Ravi Dharamshi is a distinguished investor and the Founder, Managing Director, and Chief Investment Officer of ValueQuest Investment Advisors, a boutique SEBI-registered portfolio management firm in India. With over two decades of expertise in equity investing, he is renowned for identifying high-quality businesses with strong potential for long-term growth.

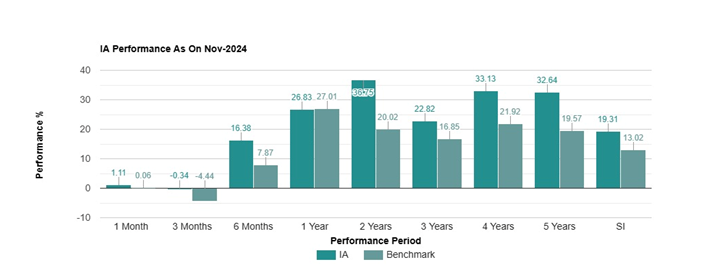

Before founding ValueQuest in 2007, Ravi Dharamshi honed his skills at Rare Enterprises, where he worked as an Analyst under the mentorship of legendary investor Rakesh Jhunjhunwala from 2003 to 2007. His journey exemplifies a deep commitment to investing and a relentless pursuit of creating wealth for his clients. Under his leadership, ValueQuest has consistently demonstrated exceptional performance. The firm’s flagship VQ Growth Fund has delivered an impressive annualized return of 19.31% since its inception in October 2010, significantly outperforming the S&P BSE 500 TRI, which returned 13.02% over the same period. This success reflects ValueQuest’s disciplined research-driven approach and commitment to excellence.

Source: APMI

In his insightful presentation, ‘Analysing competitive advantages with Mr. Ravi Dharamshi’, delivered to the Finnacle Institute, Mr. Dharamshi shared valuable lessons from his successful investing career. This blog is structured in three parts: Part 1 will introduce ValueQuest’s S.C.A.L.E framework, Part 2 will explore the key drivers of wealth creation and ValueQuest’s rigorous research process, and Part 3 will reflect on why investing is simple, but not easy.

Let’s dive into Part 2!

What matters in Wealth Creation?

A differentiated time horizon is a crucial factor in wealth creation, as it enables investors to focus on long-term value rather than short-term volatility. Most brokerages and financial news channels prioritize short-term metrics, such as daily price movements, sentiments or quarterly and one-year forward earnings estimates. While these data points may be immediately relevant, they often fail to capture the deeper, more enduring factors that drive a business's true value. This narrow focus can lead to reactive decision-making and missed opportunities for sustainable wealth creation.

At ValueQuest, the investment philosophy emphasizes a longer-term perspective, which aligns with the dynamics of real business growth. This approach begins by analyzing industry cycles and competitive positioning over a 3-year horizon. This timeframe allows for a deeper understanding of structural trends, market share shifts, and how companies respond to changing economic and industry conditions. It helps identify businesses with the resilience and adaptability to thrive in evolving environments.

The focus extends further to assess return on invested capital (ROIC) and the sustainability of competitive moats over a 5-year period. This medium-term analysis evaluates how effectively a company allocates capital and whether its competitive advantages—such as cost leadership, branding, or intellectual property—can withstand pressures from competitors or market disruptions.

Beyond 5 years, ValueQuest considers the people and culture driving the business, as these elements shape a company’s ability to innovate, adapt, and maintain ethical and sustainable practices over decades. Leadership quality, organizational culture, and alignment with long-term goals are critical for compounding value over time.

By adopting a differentiated time horizon, ValueQuest identifies businesses capable of delivering sustainable, long-term wealth creation. This disciplined approach avoids the noise of short-term market fluctuations and focuses on the fundamental drivers of enduring success.

Avoiding Noise to Drive Long-Term Wealth Creation

The ValueQuest framework is not only defined by what it focuses on but also by what it consciously avoids. The team deliberately steers clear of areas such as market timing, macroeconomic forecasting, momentum trades, and flavour-of-the-season industries. While these strategies may yield profits for some, they often involve high levels of speculation, short-term decision-making, and exposure to unpredictable risks, making it unfavourable for ValueQuest.

Market timing, for instance, requires predicting short-term price movements—a notoriously challenging endeavor given the unpredictability of market behavior. Similarly, macroeconomic forecasting, which involves anticipating economic or geopolitical trends, can be fraught with uncertainty and is often influenced by factors beyond the control of individual businesses.

The framework also avoids momentum trades, which rely on chasing stocks with upward price trends. While this approach may work in certain market conditions, it often involves buying into overvalued stocks and can result in sharp losses when momentum shifts. Lastly, flavour-of-the-season industries—those that temporarily gain popularity due to hype or speculative interest—may lack the fundamental strength or sustainability needed for long-term wealth creation.

By excluding these areas, ValueQuest ensures that its investment philosophy remains disciplined and focused on what it does best: identifying high-quality businesses with strong fundamentals, sustainable moats, and long-term growth potential. This approach minimizes distractions from market noise, enabling the team to concentrate its efforts on creating enduring value for its investors. The clarity of focus is a cornerstone of ValueQuest’s success in delivering consistent, long-term wealth creation.

The Four Step Research Process

Connecting the Dots

While many investors categorize themselves as value or growth investors, ValueQuest purposefully defines itself as an opportunistic investor, deliberately avoiding rigid labels. The firm does not subscribe strictly to a bottom-up or top-down investment approach; instead, it blends both methods to capture opportunities from multiple angles.

ValueQuest builds its investment strategy around a thematic view, identifying broad market trends, but its true focus lies in understanding individual companies at a granular level. The firm employs a combination of annual report analysis, on-the-ground scuttlebutt, and competitive analysis to gain a comprehensive understanding of each business. This in-depth, research-driven approach ensures that ValueQuest has a solid grasp of the company's strengths, weaknesses, and growth potential.

What sets ValueQuest apart is its ability to monitor slow, incremental changes within businesses that others might overlook or consider immaterial. These subtle shifts—such as corporate actions, management changes, or policy updates—can serve as important triggers for future growth or value realization. By focusing on these often-missed indicators, ValueQuest is able to spot opportunities before they become apparent to the broader market.

Filter

The success of any investment is closely tied to the quality of the business and its management. While quality is inherently subjective and varies based on an investor’s perspective, it can be assessed by examining how customers value the company’s products or services. If customers are willingly overpaying for what the business offers, it often signals a strong, high-quality offering that resonates in the market.

An investor’s circle of competence refers to areas where they have knowledge and expertise. However, understanding this circle also means recognizing blind spots—areas where one mistakenly believes they have expertise when they do not. These blind spots can lead to poor decision-making, so investors should avoid sectors where they lack understanding to mitigate unnecessary risks and ensure more informed, confident decisions.

In evaluating investments, it is crucial to identify deal breakers—factors like unethical behavior, poor management, or a weak competitive position. Actively seeking disconfirming evidence that challenges one’s initial investment thesis is key to avoiding biases and making objective decisions. If compelling evidence undermines the investment case, it signals the need to reassess or abandon the opportunity, protecting investors from potential losses.

Investing in businesses with a competitive advantage or unique market positioning is fundamental to long-term success. Companies with sustainable advantages, such as intellectual property or strong brand loyalty, are better positioned to maintain their leadership.

Investigate

A solid investment decision starts with desk research, which provides a historical perspective on the business, industry, and market dynamics. By analyzing past performance, trends, and key events, investors can gain valuable insights into the company’s growth trajectory and its balance sheet strength. While desk research offers valuable insights, it’s crucial to supplement it with a 360-degree approach. This means gathering information from multiple sources, such as talking to industry experts, customers, suppliers, and employees to create a more accurate, on-the-ground understanding of the business and its competitive positioning. This comprehensive perspective allows investors to spot risks or opportunities that might not be captured through financial statements alone.

It’s essential to connect narratives to numbers. A compelling story about a business can be persuasive, but the numbers validate the story. By linking qualitative insights from research and interviews with quantitative data like financial metrics, margins, and growth rates, investors can assess whether the narrative aligns with the company’s actual performance. This connection helps to avoid getting caught up in hype or wishful thinking and leads to more objective decision-making.

Lastly, the principle of inversion encourages investors to consider the opposite of their thesis—what if the investment is wrong? By actively seeking evidence or scenarios that could undermine their investment thesis, investors can identify weaknesses in their research or even weaknesses in the investment. Inversion helps investors avoid risks.

Risk-Reward

When evaluating an investment, understanding the risk-reward ratio is paramount. This means weighing the potential gains against the potential losses. Ideally, investors aim for investments where the potential upside significantly outweighs the downside.

A crucial aspect of successful investing is identifying areas where the market is wrong or unaware of certain opportunities. This is often achieved by leveraging variant perception—having a different view on a business or industry compared to the consensus. By conducting thorough research, investors can uncover insights or trends that others might have overlooked. Additionally, a long-term time horizon is essential for recognizing opportunities that others may dismiss in the short term, allowing investors to capitalize on market mispricing that might take years to materialize.

The concept of margin of safety is a core principle in investing. It refers to purchasing a stock or asset at a price below its intrinsic value, providing a cushion against errors in judgment or unforeseen market downturns. This reduces the likelihood of capital loss because the investment has been made with a built-in buffer. A higher margin of safety reduces the risk of losing capital, especially in uncertain or volatile market conditions.

Asymmetric risk-reward describes investments where the potential for gains far exceeds the potential for losses. This kind of investment offers a high reward with low risk, meaning that the probability of experiencing significant losses is small compared to the probability of generating substantial returns. This is an ideal scenario for investors, as it maximizes the upside while limiting the downside, creating a favorable environment for wealth generation.

It’s essential to determine how much of the narrative or story behind a business is already reflected in the price. A compelling story is valuable, but if the market has priced it in, the potential for future gains diminishes. Investors need to ensure that the underlying value and growth prospects are not fully captured by the current market price, leaving room for upside.

Conclusion

Successful investing demands a disciplined approach that integrates deep research, critical thinking, and emotional resilience. The ValueQuest philosophy emphasizes the importance of a differentiated time horizon, focusing on long-term value creation rather than succumbing to short-term market noise. By avoiding speculative strategies such as market timing and momentum trades, ValueQuest remains committed to identifying high-quality businesses with sustainable competitive advantages. The S.C.A.L.E framework, combined with a robust research process, demonstrates the value of blending thematic perspectives with a granular understanding of individual companies. Ultimately, investing is as much an art as it is a science—simple in principle but challenging in execution. Success lies in maintaining conviction, thinking like an owner, and adhering to the timeless tenets of good business, good management, and good value.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: