Last month, the team from MoneyWorks4Me attended a presentation by members of the Adani Group to discuss the history and future of the group. The vision of the group, combined by their executional prowess were noteworthy.

The group believes that the major hurdle to India’s growth is the lack of infrastructure to support a consumer-oriented economy. Apart from the top percentiles, India’s demographics are non-discretionary consumers of infrastructure and its related services. Their goal is to provide basic services to the greatest number of people in an affordable manner. Infrastructure is viewed as the platform for the growth of the economy. This is reflected in the group’s portfolio which consists of 85% of core infrastructure business and 7% cement. All the businesses, barring cement, have been developed organically by the company through their flagship company, Adani Enterprises. The company is also foraying into the metals business through Kutch Copper, which will begin operations in the first quarter of FY25.

Adani Enterprises is viewed by the group as an incubator of new businesses rather than merely a business in itself. While Adani Enterprises was the first company in the group, it has created ‘EBITDA Unicorns’ such as Adani Power and Adani Ports & Special Economic Zone, while creating new ones like Adani Green Energy, and Adani Energy Solutions. The number of profitable new ventures created by them rivals those created by venture capitalists in terms of profitability as well as the overall impact on the economy.

The impact of the Adani Group on India’s economy and growth are noteworthy. Adani group led the infrastructure developments to allow cape-size vessels to dock in India. As a result, a larger amount of trade was routed directly to Indian ports which increased India’s share in the global maritime trade. This increase in trade was subsequently followed by infrastructural developments in logistics to support the increase in volume, which shows the exponential impact of infrastructure development. The company’s infrastructure development also takes the internet economy into consideration, which and it owns India’s largest industrial cloud business in partnership with Google.

The group’s ambitions have not dimmed despite the tremendous industry-leading growth rates and continues to pursue ambitious goals. The group aims to make Mumbai the first city in the world powered majorly by renewable energy, beating Western counterparts to achieve this status. The company’s portfolio of ports, airports and infrastructure will continue to expand as the group plans to deploy more than Rs. 7 lakh crores over the next 10 years. While the Hindenburg report raised many questions about governance within the group, the clean chit and lack of evidence found by the Supreme Court and SEBI have boosted the confidence of the investment community in the group.

Needless to say the group believes that India’s growth story is reflected in the story of the Adani group.

Check out the analysis of various Adani group companies:

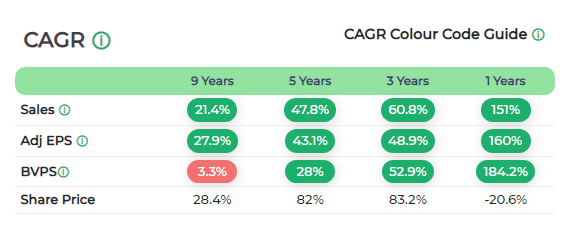

1. Adani Enterprises Ltd

Adani Enterprises is presently focused on businesses related to airports, roads, water management, data centers, solar manufacturing, defense and aerospace, edible oils and foods, mining, integrated resource solutions and integrated agri products.

a. Is Adani Enterprises Ltd a good quality company? The past 10 years' financial track record analysis by Moneyworks4me indicates that Adani Enterprises Ltd is an average-quality company.

b. Is Adani Enterprises Ltd undervalued or overvalued? The key valuation ratios of Adani Enterprises Ltd currently when compared to its past seem to suggest it is in the Somewhat overvalued zone.

c. Is Adani Enterprises Ltd a good buy now?

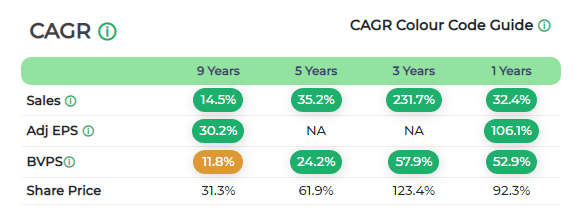

2. Adani Green Energy Ltd

Adani Green Energy is a holding company of several subsidiaries carrying business of renewable power generation within the Group. The Group is primarily involved in renewable power generation and other ancillary and related activities.

a. Is Adani Green Energy Ltd a good quality company? The past 10 years’ financial track record analysis by Moneyworks4me indicates that Adani Green Energy Ltd is a below-average quality company.

b. Is Adani Green Energy Ltd undervalued or overvalued? The key valuation ratios of Adani Green Energy Ltd currently when compared to its past seem to suggest it is in the Fair zone.

c. Is Adani Green Energy Ltd a good buy now?

3. Adani Ports and Special Economic Zone Ltd

The Company is primarily engaged in one business segment, namely developing, operating and maintaining the Ports services, Ports related Infrastructure development activities and development of infrastructure.

a. Is Adani Ports and Special Economic Zone Ltd a good quality company? The past 10 years' financial track record analysis by Moneyworks4me indicates that Adani Ports and Special Economic Zone Ltd is a good quality company.

b. Is Adani Ports and Special Economic Zone Ltd undervalued or overvalued? The key valuation ratios of Adani Ports and Special Economic Zone Ltd currently when compared to its past seem to suggest it is in the Fair zone.

c. Is Adani Ports and Special Economic Zone Ltd a good buy now?

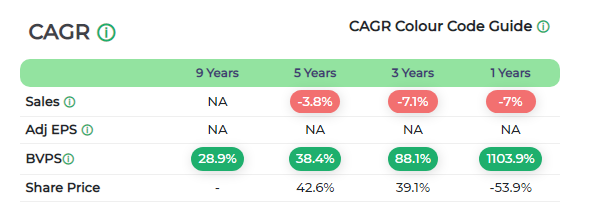

4. Adani Power Ltd

The company is engaged in the business of generation, accumulation, distribution and supply of power and to generally deal in electricity and to explore, develop, generate, accumulate, supply and distribute or to deal in other forms of energy from any source whatsoever.

a. Is Adani Power Ltd a good quality company? The past 10 years' financial track record analysis by Moneyworks4me indicates that Adani Power Ltd is an average-quality company.

b. Is Adani Power Ltd undervalued or overvalued? The key valuation ratios of Adani Power Ltd currently when compared to its past seem to suggest it is in the Somewhat overvalued zone.

c. Is Adani Power Ltd a good buy now?

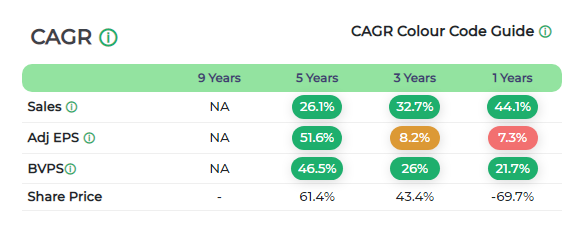

5. Adani Energy Solutions Ltd

The company operates in India's power transmission and distribution sectors. It builds new transmission systems under licensing agreements, maintains existing assets, and focuses on expanding its customer base by providing reliable, affordable power and excellent service. It ventured into retail electricity distribution by acquiring Mumbai's GTD business license, now serving customers through Adani Electricity Mumbai (AEML) in Mumbai suburbs and Thane district.

a. Is Adani Energy Solutions Ltd a good quality company? The past 10 years’ financial track record analysis by Moneyworks4me indicates that Adani Energy Solutions Ltd is a below-average quality company.

b. Is Adani Energy Solutions Ltd undervalued or overvalued? The key valuation ratios of Adani Energy Solutions Ltd currently when compared to its past seem to suggest it is in the Fair zone.

c. Is Adani Energy Solutions Ltd a good buy now?

6. Adani Total Gas Ltd

The company is engaged in the City Gas Distribution (CGD) business and supplies natural gas to domestic, commercial, industrial and vehicle users in various geographical areas.

a. Is Adani Total Gas Ltd a good quality company? The past 10 years’ financial track record analysis by Moneyworks4me indicates that Adani Total Gas Ltd is a below-average quality company.

b. Is Adani Total Gas Ltd undervalued or overvalued? The key valuation ratios of Adani Total Gas Ltd currently when compared to its past seem to suggest it is in the Fair zone.

c. Is Adani Total Gas Ltd a good buy now?

7. Ambuja Cements Ltd

The company is one of the leading cement manufacturing companies in India.

a. Is Ambuja Cements Ltd a good quality company? The past 10 years' financial track record analysis by Moneyworks4me indicates that Ambuja Cements Ltd is a good quality company.

b. Is Ambuja Cements Ltd undervalued or overvalued? The key valuation ratios of Ambuja Cements Ltd currently when compared to its past seem to suggest it is in the Overvalued zone.

c. Is Ambuja Cements Ltd a good buy now?

8. Adani Wilmar Ltd

The company is one of the few large FMCG food companies in India to offer most of the essential kitchen commodities for Indian consumers, including edible oil, wheat flour, rice, pulses and sugar. Its products are offered under a diverse range of brands across a broad price spectrum and cater to different customer groups.

a. Is Adani Wilmar Ltd a good quality company? The past 10 years' financial track record analysis by Moneyworks4me indicates that Adani Wilmar Ltd is a good quality company.

b. Is Adani Wilmar Ltd undervalued or overvalued? The key valuation ratios of Adani Wilmar Ltd currently when compared to its past seem to suggest it is in the Fair zone.

c. Is Adani Wilmar Ltd a good buy now?

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: