Go Digit General Insurance Limited IPO Details:

Opening Date: May 15, 2024

Closing Date: May 17, 2024

Listing: BSE and NSE

Number of Shares: 9.6 Cr shares

Face Value: Rs 10 per share

Price Band: Rs 258-272 per equity share

Issue Size: Rs 2,614.65 Cr

About the Go Digit General Insurance Limited Company:

Go Digit is a digital full-stack non-life insurance company. It offers various insurance products, ranging from motor, health, travel, property, marine, liability coverage, and many others. As a digital full stack insurance company, Go Digit deploys a combination of insurance and technology solutions to assist in enrolment, insurance claims processing, underwriting, policy administration, data insights and fraud detection. One of the company’s objectives is to make insurance documents easily accessible and readable by the common public. The company’s main target audience is young and tech-savvy people.

Go Digit has developed predictive underwriting models that utilize insights from their data bank. These models help them identify and target markets and customers in India which are likely to be more profitable, enabling them to price their coverage accurately.

Go Digit has captured approximately 3.3% of the overall non-life insurance market during FY 2023, which has increased to an estimated 4.3% as of the 9M FY 24 measured by the GWP (Gross Written Premium) for public and private general insurance companies (excluding standalone health insurers and specialized PSUs).

Industry Overview:

For FY 2023, the country’s non-life insurance sector had a penetration rate of 1.0% of the GDP. In comparison, in 2022, China accounted for a penetration of 1.9%. This low penetration stems from financial illiteracy, lack of awareness, low household disposable income, complex products and inefficiencies in the distribution system.

However, with initiatives by IRDAI like the "Insurance for All by 2047", the government aims to provide life, health, and property insurance to every citizen by 2047. The main major strategies to be adopted in working toward the realization of the objective of IRDAI include the following:

- Promoting micro insurance products to help low-income groups.

- Collaboration with governments to support programs such as PMJAY to expand the health insurance coverage of their population.

- Expanding financial inclusion through the inclusion of insurance in existing social and economic programs.

- Advocacy for standardized insurance plans that would make it easier for consumers to compare the offerings.

- Leverage technology to improve accessibility and simplify processes, particularly in rural areas.

- Enhance financial literacy and ensure efficiency in the claim settlement process.

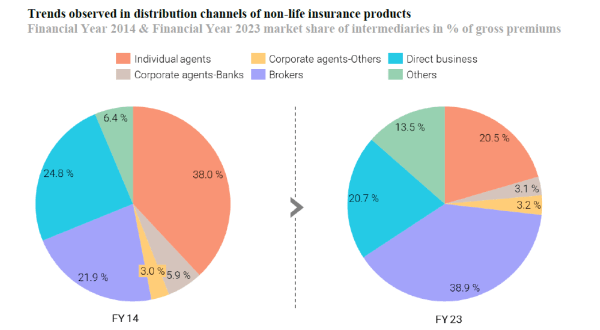

With the advent of technology, Insurance distribution via Brokers is garnering pace as can be seen from the rise of brokers like PolicyBazaar. A shift in business to Brokers from individual agents can be seen below:

(Source: DRHP)

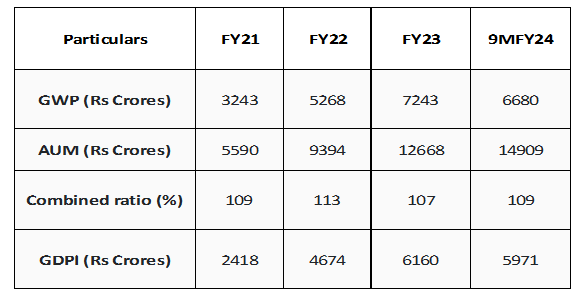

Key Performance Indicators:

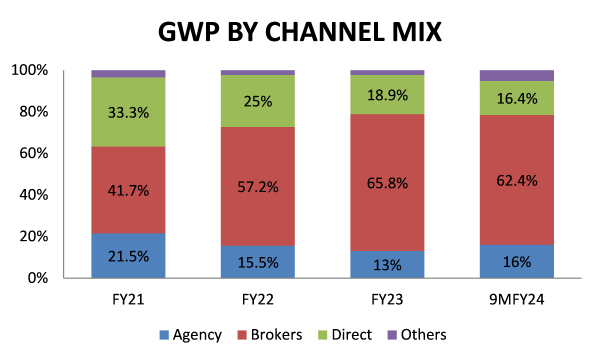

Channel Mix:

The company has a digital-led physical distribution network. They distribute their products through a mostly partnership-based model, across various channels. As of Q3 FY24, they maintained relationships with approximately 61,972 Key Distribution Partners, which included approximately 58,532 Point of sale Persons, as well as individual agents, corporate agents, brokers and others. They also sell products directly to customers through their website and through web aggregators. The company adopts a “Phy-gital” mode of distribution.

Business Segments:

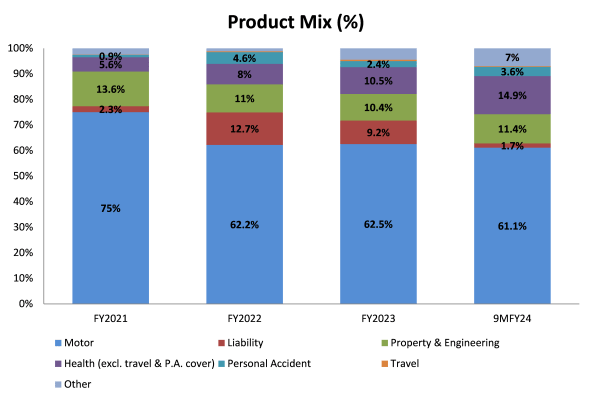

The company derives a majority of its GWP from Motor insurance, whose share has decreased from 75% to 61% from FY2021 to 9MFY24. The other 2 main segments are Property & Engineering and health, with a combined contribution of ~26% in the 9MFY24, with Liability, personal accident, travel and other products accounting for the rest.

Competitors: While there are many large players in the non-life insurance sector (ICICI Lombard, SBI General Insurance, Bajaj Allianz) the main competitors in the digital full-stack segment are Navi and Acko. However, In FY2023 and 9MFY24, Go Digit had an approximate 82% market share in GWP among digital full-stack insurers, with the main contribution by motor insurance, which forms around 62% of Go Digit’s GWP.

Objects of the Offer:

The company proposes to utilize the Net proceeds from the fresh issue comprising 41,360,294 shares aggregating around Rs. 1,125 crores, towards maintaining the solvency ratio as prescribed according to IRDAI regulations & in the OFS category, the holding company is the major selling shareholder, which will be offloading 54,755,614 shares, while other shareholders are selling up to 10778 shares totaling to 54,766,392, thus aggregating to ~ Rs. 1,489 crores, making the total IPO size to Rs.2614 crores.

Selling shareholders:

(1) Go Digit Infoworks Services Private Limited (Parent Holding co) (2) Nikita Mihir Vakharia, jointly with Mihir Atul Vakharia (3) Nikunj Hirendra Shah, jointly with Sohag Hirendra Shah and (4) Subramaniam Vasudevan, jointly with Shanti Subramaniam

Concerns:

- Lack of strong Distribution: Large Insurers back on strong parentage for a sustained distribution channel. Go Digit relies on brokers for more than 2/3rd of its GWP. Pricing pressure from brokers can decrease profitability for Go Digit.

- Product concentration risk: Go Digit derives a significant part of its revenue (~62%) from Motor insurance and any constraints, regulatory changes, and underlying sales of motor vehicles falling significantly can impact the profitability of Go-Digit

- Solvency - Due to rapid growth, the solvency requirements as mandated by IRDAI might be affected. This is also evident by the fact that the proceeds from the fresh issue are being used to satisfy the solvency requirements of IRDAI.

- Competitive intensity: The non-life insurance space is dominated by many large players, both private as well as public, thus there always is a risk of reducing the profitability of core products due to competetion.

Management:

Kamesh Goyal: He is the Non-Executive Chairman of the company. He has been on the Board of the Company since the date of its incorporation. He is a science and law graduate and has done his post-graduation in business administration from the University of Delhi and held the position of CEO at Bajaj Allianz General Insurance.

Jasleen Kohli: She serves as MD and CEO of the Company. She is an alumnus of K J Somaiya Institute of Management Studies and Research where she completed her Post graduate program in management studies. She was earlier the head of operations at Bajaj Allianz General Insurance.

MoneyWorks4Me Opinion

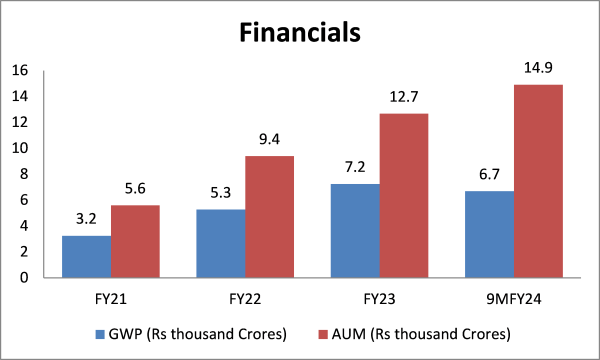

The quality of underwriting of any insurer can be judged by its Loss ratio which for Go Digit is amongst the best. The shift in consumer sentiment toward purchasing from Digital channels and the pace of growth of Go Digit in this segment is what we like about the company. It has been able to grow its GWP/AUM at a CAGR of 49%/51% in the last 3 years as against peers who are able to grow 18%/23%. Although this has created pressure on the Solvency ratio, the Company is raising enough money that will help it maintain its solvency ratio to grow at its current pace of growth.

Insurance needs a certain scale so that the cost of operations (ie. Expense ratio which is highest amongst peers for Go Digit) reduces to a level that the company is able to generate decent ROEs. We expect that with scale, Go Digit’s expense ratio shall decrease and investment income from the float shall increase leading to significantly higher profitability. We advise aggressive investors to subscribe to the IPO as this is a good bet on rising insurance penetration in India led by the Phy-gital model.

Note: Insurance is a tough business to crack, as is the accounting difficult to understand. Until the company is able to generate decent ROEs, it should be tracked closely. Only investors with a high risk appetite and long period of holding should subscribe to this IPO.

Recommendation: Buy for Aggressive Investors

Go Digit General Insurance Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | May 15, 2024 |

| IPO Close Date | May 17, 2024 |

| Basis of Allotment Date | May 21, 2024 |

| Refunds Initiation | May 22, 2024 |

| A credit of Shares to Demat Account | May 22, 2024 |

| IPO Listing Date | May 23, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 55 | Rs. 14,960 |

| Maximum | 13 | 715 | Rs. 194,480 |

Go Digit General Insurance Limited IPO FAQs:

When will the Go Digit General Insurance Ltd IPO open?

Go Digit General Insurance Ltd IPO will open for subscription on Wednesday, 15th May 2024, and closes on Friday, 17th May 2024.

What is the price band of Go Digit General Insurance Ltd IPO?

The price band for Go Digit General Insurance Ltd IPO is Rs. 258-272/share.

What is the lot size for the Go Digit General Insurance Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 55 shares, up to a maximum of 13 lots i.e. Rs. 1,94,480/-.

What is the issue size of Go Digit General Insurance Ltd IPO?

The total issue size is ~ Rs. 2,614.65 Cr.

When will the basis of allotment be out?

Allotment will be finalized on May 21st and refunds will be initiated by May 22nd. Shares allotment will be credited in Demat accounts by May 22nd.

What is the listing date of Go Digit General Insurance Ltd’s IPO?

The tentative listing date of the Go Digit General Insurance Ltd IPO is May 23rd, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: