Medi Assist Healthcare Services Limited IPO Details:

Estimated Pre-Listing Market Cap: ~Rs.2878 Cr

IPO Date: January 15, 2024 to January 17, 2024

Total shares: 68,859,212

Price band: Rs. 397 - Rs. 418 per share

IPO Issue Size: ~ Rs. 1,171.58 Cr

Lot Size: 35 shares and in multiples thereof

Purpose of Issue: Offer for Sale

About Medi Assist Healthcare Services Ltd

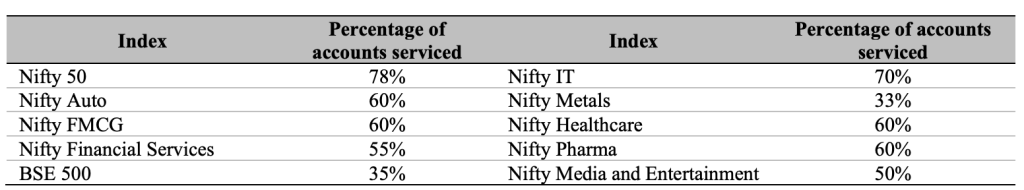

Medi Assist Healthcare Services delivers third-party administration services to insurance companies through its wholly-owned subsidiaries: Medi Assist TPA, Medvantage TPA (since February 13, 2023), and Raksha TPA (since August 25, 2023). As of the Financial Year 2023, the company effectively managed over 9,500 group accounts, representing 35% of the BSE500 and 78% of Nifty 50 companies, with premiums under management totaling Rs.12,817 crores. Over the years, the company has established a robust healthcare provider network that spans India, comprising 18,754 hospitals situated in 1,069 cities and towns, and across 31 states (including union territories) as of September 30, 2023.

About the Industry

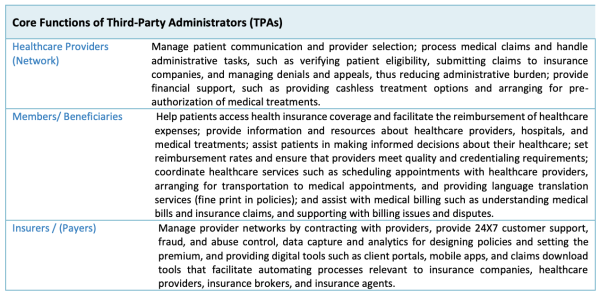

A third-party administrator (TPA) is a company that manages health insurance claims on behalf of insurance companies. In its role as a TPA, a company serves as an intermediary connecting (a) insurance companies and their policyholders, (b) insurance companies and healthcare providers (such as hospitals), and (c) the government and recipients of public health schemes. Their services encompass a wide range, from enrolling individuals and groups in health insurance plans to managing eligibility, liaising with insurers, providing enhanced customer support, developing provider networks, and educating beneficiaries about policy terms and conditions. Third Party Administrators earn revenue solely from insurance providers for their aforementioned roles. The revenue is derived as a percentage of gross premiums handled by the TPA.

Revenue & Business Model

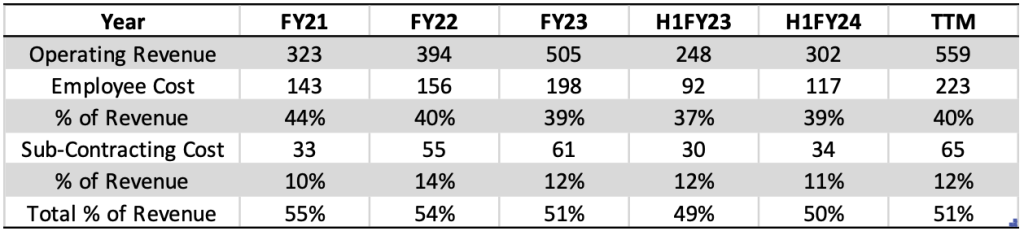

The company earns revenue as a percentage of total gross premiums handled, which can range between 3.5% to 5% of the premium, depending on their terms with insurers. The biggest costs for the company are employee and subcontracting costs, which are required to service the customers and handle claims efficiently.

Positives

1. Profit & Market Share:

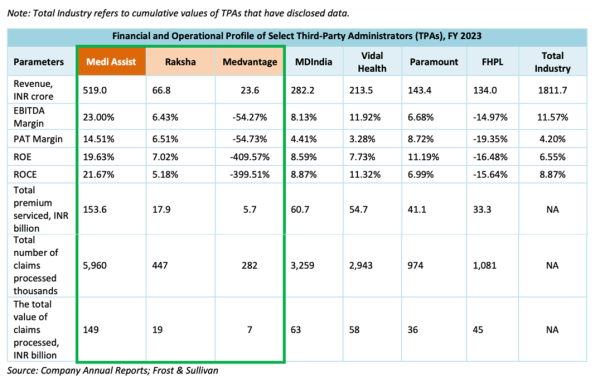

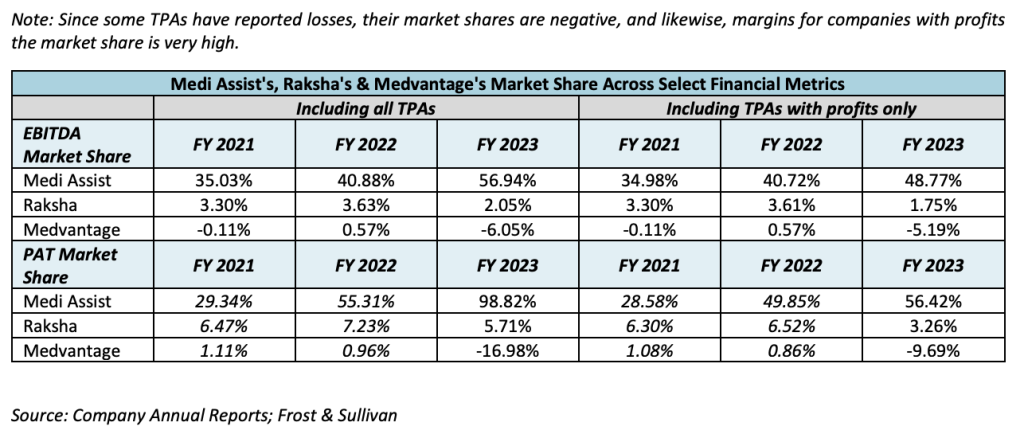

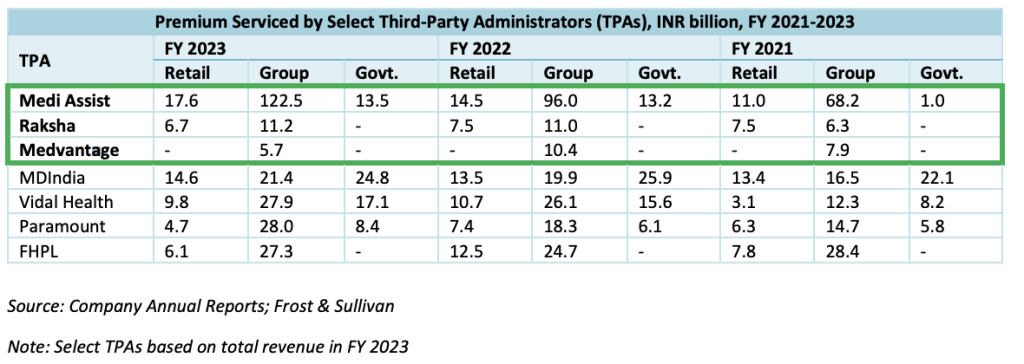

The company is the most profitable player in the market with the largest market share. The cost efficiencies should improve as the company benefits from economies of scale. With a total market share of nearly 34% for FY23, it has a market share greater than that of the next three largest combined. Additionally, excluding MediAssist, the industry has been marked by low profitability, with an EBITDA margin of 6.98%, PAT Margin of 0.07%, ROE of 0.11%, and ROCE of 2.91% in FY 2023. Medi Assist is a clear winner in the industry. The integration of Raksha and Medvantage into the company would furthermore increase the profitability of these ventures in line with Medi Assist through shared scale integration. The company has made 7 acquisitions in 8 years, which suggests a strong acquisition history.

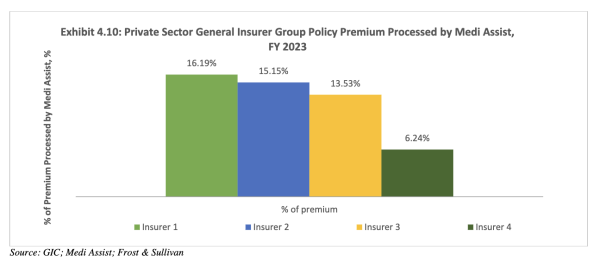

2. Clear Leadership in Group Premium Serviced while still being the largest in Retail Premium Serviced:

Medi Assist is the largest player in the group premium segment, larger than the next 4 entities combined. In the retail premium segment, the company has overtaken MDIndia to become the largest player, while additionally improving its retail footprint through acquisitions.

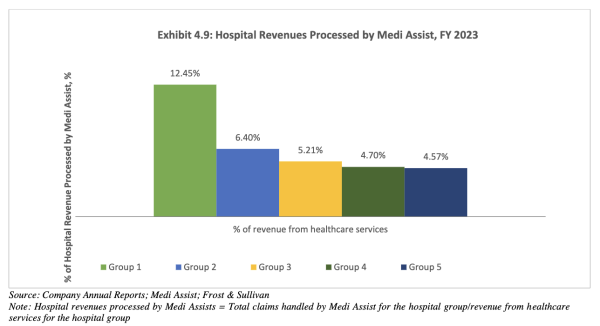

3. Sticky Flywheels as a Result of Size:

Due to its market-leading position, advanced technology platforms, and substantial volume of administered claims, the company has successfully negotiated discounted rates and preferential packages with hospitals. These agreements prove advantageous for both insurers and the insured by effectively managing and controlling medical cost inflation. Notably, the company's cashless claims pay-out inflation Compound Annual Growth Rate (CAGR) between the Financial Years 2021 and 2023 stood at 5.58%, excluding claims related to the COVID-19 pandemic. This rate is significantly lower, less than half, than the estimated CAGR for medical inflation in the country, which is reported at 11.94%. This makes it a preferred partner for insurers, insured and hospitals.

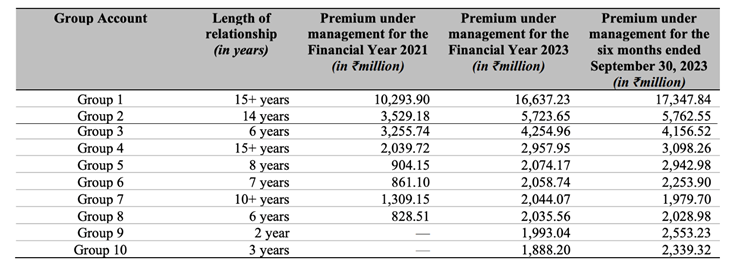

The company has serviced over 9,500 group accounts with premium under management of Rs.12,817 crores for the Financial Year 2023. Throughout FY21, FY22 and FY23, as well as the six months ending H1FY24, the company has maintained a retention rate of 95.09%, 93.94%, 94.17%, and 94.01% for all our group accounts based on premiums serviced, respectively. Additionally, within the 50 largest group accounts over the mentioned periods, the company retained these accounts despite changes in the insurance provider in 12 instances in FY 2021, 5 instances in FY 2022, 4 instances in FY 2023, and 4 instances in H1FY24. As of H1FY24, the average duration of the company’s relationship with the top 10 group accounts, measured by premiums serviced, was 8.6 years.

4. Acquisition Strategy:

As the most profitable player in the industry, Medi Assist has been able to purchase other TPAs through internal accruals. Such acquisitions are done for strategic reasons. Raksha was acquired in 2023 to expand the geographical footprint by extending coverage to Tier 2 and 3 cities in northern, central, and western India; while Medvantage was acquired in 2023 to enhance and solidify the presence in corporate/group schemes. Even after spending Rs.136 crores, the company has Rs.76 crores in cash and bank balances. Moreover, further consolidation in the industry could increase the negotiating power of TPAs.

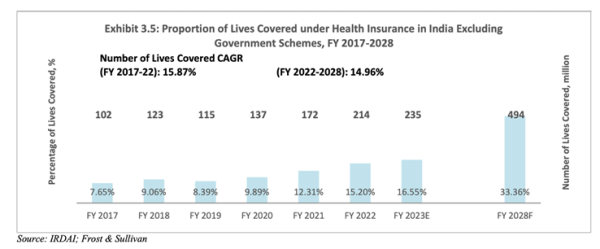

5. High Growth Trajectory due to under penetration and Expected Growth in the Health Insurance Industry:

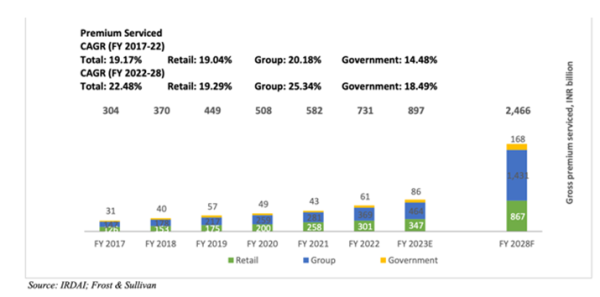

The premium serviced under health insurance has grown at a CAGR of 19.17% from FY17 to FY22. While the expected CAGR for FY22 to FY27 is higher at 22.48%, a conservative growth rate in line with the historic trend is still considerably high. More importantly, the company’s growth rate has been higher than the market growth rate organically as well as through acquisitions.

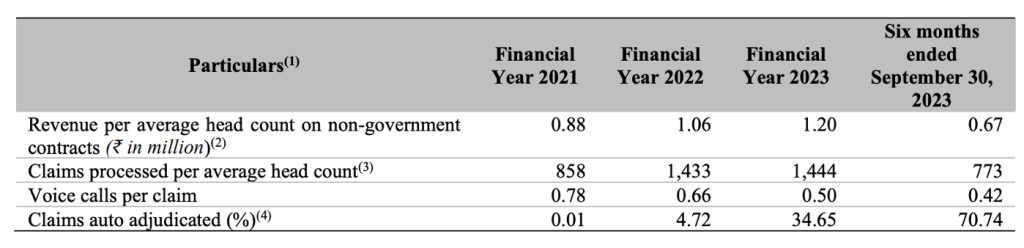

6. Operating leverage through claim processing efficiency:

With high-quality technology, the company is able to process claims automatically with limited input from employees. As a result, there has been a 16.7% annualized improvement in revenue per employee and a staggering increase in auto-adjudicated claims from near zero to 70.74% of total claims. While the operating leverage may not be immediately visible due to the high costs associated with developing such technology, such expenditure is expected to improve the quality of the business in the long run.

Financials:

The company is on a strong growth trajectory with the largest market share in the TPA industry. We expect the ROCE and ROE to remain higher than 20% in the long term coupled with high sales growth and operating leverage which should have a disproportionate impact on the EPS going forward.

(Source: Moneyworksme) (Note: Numbers only available from 2018)

Concerns:

1. Increase in receivables:

While the company has successfully managed its receivables, there has been a 79% increase in receivables from H1FY23 to H1FY24, while there has been a 24% increase in revenue over the same period. This could be attributed to the acquisition of Medvantage on February 13, 2023, and Raksha TPA on August 25, 2023. This would be a key monitorable going forward due to its impact on cash flow from operations.

2. Failure to successfully integrate acquisitions:

The companies acquired by Medi Assist have significantly lower EBITDA and PAT Margins than Medi Assist. If the company is unable to successfully integrate such acquisitions, the overall profitability of the company could reduce significantly.

3. Loss of any large group client:

For FY21, FY22 and FY23, and H1FY24, the company’s revenue from group accounts was 65.90%, 71.17%, 74.41%, and 72.19% of the revenue from contracts with customers, respectively. The loss of any large group client would lead to a significant loss in revenue with an incremental loss in profits due to an inability to spread fixed costs associated with the business.

For FY21, FY22 and FY23, and H1FY24, the company’s revenue from group accounts was 65.90%, 71.17%, 74.41%, and 72.19% of the revenue from contracts with customers, respectively. The loss of any large group client would lead to a significant loss in revenue with an incremental loss in profits due to an inability to spread fixed costs associated with the business.

Management:

Dr. Vikram Jit Singh Chhatwal serves as the Chairman and Whole-time Director of the company. He holds a bachelor's degree in medicine and surgery from Jawaharlal Nehru Medical College, Belgaum, a Doctor of Philosophy degree from the National University of Singapore, an MBA in International Management from Ecole Nationale des Ponts et Chaussées, Paris, and a post-graduate diploma in public health administration from the Institute of Health Care Administration, Chennai. He also served as a member of the NUS President's Advancement Advisory Council. Dr. Chhatwal joined the company in 2007, initially as an additional director.

Satish V.N. Gidugu is the full-time director and CEO of the company. He initially joined the company in 2013 as the CTO and was later re-designated as the COO in 2015. Mr. Gidugu holds a bachelor's degree in technology with a specialization in naval architecture from the IIT Madras. Before his current role, he was associated with redBus (a part of MakeMyTrip ), SAP Labs India, and Intergraph Consulting showcasing a comprehensive background in technology and management.

Valuation and Summary:

At a maximum valuation of 39 P/E based on FY23 Earnings and 50 P/E based on TTM Earnings, the company could be considered to be priced at a premium. However, in our opinion, the earnings are depressed due to short-term non-recurring expenses which have increased considerably in H1FY24. Moreover, an increase in operating leverage accompanied by the 20% plus growth of the industry coupled with market share gains make it attractive given that the company has a history of high cash flow conversion with very low capital expenditure requirements. Furthermore, the company dominates the industry’s profit pool, which shows a strong competitive advantage. These factors make us recommend subscribing to the IPO.

Recommendation: Subscribe for Long Term

Medi Assist Healthcare Services Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | January 15, 2024 |

| IPO Close Date | January 17, 2024 |

| Basis of Allotment Date | January 18, 2024 |

| Refunds Initiation | January 19, 2024 |

| A credit of Shares to Demat Account | January 19, 2024 |

| IPO Listing Date | January 22, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 35 | Rs. 14,630 |

| Maximum | 13 | 455 | Rs. 190,190 |

Medi Assist Healthcare Services Limited IPO FAQs:

When will the Medi Assist Healthcare Services Ltd IPO open?

Medi Assist Healthcare Services IPO will open for subscription on Monday, 15th January 2024, and closes on Wednesday 17th January 2024.

What is the price band of Medi Assist Healthcare Services Ltd IPO?

The price band for Medi Assist Healthcare Services Ltd IPO is Rs. 397-418/share.

What is the lot size for the Medi Assist Healthcare Services Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 35 shares, up to a maximum of 13 lots i.e. Rs. 1,90,190/-.

What is the issue size of Medi Assist Healthcare Services Ltd IPO?

The total issue size is ~ Rs. 1,171.58 Cr.

When will the basis of allotment be out?

Allotment will be finalized on January 18th and refunds will be initiated by January 19th. Shares allotment will be credited in Demat accounts by January 19th.

What is the listing date of Medi Assist Healthcare Services Ltd’s IPO?

The tentative listing date of the Medi Assist Healthcare Services IPO is January 22nd, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: