DEE Development Engineers Ltd IPO Details:

Opening Date: June 19, 2024

Closing Date: June 21, 2024

Listing: BSE and NSE

Number of Shares: 2.05 Cr shares

Face Value: Rs 10 per share

Price Band: Rs 193-203 per equity share

Issue Size: Rs 418.01 Cr

About the DEE Development Engineers Ltd:

DEE is an engineering company providing specialized process piping solutions for industries in oil and gas, power (including nuclear), chemicals and other process oriented industries. The company provides engineering, procurement and manufacturing services. DEE has over 3 and half decades of manufacturing experience. As part of their specialized process piping solutions, they manufacture and supply piping products such as high-pressure piping systems, piping spools, high frequency induction pipe bends, Longitudinally Submerged Arc Welding pipes, industrial pipe fittings, pressure vessels, industrial stacks, modular skids and accessories including boiler super heater coils, de-super heaters and other customized manufactured components.

Industry Overview

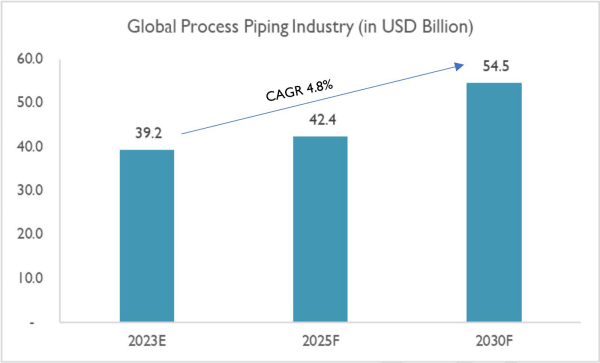

The global market for process piping solutions is expected to grow at a CAGR of 4.8% to reach US$ 54.5 billion, from CY2023-CY2030.

This growth is expected to come from strong growth in capital expenditure in China and India, with the Indian Government targeting to increase the manufacturing sector share in GDP from current ~15% to 25% by the year 2025. To achieve this target, the government implemented programs such as Make in India, and PLI- Production Linked Incentive.

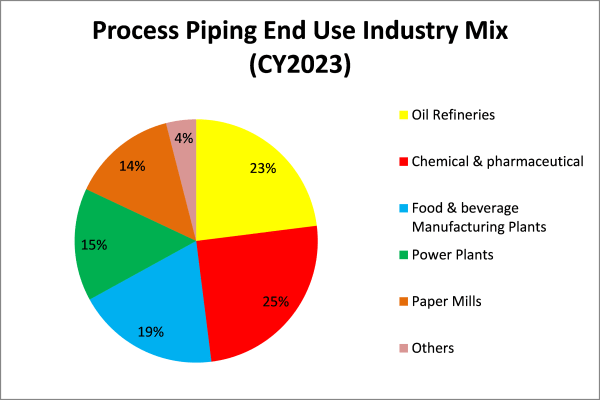

Increasing chemical and petroleum refining is expected to drive demand for piping systems, and strong demand for petrochemicals from developing and developed economies are expected to drive the next wave of capital spending, which will be resulting in an increased demand for piping. By FY30, the process piping industry is forecasted to reach an annual turnover of Rs.~38,000 crores. In CY 2023, the Indian Piping Industry Market was estimated to be worth roughly Rs. 25,000+ crores with the segment mix given below.

Conventional energy demand in India is expected to grow strongly, atleast in the short to medium term, with the petroleum consumption in India expected to hit 335 mtpa in FY2030.

Business Segment

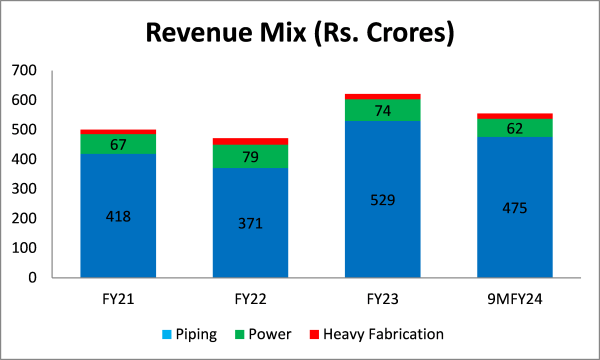

The company operates in three sectors, Piping solutions which is the largest followed by Power and then by heavy fabrication. The revenue breakup is as follows;

The company has order book of worth 829 Cr as of Dec 2023

1) Piping solutions:

under this division, the company manufactures and supplies piping products such as high pressure piping systems, piping spools, Induction bends, longitudinally Submerged Arc Welding pipes, industrial pipe fittings, pressure vessels, industrial stacks, modular skids and accessories including boiler super heater coils, de-super heaters and other custom components.

Key products under this segment are:

a) Piping spools: these are pre-fabricated components of a piping system which include pipes, flanges and industrial pipe fittings. They connect long pipes, by welding them or bolting them to another pipe via flanges.

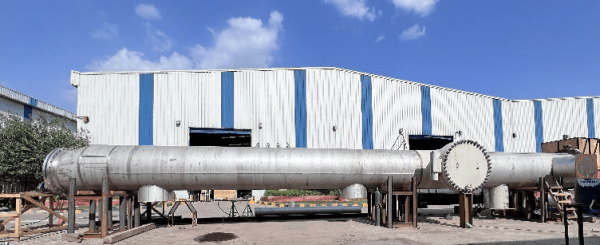

(An example of a Piping spool, source RHP)

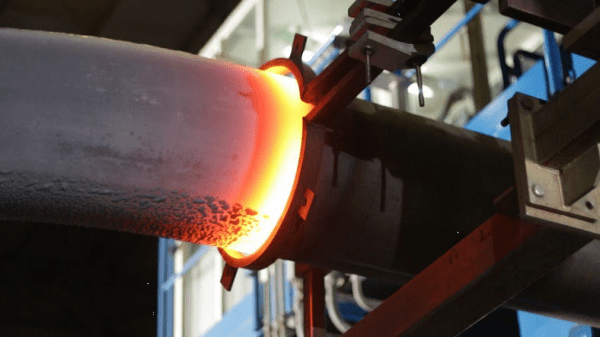

b) Induction Pipe spools: These are also known as weld less pipe spools. These are pipes which are bent at desired angles via a process called as high frequency induction bending. This process generates extreme heat in the area of pipe which needs to be bent. These pipes are used in various industries like power (both thermal and nuclear), oil and gas, petrochemical refineries, process industries, desalination plants and cement industries.

(An example of a weld less Pipe spool, source RHP)

c) Industrial Pipe fittings: These are used in piping systems to connect pipes and help in adapting the pipes to different sizes or shapes, to provide a joint of dissimilar piping or for redirecting the piping system. These are sold directly to OEMs and also find applications in the power and oil and gas industries, respectively.

(Pipe Fittings; source RHP)

d) Pressure vessels: These are specialized container designed to hold gases or liquids at pressures which are significantly different from the surrounding pressures. DEE manufactures different types of pressure vessels depending on customer specifications.

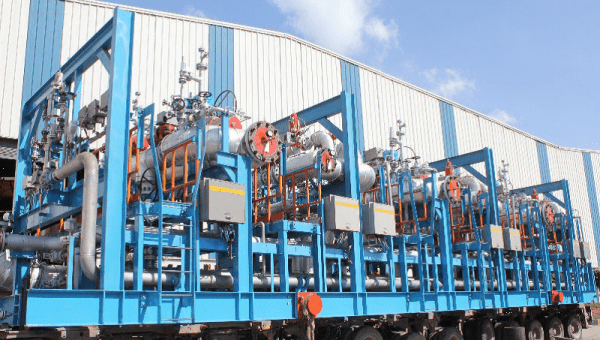

e) Modular Piping (Skids and Modules): These are self-contained systems where the machinery, piping system and instrumentation are enclosed under a frame or module. These can be part of the manufacturing infrastructure or in some cases, the entire manufacturing infrastructure.

(An example of a modular skid, source RHP)

2) Power:

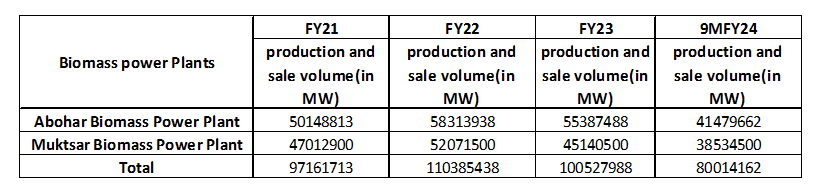

The Company produces electricity through its biomass plants from raw materials such as paddy straw, mustard straw and cotton stalks. These biomass plants are located at Abohar and Muktsar in Punjab. The aggregate annual contracted capacity of the biomass power plants is 14 MW, which has been fully contracted for under the power purchase agreements entered with the Punjab State Power Corporation Limited. These plants source substantial amounts of water from the Punjab Irrigation Department.

3) Heavy Fabrication:

Under this division, the company undertakes heavy piping and fabrication solutions for requirements of the renewable power sector and undertake the manufacturing of wind turbine towers and industrial stacks(Industrial Chimneys) at their Anjar Heavy Fabrication facility, which spans an area of approximately 88429 square meters.

Manufacturing Facility

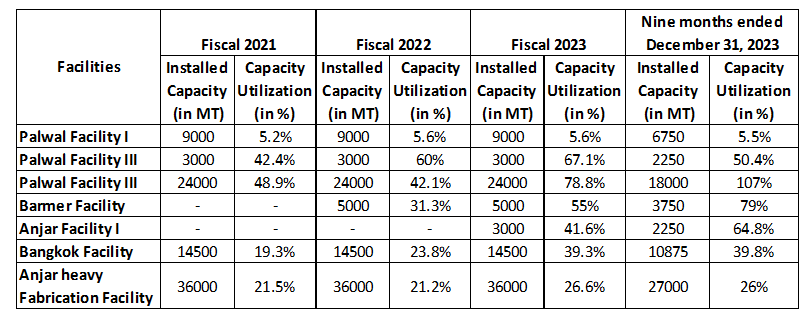

DEE has seven strategically located manufacturing facilities at Palwal in Haryana, Anjar in Gujarat, Barmer in Rajasthan, Numaligarh in Assam and Bangkok in Thailand, with three Manufacturing facilities located at Palwal.

Objects of the Offer:

Out of the total issue size of Rs. 418 crores, Rs. 325 crores are to be raised via fresh issue, while the remaining Rs. 93 crores are Offer for sale.

The company plans to utilize Rs. 75 crores for funding its working capital requirements, Rs. 175 crores for repayment/ payment of borrowings and the remaining for general corporate purposes.

The promoter, Krishan Bansal is the selling shareholder, who will be offloading Rs. 93 crore worth of shares in the IPO

Positives:

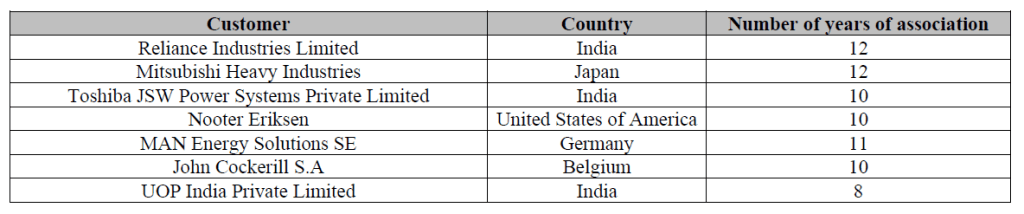

Customer stickiness: The Company has a long standing relationship with its clients. Some of the Marquee names, like Reliance Industries and Mitsubishi are its long standing customers, with which DEE has a relationship of 12 years.

Concerns:

Capex Heavy Business: The company incurs heavy Capital expenditures, given the inherent nature of the business. The company had incurred Rs. 16 crores, Rs. 21 crores, Rs. 59 crores and Rs. 81 crores worth of Capex in the Financial Years FY21, FY22, FY23 and 9MFY24 respectively.

Increased working capital requirements: The company required working capital in excess of Rs. 300 crores from FY21-FY23, and projects it to increase to Rs. 405 crores in FY24 and Rs. 480 crores in FY25. The company’s Cash conversion cycle stood at 200 days in FY23

Exposure to raw material price volatility risk : The major input material used by the company for fabrication is steel pipes, total cost of materials consumed constituted around 39% of TOI in FY23. The prices of steel pipes are linked to demand-supply scenario of market and the company generally enters into the fixed-price contracts with customers in piping segment and hence any sharp variation in input costs may impact the margins of the company as there is no pass on.

Financials

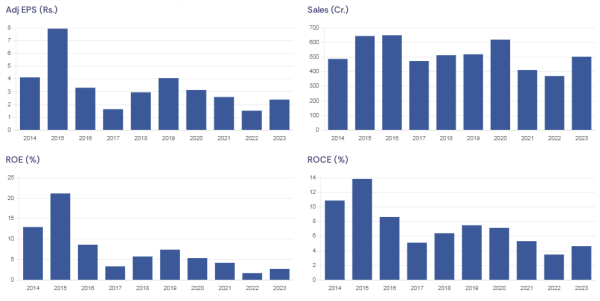

From Rs.~ 484 crores revenue in FY2014, the revenue growth has more or less remained flat as the revenue for FY23 was Rs. 502 crores. The Return on Equity (RoE) has also fallen and has not recovered since its peak of 20%+ in FY15. However, the growth in sales seems to be coming back as the company reported revenue of Rs. 546 crores in the 9 months ended December 2023.

Key Management Personnel

Krishan Lalit Bansal: He is the founder, Chairman and Managing Director of the company. He completed his bachelor in mechanical engineering from Punjab Engineering college, Chandigarh. He is recipient of various awards from Faridabad Industrial Association.

Ashima Bansal: She is a whole time director of the firm and spouse of Krishan Lalit Bansal. She completed her bachelor’s degree in education and Master’s degree in Arts from Panjab University. She has been associated with the company since April 2007

Shikha Bansal: She is the whole time director of the company and daughter in law of Krishan Bansal and Ashima Bansal and holds a bachelor’s degree in commerce from University of Delhi and Master’s degree in commerce from Himachal Pradesh University. She is associated with the company since December 2020.

MoneyWorks4Me Opinion

DEE has witnessed top line stagnation over past decade. (FY23 RS.502 Cr v/s FY14 Rs. 484 Cr). Moreover, the company's Return on Equity (RoE) is substantially lower than its cost of capital, indicating inefficient use of shareholder funds.

DEE Development operates in a working capital-intensive industry, necessitating significant investments to drive growth. This heavy reliance on working capital adversely impacts the company's ability to generate free cash flow. Given these financial dynamics and the industry's characteristics, we recommend AVOID.

Recommendation: Avoid

DEE Development Engineers Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | June 19, 2024 |

| IPO Close Date | June 21, 2024 |

| Basis of Allotment Date | June 24, 2024 |

| Refunds Initiation | June 25, 2024 |

| A credit of Shares to Demat Account | June 25, 2024 |

| IPO Listing Date | June 26, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 73 | Rs. 14,819 |

| Maximum | 13 | 949 | Rs. 192,647 |

DEE Development Engineers Limited IPO FAQs:

When will the DEE Development Engineers Ltd IPO open?

DEE Development Engineers Ltd IPO will open for subscription on Wednesday, 19th June 2024, and closes on Friday, 21st June 2024.

What is the price band of DEE Development Engineers Ltd IPO?

The price band for DEE Development Engineers Ltd IPO is Rs. 193-203/share.

What is the lot size for the DEE Development Engineers Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 73 shares, up to a maximum of 13 lots i.e. Rs. 1,92,647/-.

What is the issue size of DEE Development Engineers Ltd IPO?

The total issue size is ~ Rs. 418.01 Cr.

When will the basis of allotment be out?

Allotment will be finalized on June 24th and refunds will be initiated by June 25th. Shares allotment will be credited in Demat accounts by June 25th.

What is the listing date of DEE Development Engineers Ltd’s IPO?

The tentative listing date of the DEE Development Engineers Ltd IPO is June 26th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: