Analyzing Krsnaa’s annual report we have compiled a report, with an overview of the sector, growth strategies, balance sheet and management changes as well as our observations. Read our initiating note to understand Krsnaa’s business model in depth.

Profile of the company-

Krsnaa Diagnostics (KDL) is one of the largest players in the diagnostic sector through Public-Private Partnerships (PPP). The company focuses on making quality diagnostic services accessible and affordable to a large portion of the Indian population. By collaborating with both government and private hospitals, Krsnaa Diagnostics serves communities in urban, semi-urban and rural areas. Its wide range of radiology, pathology, and teleradiology services has allowed it to expand its presence across the country.

Sector tailwinds and increased government allocation aiding PPP diagnostics-

- Governments’ budgeted expenditure on the health sector reached 2.1 percent of the GDP in FY23. It is expected the Government will increase the expenditure to 2.5 percent by FY25, specially focusing on the underprivileged population.

- The fiscal year 2024 observed a significant 15% increase in budget allocation for healthcare as compared to the previous year. The growth can be owed to various initiatives undertaken by the Government such as the Pradhan Mantri Atmanirbhar Swasth Bharat Yojana (PMASBY), Pradhan Mantri Swasthya Suraksha Yojana (PMSSY) and Pradhan Mantri Jan Arogya Yojana (PMJAY).

- The National Health Mission (NHM) has become one of the largest initiatives by the Ministry of Health and Family Welfare (MoHFW), with a budget estimate of Rs. 35,947 crores for 2024. As part of NHM, a free essential diagnostic initiative was launched to reduce the high out-of-pocket costs for diagnostics and improve overall healthcare services. This is expected to boost the growth of PPP diagnostics.

- The diagnostic market is projected to significantly expand between FY23-28, reaching an estimated market size of Rs. 1,20,000 Cr, with a Compound Annual Growth Rate (CAGR) of 8-10%.

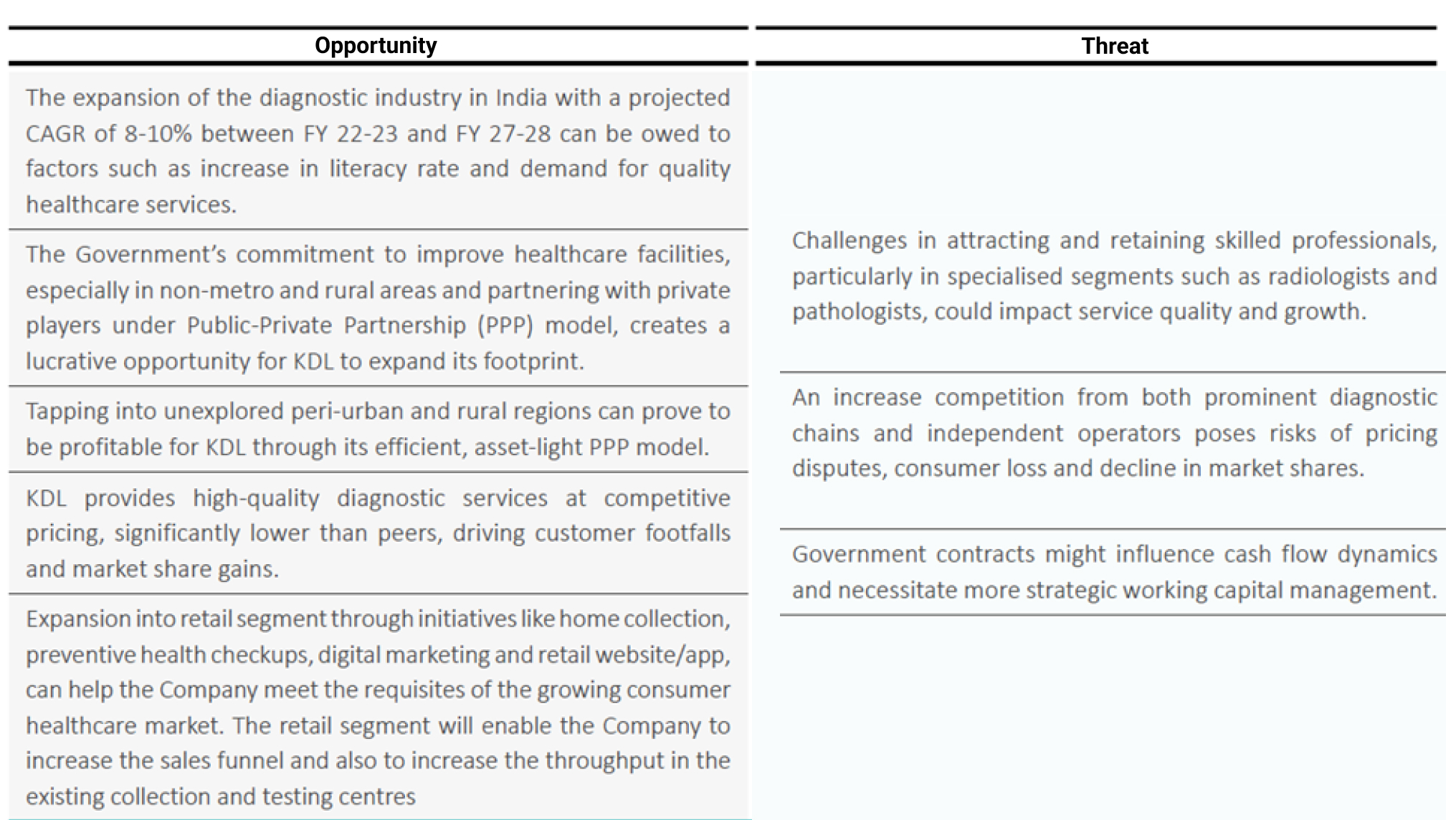

Opportunity and threats

Growth Strategies

- Tapping into New Markets- Krsnaa is participating in new Public-Private Partnership (PPP) tenders to tap into under-penetrated and growing diagnostics markets, creating additional revenue streams for future growth.

- The company is focused on the timely and successful implementation of new projects to ensure efficient growth and service delivery.

- It plans to expand its presence in Tier I, II, and III cities to meet the increasing demand for quality diagnostic services, which will strengthen its position in these regions. The company also plans to further extend its reach into semi-urban and rural areas.

- Expansion of Pathology Business - By capitalizing on the extensive infrastructure of existing centers and addition of new collection centers to reach more consumers

- Increasing Visibility- Digital campaigns to increase consumer awareness about Krsnaa’s competitive price offerings

B2C – leveraging existing infrastructure to directly reach customers

KDL is strategically expanding its retail segment, which currently accounts for only 1-2% of its revenue, revealing significant growth potential. The company plans to leverage its existing infrastructure in key locations like Maharashtra, Punjab, Orissa, and Assam to scale its retail presence. The company will first start by offering pathology services and setting up collection centers using existing labs for testing. This will ensure initial capital outlay will be limited. Pricing for such services will be higher than B2G segment but will remain competitive compared to the broader market. Margins by year end are expected to be in line with broader operations once stabilized (~25% EBITDA).

Krsnaa has already inaugurated its first B2C private lab in Mumbai, covering 15,000 sq. ft. To enhance brand recall and customer growth, Krsnaa is focusing on telereporting, effective branding, and marketing initiatives while ensuring affordable, high-quality services. Additionally, it aims to strengthen brand recognition and customer loyalty through efficient service delivery and is expanding its in-home visit services for greater healthcare accessibility. To further this expansion, the company plans to broaden its service portfolio, diversify its reach through a franchisee model, and solidify its Hospital Lab Management (HLM) model.

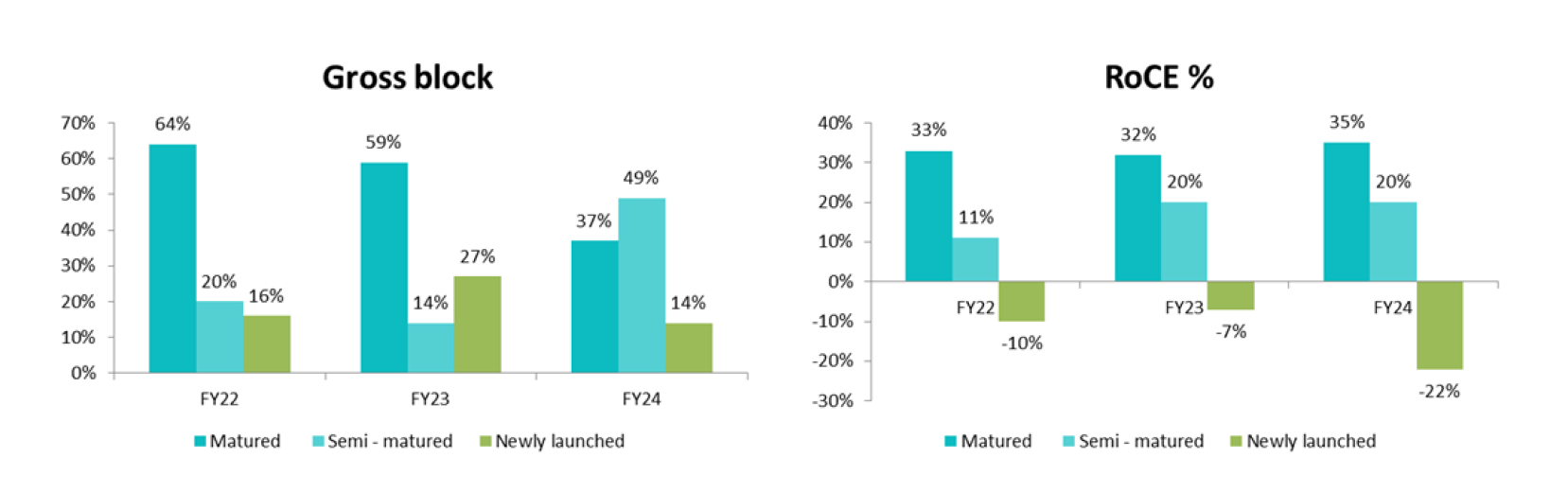

Profitability to be driven by newly launched and semi matured centers

Source: Moneyworks4me research

Centers operational for over 3 years show higher margins, while those under 3 years tend to be around break-even levels. New centers (less than 1.5 years) face negative margins due to higher initial costs during the ramp-up phase. Revenue growth happens gradually, with investments today laying the foundation for future profitability. Typically, PPP projects take 1-2 years to stabilize, and by year 3, centers reach maturity. Although this can vary by project, this trend indicates performance will improve as projects mature.

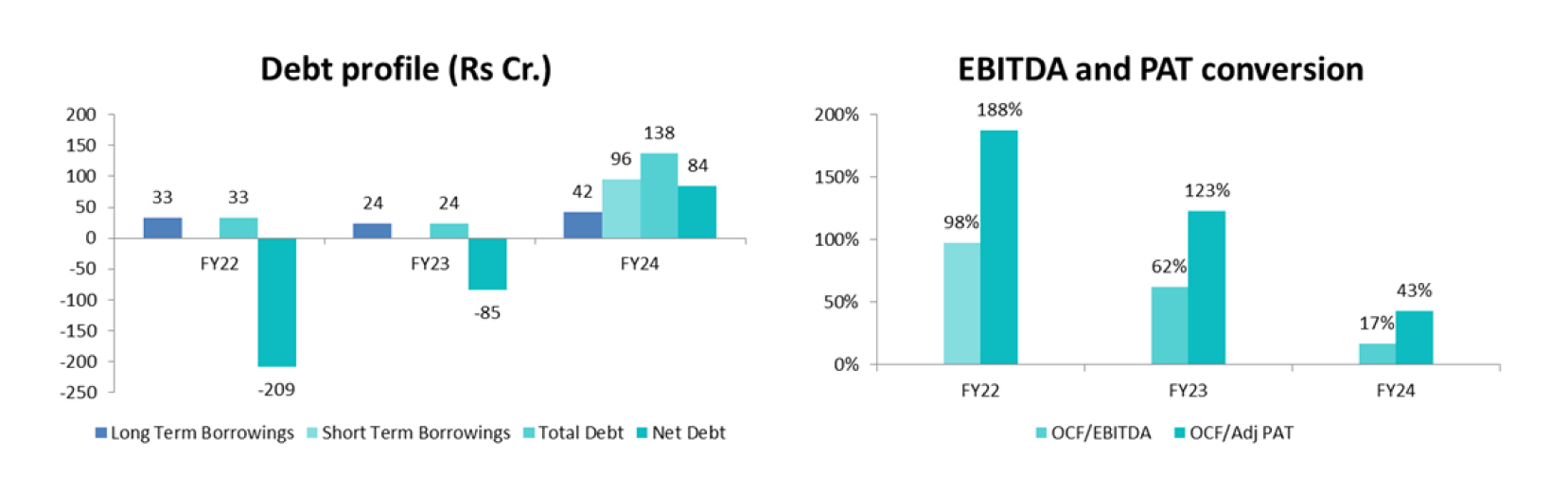

Some changes in balance sheet which are worth highlighting-

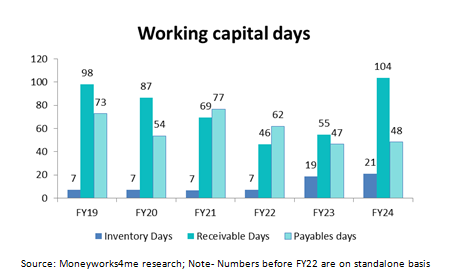

- Working capital stretched temporarily

- At year-end, receivable days stood at 104 due to delays from election-related activities (Same happened in FY19 as well) and increased receivables from Himachal Pradesh. Excluding Himachal Pradesh, receivables were 68 days. Payments from Himachal Pradesh started in April and May, with receivables expected to return to normal.

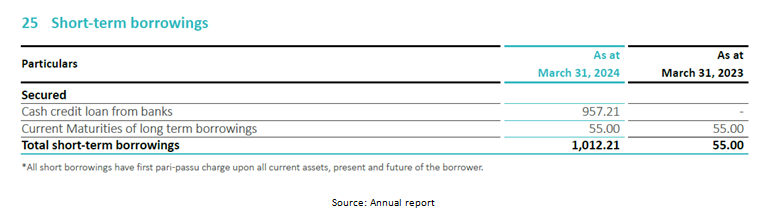

- This extended receivables resulted in short term borrowings increasing by Rs 96 Cr at end of FY24.

- In Q1 FY25, receivable days were around 100, totaling Rs. 190 crores, with significant collections in June and July post-elections. Full recovery is anticipated by the end of Q2, between June and August.

Healthy financial position-

Source: Moneyworks4me research

- Net debt stood at Rs. 84 Cr at end of the financial year. As explained above, increase in short term borrowings is due to receivables increase which is temporarily stretche

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: