so you can act on this. So, you can build your portfolio when high-quality stocks in your chosen universe are available at an attractive price.

You could do this for any set of stocks you are interested in. You want to choose the best banks, IT stocks, Pharma or Auto stocks, select the sector or industry and apply the DeciZen Rating Screens and you have a shortlist of the best ones. Study further and build your portfolio.

How does Alpha help you manage your portfolio systematically for better returns?

With Alpha, every stock in your portfolio carries the DeciZen parameters color-codes and star ratings. So, when you check your portfolio you will be able to zoom into stocks that need to be reviewed. For example, if you bought stocks with 4+ star ratings then any stock with 3 stars needs to be looked at. If you bought when stocks were under or fair valued then any stock which has moved to somewhat over-valued or over-valued, ie. The red color needs to be reviewed.

In addition, Alpha will alert you when a stock in your portfolio is clearly over-valued and you need to consider selling. You can take a better decision looking at the Price Trend and if it is strong you could wait for a better price before selling. Or sell, partly or fully when the stock moves to Over-valued and the Price Trend is Weak. By selling over-valued stocks and buying under-valued good quality stocks you can enhance the returns earned.

How does Alpha help you manage your Portfolio Risks better?

As a subscriber of Alpha, you get the portfolio analysis on a real-time basis. You can see the stock-related risks and portfolio-related risks that you are carrying and make changes to manage risk better and have a well-diversified portfolio.

All this at an unbelievably small fee.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: