Looking to build a portfolio that is all-weather and enables you to meet your financial goals?

For those of us who grew up in places that saw a lot of rain, like Mumbai getting ‘rainy’ shoes every year was a ritual and walking through puddles of water without a care, a joy. But it does not get us all worked up if we don’t have rainy shoes; we managed.

But trying walking or driving in the snow and you realize that without all-weather shoes and tyres you are running a major risk, sometimes even death. More so because the weather changes suddenly, sometimes.

It is no surprise that the idea of an All-weather portfolio is seen as essential by veterans in investing; people who have seen how the ‘weather’ changes so dramatically that it can severely and permanently injure your portfolio.

How do you do this? The answer is asset allocation; invest in different asset classes - equity, debt, and gold. But what asset allocation can make your portfolio all-weather?

The All-weather strategy made famous by Ray Dalio says do 55% US Bonds, 30% Equity, and 15% gold and commodities. I think this does take care of even the worst weather, even calamities, I think. But the trouble with this is that you need to have a lot of money to reach your financial goals let alone financial freedom. It works for the ultra rich who have so much money that they can meet all their goals with very low returns and their top priority is to preserve their capital. It won’t work for you and me. We need to be able to make a large allocation to equity to earn returns that beats inflation by a good solid margin while enjoying the benefits of an all-weather portfolio. At-least much of it.

This is the focus of how we recommend and help you invest successfully. And this lead us to the question: What would be an All-weather stock portfolio look like?

Every experienced equity investor realizes that stocks will go up and down with the market and the All-weather stock portfolio cannot be an exception. What you need is an assurance that even in case of a serious market or economic downturn there is no permanent loss and when the storm blows over your portfolio recovers very fast, faster than the market.

What can give us this assurance? The answer is a portfolio of the most resilient stocks. Resilient means having the ability to bounce back from difficult times, the ability to endure strain without being permanently injured. It implies the ability to recover shape quickly when the deforming force or pressure is removed. Essentially, we are looking for companies and management that have this ability.

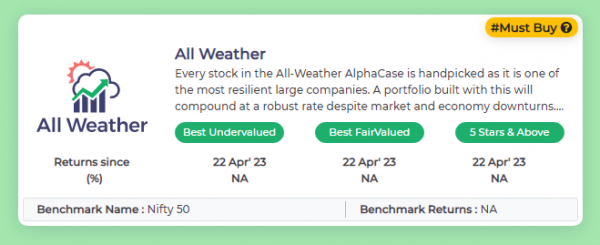

The All-Weather AlphaCase has handpicked stocks that are known for their resilience and to grow robustly in good times. They are all large companies, with very strong brands, proven management capabilities, and long track records of solid performance.

But that’s not all. How you build your portfolio from these stocks is also equally important. As you can guess these stocks could be expensive to very expensive and buying them at high prices adds to the risk of steep correction and make you uncomfortable when you have a higher allocation to equity.

AlphaCases is designed to enable you to invest in these stocks at a reasonable price. It enables you to follow 3 strategies to do this:

All-Weather AlphaCase - Best Undervalued

This AlphaCase identifies the stocks from the All-weather universe that are undervalued by the market; relative to their past based on key relevant valuation ratios. You don’t need to rush into building this portfolio as you will be alerted when these stocks are available at an attractive price at any time in the future. This works best for investors who are comfortable being contrarian and waiting patiently. View more...

All-Weather AlphaCase - Best FairValued

As the name suggests this AlphaCase variant enables you to build your portfolio when the market offers these stocks at a fair price and is likely to go up. This is suitable for investors who prefer to not go against the market and are comfortable to pay a fair price. View more...

All-Weather AlphaCase - Five Stars & Above

The Five Stars & Above AlphaCase portfolio enable you to invest in all-weather stocks when the combination of valuation and Price Trend is in favour. This leads to buying when an undervalued stock has started to move up and fair-valued stocks are clearly showing signs of a strong upward movement. View more...

How many stocks will be available under each strategy will vary from time to time, on the specific company situation, market’s reaction to it, on the overall market sentiments, and finally how much money you have which you have not put to work. With Alpha Stocks you have access to the 3 variants, so you can check and decide what to invest in.

View All Weather Stocks - Case Now

Here are answers to some frequently asked questions (FAQs) about Alpha Stocks and the All-Weather AlphaCase

Q 1: What is Alpha-Stocks?

A: AlphaStocks is an intelligent System that enables you to make informed stock-investing decisions. Alpha-Stocks help you build your portfolio with the best opportunities and manage it to earn high returns consistently.

Q 2: How does Alpha-Stocks identify the best opportunities?

A: To invest in the best opportunities you need a way to identify for each stock:

- Quality: Is the stock worth investing in, it is safe to invest in, is the company profitable, can it withstand economic and market cycles? Read more

- Valuation: Is the current price a fair and reasonable price to pay for the stock, are you likely to earn high, medium, or low returns at this price? Read more

- Price Trend: Should you consider acting now or are you better off waiting? Is it more likely that the prices will rise in the near term, remain flat or fall? Read more

Alpha-Stocks uses data-driven analysis and intelligence to answer these 3 questions. It color-codes each stock as Green, Orange or Red. So, every stock on MoneyWorks4me comes with the three tags on QVPT to enable you to make an informed decision.

Q 3: How do you invest successfully using the Alpha-Stocks?

A: Follow this Simple Rule: Invest mostly in Green Quality stocks, when the Valuation is Green or Orange. Buy when the Price Trend changes from Red to Orange and even Green if the stock is not overvalued. Sell when Stocks is fully overvalued and Price Trend changes from Green to Orange or Red. At all other times there is no need to take any action. To find the list of stocks that qualify simply use AlphaCases

Q 4: What are AlphaCases?

A: AlphaCases is an intelligent System available in Alpha-Stocks that provides you with a list of stocks that qualify as an opportunity based on its QVPT rating. There are 27 AlphaCases based on different Index, Sector and Themes. In each Alphacase you can select from 3 powerful investing strategies – Best Undervalued, Best Fairvalued and 5-Stars. All of them enable you to build your portfolio with the best opportunities available now and in the future. Read more.

Q 5: How do you build a portfolio with AlphaCases?

A: You need to build a well-diversified portfolio with 25 to 30 stocks. Select an AlphaCases to build a portfolio of large Cap stocks of strong and resilient companies to ensure stable and steady growth and withstand market and economic cycles. The All-Weather Stocks AlphaCase is designed for this purpose. This should be 50% to 70% of your equity portfolio. The rest you invest in AlphaCases that will help enhance your portfolio returns eg mid, small cap stocks or any sector and theme that you think has a bright future.

Q 6: What is special about the All-weather AlphaCase?

A: All the stocks are handpicked from amongst the high-quality stocks, so they are the best of the best. You can invest in them confidently. It tracks the best resilient large cap stocks and you can build a strong and steadily compounding portfolio with stocks in this AlphaCase. It covers the most important sectors so you will be able to build a well-diversified portfolio over time.

Q 7: Can a beginner use AlphaCases?

A: The system is designed to be easy to use and requires no prior investment experience. Start with the All-Weather Stocks AlphaCase. Read the Pocket Guide to Investing Successfully in Stocks and start. You will find many useful easy-to-use tools that help you make informed investing decisions.

Q 8: Can you SIP in AlphaCases?

A: Yes, AlphaCase works extremely well when you SIP. That’s because every time you SIP you are investing in the set of stocks that pass the criteria on that day. This enables you to build your portfolio with the best quality stocks always bought at reasonable prices. This is a big advantage over buying an Index Fund, ETF or a Mutual Fund where you buy the entire portfolio, where some of the stocks are expensive.

Q 9: How do you get more confidence about investing in a stock that passes QVPT criteria?

A: You should refer to the Company's 10-year X-Ray to see important financial and market-related details. Read more o understand how to interpret the X-Ray.

Q 10: How has AlphaCases performed over the past year?

A: You can see the performance of AlphaCases since its inception for the 3 variant investing Strategies in real-time. You can also see how the relevant Benchmark Index has performed (starting date same as the Best Undervalued Strategy). AlphaCases has outperformed most of the time. For example, Nifty50 has delivered negative 0.7, almost flat, between April 22 to April 23. AlphaCases 3 variants for Nifty50 have delivered 13%, 8 and 4%. The All-weather AlphaCase has been launched a year later and while the performance data is yet to come, we expect it will do even better than the Nifty50 AlphaCase.

If you are interested in having the All-weather AlphaCase and other AlphaCases, invaluable tools for investing successfully visit the Alpha-Stock page and download the Pocket guide.

...Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: