Introduction to AMC Business Model

As investors, we constantly seek opportunities in high-growth businesses that offer superior return on equity (ROEs), require lower capital expenditure (capex), and provide high dividends. Investing in Asset Management Companies (AMCs) aligns perfectly with this criteria. AMCs operate in a rapidly expanding financial sector, demonstrate robust ROE through efficient management, and typically have lower capex requirements compared to other industries. Additionally, many AMCs offer attractive dividend payouts, making them a compelling choice for investors aiming for growth, profitability, and regular income. In this blog, we will deep dive into the Indian Asset management industry.

AMCs in India have emerged as pivotal players in the financial ecosystem, primarily focusing on pooling resources from investors to create diversified portfolios of securities, including stocks, bonds, and other assets. This model enables individual investors to gain access to professionally managed portfolios, thus benefiting from diversification and expert management.

AMCs generate revenue through management fees, which are typically a percentage of the assets under management (AUM). This business model is attractive due to its strong free cash flow generation, minimal credit risk, and high RoE. Unlike traditional banks or non-banking financial companies (NBFCs), AMCs do not bear significant credit risk, resulting in more stable earnings.

Growth Potential of AMCs in India

The growth potential of the AMC sector in India is substantial, driven by several key factors:

Increasing Retail Participation: There has been a significant rise in retail investor participation in mutual funds, facilitated by the increasing financial literacy and awareness campaigns. The popularity of Systematic Investment Plans (SIPs) has further bolstered this trend, providing a steady inflow of funds. The industry’s total AUM has more than doubled in the last five years at Rs 53.40 lakh crore in March 2024, as against Rs 22.26 lakh crore in March 2020. As of April 2024, mutual fund SIP contributions have more than doubled since May 2019, from Rs 8,183 crore to Rs 20,371 crore per month.

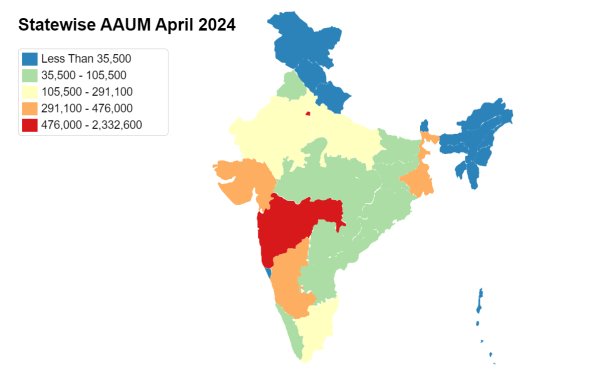

Geographical Penetration: AMCs are expanding their reach beyond major cities (T-30) to smaller towns and cities (B-30). This expansion is crucial, given that most of the Indian population resides in these areas.

*(AAUM- Average asset under management in Rs. Cr) | Source: AMFI

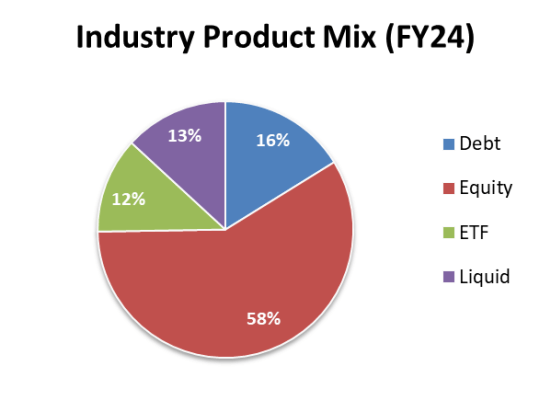

Diverse Product Offerings: The introduction and growing acceptance of passive investment vehicles like Exchange Traded Funds (ETFs) have diversified the investment options available to retail investors, contributing to the growth of AUM.

Source: Ace MF

Digital Distribution Channels: The advent of fintech platforms and digital distribution channels has made investing in mutual funds more accessible, appealing to a broader audience and enhancing the growth prospects of AMCs. The Indian mutual fund industry’s overall AUMs have seen a 20% CAGR over FY2012-22, with active equity AUM growth higher at 25% CAGR in this period. According to the industry report over FY22 to FY32, AUM is expected to grow at a CAGR of ~15%.

Factors to Consider while analyzing AMC Business:

AUM Growth: Consistent AUM growth is a positive indicator. Factors contributing to this growth include retail participation, geographical expansion, and product diversification. Given the readily available access to information for retail customers and the competitive environment within AMC markets, achieving scheme outperformance is essential to draw equity fund inflows.

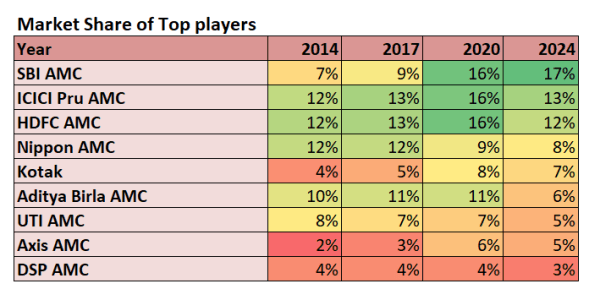

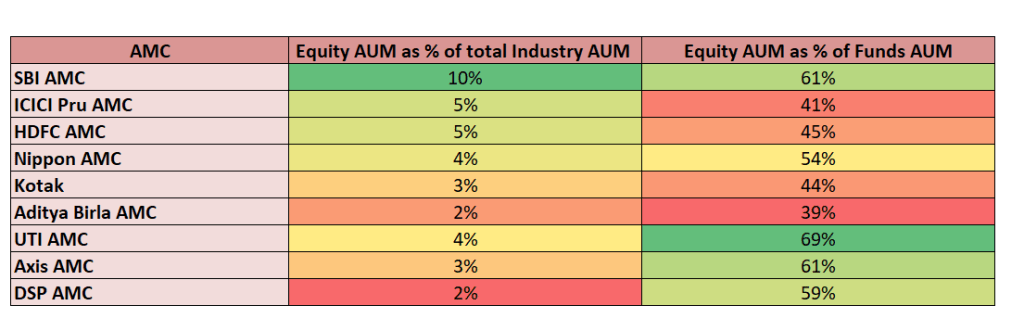

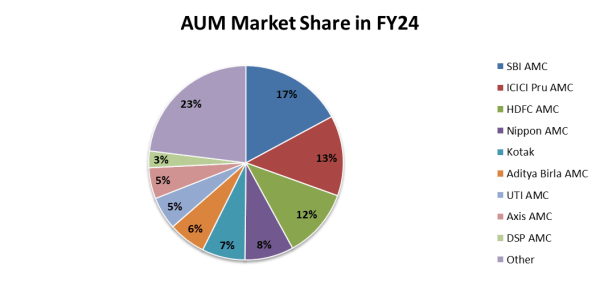

Market Share and Competitive Position: Analyzing an AMC’s market share, particularly in equity and debt funds, helps assess its competitive position and growth potential. SBI AMC stands out with a rapid pace in AUM growth, allowing it to earn the largest AMC tag in India since Dec 2021. SBI AMC doubled its market share from ~8% in Mar 2016 to 17% in March 24. Similarly, Axis AMC witnessed multifold growth in AUM with an improvement in market share to ~5% in March 24 from ~3% in Mar 2016 whereas Kotak AMC improved its market share to ~7% in March 24 from ~4.4% in March 2016.

Source: Ace MF

- Split between equity and non-equity AUM: Equity has high management fees compared to debt and other products hence AMC which has a higher share of equity AUM as a percentage of total AUM will have a High Revenue yield.

Source: Ace MF as of FY24

Distribution Network: A robust distribution network aids in accumulating AUM for AMCs. Additionally, having a bank as a parent company contributes to AUM's growth. This is evidenced by the fact that 6 out of the top 10 AMCs have banks as their parent companies.

Key Concerns in AMC Business

Despite the robust growth outlook, the AMC sector faces several risks:

Market Volatility: The performance of AMCs is closely linked to the financial markets. Volatility in equity and debt markets can affect fund inflows and overall returns, posing a significant risk

Regulatory Changes: The Securities and Exchange Board of India (SEBI) has implemented various regulations to enhance transparency and protect investor interests. While these regulations are beneficial in the long run, they can pose short-term challenges for AMCs in terms of compliance and operational costs.

Competitive Pressure: The AMC industry in India is highly competitive, with a few large players dominating the market. This intense competition, especially in attracting and retaining retail investors, can impact market share and profitability. The number of active AMCs stands at 43 while the AUM share of top-7 AMCs is ~70% of the average AUM.

Source: Ace MF

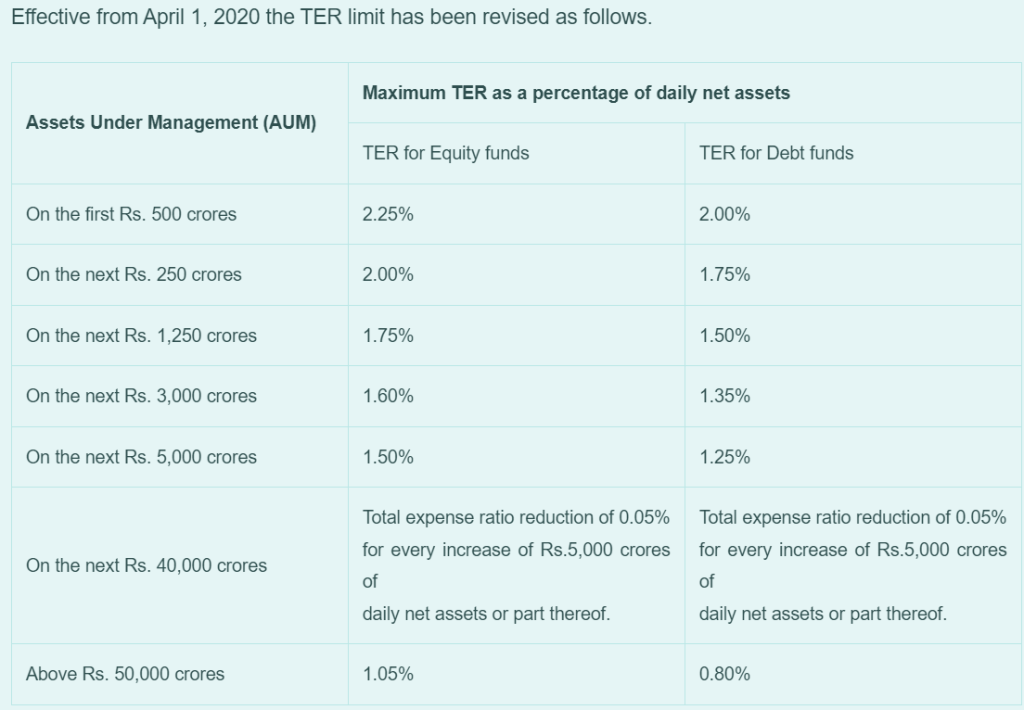

Regulation on Total Expense Ratio (TER): Under SEBI (Mutual Funds) Regulations, 1996, Mutual Funds are permitted to charge certain operating expenses for managing a mutual fund scheme – such as sales & marketing/advertising expenses, administrative expenses, transaction costs, investment management fees, registrar fees, custodian fees, audit fees – as a percentage of the fund’s daily net assets. With consistent growth in AUM, as per these regulations, larger fund schemes need to operate with a lower TER (total expense ratio) which negatively impacts their revenue yield.

Source: AMFI

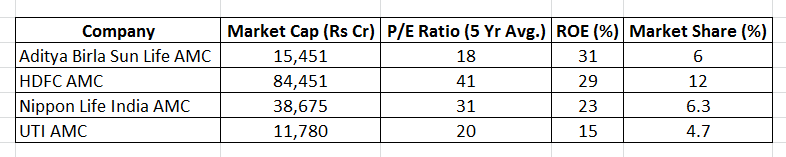

Valuation of Different Listed Players in the AMC Sector

Valuation metrics, such as Price-to-Earnings (P/E) ratio, Return on Equity (ROE), and market share, play a crucial role in assessing the performance and potential of listed AMCs in India. Here, we compare the valuation of four major players in the Indian AMC market: Aditya Birla Sun Life AMC, HDFC AMC, Nippon Life India AMC, and UTI AMC.

HDFC AMC stands out with the highest P/E ratio of 41 (5-year Average) and an impressive ROE of 29% (5-year Average), reflecting its strong profitability and market position. It also holds the largest market share at ~12%, underlining its dominance in the sector.

Nippon Life India AMC, with a P/E ratio of 31 and an ROE of 23%, follows closely behind, demonstrating stable returns and a significant market presence.

Aditya Birla Sun Life AMC, although having a lower market share of 6%, maintains a healthy P/E ratio of 18 and an ROE of 31%, indicating solid performance. UTI AMC, despite having the smallest market cap and market share among the four, shows a competitive P/E ratio of 20 and an ROE of 15%, suggesting it is attractively priced with growth potential.

The table and chart below provide a detailed comparison of these valuation metrics:  This comparison highlights that while HDFC AMC leads in terms of valuation multiples and market share, other players like Nippon Life India AMC, Aditya Birla Sun Life AMC & UTI AMC also offer strong financial metrics, presenting diverse opportunities for investors.

This comparison highlights that while HDFC AMC leads in terms of valuation multiples and market share, other players like Nippon Life India AMC, Aditya Birla Sun Life AMC & UTI AMC also offer strong financial metrics, presenting diverse opportunities for investors.

MoneyWorks4Me Opinion

We like the AMC Business model because unlike most financial players, AMCs do not attract credit risk which is the biggest safeguard for earnings stability. This, coupled with a relatively simplified business model and high operating leverage, results in superior RoEs. Finally, due to a linear capital structure and the absence of additional capital requirements for growth, AMCs generate a decent free cash flow for investors, which in turn is eligible for distribution as dividends.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: