Sanstar Ltd IPO Details:

Opening Date: July 19, 2024

Closing Date: July 23, 2024

Listing: BSE and NSE

Number of Shares: 5.37 Cr shares

Face Value: Rs 2 per share

Price Band: Rs 90-95 per equity share

Issue Size: Rs 510.15 Cr

About Sanstar:

Sanstar Ltd is a major manufacturer of plant based speciality products and ingredient solutions in India for food, animal nutrition and other industrial applications. Their products include liquid glucose, maize starches and co-products such as germs, gluten, fibre and enriched protein. These products and ingredient solutions add taste, texture, nutrients to foods such as bakery products, and are also used in animal nutrition products along with industrial products such as disintegrants, supplements and coasting agents.

Sanstar has a production capacity of 3,63,000 tons per annum (1,100 tons per day) and is the 5th largest manufacturer of Maize (Makka) based speciality products and ingredient solutions in India with the company’s products being sold in 22 states in the country.

Industry Overview:

Maize Starch: It is a plant – based ingredient derived from wet milling process of Maize (Makka). Sources of starch are cereal grain seeds, tubers, roots and legume fruits, leaves and seeds. Commercially derived starch is mainly Tapioca, wheat, potatoes, rice and Maize, with Maize being the most popular one.

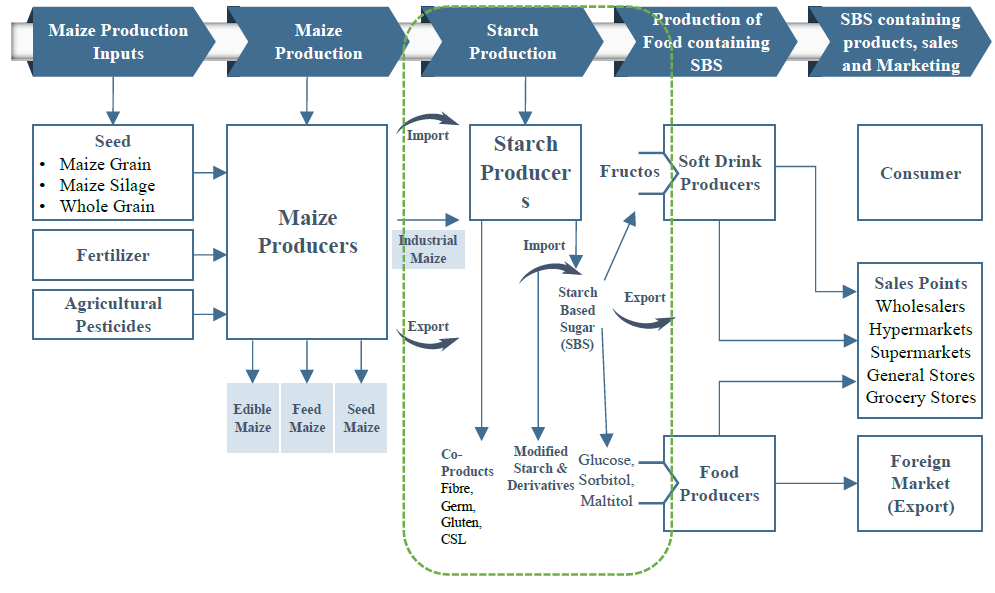

The Maize value chain

SBS- Starch based sugar

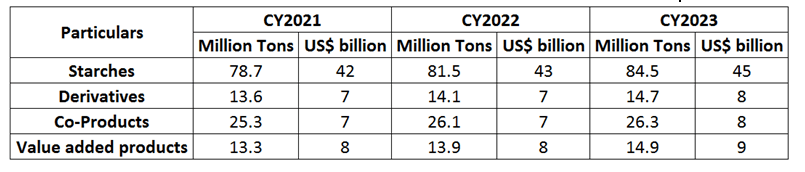

The global starch Maize starch market is expected to grow at a CAGR of ~4.25% between CY23 and CY29.In CY23, this market was valued at US$45 billion and 84.5 Million tons in value and volume terms respectively.

In India, 1/3rd of production of total maize produced in India is utilized for human consumption with ~10-15% being utilized for starch production. Around ~50-55% is consumed for animal and poultry production.

Starch is used for various culinary, household and industrial purpose, with India being among the top 10 maize producing countries in the world. The maize starch market is anticipated to grow at a CAGR of 5.12% during the period between 2023-2029. This market was valued at US$3.1 billion and 7.27 Million tons in value and volume terms respectively.

Global Opportunities: India is the largest global exporter of maize starch, exporting ~4.78 lakh tons in 2022. Export volumes have increased by 15% from 2018 to 2022. India is also among the top 10 global exporters of sweeteners like liquid glucose. Local raw material availability, capable processing sector, and good quality at lower costs are increasing the global demand for Indian maize-based specialty products and ingredients.

Global Maize based speciality products & ingredients Solutions market

Indian Maize based speciality products & ingredients solutions market

The Global Native Starch and Co-Products Industry

This industry was expected to be valued at US$ 29 billion in CY23 with a projected CAGR of 3.78% from 2023-2029. This market grew at a CAGR of 2.78% from 2019-2023. The higher projected growth is expected to come from the Food & Beverages, textiles, paper, cosmetics, adhesives and pharma industries and also from the governmental impetus to increase the productivity of maize. The projected volume by 2029 is expected to be 74.2 million tons. The largest use of native starch is in the food and beverages industry which accounted for 70.1% of the total volumes at ~42 million tons.

The products which remain after separating the maize starch slurry during the wet milling process are called as co-products. These include products such as Germ, Gluten, Fibre and Maize steep liquor. The current global market for such co-products stands at US$6.9 billion and is expected to reach US$8.5 billion by CY2029.

The Indian Native Maize starch Market:

The Indian market was estimated in 2023 to be valued at US$1.9 billion with volume 4.87 million tons. This market is forecasted to grow at CAGR of 4.56% till 2029. This market grew significantly due to new plants being opened with capacity exceeding 600 tons a day. Many players in this market are undergoing capacity expansions to cater to increasing demand. The viable capacity for maize starch ranges from 600-800 tons a day. India’s installed starch capacity is estimated to range from 5.8 – 6.5 MTPA, with the industry experiencing a surge in expansion activity. India is the largest exporter of starch with a global share of 14.3% in CY2022.

The end user industries of the Indian Native Maize Starch Market is mainly dominated by the Food & Beverage Industry, which consumes around 30% of the production, followed by 23.4% from the paper industry and 16.8% from textile industry. Adhesive, Animal feed, Pharmaceutical and Chemical industries contribute the remaining volumes.

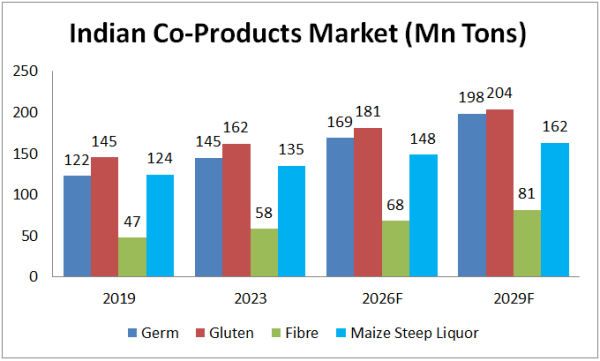

Indian Co-Products Market:

The co products market in India was estimated to be approx. 1.12 million tons in CY2023 valued at US$500 mil. This demand in India is driven mainly by the poultry industry.

The Modified Starch Industry:

Modified starches overcome the shortcomings of native starches such as loss of viscosity and thickening power when being cooked or stored.

The global modified starch market was estimated to be worth US$15.6 billion in 2023 and is projected to grow at a CAGR of 5.11% from CY2023-2029.

In the past, trade barriers had largely kept food products such as modified starch markets regional, which are now being reduced due to trade liberalizations and agricultural reforms.

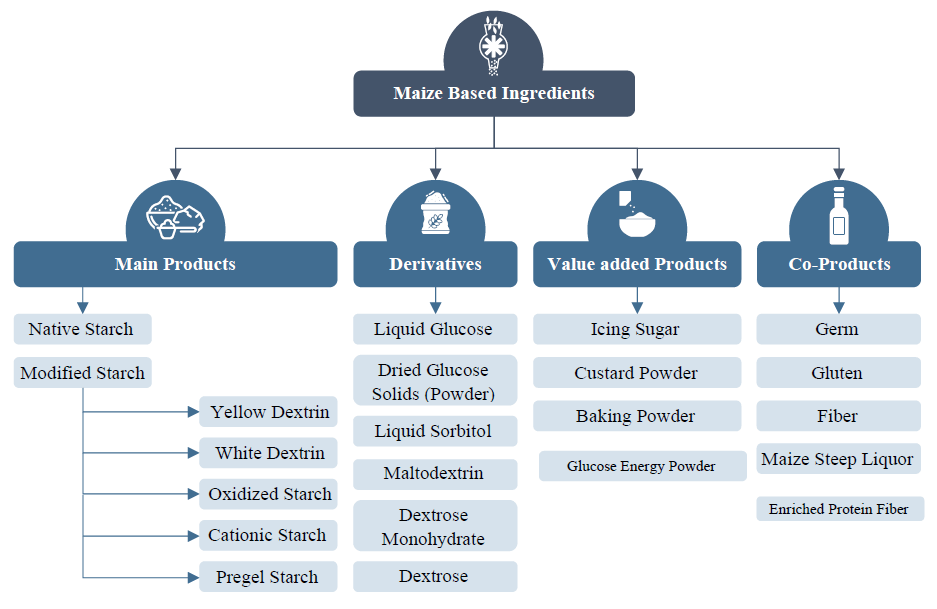

This industry produces various types of modified starches, which includes yellow Dextrin, White Dextrin, oxidized Starch, Catonic Starch and Pregel Starch.

Business Segments:

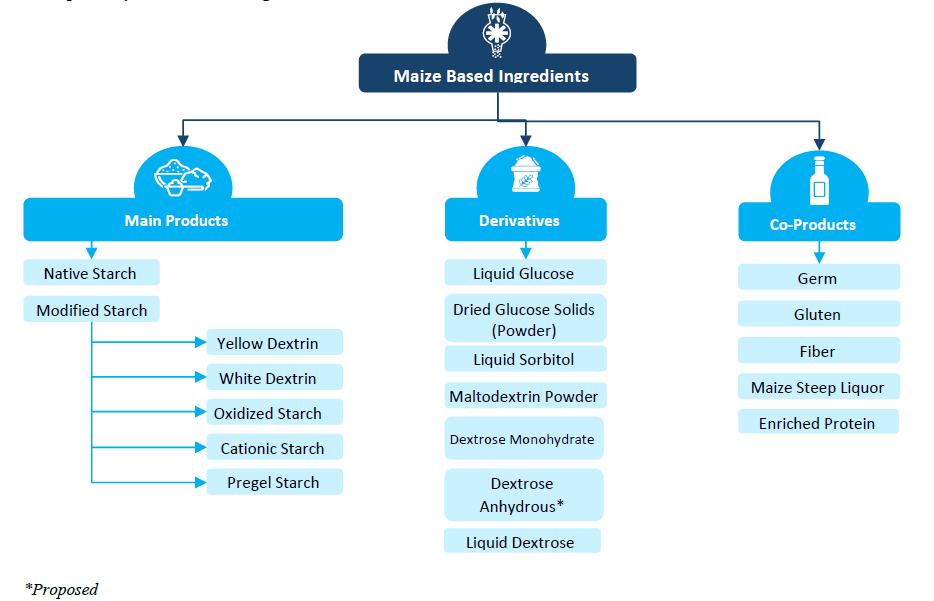

The company manufacturers various types of Maize (Makka in Hindi) starches, derivatives and its co-products

The company’s main products in the Maize starch line are:

Native maize Starch: It is powder obtained from the starchy part of maize and is mainly used in foods and pharmaceuticals industry

Modified Maize Starch: Produced by treating native starch to change its properties and is mainly used in Pharma and Paper industries.

The company also sells co-products from Maize which are:

- Germs: This is processed into Maize Oil, which is further processed in manufacturing of oil, margarine, mayonnaise, salad dressing, soaps etc.

- Gluten: Is used for cattle nutrition products and also used in poultry industry for broiler

- Fibre: Mainly used in animal nutrition and used in limited occasions to thicken processed foods like cereals, baked goods, dairy products, protein bars, and salad dressings

- Maize Steep Liquor: Used in animal nutrition products and remaining in pharma industry as an additive for microbial growth media

The company has also entered Maize starch derivatives, although revenues from this segment are minuscule.

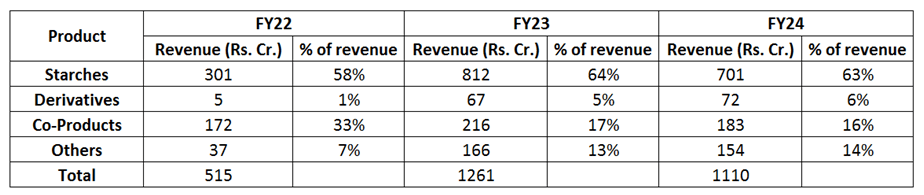

Segmental revenue mix

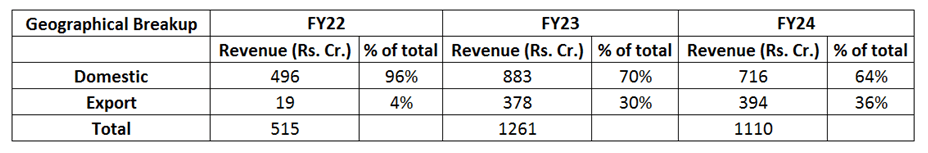

Geographical Revenue breakup

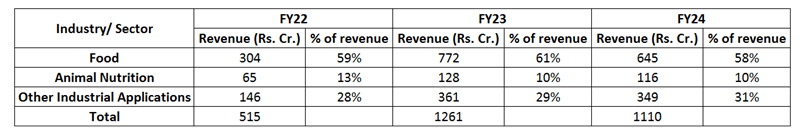

Sanstar’s client industries

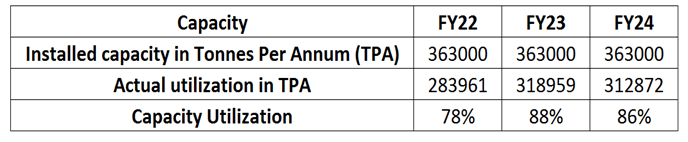

Capacity utilization

Competitors: Competitors to Sanstar are mainly Gujarat Ambuja Starch Products, Roquette India, Sukhjit Starch Products, BlueCraft Agro, Sayaji Maize Products, Cargill, Universal Starch Chem- Allied Products, Gulshan Polyols and others.

Purpose of the Issue:

The company plans to utilize the proceeds from the fresh issue to fund the expansion of their facility in Dhule and to repay or pre-pay certain borrowings availed by the company. The remainder is planned to be utilized for General corporate Purpose.

The OFS size is roughly Rs. 113 crores, in which the promoters and promoter group are the only selling shareholders.

Concerns:

- Competitive Intensity: this industry is highly competitive with no pricing power.

- Geographical concentration risk: derived nearly 82% of revenue from the western region of the country (The share of west in the overall industry is 35%).

- Food sector dependency: the company derives 58% of its revenues from the Food and Beverages Industry. Any downturn in this sector will impact Sanstar directly.

Financials:

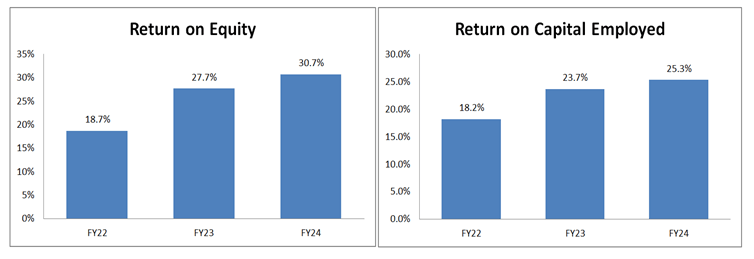

Revenues have doubled between FY22-24, largely led by starch and value added (other) products segment. Revenues have declined 11% in FY24, drive by starch segment. EBITDA margin has expanded over last year because of raw material price softening. We don’t expect company to maintain very high margin (>10%). The company posted healthy return ratios in FY24, with RoE being in excess of 25% and RoCE being around the 25% mark. We don’t expect incremental RoEs to be as strong.

Management:

Gouthamchand Sohanlal Chowdhary: He is the Chairman, Managing Director and promoter of the company and has been associated since 2012. He completed his schooling from Monfort School Yercaud, Tamil Nadu and supervises the overall functions of the company & is responsible for overseeing the strategic growth initiatives and expansion plans

Sambhav Chowdhary: He is the joint managing director and Co-promoter of the company and has been associated since 2012. He holds a bachelor’s degree in engineering from Gujarat University. He was employed with Infosys technologies from the years 2005-06 and is responsible for day to day operations and expansion plans of the company.

Shreyans Chowdhary. He is the joint managing director and one of the promoters of the company. He has been associated with the company since 2012 and holds a bachelor’s degree in engineering from Gujarat University and Masters degree of Science in Management with a specialization in Marketing from city university London Sir John Cass Business School. He is responsible for management of commercial and sales related aspects of the firm.

Opinion:

Sanstar operates in a highly competitive and slow-growing market but the company is nearly doubling its capacity. We remain cautious because 30% of revenue is from export markets at peak prices. If such prices don’t sustain EBITDA margin will correct also operating deleverage will hurt the bottom line. At P/E of 25 & P/B of ~4.25x post-listing at the upper price band, the valuation appears to have priced in future growth.

Recommendation: Avoid

Sanstar Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | July 19, 2024 |

| IPO Close Date | July 23, 2024 |

| Basis of Allotment Date | July 24, 2024 |

| Refunds Initiation | July 25, 2024 |

| A credit of Shares to Demat Account | July 25, 2024 |

| IPO Listing Date | July 26, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 150 | Rs. 14,250 |

| Maximum | 14 | 2100 | Rs. 199,500 |

Sanstar Limited IPO FAQs:

When will the Sanstar Ltd IPO open?

Sanstar Ltd IPO will open for subscription on Friday, 19th July 2024, and closes on Tuesday, 23rd July 2024.

What is the price band of Sanstar Ltd IPO?

The price band for Sanstar Ltd IPO is Rs. 90-95/share.

What is the lot size for the Sanstar Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 150 shares, up to a maximum of 14 lots i.e. Rs. 1,99,500/-.

What is the issue size of Sanstar Ltd IPO?

The total issue size is ~ Rs. 510.15 Cr.

When will the basis of allotment be out?

Allotment will be finalized on July 24th and refunds will be initiated by July 25th. Shares allotment will be credited in Demat accounts by July 25th.

What is the listing date of Sanstar Ltd’s IPO?

The tentative listing date of the Sanstar Ltd IPO is July 26th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: