Allied Blenders and Distillers Ltd IPO Details:

Opening Date: June 25, 2024

Closing Date: June 27, 2024

Listing: BSE and NSE

Number of Shares: 5.33 Cr shares

Face Value: Rs 2 per share

Price Band: Rs 267-281 per equity share

Issue Size: Rs 1,500 Cr

About Allied Blenders and Distillers Ltd:

It is the 3rd largest Indian-made foreign liquor (IMFL) company in India (in terms of annual sales till FY22). It is a leading exporter of IMFL with a market share by sales volume of ~11.8% in the whisky market for FY23. The company has sales across India and has developed an extensive footprint with retailers across 79,329 outlets.

ABDL’s flagship brand, Officer’s Choice Whisky was launched in 1988 to enter into mass premium Whisky segment (also known as Deluxe segment) and was one of the top selling whisky brand between 2016 and 2019. Over the years, the product portfolio has been expanded across various categories and segments. ABDL owns and operates its distillery located in Rangpur, Telangana and relies on 32 bottling facilities (owned or contracted) with a capacity of 6 crores litres of Extra Neutral Alcohol (ENA), which is a key material used in alcoholic drinks.

Its major product range of whiskies is mainly positioned in the mass premium segment and also has some products in the luxury segment. It derives ~2% of its revenues from sales overseas.

Industry Overview:

The Indian Alcoholic beverage market was estimated to be worth Rs. 3.2 trillion in FY23 and was the 3rd largest market after China and Russia. This industry is projected to grow by 11.3% between FY23-28; of this growth 6.1% is expected to be driven by volume.

The estimated alcohol consumption per capita in India for FY23 was estimated to be 3.2 litres, against the world average of ~5 litres. The Indian market was estimated to be ~3.2 billion litres of pure alcohol, with distilled beverages contributing nearly 92% of the total alcohol consumption. According to estimates, the Indian market is worth more than 1 billion cases in volume and is projected to reach 1.45 billion cases by FY28.

The Indian alcoholic beverages market mainly comprises of Indian Made Foreign Liquor (IMFL), Indian Made Indian Liquor (IMIL) and Beer. The Indian market is dominated by IMFL and is estimated to have contributed close to 69% in value terms to the overall market in FY23. So while volumes are similar, ASP for IMIL/Beer is comparatively lower.

Indian Made Indian Liquor (IMIL) was close to one third of the alcoholic beverage market by volume in FY23. IMIL basically are local flavoured drinks made by regional producers. The shift from IMIL to IMFL will drive the IMFL category in India, given the rising theme of premiumisation as well as potential health concerns with IMIL liquor.

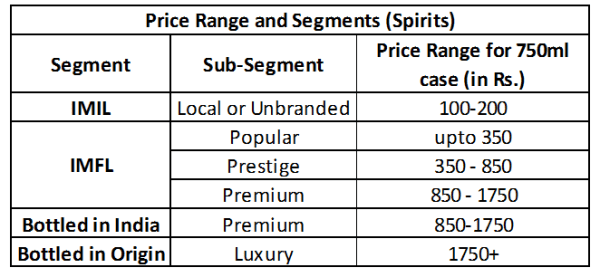

In India, more than 90% of the alcohol is consumed in the form of spirits. Spirits are liquor which is distilled; meaning where the alcohol content and water are separated and the alcohol part is further processed for drinking. Spirits have the highest alcohol volume content among other drinks.

Within this category, India is dominated by brown spirits with white spirits contributing a small share. This is in sharp contrast to other markets, where white spirits dominate. Brown spirits are alcoholic beverages which are aged in a wooden barrel, thus absorbing the flavour and colour of the wood, while white spirits are generally not aged in wood, or are filtered after ageing in wood. Brown spirits include whisky, rum and brandy and white spirits include vodka and gin.

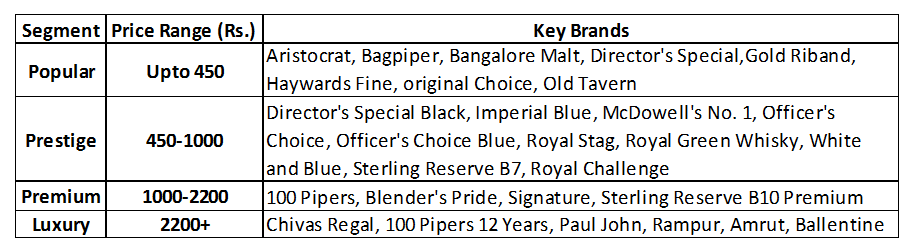

The Indian Whisky market is projected to reach Rs. 2.34 trillion by FY28 and was valued at Rs. 1.5 trillion in FY23. The whisky market can be divided into 4 segments which are popular, prestige, premium and luxury segments. The segment consisting of popular and prestige contributed close to 86% of the total volume in India in FY23.

The Popular segment plays an important role in the price sensitive category, which include the IMIL segment. This segment contributed 37% by volume (67 million cases in FY21) to the whisky market in India and is projected to reach 83 million cases in FY25.

Prestige is the largest whisky segment contributing 51% to volume at 124 million cases in FY23 and is expected to reach 192 million cases by FY28 (growing contribution to 54%) by FY28.

Distribution: Channels in India differ state to state and can be classified into three types. Distributor, wholesaler or a state government controlled entity.

Business Segments:

In the alcoholic beverage segment, the company is present in the distilled beverages segment spread across five main categories, Whisky, Brandy, Rum, Vodka, and Gin.

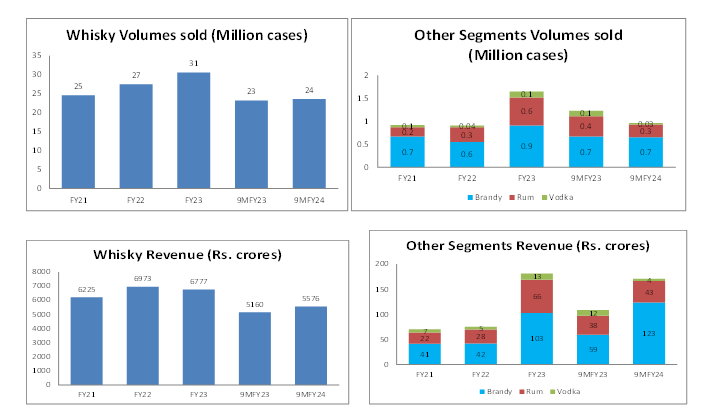

Whisky: It is a distilled alcoholic beverage. Whisky is made from fermented grain mash and later aged in wooden caskets made of oak, which gives whisky its distinctive flavour. This is the largest segment for ABDL, as it main brands, Officer Choice and Officer’s Choice Blue cater to the the prestige segment. Brands, Sterling Reserve Blend 7 Whisky and Sterling Reserve 10 Whisky cater to the Semi-Premium and Premium Segments of the market respectively. It also has Iconiq White, Srishti premium Blended and X&O Barrel Premium Whisky in the Deluxe, Semi-premium and premium segment of the market. In 9MFY24, the Whisky segment sold over 96 million cases with revenues of Rs. 5,576 Cr.

Brandy: This is the second largest segment, albeit a small one for ABDL, as it contributed ~2.6% of the total cases sold in 9MFY24 with revenue of Rs. 123 Cr. The process for manufacturing Brandy is same as that for whisky, except that fruits, particularly grapes are used rather than grains as the raw material. The company has 2 brands in this segment, namely Kyron and Sterling Reserve which cater to the Premium segment.

Rum: This segment contributed ~1.1% of the total cases sold by ABDL in 9M FY24. Again, manufacturing Rum is more or less similar to whisky, but sugarcane molasses or sugarcane juice is used as raw material. ABDL has 2 offerings, Officer’s Choice Rum and Jolly Roger, which cater to the mass premium and deluxe segments in India.

Vodka: Vodka is manufactured from grains such as wheat, rye, corn or barley or even potatoes and fermented. This fermented liquid is distilled and later filtered through materials like charcoal to achieve a clean smooth taste and then bottled. This is a very small segment for ABDL, contributing 30 thousand cases sold in 9MFY24 via its brand called Class 21, which caters to the Mass premium segment.

Gin: A gin is manufactured by fermenting grains such as barley, corn, rye or wheat. The fermented liquid is later distilled and then re distilled with juniper berries or other botanicals for additional flavours. Later the distilled gin is diluted with water or may even undergo additional aging or flavouring process. ABDL, in January 2024, launched its product under the name Zoya in this segment, catering to the premium market, and thus has not yet reported any meaningful sales.

Segment-wise volume & revenue:

Purpose of the issue:

Total issue size is Rs. 1500 Cr; fresh issue of Rs. 1000 Cr and Offer for sale of Rs. 500 Cr. The amount received from the fresh issue is proposed to be utilized for the payment/ pre-payment of borrowing to the tune of Rs. 720 Cr. The remaining will be utilized for general corporate purposes.

The OFS part comprising of Rs. 500 Cr. is being offloaded by the promoter entity, mainly comprising of Kishore Chhabria and Bina Chhabria.

Concerns:

Competitive Intensity: Given the lucrative nature of this industry, there are quite a lot of players, both Indian as well as foreign owned multinationals.

Regulatory Risk: The Alcoholic beverages industry is subject to multiple regulatory hurdles, with some states even controlling the prices of alcohol. A price increase or decrease must be approved by the respective state authorities. Any changes in regulations will significantly impact ABDL and the industry as a whole.

Heavy Taxes: The alcohol Industry is heavily taxed in India. Any increase in taxes will impact the volumes of ABDL.

Product concentration risk: ABDL derives over 96% of its revenue from only the whiskey segment.

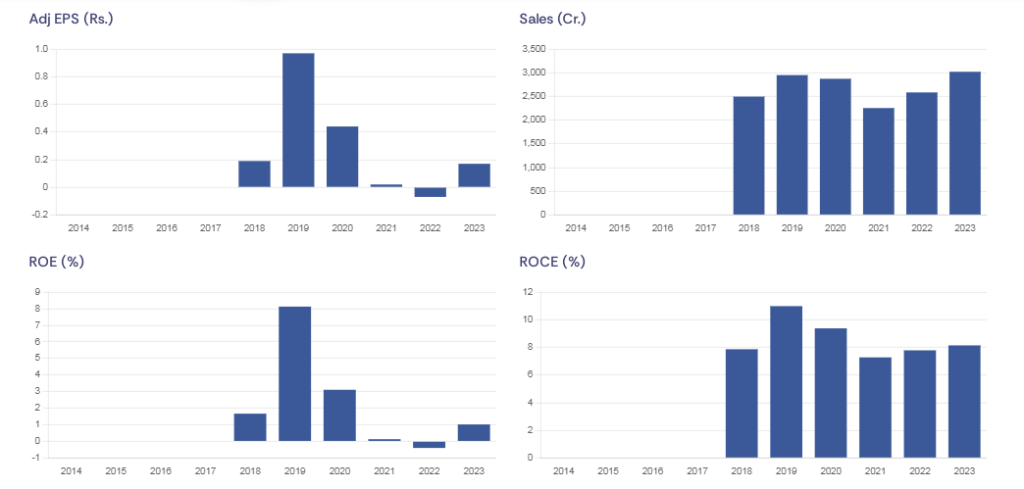

Financials:

The company’s sales have hovered around the around the Rs. 2500 cr to Rs. 3000 cr. mark since FY18, the company reported poor EPS along with poor return ratios in the past due to high interest and elevated cost of production.

Management:

Kishore Chhabria: He is the Promoter Chairman of the company. He completed his Bachelor’s degree in commerce from University of Bombay and prior to ABDL, he was associated as Managing director of Shaw Wallace and later with B.D.A. Ltd. He has over 19 years of experience in management.

Bina Kishore Chhabria: She is wife of Kishore Chhabria and serves on the board in her capacity as a Co-Chairman and non-executive director.

Resham Chhabria: She is the Whole time director, Vice-Chairman and part of the promoter group. She completed her bachelors of commerce from university of Mumbai and completed the Management Development program from Aresty Institute of Executive Education, The Wharton School, University of Pennsylvania and has 2 years of experience in management.

Shekhar Ramamurthy: Whole-Time Director and Executive Deputy Chairman. He holds a Post graduate diploma in Management from IIM Calcutta. Prior to joining ABDL, he was associated with United Spirits Ltd and United Breweries Ltd and has 33 years of experience.

Alok Gupta: He is the Managing Director of the firm. He holds a post graduate diploma in Business management from Institute of Management Technology, Ghaziabad. Prior to Joining ABDL, he was associated with Autometers Ltd, McDowell & Co Ltd, Whyte and Mackay Ltd, United Spirits Ltd and Essar Capital Advisory India Pvt. Ltd and has over 26 years of experience in field of management, marketing and portfolio management.

Arun Barik: He is an executive director of the company and holds a bachelor of science from Utkal University, Bhubaneswar. Prior to joining ABDL, he was associated with Seagram distillers Ltd and Mason & Summers Alcobev Pvt Ltd. He has over 27 years of experience in various fields.

MoneyWorks4Me Opinion

ABDL operates in intensely competitive industry and has leadership in only one segment (whisky). In addition to the concerns mentioned above, the company has significant statutory dues (Rs.500 Cr) on which it pays interest. Post paying off debt the profitability will increase but valuations are pricey. Recommend to Avoid strictly.

Recommendation: Avoid

Allied Blenders and Distillers Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | June 25, 2024 |

| IPO Close Date | June 27, 2024 |

| Basis of Allotment Date | June 28, 2024 |

| Refunds Initiation | July 01, 2024 |

| A credit of Shares to Demat Account | July 01, 2024 |

| IPO Listing Date | July 02, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 53 | Rs. 14,893 |

| Maximum | 13 | 689 | Rs. 193,609 |

Allied Blenders and Distillers Limited IPO FAQs:

When will the Allied Blenders and Distillers Ltd IPO open?

Allied Blenders and Distillers Ltd IPO will open for subscription on Tuesday, 25th June 2024, and closes on Thursday, 27th June 2024.

What is the price band of Allied Blenders and Distillers Ltd IPO?

The price band for Allied Blenders and Distillers Ltd IPO is Rs. 267-281/share.

What is the lot size for the Allied Blenders and Distillers Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 53 shares, up to a maximum of 13 lots i.e. Rs. 1,93,609/-.

What is the issue size of Allied Blenders and Distillers Ltd IPO?

The total issue size is ~ Rs. 1,500 Cr.

When will the basis of allotment be out?

Allotment will be finalized on June 28th and refunds will be initiated by July 1st. Shares allotment will be credited in Demat accounts by July 1st.

What is the listing date of Allied Blenders and Distillers Ltd’s IPO?

The tentative listing date of the Allied Blenders and Distillers Ltd IPO is July 2nd, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: