“This time is different”, John Templeton has rightly said these are the four most dangerous words in stock market.

Every market cycle is different no doubt, but how intermediaries behave is surprisingly very similar.

When the market participation increases and liquidity is abundant, investment banks and investment companies flood the market with IPOs* (Initial Public Offerings) and NFOs* (New Fund Offers)

IPO vs NFO

Investor excitement never fades away for IPOs, but it is well understood why investors would be excited. IPO listings are usually of new-age business model or high growth sector which need capital to fuel more growth. Excitement to participate in new or different themes is a strong enough reason for IPOs. But we could not wrap our heads around why would an NFO excite investors?

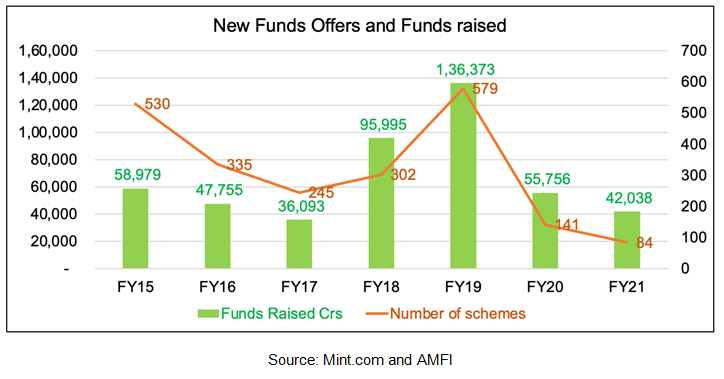

The following image shows that NFO raises phenomenal sums every year, especially in years when markets perform well. Such large sums collected in NFO seem extraordinary.

New Fund Offer (NFO) has nothing “NEW”

NFO proceeds, unlike IPO, are invested in diversified portfolio stocks listed in the stock market. It is unlikely to have different growth prospects versus existing funds available in the market. Take, for example, there has been a flurry of Flexi and Multicap NFOs by several funds houses, which is pretty much how most Equity funds invest.

On rare occasions, a fund offer has a very unique mandate or brings a new type of diversification opportunity.

NFO has no track record

Mutual funds investment must be made based on the long-term track record of a fund manager. The most popular method to invest in a mutual fund is by checking the track record, but NFO has no track record as it is raising fresh funds. Without looking at the portfolio or track record, it is like shooting in the dark. We believe that most fund managers also know that they have to establish a track record before they see a rise in assets under management. There could be an exception in NFO if the fund manager is reputed and has communicated his/her mandate clearly.

It appears today the push strategy used by incentive-led distributors might be helping NFOs collect large amounts of funds without any track record to talk about.

NFO Is not Cheap

One popular misconception we encountered is that since the NAV of newly launched NFO is Rs. 10 (All NFOs are priced at Rs. 10/unit), it is quite a bargain versus existing funds with NAV of Rs. 100/200/500/1000/unit.

NFO money gets invested in a similar fashion as any existing mutual fund. If it were to match with an existing mutual fund, its gains and losses will be exactly the same.

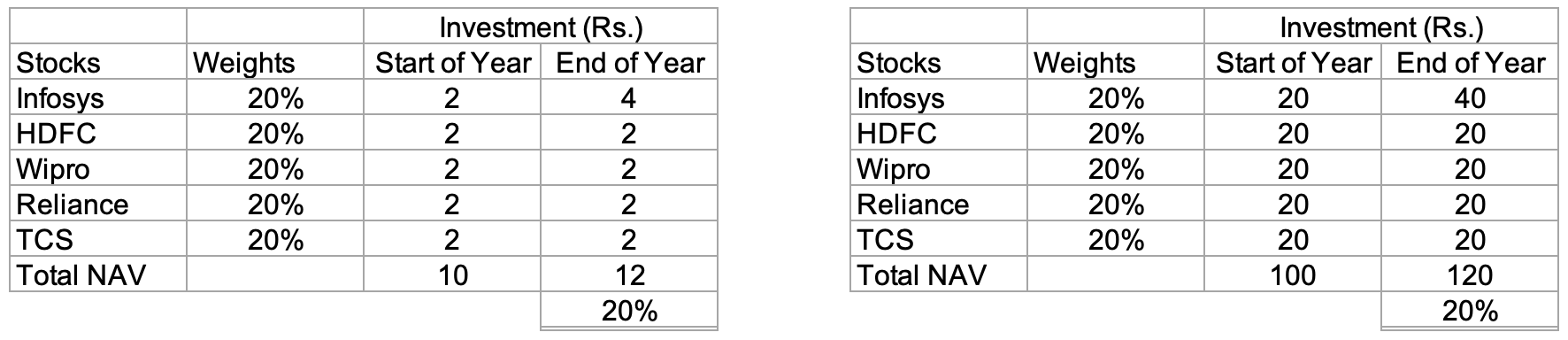

Take two funds with lower and higher NAV. If investment in Infosys doubles, NAV of NFO will go up by Rs. 2/unit or 20%. The existing fund also benefits from Infosys stock, as its NAV rises by Rs. 20/unit which is a similar 20% return.

The lower NAV of NFO doesn’t mean it has more upside potential.

When does NFO make sense?

If NFO has a unique mandate of investing in a particular structure or new sector or in a particular market segment that did not exist before, it is worth considering for further analysis. Recently we had reviewed FANG+ NFO, one of its kind then. In the future, if we see an NFO in REITs (Real Estate Investment Trusts) space, it is likely to be unique as no other fund currently offers exposure to Real Estate till now.

If a fund is new in its category, prefer the one with a track record of few years, provided it will add significant diversification to your portfolio.

In our opinion, 90% of the NFOs will be in the same category that already exists by the same or other fund houses. There is a very high chance, a typical diversified fund will own 50+ Stocks, with significant overlap with your existing portfolio. After the NFO portfolio is disclosed, use our tool on Mutual Fund to find out how much diversification it will add to your portfolio.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: