In the colorful tapestry of India's textile and apparel sector, the innerwear industry stands as a silent yet indispensable thread, weaving comfort and style into the daily lives of millions. Emerging from a valuation of Rs. 61,091 crores in 2023, the market is on a trajectory to touch Rs. 75,466 crores by 2025 (11% CAGR). The Indian Innerwear Industry is dominated by players such as Page Industries (Jockey), Lux Industries, Dollar Industries, Rupa & Company in the listed space and JG Hosiery (Macho), Dixcy Textiles (Dixcy Scott) and V-Star in the unlisted space. These brands are present in women’s innerwear and athleisure segments as well, but the bulk of revenue and profits come from the men’s innerwear segment, making it the primary area of focus.

The innerwear market is dominated by a large number of small unorganized players which, as a total, make up 60% of the total market. While these players lack distribution and competitive pricing power, their existence puts barriers on the growth of larger players that target lower-income demographics.

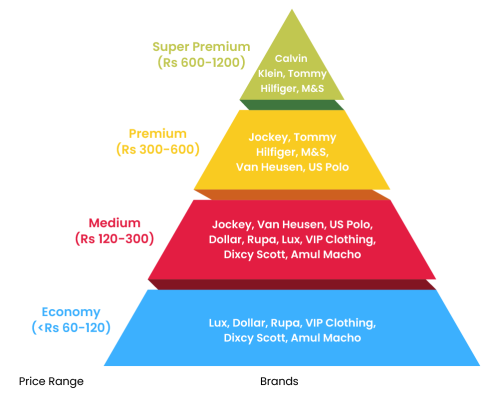

The Indian Innerwear can be further broken down by price segments as different brands offer apparel at different price points, attracting different demographics. At the top of the pyramid, we have international brands such as Calvin Klein and Marks & Spencer’s where the average price of an item is north of Rs. 600. The premium market has players such as Jockey, US Polo and Van Heusen that offer items between Rs. 300 and Rs 600. The economy market is dominated by brands such as VIP, Lux, Rupa, Dollar and Amul Macho while the Medium segment consists of the lower end of the premium segment and the upper end of the economy segment. It is usual for brands to be present in multiple sub-segments through sub-branding initiatives.

Source: Moneyworks4me Research

Value Chain

To understand the value chain, we must first understand the difference between wholesalers and distributors. Wholesalers are those that purchase goods from a company at a fixed price and control the prices charged to the retailer. In a wholesale model, the company has little knowledge about sales at the retailer level. In a distributor model, the distributor receives a fixed distribution margin while the company sets the margin received by the retailer. In this model, the company is well aware of sales at the retailer level. The distributor model has already been implemented in other industries such as FMCG and is expected to become the standard model in the innerwear industry.

The value chain for manufacturers starts after procuring yarn. Some players have outsourced certain phases of the manufacturing or a percentage of overall manufacturing to small-scale manufacturers to reduce their manufacturing risk.

Once manufactured, the products enter a multi-tiered distribution chain which involves the company selling goods to wholesalers and distributors, which further sell it to retailers or sub-wholesalers. Such distribution systems rely on either the company creating its own distribution system or the infrastructure of existing players which these companies leverage. Each has its own risks and benefits. Players such as Page Industries rely on Exclusive Brand Outlets (EBOs) and exclusive distributors to sell their products. This leads to nil competition for shelf space in these stores and faster cash conversion cycles as a result of their control over the supply chain.

However, companies such as Rupa & Company, Lux Industries and Dollar Industries primarily rely on Multi-Brand Outlets (MBOs) and wholesalers which sell multiple brands and often require extensive credit cycles. It could also be said that the brand’s price position can determine its strategy to focus on EBOs or MBOs. Brands competing in the premium and super premium space may be willing to develop their own supply chain as brand value may itself be defined through a different distribution system. They may also use the traditional value chain, but this method is not the primary focus for players like Page Industries.

Source: Moneyworks4me Research

Key Variables

The profitability of companies within the market is primarily determined by:

- Raw material prices

- Advertisement spends driven by competition

- Distribution strategy

Input costs play a significant role in determining the profitability of companies in the economy and medium segment due to the limited ability to pass on price increases. This is due to the limited spending power of consumers in this segment. To prevent customer attrition, less premium brands cannot fully pass on the increasing costs. Moreover, a sharp decrease in cotton prices can lead to high-cost inventory being unloaded at lower prices due to price competition. However, higher brand premiumization and rising per capita income may reduce the raw material risk for players.

Source: Screener.in

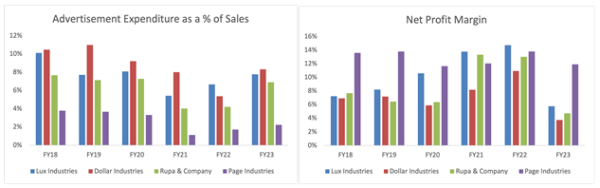

Competition in the economy and medium segment comes from both organized and unorganized players. Unorganized players with local distribution systems mainly compete on price, limiting the brand premium organized players can charge while additionally acting as a deterrent to product upgradation. Furthermore, organized players compete for customer mind share through advertisements and promotion, which leads to higher costs. Any sustainable reduction in advertisement costs leads to higher profitability than peers.

Moneyworks4me Research

An effective distribution strategy helps a company capture more of the value it creates. Distributor-based models allow the company to increase control over the value chain through knowledge and pricing at the retailer level, which allows a company to receive a larger share of the value pie. Among players that continue to rely on the tradition wholesale model, the value captured is lower due to a lack of knowledge and control over pricing. Marginal differences between such players may exist due to market share differences in a particular region and relationships with wholesalers.

A company can gain further distribution advantages by using a pull-based strategy as opposed to the push-based strategy generally used by companies in the industry. In a pull-based model, the inventory requirements are lower as the inventory is based on real demand rather than anticipated demand which causes inventory to build up. By reducing the inventory in the supply chain, distributors, and therefore retailers, can reduce their working capital requirements and increase their return on capital employed. Therefore, the company does not have to increase margins to incentivize distributors. This leads to higher value captured by the company.

Competitive Advantage

Competitive Advantages are those that allow a company to earn significantly above their cost of capital as well as grow at a higher rate. In the innerwear industry, there are very few ways in which brands have distinguished themselves. While the brands may be different, the methods used by most companies are similar. Players such as Lux Industries, Dollar Industries and Rupa & Company, which dominate the economy and medium space, have resorted to similar competitive positioning. The location of manufacturing facilities is similar, the method of distribution to multi-brand outlets is similar and the method of advertisement, promotion through celebrities, is similar. At best, such players may have competitive advantages due to their relative size.

Page Industries (industry leader), however, has differentiated itself in many aspects from such players. It has positioned its brand Jockey in the premium segment, which limits competition. Second, it relies on models for advertisement, which reduces advertisement costs. Third, the company sells a large amount of its products through exclusive brand outlets of franchisees, which gives it more control over the payment cycle and positioning of the brand at the retail level. In summary, it can be said that competitive advantages are due to differences at multiple levels of operation, but are ultimately visible in the distribution success of a company.

Valuation

Since this industry relies more on working capital than on capital investment, reductions in working capital/cash conversion cycle and increases in growth rates ultimately determine the valuation of players in the Indian Innerwear Industry. In summary, the dominance of a player is dependent on its control over its distribution system, which reduces the threat of competition and reduces the capital employed significantly.

...Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: