When a person who is earning an income meets with an untimely death, the family loses many things. Life insurance protects the loss of income, providing the family the benefit of income similar to what they would have got if you were alive.

Optimum life insurance coverage is important for several reasons:

Protects your loved ones: The primary purpose of life insurance is to provide income protection to your loved ones. Sufficient insurance ensures their standard of living and lifestyle is not compromised.

Help achieve critical financial goals: Life insurance can also help you achieve your long-term financial goals especially the non-negotiable ones. For example, your kid’s education goals or a medical emergency buffer for your elderly parents. Life insurance can provide the funds necessary to provide for these goals.

Pays off liabilities: If you have debts or liabilities, such as credit card debt, personal loans, or a mortgage, life insurance can provide the funds necessary to pay off these obligations. This can relieve your loved ones of the burden of paying off your debts in your absence.

Optimum life insurance coverage provides peace of mind knowing that your loved ones will be financially protected if something unexpected happens to you. This can relieve the stress and anxiety associated with worrying about your family's future financial well-being.

MoneyWorks4Me’s comprehensive financial tool helps our subscribers to assess the optimum life insurance coverage needed to protect their liabilities and provide for their non-negotiable financial goals even in their absence. It also helps them assess if their current insurance coverage is sufficient or inadequate.

Let’s see a case below.

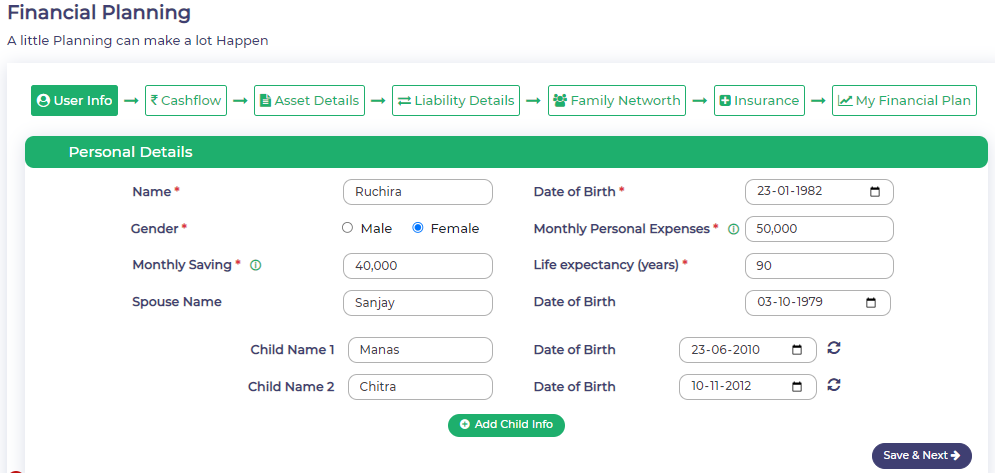

Ruchira (41) and Sanjay(43), a married couple from Mumbai seeks our help to assess their financial plan and their insurance coverage. The couple has two children Manas(13) and Chitra (11). The basic initial info is captured as below.

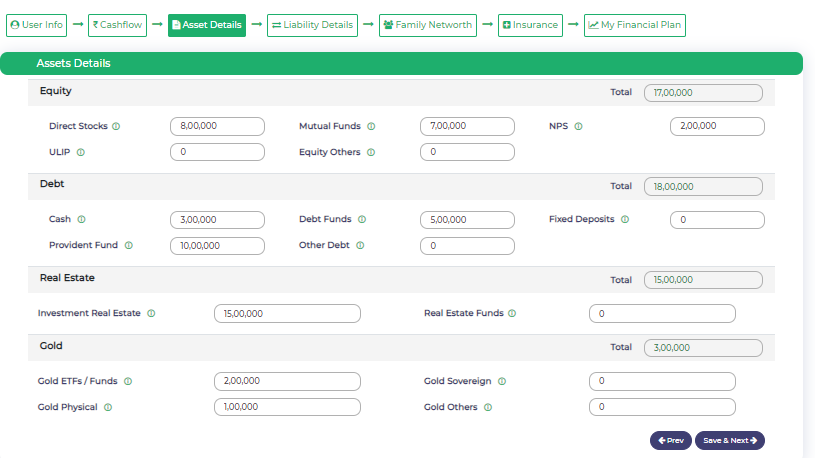

Assets and investments:

The couple have been saving through stocks, mutual funds, and debt for a while and have amassed a decent corpus till date.

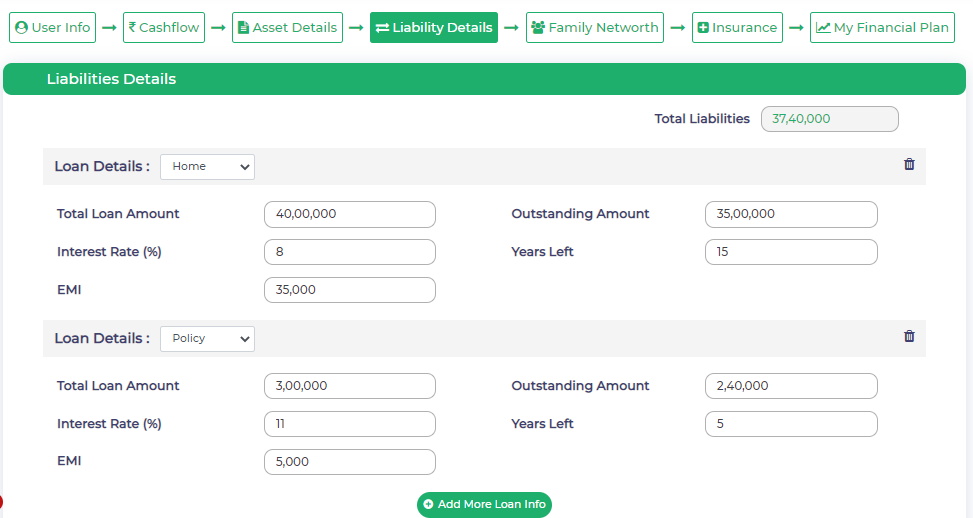

Liabilities:

They have an ongoing home loan and a policy loan for which they are paying EMIs.

Financial Goals

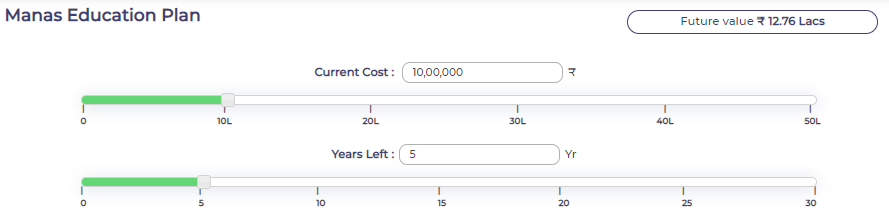

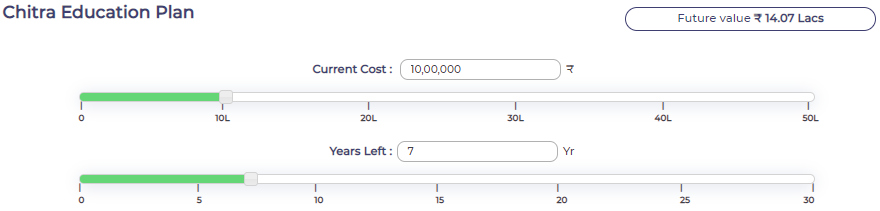

Ruchira and Sanjay wish to plan for their children’s education and marriage goals. Education goals are non-negotiable.

Since achieving these goals is critical and non-negotiable, today’s cost of these goals should be considered in the insurance planning.

Optimum Insurance Coverage required

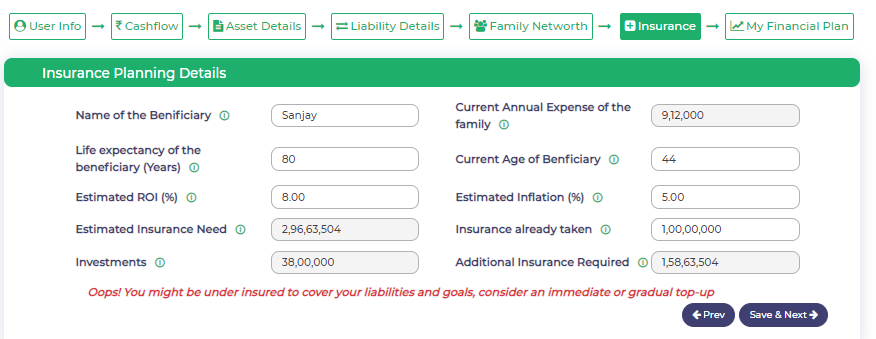

Now putting all things together, MoneyWorks4Me FPT lets you know how much insurance coverage is needed to sustain your family’s style even in your absence and protect them from any liability claims and other legal issues.

“Estimated Insurance needs” considers your actual insurance requirement based on your current annual expenses, the outstanding liabilities you have and today’s value of your critical goals. This figure will change with change in your liabilities and goal assumptions. Which means any time there is a significant change, say you pay of your home loan early or increase the amount of your goals, the financial plan needs to be updated to ensure the amount is close to reality.

As above Ruchira, needs to enhance her life insurance coverage by additional 1.58 Cr to provide for the families standard of living, her critical goals and liabilities. What are the things to consider while buying an insurance plan is highlighted in our prior blog on Life Insurance Here

In conclusion, optimum life insurance coverage is essential for protecting the income for your loved ones and achieving your non-negotiable goals. It is important to work with a qualified insurance expert to determine the appropriate type of life insurance that meets your specific needs.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: