Every so often, the market buzzes with headlines like:

“Siemens AG to increase stake in Indian arm”

“Vijay Mallya considering 49% stake sale in Whyte & Mackay.”

Both sound dramatic — but the implications couldn’t be more different.

When Siemens AG increased its stake in the Indian subsidiary, investors took it as a vote of confidence — a move signaling expansion and long-term commitment to India.

But when Vijay Mallya’s United Spirits considered selling a stake in Whyte & Mackay to repay debt, the market viewed it negatively — a distress sale rather than a strategic one.

The takeaway?

Promoter activity can move markets — but not all moves mean the same thing.

That’s why as investors, we must go beyond the headline and analyse the intent behind the promoter’s action.

What Does “Promoter Shareholding” Really Mean?

Promoters are the original architects of a company — founders, owners, or controlling shareholders.

Their stake represents the percentage of shares they hold out of the total issued shares.

Regulations require all listed companies to maintain at least 25% public shareholding, which means promoters can hold a maximum of 75%.

Because promoters have the most skin in the game, their buying or selling often sends strong signals.

- Increasing stake is typically seen as a sign of confidence.

- Reducing stake can spark concern about future prospects.

But as we’ll see, these signals can sometimes mislead.

When Increasing Promoter Stake Isn’t a Good Sign

1. Buying to Boost the Stock Price

Sometimes, promoters buy shares simply to prop up a falling stock price, not because they believe in future growth.

Such cosmetic buying may temporarily lift market sentiment — but it doesn’t fix weak fundamentals.

2. Buying Unsubscribed Shares in a Rights Issue

If a rights issue fails to attract enough investors, promoters might step in and buy the leftovers to prevent embarrassment.

While this raises their stake, it doesn’t indicate confidence — it’s damage control.

3. High Dividends + High Promoter Holding = Red Flag

Companies with large promoter stakes often announce generous dividends. While this looks investor-friendly, it can sometimes be self-serving — with most dividends flowing right back to promoters.

In 2010, reports highlighted several cases — Sun Pharma, Adani Group, and earlier HCL Technologies and Wipro — where high dividends seemed to disproportionately benefit promoter families.

So, always check whether the dividend payout aligns with long-term capital allocation. A high payout may mean fewer funds left for growth or innovation.

4. The Everonn Example – When Promoter Changes Mislead

When Everonn Education saw promoter shareholding jump from 42% to 55% in just one quarter, investors assumed renewed confidence.

But in reality, the increase came after a management reshuffle and foreign investment, following a tax fraud case involving the old promoter.

The company’s fundamentals were uncertain — proof that a rising stake isn’t always a green flag.

When High Promoter Holding Becomes a Problem

Even if genuine, very high promoter ownership can make a stock illiquid, since fewer shares are available for public trading.

Low liquidity means large price swings and difficulty entering or exiting positions — especially in mid-cap and small-cap companies.

The Flip Side: Low Promoter Holding

A low promoter stake can mean two things:

- Lack of confidence — Promoters may not be fully committed to the company’s growth.

- Risk of hostile takeover — Low holdings make it easier for outsiders to accumulate controlling stakes.

We’ve seen this play out before:

- Essel Group vs. IVRCL, where Essel acquired ~10% through open market purchases.

- The EIH–ITC episode, where Reliance Industries stepped in to prevent a takeover attempt.

That said, not every sale is negative — it might reflect internal restructuring, promoter succession planning, or new capital issuance. Context matters.

What Is an Ideal Promoter Shareholding?

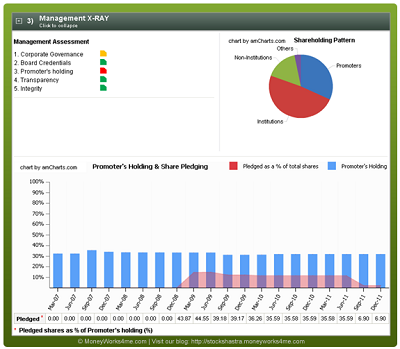

At MoneyWorks4Me, our Management X-Ray Tool assesses promoter ownership as a key management indicator.

We consider:

- 35–65% promoter holding → Ideal range (balanced control and liquidity).

- Below 15% → Concerning (potential takeover risk or weak promoter interest).

- Above 75% → Non-compliant and typically illiquid.

Additionally, investors must track pledged shares — when promoters use their shares as collateral for loans. A high percentage of pledged shares is a red flag, as it can trigger forced selling during downturns.

Promoter Activity vs. Company Performance: Not Always Aligned

A 2011 ET Intelligence Group study of BSE 500 companies found that promoter behavior doesn’t always correlate with company performance.

In some cases, promoters bought more shares even as earnings stagnated; in others, they sold before a strong rebound.

The lesson: Don’t blindly copy promoter moves — understand the motive.

The Bottom Line

Promoters know their businesses best, but that doesn’t mean every move they make benefits minority shareholders.

A rising stake can reflect confidence — or camouflage trouble.

A sale can signal distress — or just smart diversification.

The key is to investigate the “why” behind the move before you act.

When evaluating promoter activity:

- Look for context — not just numbers.

- Analyse dividend policies, pledging levels, and liquidity.

- Combine promoter data with financial performance, governance, and valuations.

At MoneyWorks4Me, our tools help you decode promoter shareholding patterns as part of a complete Management X-Ray, so you can make better, evidence-based investment decisions — not emotional ones.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: