Akums Drugs and Pharmaceuticals Limited IPO Details:

Estimated Pre-listing Market Cap: Rs. 10,685 Crores

IPO Date: 30th July to 1st August, 2024

Total Issue Size: ~2.73 Cr shares

Fresh Issue: ~ 1.0 Cr shares

Offer for Sale: ~ 1.73 Cr shares

Price band: Rs. 646 – Rs. 679 per share

IPO Issue Size: ~ Rs. ~1,857 Cr

Lot Size: 22 shares and multiples thereof

Purpose of Issue: Offer for Sale by Promoter and Investors & Fresh Issue

About Akums Drugs and Pharmaceuticals Ltd:

Akums Drugs and Pharmaceuticals is the largest India-focused CDMO serving the Indian domestic pharmaceutical industry. They specialize in developing and producing a wide range of pharmaceutical products, including branded formulations and active pharmaceutical ingredients. Akums' manufacturing units are accredited by several global regulatory bodies, including the European Good Manufacturing Practice, the World Health Organization Good Manufacturing Practice, and the United States National Sanitation Foundation.

In FY24, Akums Drugs and Pharmaceuticals produced formulations for all 10 leading pharmaceutical companies and 26 of the top 30 pharmaceutical companies in India by sales. The company held a 30.2% market share by value in the Indian domestic CDMO market in FY24, up from 26.7% in FY21. Akums operates 10 manufacturing plants with a total production capacity of 49.23 billion units annually, making it 4.5 times larger than its second-largest competitor in terms of capacity.

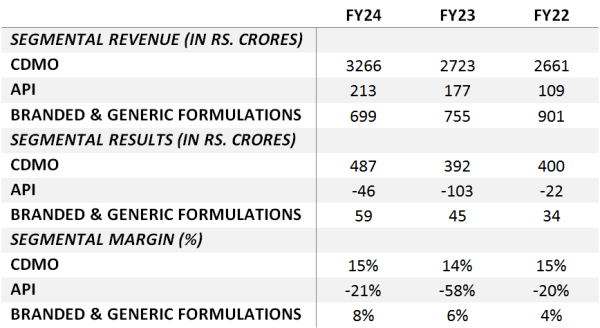

The CDMO business accounted for around 78% of the revenues in FY24, while sale of formulations (branded & generic) and APIs accounted for 17% and 5% respectively.

Industry Overview

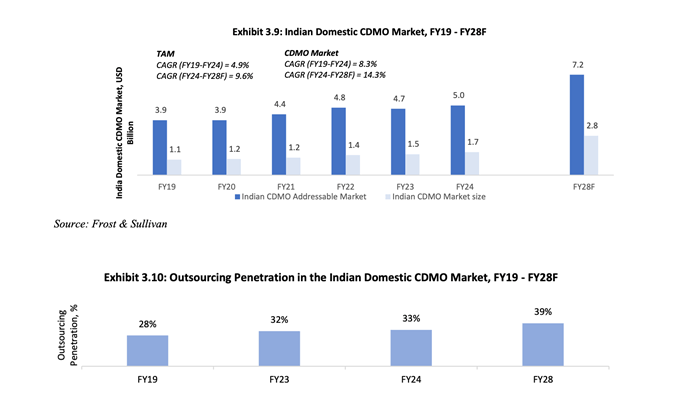

The Indian CDMO market is still developing compared to export-driven markets. Recently, Indian pharmaceutical manufacturers have started outsourcing large-scale manufacturing to CDMOs. This shift is due to increased demand for traditional and new formulations, high penalties for poor quality, the need for specialized commercialization for trade generics, and the goal of improving profitability through cost efficiency.

Leading Indian pharmaceutical companies, including Cipla, Sun Pharma, Glenmark, Wockhardt, Emcure, Lupin, Intas, Ajanta Pharma, Mankind Pharma, Indoco Remedies, Zuventus Healthcare, and Eris Lifesciences, are increasingly outsourcing drug manufacturing to CDMOs. Key CDMOs in India include Innova Captab, Windlas Biotech, and Akums.

The Industry is expected to benefit from the overall growth in the Indian Pharmaceutical market as well as an increase in CDMO penetration. This is expected to result in an annualised market growth of 14.3% between FY24 and FY28.

Financials

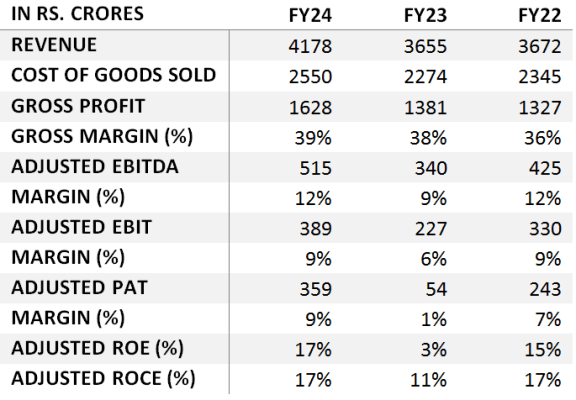

The financials need to be adjusted due to the impact of the put option liability which is a result of guarantees made under the shareholder agreement by the company to the private equity investor to repurchase the shares at a fair value in case the company is unable to give the investor an exit within a stipulated time period. As a result of the IPO, the put option has been extinguished, and the required adjustments must be made.

in the event the Company is unable to facilitate an exit for the Investor within the time period specified under the SHA, the Company was required to buy back the Equity Shares held by the Investor, or any portion thereof, in accordance with applicable law, at a price per Equity Share which is equal to the fair market value (as defined in the SHA) of the Equity Shares.

Utilisation of Funds

The Fresh Issue of Rs. 680 crores will be used to (a) repay the debt of around Rs. 387 crores owed by the company as well as its subsidiaries, (b) fund incremental working capital requirements and (c) pursue inorganic initiatives for growth.

The Offer For Sale of 1.7 crore shares will be primarily used to give the private equity investor a partial exit through the sale of 1.4 crore shares of the 2.1 crore shares owned by the entity. The remaining 0.3 crore shares are being offered by the promoters.

The promoters will maintain a 75% ownership post-listing, a decrease from the current 85% shareholding. Ruby QC Investment Holdings will continue to own around 4.6% of the outstanding shares.

Positives

Largest domestic CDMO player: The company is the largest domestic-focused player by a huge margin. With a total formulation capacity of 49.23 billion, it is still larger than the next three largest companies combined. Tirupati Medicare, Innova Captab, and Synokem Pharma, the three next largest players have formulation capacities of 5.12 billion, 10.87 billion and 10.96 billion respectively.

Large variety of offerings: Akums is the only Indian CDMO that offers oral dosage forms of gummies, chewables, and softgels, among its 60 different dosage forms. This diverse range of offerings is the highest among domestically focused CDMOs in India.

Concerns

Low R&D: At 2.69% of total revenue, the total R&D spend of the company in FY24 is low which suggests that the company’s CDMO operations are more focused on contract manufacturing than development. The company's historic R&D spends are also low at 2.68% and 1.94% for FY23 and FY22 respectively. It is assumed that a portion of the R&D is spent on API and Generic formulations, which further reduce the overall research and development in the CDMO business.

API & Generics: The API business, which contributes 5% to the revenue, is loss-making and the segmental loss is 21% for FY24. Over the last 3 years, while the business has doubled, the losses have doubled as well. The formulations business is profitable with a segmental margin of 8% in FY24 which has increased from 4% in FY22, however the sales are reducing every year.

Management

Sanjeev Jain, serving as the Managing Director, completed his matriculation in 1981 from the Central Board of Secondary Examination. As a co-founder, promoter, and director since April 19, 2004, he brings over 38 years of experience in the Indian pharmaceutical industry, managing all aspects of the CDMO business.

Sandeep Jain, also a Managing Director, holds a bachelor's degree in commerce from the University of Delhi. Since April 19, 2004, he has been a co-founder, promoter, and director of the company. Additionally, he is the current Chairman of the Association of Devbhumi Pharma Industries and the former Chairman of the Confederation of Indian Industry’s Uttarakhand state council.

Sanjay Sinha, who is a Whole Time Director and the President of Operations, holds a bachelor's degree in pharmaceutical sciences from Ranchi University and a master’s degree in pharmacy from the University of Delhi. He joined the company in November 2022, bringing previous experience as the President of Operations (Formulations) at Ipca Laboratories Limited.

MoneyWorks4Me Opinion

Akums Drugs and Pharmaceuticals is the largest India-focused CDMO serving the Indian domestic pharmaceutical industry, with capacities and capabilities superior to that of its competitors. While the company’s strengths are evident, the positioning of the company as a purely domestic CDMO player, with limited research and development are cause for concern with respect to growth. The scope for margin improvement in this business seems limited, while the overall margins itself are quite low for a pharmaceutical company. Additionally, at an adjusted P/E of approximately 30, the growth is priced in.

Akums Drugs and Pharmaceuticals Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | July 30, 2024 |

| IPO Close Date | August 01, 2024 |

| Basis of Allotment Date | August 02, 2024 |

| Refunds Initiation | August 05, 2024 |

| A credit of Shares to Demat Account | August 05, 2024 |

| IPO Listing Date | August 06, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 22 | Rs. 14,938 |

| Maximum | 13 | 286 | Rs. 194,194 |

Akums Drugs and Pharmaceuticals Limited IPO FAQs:

When will the Akums Drugs and Pharmaceuticals Ltd IPO open?

Akums Drugs and Pharmaceuticals Ltd IPO will open for subscription on Tuesday, 30th July 2024, and closes on Thursday, 1st August 2024.

What is the price band of Akums Drugs and Pharmaceuticals Ltd IPO?

The price band for Akums Drugs and Pharmaceuticals Ltd IPO is Rs. 646-679/share.

What is the lot size for the Akums Drugs and Pharmaceuticals Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 22 shares, up to a maximum of 13 lots i.e. Rs. 1,94,194/-.

What is the issue size of Akums Drugs and Pharmaceuticals Ltd IPO?

The total issue size is ~ Rs. 1856.74 Cr.

When will the basis of allotment be out?

Allotment will be finalized on August 2nd and refunds will be initiated by August 5th. Shares allotment will be credited in Demat accounts by August 5th.

What is the listing date of Akums Drugs and Pharmaceuticals Ltd’s IPO?

The tentative listing date of the Akums Drugs and Pharmaceuticals Ltd IPO is August 6th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: