As the New Year begins, marking the start of the tax-saving period, taxpayers often explore options under Section 80C of the Income Tax Act for investment options, offering up to ? 1.5 lakh tax deductions during the financial year. Equity Linked Savings Schemes (ELSS), a type of tax-saving mutual fund, is one of the best options and viable choices for many investors. They not only provide tax benefits under Section 80C but also have the potential for higher returns compared to usual options like PPF or NSC, despite relatively higher risk due to equity exposure. With a shorter lock-in period of three years, ELSS funds offer earlier access to funds, but it's crucial to have a longer investment perspective. Equity investing is a long-term game; it is advisable to invest for five to seven years, for substantial returns.

What are the best funds for 2024?

We've used specific criteria to pick the best funds: Consistency of outperformance, quality of holdings, and upside potential.

Many funds show consistent performance but don't always outperform their benchmarks. For actively managed funds, beating the benchmark and generating alpha is important. So, we focused on consistency of outperformance rather than just performance.

Instead of just looking at average returns, we evaluated fund performance using 3 to 5-year average rolling returns with various start and end dates. This gives a more comprehensive view.

The quality of holdings is also crucial. Funds with high-quality holdings tend to perform better over time and handle market downturns more effectively.

Finally, upside potential is a key factor. It's important to assess a fund's potential for future performance, especially when investing a large amount. We chose funds with promising upside potential based on their valuations and steered clear of those likely to deliver only mediocre returns.

Following is a list of ten shortlisted ELSS funds for 2024 based on the above-mentioned parameters.

Source: Moneyworks4me

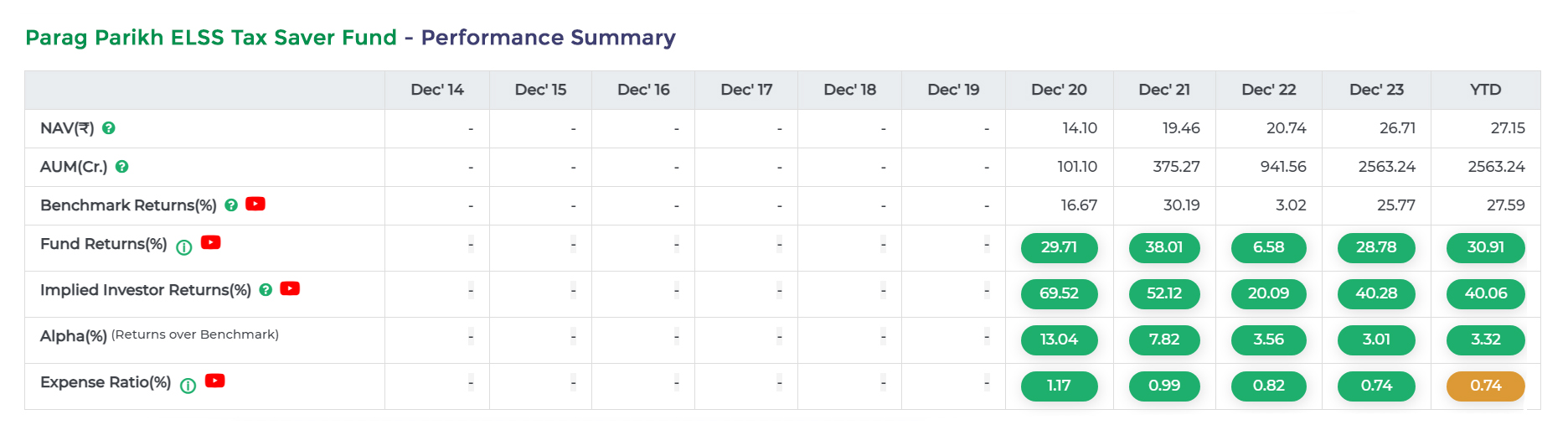

1. Parag Parikh ELSS Tax Saver Fund

Parag Parikh ELSS Tax Saver Fund is launched on 24 Jul 2019. It is Open Ended scheme, managed currently by the fund managers Rajeev Thakkar and Raunak Onkar. The benchmark of the scheme is S&P BSE 500 TRI. The current AUM of the fund is ? 2,563 Cr.

The fund is a blend of large, mid and small-cap. It utilizes a bottom-up approach for its stock selection process. The fund focuses primarily on investing in companies that enjoy strong business models and sustainable competitive advantages over their competitors. This strategy allows the fund a broad flexibility in terms of market capitalization. Although the fund is newer compared to other mentioned funds, it has swiftly grown its AUM over the past year. The portfolio is characterized by its minimal turnover, indicating a stable and confident approach to its holdings.

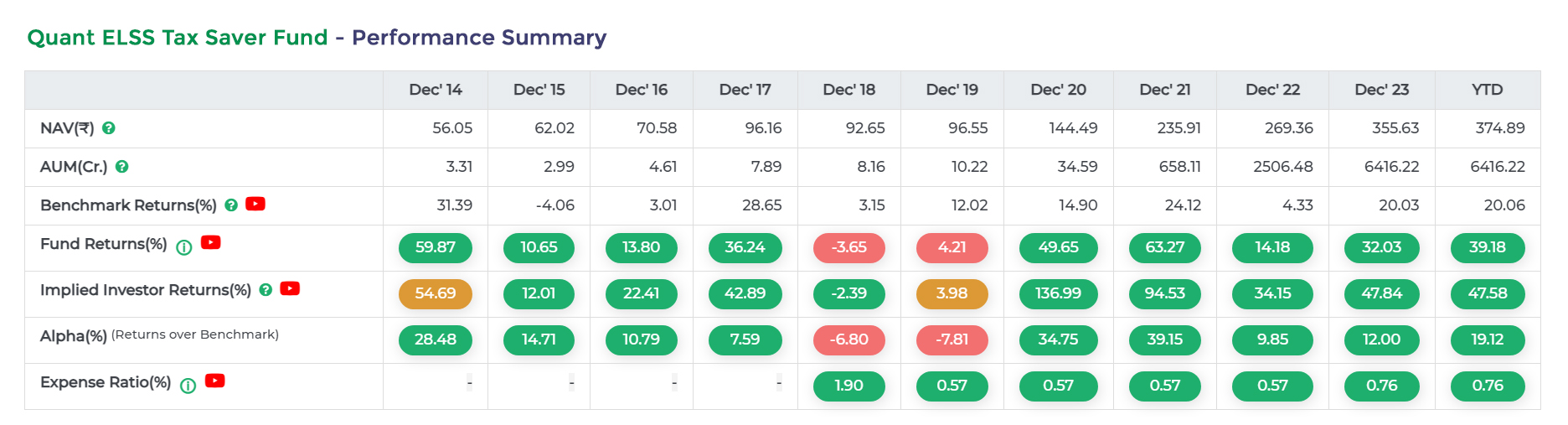

2. Quant ELSS Tax Saver Fund

Quant ELSS Tax Saver Fund is an open-ended scheme, launched on 31 Mar 2000. It is currently managed by Ankit Pande and Vasav Sahgal as the fund managers. The current AUM of the fund is ? 6,416 Cr and the benchmark of the scheme is NIFTY 500 – TRI.

This open-ended scheme managed like a Flexi cap, is designed for long-term investors. It offers benefits like equity participation, the lowest lock-in period, and tax savings under Section 80C. The fund primarily invests in undervalued, high-growth, and less popular companies.

3. Mirae Asset ELSS Tax Saver Fund

Mirae Asset ELSS Tax Saver Fund is an open-ended scheme launched on 28 Dec 2015, with a current AUM of ? 20,431 Cr. The fund is currently managed by the fund manager Neelesh Surana and the Benchmark of the scheme is S&P BSE SENSEX - TRI. The scheme seeks to generate long-term capital appreciation from a diversified portfolio of predominantly equity and equity-related instruments.

4. Bank of India ELSS Tax Saver

Bank of India ELSS Tax Saver fund is launched on 25 Feb 2009, with a current AUM of ? 1,040 Cr. The fund is currently managed by Alok Singh as the fund manager. The benchmark of the scheme is S&P BSE 500 - TRI.

The fund primarily invests in large and midcap opportunities to generate value, with a significant focus on the BFSI sector to capitalize on credit growth. It aims to create a diverse portfolio across various sectors and market capitalizations, focusing on companies with sustainable business models. The fund employs a top-down approach for selecting stocks. However, its high turnover rate compared to similar funds raises concerns about its stability and investment strategy.

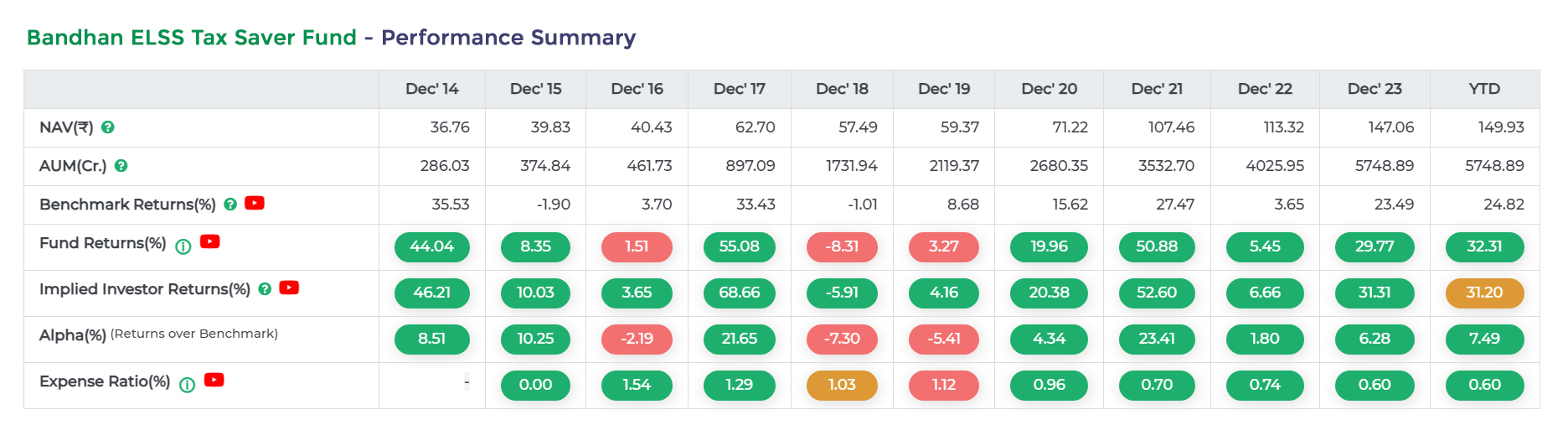

5. Bandhan ELSS Tax Saver Fund

Bandhan ELSS Tax Saver Fund is an Equity - ELSS with an ? 5,749 Cr AUM. It is Open Ended scheme launched on 26 Dec 2008. Currently, Daylynn Pinto as the manager managing the fund. The benchmark of the scheme is S&P BSE 500 - TRI.

The fund follows a "growth at reasonable value" investing strategy. It invests in companies with fundamentally sound business models and long-term sustainable profit growth. The fund is expected to perform well for investors seeking a focused, aggressive portfolio of high-quality companies.

6. DSP ELSS Tax Saver Fund

Introduced on 18 January 2007, the DSP ELSS Tax Saver Fund currently has an AUM of ? 13,583 Cr and is managed by fund managers Rohit Singhania and Charanjit Singh. The fund managers state that the fund isn't restricted to a specific investment strategy, allowing them to capitalize on various market opportunities. This flexibility results in a higher churn ratio compared to many of its peers.

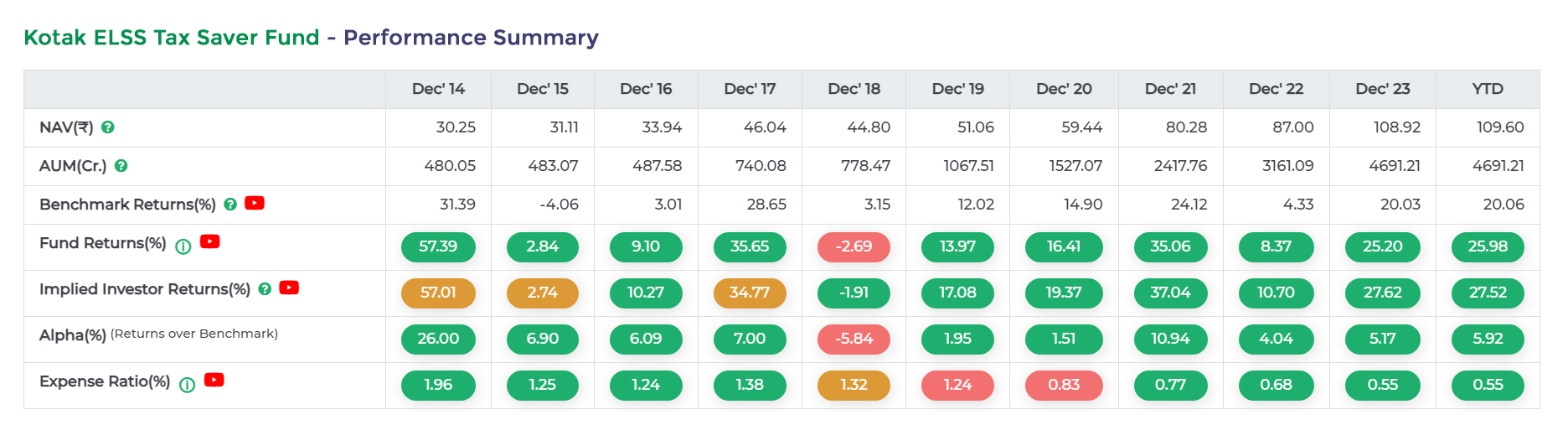

7. Kotak ELSS Tax Saver Fund

Kotak ELSS Tax Saver Fund is an Equity - ELSS with an ? 4,691 Cr AUM. It is an open-ended scheme launched on 23 Nov 2005. The benchmark of the scheme is NIFTY 50 - TRI. Managed by Harsha Upadhyaya, the fund adopts a 'growth at a reasonable price' investment strategy, aiming to benefit from India's economic revival. The fund primarily targets companies likely to experience re-rating, maintaining a large-cap focus with around 70% of its portfolio in large-cap stocks. Its comprehensive investment approach combines bottom-up stock selection and a top-down thematic overlay for identifying potential stock opportunities.

8. Invesco India ELSS Tax Saver Fund

The Invesco India ELSS Tax Saver Fund is an Equity-ELSS fund with an AUM of ? 2,459 crore, which was launched on December 29, 2006. Managed by Amit Nigam and Dhimant Kothari, it benchmarks against the S&P BSE 500 - TRI. The fund employs a bottom-up approach, investing across various market caps and sectors. It aims for a diversified portfolio through stock selection, capitalization bias, and sector allocation. Despite its high turnover due to opportunistic market strategies, the fund has outperformed most peers in its category.

9. Axis ELSS Tax Saver Fund

Axis ELSS Tax Saver Fund is launched on 29 Dec 2009, with a current fund size of ? 34,300 Cr AUM. It is currently managed by the fund managers Shreyash Devalkar and Ashish Naik, benchmarking its performance with NIFTY 50 - TRI.

The Scheme invests in companies with strong growth & a sustainable business model. The core investment philosophy of the fund is to invest in quality businesses and to focus on a steady consistent and long-term portfolio with limited downside risk. The fund is positioned to capitalize on the market cycle of quality businesses.

10. Canara Robeco ELSS Tax Saver

The Canara Robeco ELSS Tax Saver Fund was launched on 31 Mar 1993, currently managed by the fund managers Vishal Mishra and Shridatta Bhandwaldar. It is an open-ended scheme with an AUM of ? 7,033 Cr. The investment emphasis of the scheme is on identifying companies with strong competitive positions in good business and having quality management. The fund consistently outperforms its benchmark, the S&P BSE SENSEX - TRI, in terms of 3-year and 5-year rolling returns.

MoneyWorks4me’s Top Pick:

Parag Parikh ELSS Tax Saver Fund: The current fund portfolio is nicely positioned to benefit from India’s economic recovery cycle. Its comprehensive investment approach of bottom-up stock selection and current portfolio is poised to benefit from private capex, demand recovery and credit growth. We currently prefer this fund over its peers.

However, investment in any of the above funds with an investment horizon of 5-7 years should yield good returns.

For your other needs, you can find recommendations based on your age and other factors - use the Funds4me feature. Armed with comprehensive information, you can make an even better-informed decision.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: