Indegene Limited IPO Details:

Opening Date: May 06, 2024

Closing Date: May 08, 2024

Listing: BSE and NSE

Number of Shares: 40,746,891 shares

Face Value: Rs 2 per share

Price Band: Rs 430-452 per equity share

Issue Size: Rs 1841.76 crore

About the Indegene Limited Company:

Indegene Ltd provides commercialization and digital services to its clients in the life sciences field, which includes biopharmaceuticals, biotech, and medical devices. Much like BPO (business process outsourcing) companies work, Indegene provides range of products assisting in drug development, clinical trials, and all the way to marketing and government regulation compliance, supported by technology. It has over 20 years of healthcare experience to empower the full product-market lifecycle. In FY23, it served about 65 active clients and all the top 20 biopharmaceutical firms by revenue, across 10 countries.

About the industry:

The Life sciences industry comprises of entities engaged in R&D, manufacturing and marketing of drugs and medical devices. 2 main segments under this are:

- Biopharmaceutical: This segment comprises companies which discover, develop, manufacture and sell drugs.

- Medical devices: Comprises of companies involved in R&D, development, production and sale of systems and devices of medical applications.

Combined revenues of the biopharmaceutical and medical devices segment was estimated at $1.8 trillion in 2023, with biopharmaceuticals constituting 69%. By 2026, combined sales are expected to grow at a CAGR of ~5%, to reach $2.1 trillion. These companies undertake several activities to discover, manufacture and market products.

As per the value chain defined, life sciences operations expenditures grew at a CAGR of 6.7%, to Rs. 12.0 trillion (US$156 billion) from 2020 to 2022. This is forecasted to reach Rs. 15.5 trillion (US$201 billion) by 2026, growing at a CAGR of 6.5%. Among the factors that are predicted to fuel this growth are the aging population, growing number of people diagnosed with chronic diseases and the identification of new diseases. The historical growth was slightly higher due to the pandemic effects, which is a one-off.

Revenue and Business Model:

It serves the following four major business sectors of health and pharmaceutical services:

Enterprise Commercial Solutions (ECS):

This focuses on strengthening the sales and marketing strategies for clients, including extensive content development for healthcare professionals and patients. Indegene assists life sciences companies by creating customized marketing plans and campaigns, expanding their reach to healthcare professionals (“HCPs”), and providing insights on HCP preferences. Indegene also provides digital asset management, marketing automation, customer data management and analytics solutions to measure the effectiveness of marketing campaigns.

Omni-channel Activation:

These solutions enable life sciences to optimize the promotion of biopharmaceutical products and medical devices to healthcare professionals from multiple channels. In conventional practices, these were traditionally managed with human medical representatives and personal discussions. The firm uses digital technologies with analytics to get similar results in a shorter time and with less expenditure. This is done with the support of the company's NEXT HCP Journey Optimization platform, which helps in the segmentation of customers and the optimization of channels to enhance the deployment of medical representatives. Also, through its subsidiary Cult Health, it helps life science firms develop marketing strategy, design, and content production for multi-channel distribution.

Enterprise Medical Solutions (EMS):

Under this segment, Indegene establishes Centers of Excellence (CoE) to undertake large-scale regulatory and medical operations for the clients. These CoEs comprise multidisciplinary teams who assist the clients with a) Writing medical content, regulatory submissions, product labels and other medical information; b) Reviewing medical communications to ensure compliance with regulatory guidelines and ethical practices; c) Monitoring complaints arising from the use of Bio-pharmaceutical products; d) Conducting medical research to support market access and pricing strategies.

Enterprise Clinical Solutions and Consultancy Services (Others):

Indegene offers solutions in drug discovery and clinical trial operations of life sciences companies, which include digitally enabled recruitment for clinical trials, clinical data management and assistance with regulatory submissions. They also help in data management and analytics for biopharmaceutical companies to seamlessly handle and analyze sources of data during clinical trials to build a case for regulatory approvals. They provide consultancy services through subsidiary DT Associates Limited, under the “DT Consulting” brand to help life sciences companies in their digital transformation for their customer experience.

The company offers a broad range of services to support pharmaceutical and healthcare industries, ranging from drug development to market development.

The company employs 2 models for charging its clients;

Resource Utilization Model: The number of employees and number of hours required for a project, whether hourly or fixed, it depends on resource utilization.

Fixed Price/Unitized Billing Model: Clients are charged a fixed price based on estimated total project costs, ensuring predictable pricing.

In some cases, Omni-channel solutions may be provided on an outcome-based pricing model, which aligns fees with the actual effectiveness of provided solutions.

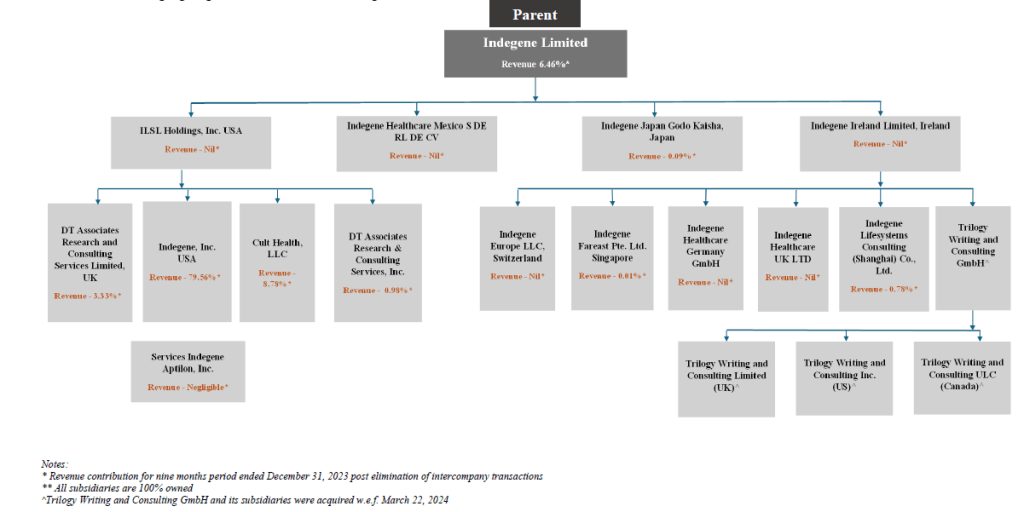

Subsidiary structure and acquisition history:

Acquisition History:

| Fiscal Year | Acquisition |

| 2005 | Incorporated Subsidiary named Indegene, Inc |

| 2006 | Acquired Medsn, Inc by Indegene, Inc * |

| 2012 | Incorporated Indegene Lifesystems Consulting (Shanghai) Co., Ltd. |

| 2017 | Acquired Encima Group |

| 2020 | Acquired DT Associates Research and Consulting Services Ltd. |

| 2021 | Incorporated Subsidiary In Indegene Japan, LLC |

| 2022 | Acquired Medical Marketing Economics, LLC and setup Mexico ops. |

| 2023 | Acquired Cult Health |

| 2023 | Acquired Healthcare Germany |

| 2024 | Acquired Trilogy Writing & Consulting through Indegene Ireland |

| * Post acquisiton of Medsn, name was changed to Indegene, Inc and IISL Holdings was intially known as Indegene Inc and was changed to IISL post the acquisition. |

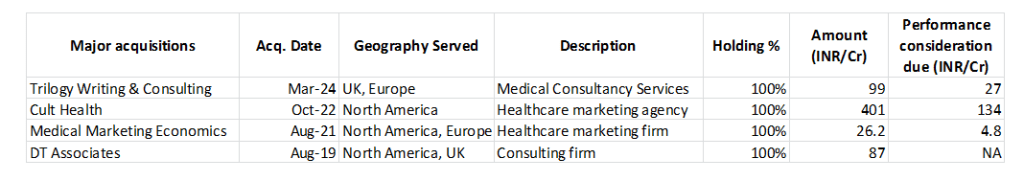

Details of major acquisitions:

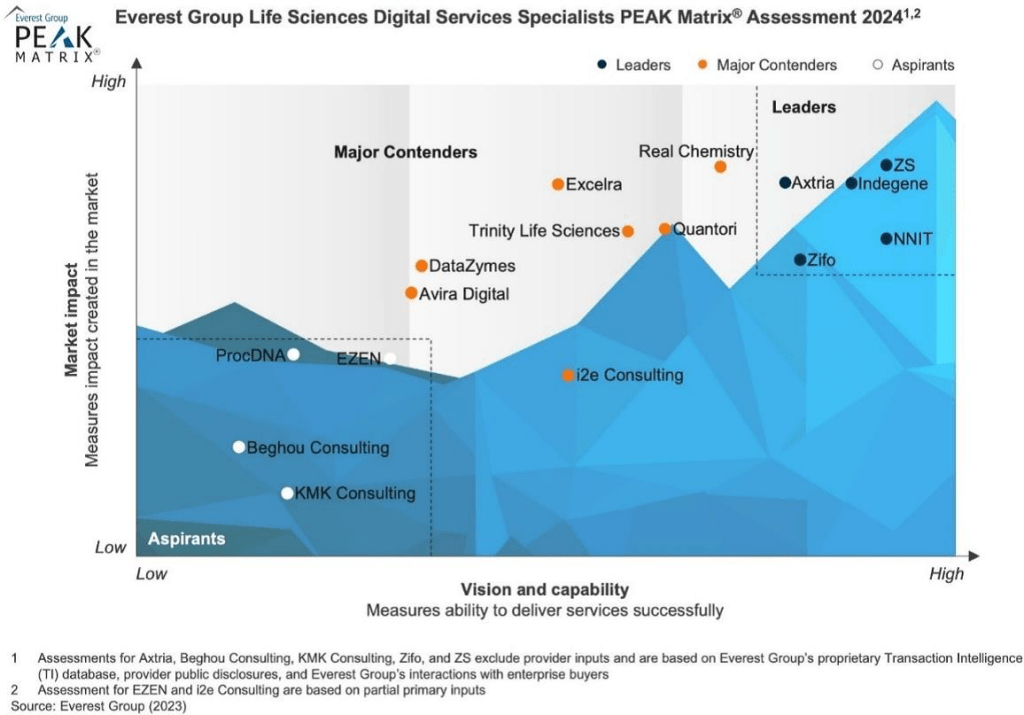

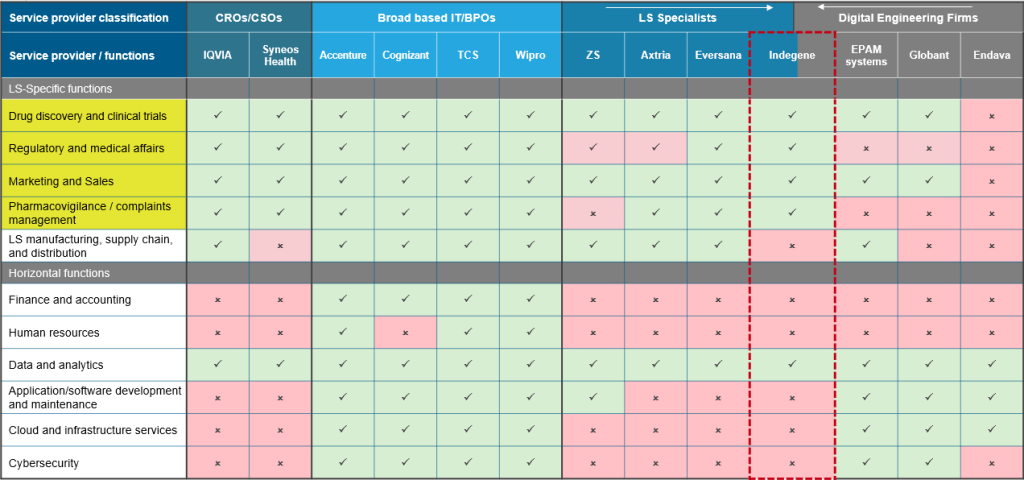

Competitors: IQVIA, Axtria, Eversana, ZS Associates are some of Indegene’s competitors. Out of this, IQVIA is listed on NYSE (revenue growth ~8% over CY18-23).

Competitor’s offerings in the Life Science value chain:

Purpose of issue:

The Company plans to utilize the Proceeds from the issue towards funding the following objectives:

- Repayment of debt of ~Rs. 391 crores of one of its material subsidiaries, ILSL Holdings, Inc.

- Funding the capital expenditure related to the purchase of computer items and refurbishing premises of the company and one of its subsidiaries, Indegene, Inc., with the combined requirements totaling Rs. 103 crores spread over 3 years.

- General corporate purposes and inorganic growth.

Positives:

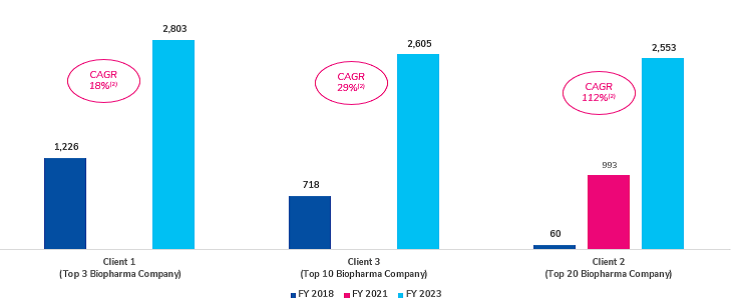

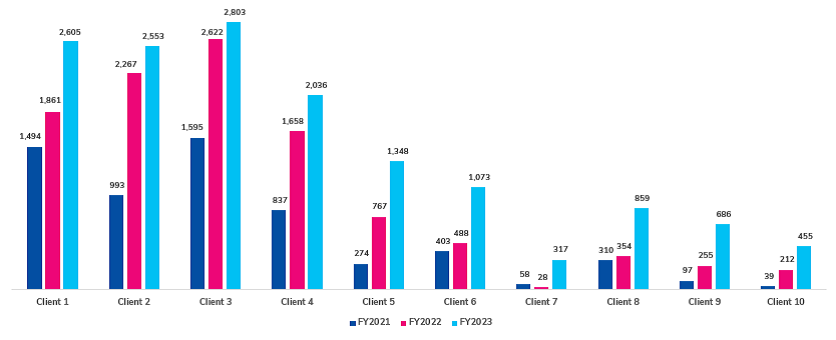

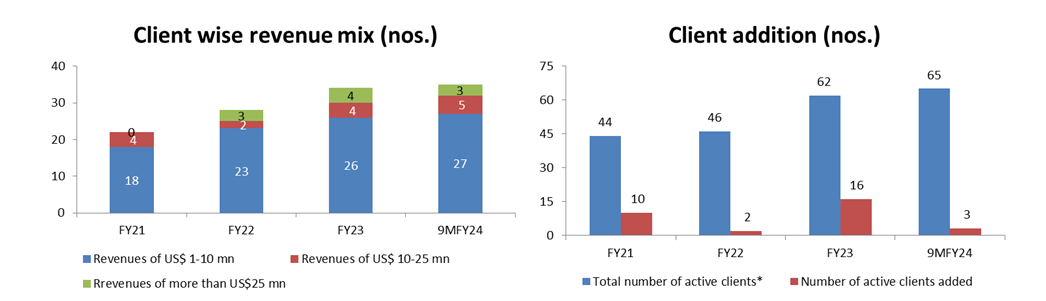

- Long-standing client relationships: Given that Indegene’s solutions are deeply integrated with the clients’ workflow, there is an inherent stickiness of clients in the business. Retention rate (revenues from existing customers as % of revenues in the previous year), was ~122%, ~160% and ~130% in FY23, FY22 and FY21 respectively.

Earnings from Top 3 clients and client additions (Rs. In Crs unless mentioned)

*Active clients are those with from whom $0.25 mn or more earned in revenues for the last twelve months preceding the relevant date.

- Inorganic growth strategy- They've got experience in finding, buying, and blending different companies and businesses to grow their operations and offer more solutions. They focus on four types of acquisitions:

- Capability Buys: They target companies providing solutions that impact various stages of the life sciences value chain.

- Technology Plays: Their aim is to acquire companies that enhance their technological capabilities, thereby improving outcomes for clients or delivery methods.

- Efficiency Plays: Targeting companies where they can leverage their technology and medical expertise to enhance existing services and deliver them more efficiently.

- Tuck-Ins / Acqui-hires: Seeking out companies to fill minor gaps in their solution portfolio or to scale up their delivery capabilities.

Concerns:

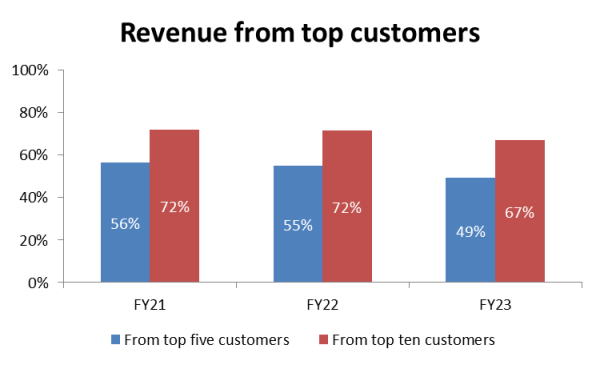

- Client concentration risk- While client concentration risk is there, it is inherent to the industry as top pharma innovator companies account for major revenues for the industry.

- Drug pricing caps create margin pressures on biopharmaceutical companies, thus risking the overall profitability of the industry and consequently, operations spending, which can impact Life sciences companies.

- Artificial intelligence (AI)- Company has delivered GEN AI solutions in past and has its NEXT suite of tools (leveraging Gen AI workbench with subject matter experts) but AI, machine learning and natural language generation technologies are in still development stages and a competitor might emerge to address better solutions.

- Auditors have put emphasis on certain matters, relating to the scheme of arrangement approved by NCLT and statements on certain matters in the last 3 years' financial statements namely-

- In FY22, there were delays in the payment of interest amounts in subsidiaries, ILSL Holdings, Inc. and Indegene Lifesystems Consulting (Shanghai) Co Ltd

- Additionally, the company delayed the payment of provident fund dues

- Furthermore, income tax related to previous assessment years was not deposited by the company due to disputes.

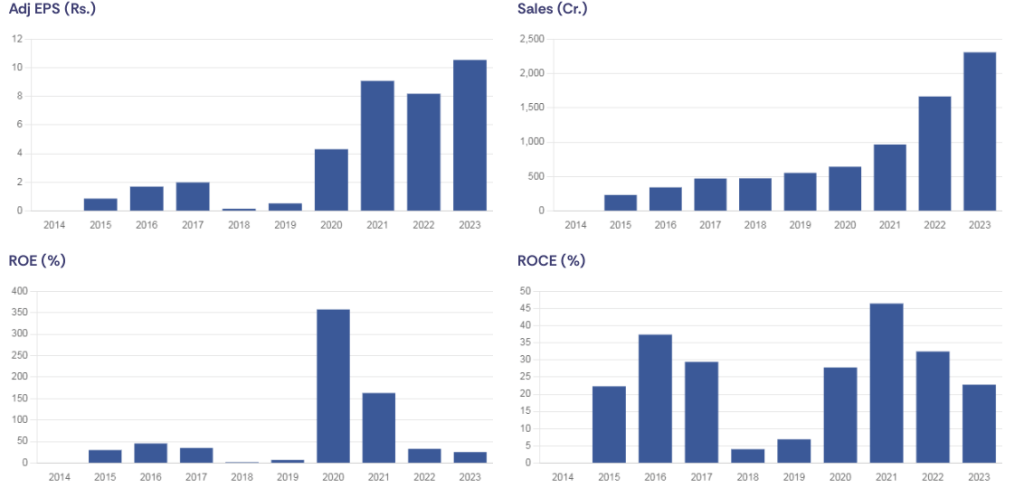

Financials:

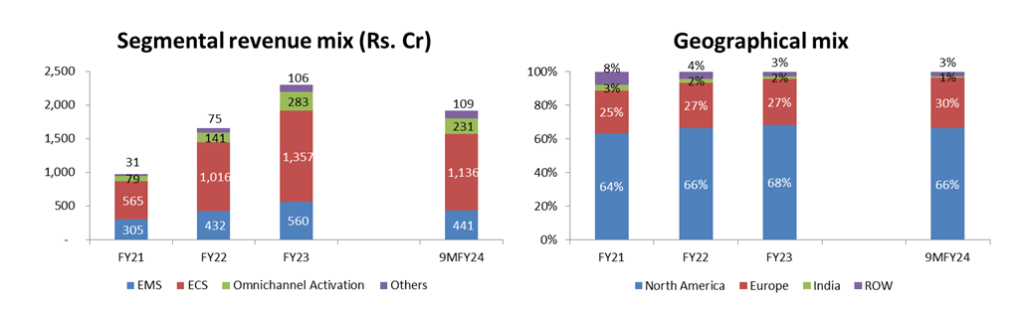

Revenue grew significantly on account of the low base effect of FY21 (Covid Year; 54% CAGR) and acqusitions. Net Profit grew at a rate of ~20% in the same period. Revenue from two main segments, Enterprise Commercial Solutions and Enterprise Medical Solutions grew at a CAGR of 55% and 35.5% respectively, from FY21 to FY23.

Management:

Manish Gupta, Chairman, Executive Director and CEO: He holds a B.Tech Degree in mechanical engineering from IIT Varanasi and a PGDM from IIM Ahmedabad. He has 24 years of experience in the technology-led healthcare solution sector.

Sanjay Parikh, Executive Director and Executive Vice President: He holds a B.Tech Degree in electrical engineering from IIT Bombay, MSc in Clinical engineering from Case Western Reserve University and PHD from John Hopkins University and has 31 years of experience in pharmaceuticals and technology-led healthcare solutions sectors

Rajesh Nair, Non-Executive Board Member and President of Key subsidiary, Indegene Inc.: He holds a bachelor of medicine & surgery from the University of Kerala and a PGDM from IIM Ahmedabad. He has 25 years of experience and is the President of Indegene, Inc.

MoneyWorks4Me Opinion

Indegene operates in a niche segment catering to the Lifesciences sector. We like that it has a long-standing relationship with the top 20 biopharmaceutical firms and has a history of successful acquisitions. On the flip side acquisition-led growth as well as the advent of artificial-intelligence led disruptions concern us. The company trades at P/E of 33x its FY24 annualized earnings which seems pricey for its return ratios (<25%), also it is liable to pay performance consideration to its past acquisitions till March 2026. Based on future acquisition triggers as well as synergy benefits from subsidiaries we advise aggressive investors to subscribe for listing gains.

Recommendation: Subscribe for listing gains

Indegene Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | May 06, 2024 |

| IPO Close Date | May 08, 2024 |

| Basis of Allotment Date | May 09, 2024 |

| Refunds Initiation | May 10, 2024 |

| A credit of Shares to Demat Account | May 10, 2024 |

| IPO Listing Date | May 13, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 33 | Rs. 14,916 |

| Maximum | 13 | 429 | Rs. 193,908 |

Indegene Limited IPO FAQs:

When will the Indegene Ltd IPO open?

Indegene Ltd IPO will open for subscription on Monday, 6th May 2024, and closes on Wednesday, 8th May 2024.

What is the price band of Indegene Ltd IPO?

The price band for Indegene Ltd IPO is Rs. 430-452/share.

What is the lot size for the Indegene Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 33 shares, up to a maximum of 13 lots i.e. Rs. 1,93,908/-.

What is the issue size of Indegene Ltd IPO?

The total issue size is ~ Rs. 1841.76Cr.

When will the basis of allotment be out?

Allotment will be finalized on May 9th and refunds will be initiated by May 10th. Shares allotment will be credited in Demat accounts by May 10th.

What is the listing date of Indegene Ltd’s IPO?

The tentative listing date of the Indegene Ltd IPO is May 13th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: