Value and growth are two investing styles that have different characteristics and performance patterns in different market cycles. More often than not, growth and value stocks, along with their respective investing strategies, are presented as either-or choices. However, incorporating both into a portfolio can enhance your overall portfolio returns. Identifying an optimal mix of value and growth stocks can contribute to a more balanced investment approach. Let’s try to understand both investing strategies for effective portfolio building in this blog.

Growth Investing Approach

The growth investment strategy focuses on identifying companies whose earnings per share (EPS) or earnings before interest, taxes, depreciation, and amortization (EBITDA) are growing at a rate higher than their industry counterparts. This strategy assumes that the above-average performance of these growth stocks will persist moving forward. Such companies may be newcomers or part of emerging sectors poised to dominate the industry in the future. The principal risk associated with investing in growth stocks lies in their potential for significant fluctuations in stock performance, particularly over the short term. Consistent growing companies over the last decade have been Asian Paints, Titan Company and Bharti Airtel.

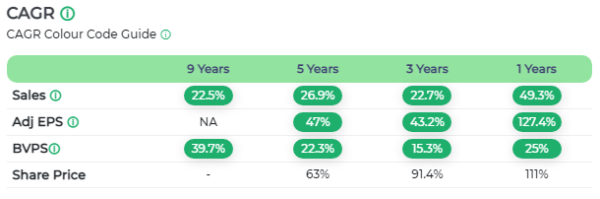

Another well-recognized example can be Varun Beverages; a financial snapshot of the same;

Click the link below to explore our curated list of growth stocks:

Value Investing Approach

Value investing is a strategy that involves picking stocks that appear to be trading for less than their intrinsic or book value. Investors who employ this strategy believe the market overreacts to good and bad news, resulting in stock price movements that do not correspond with a company's long-term fundamentals. The essence of value investing lies in finding diamonds in the rough — stocks that are undervalued by the market but have the potential for substantial price appreciation when their true value is realized. Companies like PFC, Coal India and ITC could have been on value investors' radar.

Click the link below to explore our curated list of value-investing stocks:

Choosing the Right Approach in Different Market Cycles

Bull Markets:

During bull markets, when investor confidence is high and the economy is growing, growth stocks often outperform. Their earnings are expected to rise rapidly, which can justify the premium prices paid for these stocks. In the Indian market, sectors like technology and consumer goods can see substantial growth as consumption increases.

Bear Markets:

Bear markets, characterized by falling stock prices and pessimism about the economy, tend to favor value investing. Investors may flock to undervalued stocks, which are perceived as safer bets because they are already trading at a discount and have less room to fall. In India, sectors such as utilities and consumer staples, which offer essential goods and services, may become more attractive as value plays during these times.

Volatile or Flat Markets:

In periods of high volatility or when the market is flat, both strategies can be effective, but it requires a more nuanced approach. Value investors might look for companies with strong fundamentals that have been unfairly punished by market overreactions, while growth investors may seek out those few companies that continue to grow earnings despite broader market challenges.

Performance:

Historically, value and growth stocks have taken turns dominating the market, depending on the economic and market conditions. Value stocks tend to outperform when inflation is high, economic growth is strong, and interest rates are rising, as they offer higher dividend yields and lower valuation multiples. Growth stocks tend to outperform when inflation is low, economic growth is weak, and interest rates are falling, as they benefit from lower discount rates and higher growth prospects.

Source: MSCI, Moneyworks4me

The performance of value and growth stocks in the Indian market has varied over time. A comparison of the MSCI India value and growth index shows that growth had higher annualized returns than the value from 2010 to 2015. However, value reversed this trend and nearly outperformed growth from 2015 to 2023. Both strategies beat the benchmark index (MSCI India) about half of the time. This data suggests that the market is cyclical. Therefore, it may not be wise to rely on only one strategy.

Our opinion:

Choosing the right approach for different market cycles in the Indian market depends on several factors, such as the investor’s objectives, risk tolerance and time horizon. Some investors may prefer to stick to one style, either value or growth and hold it for the long term, regardless of market fluctuations. Others may prefer to switch between value and growth, depending on the market signals and indicators, such as the price-to-earnings ratio, the dividend yield, the earnings growth rate, and the interest rate. A third option is to adopt a blended approach, which combines both value and growth stocks in a balanced portfolio and adjusts the allocation according to the market conditions.

Investors should recognize that although it may appear tempting to adhere to one investment style, the reality is that market conditions change. A hybrid approach, or being style-agnostic, can be beneficial. This involves being open to switching between value and growth investing based on changing market cycles or having a diversified portfolio that includes a mix of value and growth stocks.

At moneyworks4me, our investing philosophy is to seek quality stock at a reasonable price, a proven approach that has delivered successful outcomes in the past and is expected to do so in the future. We invite you to check out our carefully selected stock list in our Buy Zone, where you can find stocks with strong fundamentals and growth potential that are currently undervalued or fairly valued. This list is a great starting point for building a solid portfolio from scratch. Don’t miss our featured (Superstar) picks.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: