Investors will continue to lose money as long as they believe that good times will continue indefinitely and that the worst times are behind us. The lessons learnt by investors and speculators in 1992, 2000, 2008 and 2018, will be taught and forgotten until the end of time. With the Nifty 50 at an all-time high above 22,000, one may like to understand Mr. Market better.

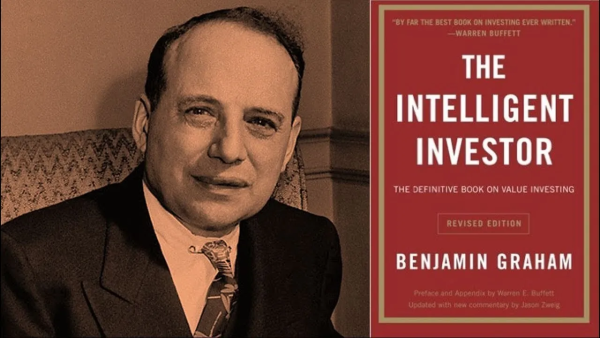

In his book, “The Intelligent Investor’, Graham introduced the concept of "Mr. Market," illustrating the irrational behaviour of the stock market and emphasizing the importance of a disciplined and rational approach to investing.

Benjamin Graham (1894–1976) was a renowned economist, professor, and investor, often referred to as the "father of value investing". Graham is best known for his influential work in the field of finance and investment, particularly through his teachings at Columbia Business School and his classic book, "Security Analysis," co-authored with David Dodd. In addition to this, Benjamin Graham has taught famous students like Warren Buffett, William J. Ruane, Irving Kahn, and Walter J. Schloss.

Source: Medium

Who is Mr Market?

In simple terms, Mr. Market is like a person who offers to buy or sell stocks every day.

Imagine you own a share in a company, and every day Mr. Market comes to you with a price at which he's willing to either buy your share or sell you an additional share. The catch is that Mr. Market is quite emotional and can be influenced by short-term factors like news, rumours and other investors' reactions.

Some days, Mr. Market might be in an optimistic and happy mood, offering you a high price for your share. On those days, it might seem like a good idea to sell. On other days, Mr. Market might be feeling pessimistic and offer a low price. On those days, it might seem like a good opportunity to buy more shares. For example, it’s probably a great idea to ask your father for a new bike when he’s in a good mood, but a terrible idea after India’s loss in the World Cup finals. Smart investors understand that the market’s mood will change on a regular basis and will act accordingly.

Mr. Market, however, is not a real entity, but rather, a collection of the behaviour of market participants. Market participants, as a whole, can therefore be overly euphoric and extremely depressed at different points in time. One must therefore ask the question, what makes Mr. Market manic depressive?

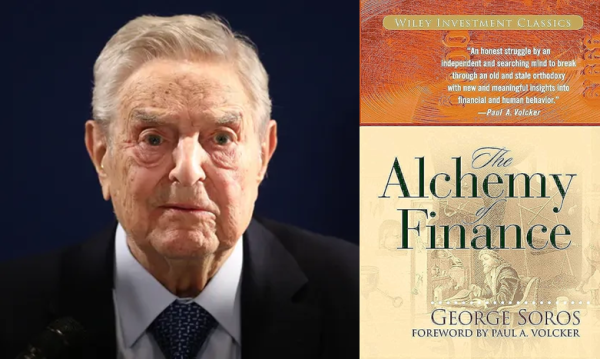

George Soros has tried to answer this questions while refuting the hypothesis that markets are efficient. He argues that markets, due to the dual participative and thinking nature of its participants, often leaves room for inefficiency in markets. Soros gained international fame in 1992 when he made a substantial profit by short selling the British pound, a move that earned him approximately $1 billion and is famously known as "Black Wednesday." He is the founder of Soros Fund Management, a hedge fund he started in 1969, which became one of the most successful in the industry. He explains his thought process in his book, “Alchemy of Finance” and his lectures at the Central European University.

Source: Forbes

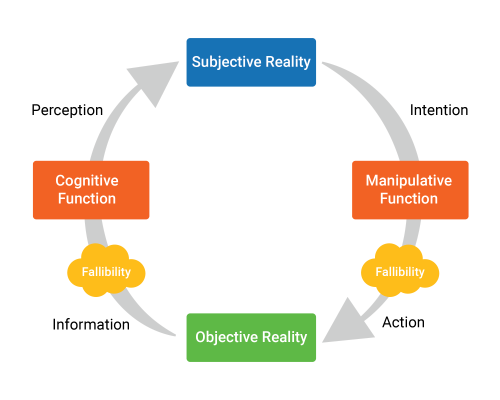

The key tenets of his conceptual framework are as follows:

1. Fallibility: It is the tendency to make mistakes or be wrong. Market participants can be wrong because their view of the world does not perfectly correspond to the actual state of affairs. While participants may gain knowledge of individual facts, they face limitations in formulating their ideas due to biases and inconsistencies in thought. Humans tend to simplify complex problems through the use of generalisations, metaphors and decision rules, which are subjective in nature.

Example: An investor might rely heavily on historical stock performance data and overlook important current market dynamics. This reliance on historical data, without considering potential changes in the economic landscape, is an example of fallibility.

2. Reflexivity: Market participants must both understand the world, and take actions on the basis of their understanding. Because of fallibility, their subjective understandings influence objective reality. This creates real changes. In short, imperfect thought shape real outcomes, which again shape thoughts imperfectly in a circular manner. Unlike physics, market participation lacks independent variables.

Example: If a group of investors collectively believes that a certain stock is undervalued, they may start buying more of that stock. This increased demand could drive up the stock price, validating their initial belief. In this way, the investors' actions (buying the stock) influence the market, creating a self-reinforcing loop.

3. Uncertainty: While thoughts shape outcomes and outcomes shape thoughts, one must leave room for slippages in both cases. Thoughts may not exactly lead to the intended actions and actions may not lead to the exact intended thoughts. This creates an element of uncertainty.

Example: A company has entered a new market with a unique value proposition. The company aims to grow this vertical but remains untested. The strategy may not be properly understood by stakeholders such as employees, customers and distributors which may lead to slower market penetration than expected. However, strong ideas may be, there would be slippage.

Source: George Soros

Mr Market, or rather market participants, are victims of fallibility, reflexivity and uncertainty, which makes markets inefficient giving it the manic-depressive characteristics as described by Benjamin Graham.

What should one learn from these characteristics of Mr. Market?

- Uncertainty exists although it may not be apparent. When everything looks certain, it rarely is so.

- Participants are fallible. The confidence of the market may be just that. The thesis on the basis of which investments are made have no compulsion to become reality.

- The confidence of the market participants may influence market behaviour, with or without reason.

Investors must therefore acknowledge that good times do not last as long as one may believe and must hedge against such uncertainty, fallibility and reflexivity by focusing on their circle of competence, valuation discipline, and focus on quality. Great companies at bad prices may still make terrible investments. Following a process with discipline is crucial for success in the markets.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: