Analyzing GPPL’s annual report we have compiled a report, with an overview of business operations, expansion plans laid out by the management, and financial performance as well as our observations.

GPPL is India's first private sector port, operating an all-weather port located on the Southwest coast of Gujarat. The port lies on a strategic international maritime trade route connecting India to various geographies. APM Terminals is the Lead Promoter and holds 44% of the company. It is a unit of Danish shipping company Maersk's transport and logistics division. The parent company operates a network of 65 terminals globally. It is uniquely positioned to help both shipping line and landside customers grow their business and achieve better supply chain efficiency, flexibility, and dependability.

GPPL’s current concession agreement (to operate port) with port authorities is valid up to Sept’2028. The Company continues to be engaged with the stakeholders for extending this.

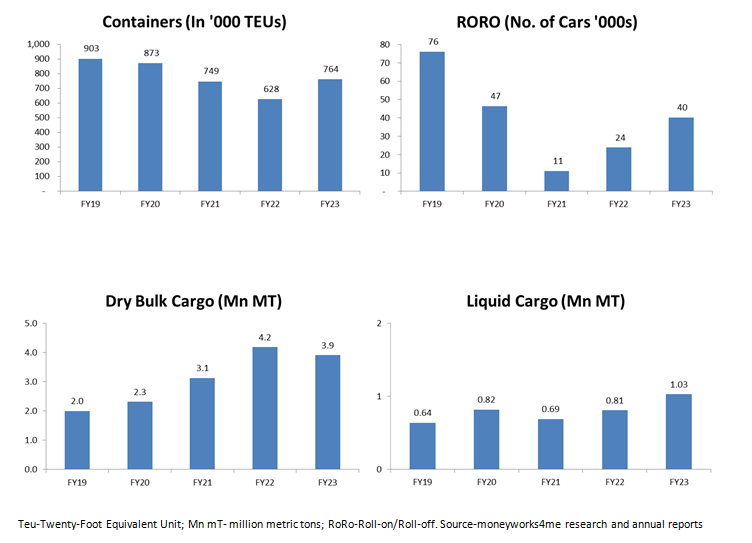

Business performance is robust on all fronts

The company's strong performance (revenues grew 24% YoY) can be attributed to several key factors, such as introducing a new container service, efficiently evacuating LPG by rail, initiating coastal movement of liquid cargo, and gaining a new RoRo (Roll on/Roll off*) customer.

- Container volume increased by 21% YoY, reaching 764,034 TEUs (Twenty-Foot Equivalent Units) compared to the previous year's 627,747 TEUs. This growth can be attributed to improved shipping line schedules and the introduction of a new service. The easing of COVID-19 restrictions and improved conditions in China contributed to more reliable shipping schedules.

- Dry Bulk cargo volume at West Coast Ports, including Pipavav, mainly consists of coal and fertilizer imports. The port handled 3.91 million metric tons (MMT) of Dry Bulk Cargo, down from 4.19 MMT in the previous year, primarily due to cargo shifting back to a nearby captive jetty following cyclone restoration work. The company also engaged in other opportunities such as break bulk imports and agri exports on a smaller scale.

- In the Liquid cargo segment, the port handled about 1.03 MMT during the year, a 28% increase YoY, driven by rising LPG imports. Efficient rail evacuation (transport from the port via rail network) of LPG within the port allowed LPG importers to expand their reach to the hinterland at a lower logistics cost.

- Car exports (*RoRo- Roll-on/Roll-off; example transporting Ford car from plant to distributor) from the West Coast faced challenges, but the port managed to handle 40,237 cars during the year, a significant increase from the previous year's 23,874 cars. This rebound was due to the addition of new customers and increased exports by existing customers.

Outlook going ahead remains stable on easing of supply chain issues and improvement in import volumes

- With China opening up and inflation impacting the Western economies, the situation of port congestion has eased, and the global supply chain has stabilised. The availability of containers has changed from shortage to excess supply. The ocean freight rates for the shipping lines have been on a downward trend as compared to the last two years but they remain high as compared to the pre-COVID days.

- As per the estimates of the World Trade Organisation, global trade growth is likely to be at 1.7% in 2023 lower than its 12-year average of 2.7% due to high inflation, monetary tightening, and financial uncertainty but it is likely to sharply improve in 2024 to 3.2%.

- The Container volume on the West Coast of India saw an increase of 4% to 14.56 mn TEUs as compared to 13.95 mn TEUs in the previous year. The increase is driven mainly by the imports into the country while the Export volume to the Western countries has been impacted.

- Considering the economic situation in the western countries, the Exports from India to the US and Europe are likely to remain under pressure in the short term. But the Exports to the Middle East and to the Far East are likely to remain steady. Imports into India are likely to see improvement with the consumption economy continuing to do well.

Expansion across segments

- GPPL’s utilization across segments such as dry bulk, liquid cargo, and containers stands at 75%, 52%, and 57% respectively.

- Dry Bulk – In FY23, GPPL commissioned additional warehouse space of 10,000 sq. mtrs. for storage of fertiliser. In order to increase the rake loading capacity and to enable faster evacuation of fertiliser cargo, GPPL has now commissioned two additional wagon loading equipment on the rail line. It will also provide operational flexibility in simultaneously handling different types of fertiliser cargo for loading on rakes.

- In an endeavour to improve the local ecosystem around the port, GPPL has entered into an agreement to hire of a warehouse on a long-term lease at the Multi-Modal Logistics Park being developed outside the port. It will help in providing warehousing solutions to the local cargo customers from the immediate hinterland.

- Liquid cargo- Capex of USD 90 million for the construction of a new liquid berth, in response to growing business requirements. The current berth is already operating at over 50% capacity, and considering the time required for obtaining necessary permissions and completing construction, the company aims to provide efficient waterfront facilities to tank farm operators within the port. Once completed, it will increase the Liquid cargo handling capacity at Pipavav from 2 MMT to 5.2 MMT.

- Additionally, the company has completed capex to upgrade the existing Liquid Berth infrastructure to handle partially loaded Very Large Gas Carriers (VLGCs), pending necessary permissions. These initiatives will increase the port's capacity for handling LPG and align with the Government of India's initiative to provide LPG connections to households through the Pradhan Mantri Ujwala Yojana.

- The company continues to collaborate closely with its business partners to explore new opportunities in RoRo segment.

Pipavav Railway Corporation Limited (PRCL) aiding the evacuation

- PRCL is an associate company, and GPPL holds a 38.8% stake in the same.

- PRCL's contribution involves providing a rail link to the Port in Pipavav, Gujarat, which is utilized by rail operators for the transportation of cargo to and from the port.

- In addition to this, it has initiated Container Train Operations to and from Pipavav Port, further enhancing its rail connectivity.

Financial performance

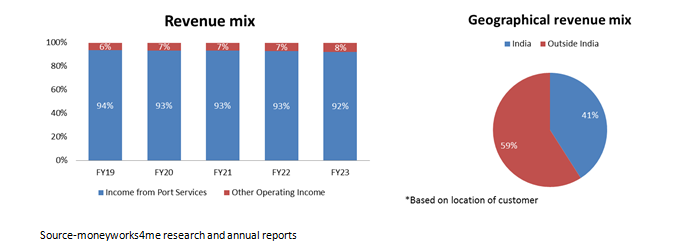

Revenue consists of Income from Port Services and Other Operating Income. Income from Port Services includes Income from Marine Services, Container and cargo Handling, Storage services as well as value-added Port Services. Other Operating Income comprises incidental Income from Operations and lease rentals from sub-leasing of land to various Port users. The majority of customers of GPPL are not located in India. The customers in the Container business are primarily the Shipping lines and in the case of Dry Bulk, Liquid, and RoRo it is the local companies that import/ export the cargo.

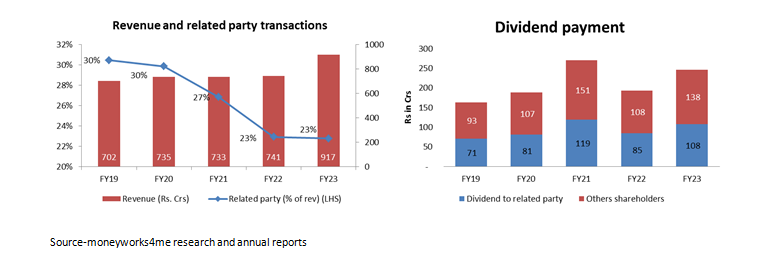

Related party transactions are not ramping up

GPPL benefits from the strong parentage of Maersk and its network. In the usual course of business, it receives income from Maersk which is not increasing significantly. Another major transaction is dividend payment to the promoter (APM Terminals Mauritius). GPPL has a well laid out dividend policy and as stated has shared entire distributable profits to shareholders (current dividend yield ~5%).

GPPL has shown resilience during cyclones

- The West Coast of India has experienced an increasing frequency of cyclones, raising concerns about their impact. The port recently faced Cyclone Biparjoy. All employees and equipment remained safe, and the port facility sustained no significant damage. Port operations were temporarily suspended for about 7 days due to severe weather conditions but resumed promptly after the cyclone subsided. The backlog was cleared within a week.

- The Saurashtra region of Gujarat was hit by Cyclone Tauktae on 17th May 2021. It disrupted the main grid power supply and communication links. Efforts are underway to restore the Bunds, the port compound wall, and the jetty fenders, with completion expected by the end of 2023. GPPL has booked Rs. 37 Cr/Rs. 4 Cr in FY23/FY22 as exceptional expenses.

- The company's Disaster Management Plans include procedures to mitigate potential risks, and management regularly reviews these plans to ensure effective measures are in place.

Accolades and Green Initiatives:

- GPPL has earned the distinction of being India's most efficient port for two consecutive years, as recognized by the World Bank and S&P Global Market Intelligence through the Global Port Performance Index.

- Additionally, the company has received certification as a "Great Place to Work" for the fifth consecutive year based on the Trust Index Employee Survey.

- GPPL has taken significant steps as part of its Green Initiatives to establish Pipavav as "Gujarat’s Green Gateway." Last year, a milestone was achieved with the commissioning of a 1,000 kWp capacity rooftop solar power plant.

- Building on this progress, the company has recently entered into a Power Purchase Agreement to procure green power, with the power generating company now supplying green energy to the grid. This move means that approximately 45% of the company's power requirements will be met through environmentally friendly sources.

- In line with its commitment and in alignment with its parent company's goals, GPPL is steadfastly pursuing the objective of achieving net-zero greenhouse gas emissions by the year 2040.

Looking ahead to FY24-28, volume growth at Indian ports is expected to stay within the range of 3-6%. We have been positive on the logistics sector for a while given the policy push and long growth runway; we expect GPPL to keep up its healthy performance and create value for shareholders.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: