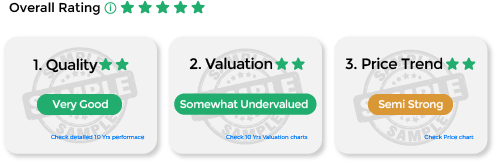

Stocks - Q : Quality | V : Valuation | PT : Price Trend

Funds - P : Performance | Q : Quality

Funds - P : Performance | Q : Quality

| Market Cap | ₹11,400 Cr. |

| P/E Ratio | 49.7 |

| TTM EPS | 22 |

| P/B Ratio | 24.96 |

| ROE | 80.25 |

| Debt to Equity | 0.04 |

| Face Value | 2 |

| BVPS | 43.8 |

| 3 Year Sales Growth | 385.06% |

| 1 Day | -1.25% |

| 1 Week | 16.60% |

| 1 Month | 27.40% |

| 3 Months | 10.40% |

| 6 Months | -28.50% |

| 1 Years | -56.20% |

| 3 Years | 1495.30% |

| 5 Years | 57759.80% |

| 10 Years | 0% |

| Fund Name | AUM(%) |

|---|---|

| Motilal Oswal Quant Fund-Reg(G) | 0.75 % |

| Motilal Oswal Quant Fund-Reg(G) | 0.93 % |

| Company Name | ||||||

|---|---|---|---|---|---|---|

| PTC India | 179.8 | -0.3 (-0.2%) | 16,007 | 14.1 | 12.8 | 1.3 |

| CESC | 161.9 | 3.7 (2.3%) | 8,606 | 5.9 | 27.3 | 2.1 |

| Reliance Power | 44.2 | 2.1 (4.9%) | 7,893 | 6 | 7.3 | 1.2 |

| JP Power Ventures | 15.9 | 0.4 (2.5%) | 6,763 | 1.3 | 12 | 1.3 |

| RattanIndia Power | 10.6 | 0.4 (3.6%) | 3,364 | -1.9 | - | 1.2 |

| Nava | 482.2 | 12.2 (2.6%) | 1,468 | 14 | 34.5 | 3.9 |

| Guj. Inds. Power | 198.8 | 8.2 (4.3%) | 1,349 | 13.7 | 14.5 | 0.9 |

| Waaree Renewables | 1,093.6 | -13.8 (-1.3%) | 867 | 22 | 49.7 | 25 |

| GMR Power and Urban | 134.7 | 0.1 (0%) | 779 | 14.9 | 9 | 5.2 |

| Acme Solar Holdings | 207.8 | 4.3 (2.1%) | 471 | 6.9 | 30 | 2.4 |

| PARTICULARS | Mar'15 | Mar'16 | Mar'17 | Mar'18 | Mar'19 | Mar'20 | Mar'21 | Mar'22 | Mar'23 | Mar'24 |

|---|---|---|---|---|---|---|---|---|---|---|

Equity and Liabilities | ||||||||||

| Shareholders Fund | 10 | 10 | 10 | 10 | 11 | 30 | 33 | 52 | 111 | 258 |

| Share Capital ⓘ | 10 | 10 | 10 | 10 | 10 | 21 | 21 | 21 | 21 | 21 |

| Reserves ⓘ | 0 | 0 | 0 | 0 | 1 | 10 | 12 | 31 | 90 | 237 |

| Minority Interest | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Debt | 0 | 0 | 0 | 0 | 36 | 37 | 37 | 0 | 0 | 10 |

| Long Term Debt | 0 | 0 | 0 | 0 | 36 | 37 | 37 | 0 | 0 | 0 |

| Short Term Debt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10 |

| Trade Payables | 0 | 0 | 0 | 0 | 0 | 0 | 3 | 58 | 77 | 298 |

| Others Liabilities ⓘ | 0 | 0 | 0 | 2 | 1 | 1 | 11 | 22 | 67 | 131 |

| Total Liabilities ⓘ | 10 | 10 | 10 | 12 | 48 | 68 | 83 | 132 | 254 | 696 |

Fixed Assets | ||||||||||

| Gross Block | 0 | 0 | 0 | 4 | 4 | 4 | 4 | 4 | 10 | 97 |

| Accumulated Depreciation | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 3 |

| Net Fixed Assetsⓘ | 0 | 0 | 0 | 4 | 4 | 3 | 3 | 3 | 9 | 94 |

| CWIP ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 80 | 3 |

| Investmentsⓘ | 1 | 1 | 0 | 0 | 32 | 32 | 32 | 1 | 0 | 9 |

| Inventories | 2 | 5 | 6 | 0 | 0 | 0 | 0 | 2 | 37 | 29 |

| Trade Receivables | 0 | 0 | 0 | 0 | 3 | 0 | 2 | 45 | 61 | 372 |

| Cash Equivalents | 0 | 0 | 0 | 7 | 1 | 0 | 1 | 39 | 13 | 117 |

| Others Assetsⓘ | 7 | 4 | 3 | 1 | 9 | 33 | 45 | 43 | 54 | 73 |

| Total Assets ⓘ | 10 | 10 | 10 | 12 | 48 | 68 | 83 | 132 | 254 | 696 |

| PARTICULARS | Mar'15 | Mar'16 | Mar'17 | Mar'18 | Mar'19 | Mar'20 | Mar'21 | Mar'22 | Mar'23 | Mar'24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Sales | 0 | 0 | 0 | 1 | 5 | 2 | 8 | 154 | 342 | 867 |

| Operating Expenses ⓘ | 0 | 0 | 1 | 2 | 3 | 2 | 5 | 140 | 266 | 668 |

| Manufacturing Costs | 0 | 0 | 0 | 0 | 0 | 0 | 4 | 133 | 253 | 645 |

| Material Costs | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Employee Cost | 0 | 0 | 0 | 0 | 1 | 1 | 1 | 6 | 9 | 17 |

| Other Costs ⓘ | 0 | 0 | 0 | 1 | 2 | 1 | 0 | 1 | 3 | 6 |

| Operating Profit ⓘ | 0 | 0 | 0 | 0 | 2 | 0 | 3 | 13 | 76 | 199 |

| Operating Profit Margin (%) | 36.4% | -723.0% | -640.0% | -16.2% | 49.5% | 2.1% | 36.2% | 8.6% | 22.2% | 22.9% |

| Other Income ⓘ | 0 | 0 | 0 | 1 | 1 | 3 | 4 | 14 | 5 | 8 |

| Interest ⓘ | 0 | 0 | 0 | 0 | 2 | 3 | 4 | 1 | 1 | 4 |

| Depreciation ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3 |

| Exceptional Items ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax ⓘ | 0 | 0 | 0 | 0 | 1 | 0 | 3 | 26 | 80 | 200 |

| Tax ⓘ | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 6 | 20 | 51 |

| Profit After Tax | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 20 | 59 | 149 |

| PAT Margin (%) | 25.5% | 220.0% | -43.3% | 9.4% | 6.1% | -9.4% | 30.8% | 13.3% | 17.4% | 17.2% |

| Adjusted EPS (₹) | 0.0 | 0.0 | 0.0 | 0.0 | 0.1 | 0.0 | 0.2 | 2.0 | 5.7 | 14.3 |

| Dividend Payout Ratio (%) | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 10% | 4% | 7% |

| PARTICULARS | Mar'15 | Mar'16 | Mar'17 | Mar'18 | Mar'19 | Mar'20 | Mar'21 | Mar'22 | Mar'23 | Mar'24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Cash Flow From Operating Activity ⓘ | 0 | 0 | -2 | 0 | 5 | 3 | 3 | 34 | 58 | 118 |

| PBT ⓘ | 0 | 0 | 0 | 0 | 1 | 0 | 3 | 26 | 80 | 200 |

| Adjustment ⓘ | 0 | 0 | 0 | -1 | 2 | 0 | 0 | -12 | -3 | -1 |

| Changes in Working Capital ⓘ | -0 | -0 | -1 | 1 | 2 | 4 | 1 | 23 | -14 | -57 |

| Tax Paid ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | -3 | -5 | -26 |

| Cash Flow From Investing Activity ⓘ | 0 | 0 | 1 | -3 | -31 | 3 | -8 | 19 | -66 | -115 |

| Capex | 0 | 0 | 0 | -4 | 0 | 0 | 0 | 0 | -86 | -10 |

| Net Investments | 0 | 0 | 1 | 0 | -32 | 0 | 0 | -26 | 16 | -106 |

| Others ⓘ | 0 | 0 | 0 | 1 | 1 | 3 | -8 | 45 | 4 | 1 |

| Cash Flow From Financing Activityⓘ | 0 | 0 | 1 | 2 | 27 | -6 | 5 | -39 | -2 | 4 |

| Net Proceeds from Shares ⓘ | 0 | 0 | 0 | 0 | 0 | 20 | 0 | 0 | 0 | 0 |

| Net Proceeds from Borrowing ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Interest Paid ⓘ | 0 | 0 | 0 | 0 | -2 | -3 | -4 | -1 | -1 | -4 |

| Dividend Paid ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | -1 | -1 | -2 |

| Others ⓘ | 0 | 0 | 1 | 3 | 29 | -23 | 9 | -37 | 0 | 10 |

| Net Cash Flow ⓘ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 13 | -10 | 6 |

| PARTICULARS | Mar'15 | Mar'16 | Mar'17 | Mar'18 | Mar'19 | Mar'20 | Mar'21 | Mar'22 | Mar'23 | Mar'24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Ratios | ||||||||||

| ROE (%) | 0.81 | 0.91 | -0.32 | 1.2 | 2.96 | -0.91 | 7.4 | 48.01 | 72.98 | 80.88 |

| ROCE (%) | 1.15 | 1.3 | -0.31 | 4.84 | 10.91 | 5.24 | 9.19 | 44.95 | 98.93 | 107.22 |

| Asset Turnover Ratio | 0.03 | 0 | 0.01 | 0.12 | 0.17 | 0.03 | 0.1 | 1.43 | 1.77 | 1.83 |

| PAT to CFO Conversion(x) | N/A | N/A | N/A | N/A | N/A | N/A | 1.5 | 1.7 | 0.98 | 0.79 |

| Working Capital Days | ||||||||||

| Receivable Days | 81 | 0 | 0 | 114 | 119 | 268 | 60 | 57 | 57 | 91 |

| Inventory Days | 2,421 | 0 | 0 | 0 | 0 | 0 | 22 | 3 | 20 | 14 |

| Payable Days | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

Waaree Renewables Technology Limited (WRTL) (Formally known as Sangam Renewables Limited) is a pioneer company to look after if one is going for CAPEX model. The company was incorporated on 22nd of June, 1999 as a private company limited by shares. It was converted into a public company on November 18, 2011. It has its registered office in Mumbai and its energy generation site is located in state of Maharashtra.

Business area of the company

The company is engaged in the business of generation of power through renewable energy sources and also providing consultancy service in this regard.

Solution & Service

| Market Cap | ₹11,400 Cr. |

| P/E Ratio | 49.7 |

| TTM EPS | 22 |

| P/B Ratio | 24.96 |

| ROE | 80.25 |

| Debt to Equity | 0.04 |

| Face Value | 2 |

| BVPS | 43.8 |

| 3 Year Sales Growth | 385.06% |

| 1 Day | -1.25% |

| 1 Week | 16.60% |

| 1 Month | 27.40% |

| 3 Months | 10.40% |

| 6 Months | -28.50% |

| 1 Years | -56.20% |

| 3 Years | 1495.30% |

| 5 Years | 57759.80% |

| 10 Years | 0% |