The budget brings a number of important changes relevant for investors. In a nutshell it seeks to keep the growth agenda intact while maintaining fiscal prudence. Major highlights include employment generation and skilling, enhancing agriculture productivity, Purvodaya initiative for eastern India, enhanced support for MSMEs, expansion of housing schemes, and investments in renewable and nuclear energy sectors. The budget aims to keep the fiscal deficit below 4.5 per cent in the coming years.

Priorities areas are-

- Productivity and Resilience in Agriculture

- Employment & Skilling

- Inclusive Human Resource Development and Social Justice

- Manufacturing & Services

- Urban Development

- Energy Security

- Infrastructure

- Innovation, Research & Development

- Next Generation Reforms

Key details from the budget speech

- Focus on Employment and Skilling- The Prime Minister’s package includes 5 schemes and initiatives to facilitate employment, skilling, and other opportunities for 4.1 crore youth over a 5-year period with a central outlay of Rs. 2 lakh crore.

- Infrastructure Investment- A provision of Rs. 11 lakh crore for capital expenditure has been made, accounting for 3.4 per cent of GDP.

- Purvodaya Initiative -A comprehensive plan will be formulated for the development of the eastern region of India, covering Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh. Infrastructure Projects -

- Include Amritsar Kolkata Industrial Corridor, Patna-Purnea Expressway, Buxar-Bhagalpur Expressway, Bodhgaya, Rajgir, Vaishali, and Darbhanga spurs, additional 2-lane bridge over river Ganga at Buxar at a cost of Rs. 26,000 crore.

- Power projects, including a new 2400 MW power plant at Pirpainti, will be taken up at a cost of Rs. 21,400 crore.

- Andhra Pradesh Reorganization Act includes the development of the Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor and the Orvakal node on the Hyderabad-Bengaluru Industrial Corridor.

- Other projects to boost tourism are also announced.

- Housing

- Under the PM Awas Yojana Urban 2.0, the housing needs of 1 crore urban poor and middle-class families will be addressed with an investment of Rs. 10 lakh crore, including central assistance of Rs. 2.2 lakh crore over the next 5 years. An interest subsidy provision is also envisaged to facilitate affordable loans.

- Focus on MSMEs

- Credit Guarantee Scheme for MSMEs- A self-financing guarantee fund will provide each applicant with guarantee cover up to Rs. 100 crore, while the loan amount may be larger. Borrowers will have to provide an upfront guarantee fee and an annual guarantee fee on the reducing loan balance.

- Mudra Loans- The limit of Mudra loans will be enhanced to Rs. 20 lakh from the current Rs. 10 lakh for entrepreneurs who have availed and successfully repaid previous loans under the ‘Tarun’ category.

- Enhanced Scope for Mandatory Onboarding in TReDS- To facilitate MSMEs in unlocking their working capital, the turnover threshold of buyers for mandatory onboarding on the TReDS platform will be reduced from Rs. 500 crore to Rs. 250 crore. This measure will bring 22 more CPSEs and 7000 more companies onto the platform. Medium enterprises will also be included.

- Energy Security

- A joint venture between NTPC and BHEL will set up an 800 MW commercial plant using Advanced Ultra Super Critical (AUSC) thermal power technology.

- Research and Development

- Research and Development of Small and Modular Nuclear Reactors- Nuclear energy will form a significant part of the energy mix for Viksit Bharat. The government will partner with the private sector for:

- Setting up Bharat Small Reactors

- Research & development of Bharat Small Modular Reactor

- Research & development of newer technologies for nuclear energy

- The Anusandhan National Research Fund will be operationalized for basic research and prototype development. A mechanism will be set up to spur private sector-driven research and innovation at a commercial scale with a financing pool of Rs. 1 lakh crore. A venture capital fund of Rs. 1,000 crore will be established to expand the space economy by five times over the next 10 years.

- Other notable points

- PM Surya Ghar Muft Bijli Yojana- This scheme aims to install rooftop solar plants to enable 1 crore households to obtain free electricity up to 300 units per month. The scheme has seen remarkable success with over 1.28 crore registrations and 14 lakh applications.

- Rural Land-Related Actions will include-

- Assignment of Unique Land Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands

- Digitization of cadastral maps

- Survey of map sub-divisions as per current ownership

- Establishment of land registry

- Linking to the farmers' registry.

- Change in taxes

- Indirect Tax changes: Apart from the reduction in customs duty on various inputs for production and critical medicines, the most significant change has been the reduction of custom duties on gold and silver to 6% and on platinum to 6.4%, which were earlier taxed at 10%.

- Direct Tax rate changes: The government has emphasized that they will continue to make efforts to simplify taxes, improve tax payer services, reduce litigation whilst enhancing revenues to the government.

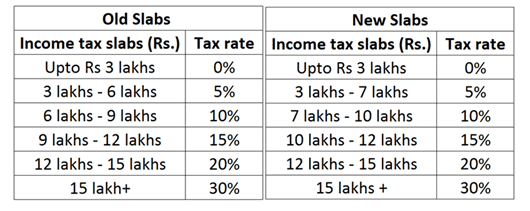

- Change in tax slab-

- Research and Development of Small and Modular Nuclear Reactors- Nuclear energy will form a significant part of the energy mix for Viksit Bharat. The government will partner with the private sector for:

According to the FM, a salaried employee in the new tax regime will save up to Rs.17,500 in tax. However, one must note that these changes are only applicable in the new tax regime. Further to this change, the standard deduction has been increased to Rs. 75,000 from Rs 50,000 and the deduction on family pension for pensioners has been proposed to be enhanced from Rs.15,000 to Rs.25,000.

Change in long-term capital gain

- The long term capital gains tax has been proposed to be increased from 10% to 12.5%, with the limit of exemption of capital gains tax on certain financial assets being proposed to be increased from Rs. 1 lakh to Rs. 1.25 lakhs. Furthermore, the definition for long term for unlisted financial assets and other non-financial assets (gold, real estate, etc) has been revised downward, from 3 years to 2 years.

- Due to such changes in the treatment of long term capital gains, any asset is now taxed on par with other assets, with the indexation benefit now being withdrawn.

Buyback

- Previously, when a company would buy back its shares, the tax on the distributed income would be taxed at the rate of 20% along with a 12% surcharge and applicable cess in the hands of the company.

- The profit made in the buyback would then be treated as capital gain in the hands of the tendering shareholder and would be taxed at 15% if the tendered shares were held for less than 1 year and 10% if the shares were held for more than a year.

- However, this method of taxation on buybacks has been entirely done away with. Buybacks will now be taxed as dividend in the hands of the shareholders on the entire consideration received, with the purchase price of the investor being set as zero.

- However, the capital loss, which will be the original purchase price of the shares for the shareholder can only be offset against other capital gains or can be carry forwarded up to a period of 8 years with the company buying back the shares not required to pay tax on the buyback anymore.

Budget Estimates 2024-25

- Total receipts (excluding borrowings) and total expenditure are estimated at Rs. 32.07 lakh crore and Rs. 48.21 lakh crore, respectively.

- Net tax receipts are estimated at Rs. 25.83 lakh crore.

- The fiscal deficit is estimated at 4.9 per cent of GDP.

- The fiscal consolidation path aims to reach a deficit below 4.5 per cent next year, with the Central Government debt on a declining path as a percentage of GDP from 2026-27 onwards.

The Union Budget 2024-25 presents a comprehensive plan to boost India's economy with a strong focus on infrastructure, employment, housing, and energy security. The government's commitment to fiscal consolidation and targeted investments in key sectors aim to drive growth and development. With new initiatives for MSMEs, housing, and renewable energy, along with a simplified tax regime, the budget seeks to create a more inclusive and sustainable economic environment. Investors can look forward to a range of opportunities as the country moves towards a more resilient and progressive future. All in all it should make long term investors feel more reassured of continued growth across all sectors at a good steady rate.

Related blog: Union Budget 2024: Continued Capex with Fiscal prudence

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: