Few of our investors shared their concern that the elevated TTM P/E ratio of Nifty is stopping them from investing in stocks. (TTM P/E – Popular ratio computed by NSE for Nifty using Trailing Twelve Months EPS)

How is the Nifty P/E ratio relevant for making an investment?

As per historical data, it is observed that investing in equity when the Nifty P/E ratio is high has led to poor returns in the future. We have tested it ourselves and agree with this conclusion that investing at a P/E ratio of more than 22-25x has led to poor returns in the subsequent 3-5 years, although it doesn’t matter over longer 10-15 years.

As per the NSE Website, the current P/E ratio of Nifty is 31.9x, clearly a red flag.

But does the current P/E ratio correctly represent Nifty’s value?

We strongly Disagree, let's see WHY?

1. Exceptional Quarter throwing up incorrect P/E ratio: Today, we know that Q1FY21 was a washout quarter when the entire nation was under lockdown. Profit for this quarter cannot be assumed for valuing a company as this doesn’t represent the company’s profit under normal circumstances.

The formula for P/E ratio is PE = Price/Earning;

Earning (denominator) is low due to losses in one quarter, so the P/E ratio has become high without a change in price.

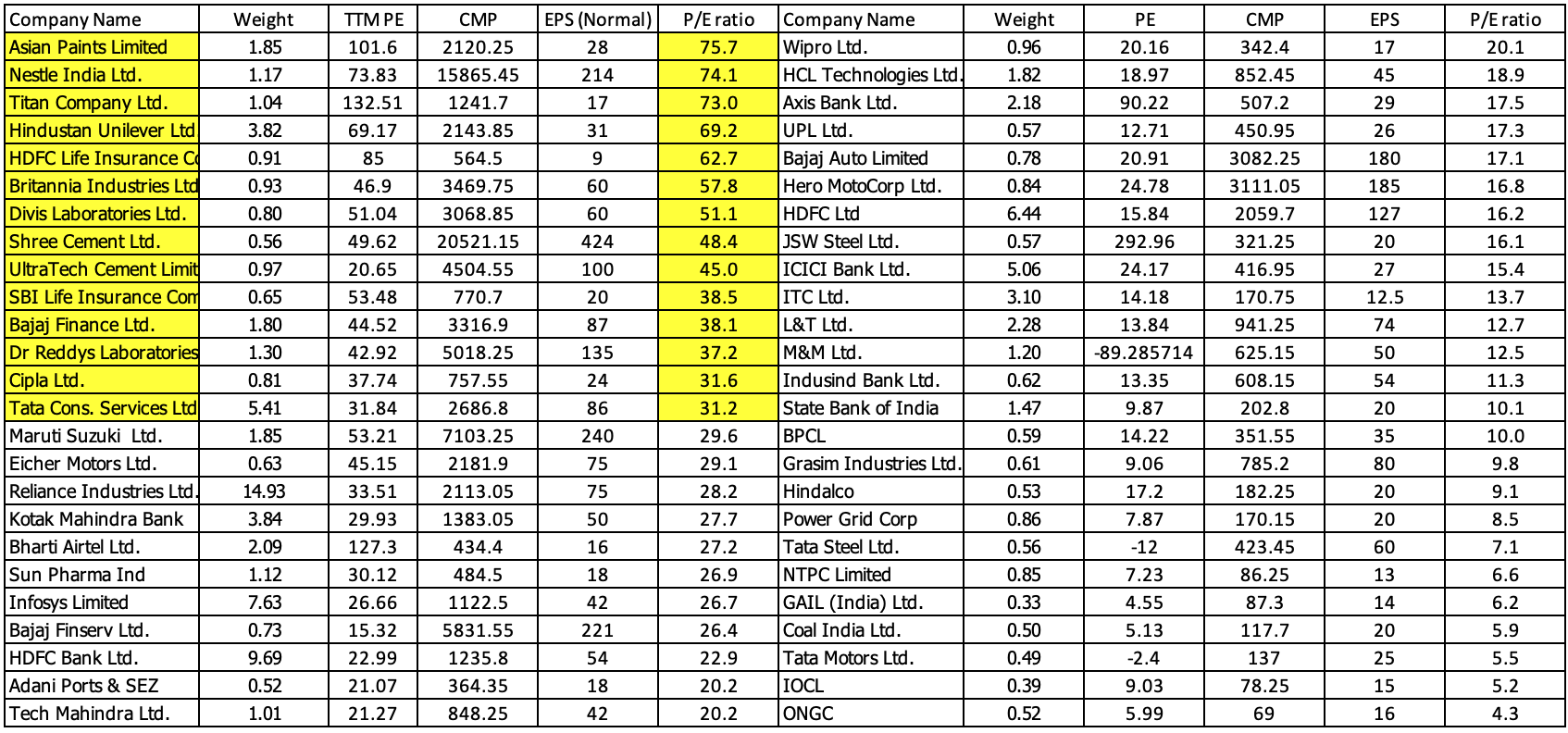

So the right way to compute the current P/E ratio is to use normal year earning per share of companies. PE = Price /Normal year EPS = 25x (our estimate, mentioned in table). We have used a normal year EPS either 2019 or 2020.

A reported P/E ratio of 31.9x may imply a bubble valuation about to burst, but Nifty is up only 5% CAGR over the last 5 years (Bubbles don’t have single-digit returns in previous 3/5 years, they usually have very high returns).

[caption id="attachment_15426" align="aligncenter" width="1694"] Table 1: TTM P/E as reported vs computed P/E on normal year EPS.[/caption]

Table 1: TTM P/E as reported vs computed P/E on normal year EPS.[/caption]

2. Share of high-value business/ Polarization: We have computed that Nifty comes to 25x on normal EPS versus 31.9x as reported by NSE. Now let’s see the details.

Within Nifty, one can see that the top 15 stocks have ‘very high’ P/E ratios versus average stock in Nifty. The top 15 names are skewing the overall P/E ratio of Nifty. If we remove these names, Nifty’s 35 stocks have an average P/E ratio of 16x.

This shows that if one ignores these 15 names, the market is more or less fairly valued assuming all the companies will earn normal year EPS soon, i.e. FY22.

3. Interest rate: One of the most logical and popular ways to value a stock is discounted cash flow (DCF). This is used by financial analysts as well as corporates. DCF is the summation of all future cash flow discounted to today’s date at a certain rate.

Usually, the rate used for discounting cash flow is a function of the government bond interest rate in the economy. A lower interest rate leads to a higher value of future cash flows (also high P/E) and a higher interest rate leads to a lesser value of future cash flow (Low P/E).

Currently, low-interest rates globally are forcing FIIs to value business more aggressively and this is helping the stock prices staying higher or recover quickly from any type of correction.

Alternatively, this can be looked at from the ‘There is no alternative’ (TINA) perspective. If bonds rates are so low (US 10-Y Bond rate is less than 1%), a fund manager will choose to invest in equity that will yield a higher return to deliver good returns to his investors.

US Central bank has been vocal that they will keep low-interest rates for the next 5 years at least. So FII will keep buying every correction thereby reduces the chances of stock prices to come to their median P/E ratio of the previous decade.

Even Warren Buffett shared that stocks must trade higher if interest rates are low and vice versa. He also mentioned in one of the annual meetings that he may have paid higher for his recent purchases versus past due to lower interest rates.

So low-interest-rate means a relatively higher P/E ratio to be the new normal.

Solution:

We have to be flexible enough to accommodate any change in the economy and rigid enough not to deviate much from our process. One has to focus on what has caused the current environment and tweaks required to sail through this period.

- You don’t have to own those super expensive names for short term gain as the long term outcome is definitely bad. So focus on other stocks instead of looking at broad market P/E ratios.

- Avoid paying up a lot throwing caution to the wind but pay up only marginally versus the past. Because if you don’t do that, your return will remain mediocre as you keep waiting perennially on a low yielding fixed income. So instead of buying an average company at P/E of 12x, one can pay closer to 14x, and instead of 18x for a good company, one can pay 20-22x.

- This has to change as interest rates start going up. The valuation benchmark will shift to earlier assumptions once interest rates return to normal (India 10-Y bond yield of 7.5-8% can be equated with Nifty P/E of 17x)

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: