Bharti Hexacom Ltd IPO Details:

Opening Date: April 03, 2024

Closing Date: April 05, 2024

Listing: BSE and NSE

Number of Shares: ~7.5 Cr shares

Face Value: Rs 5 per share

Price Band: Rs 542-570 per equity share

Issue Size: Rs 4,275 crore

Lead Managers: SBI Capital Markets, Axis Capital, Bob Capital Markets, ICICI Securities and Iifl Securities Ltd

About the Bharti Hexacom Ltd Company:

Bharti Hexacom (BHL) is a communications solutions provider offering consumer mobile services, fixed-line telephone and broadband services to customers in the Rajasthan and the North East telecommunication circles in India, which comprises the states of Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland and Tripura. The Company is a subsidiary of Bharti Airtel Limited and offers its services under the brand ‘Airtel’.

It has a distinct strategy to premiumise its portfolio by acquiring and retaining quality customers and deliver an experience to them through its Omni channel approach and use of data science. It has a complete range of digital offerings to enhance customer engagement and differentiated customised offerings through family and converged plans under the Airtel Black proposition, which has resulted in the continuous improvement of revenue market share (RMS) during the last three years.

Financials- Aided by Increasing Revenue Market Share

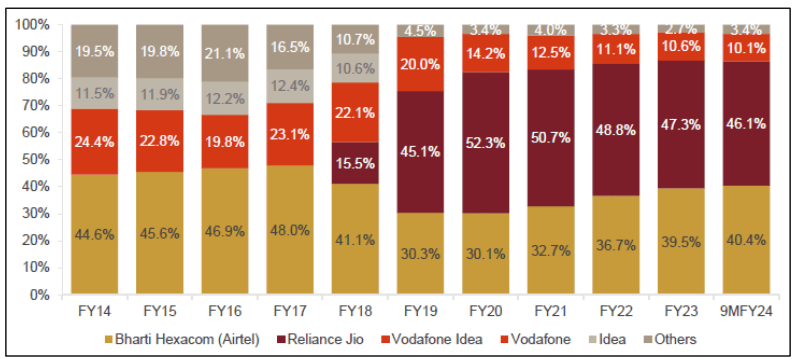

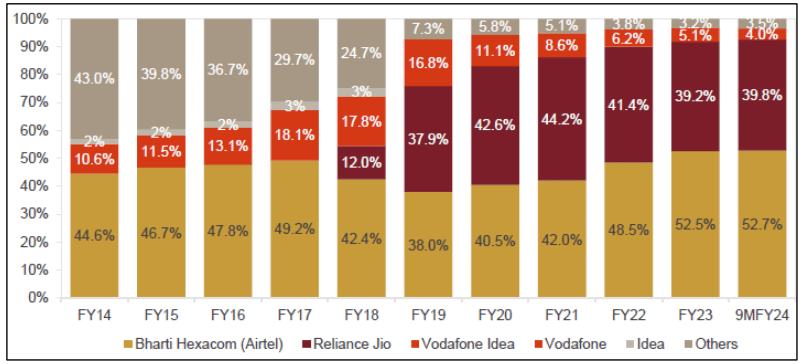

BHL was at the number one position in the North East circle during FY 22 & 23. In the Rajasthan circle, the market share gap between BHL and the market leader has narrowed between FY21 and H2FY24 and it stood at the close second position. (Source: CRISIL Report).

Rajasthan Telecom Revenue Market Share

(Source: DoT, TRAI, CRISIL, DRHP)

Telecom Northeast Revenue Market Share

(Source: DoT, TRAI, CRISIL, DRHP)

The company has been able to consistently increase its Average Revenue per User (ARPU) for mobile services from Rs, 135 for FY21 to Rs. 195 for H2FY24. The company has the highest number of Visitor Location Register (“VLR”) customers (6.3 million) and a VLR market share of 52.0% in the North East circle and the second highest in the Rajasthan circle with 23.2 million customers and a VLR market share of 38.3%, as of September 2023. Data consumption per customer per month stood at approximately 22.8 GB during the period.

On the back of overall price hikes in the industry and operating leverage, margins for BHL are improving at a significant pace as shown below:

(Amount in Rs. Cr)

Purpose of the Issue:

The issue is a complete Offer for sale by Telecommunications Consultants India Limited (“TCIL”) which owns 30% of the outstanding equity share capital of the company. Bharti Airtel is the Promoter of the company and holds 70% stake in the company. TCIL is an engineering and consultancy company providing Indian telecom expertise in all fields of telecom and information technology to developing countries around the world. TCIL wants to liquidate 50% of its hold via this IPO.

Positives:

- Strong Parentage: The Company, initially established as 'Hexacom India Limited' in 1995, was renamed 'Bharti Hexacom Limited' in 2004 following Airtel's acquisition of a majority stake. Airtel is a significant player in the global communications market, serves over 500 million customers across 17 countries and is a leader in India's communications industry. The company benefits immensely from its association with Airtel, gaining access to a vast digital infrastructure and a range of digital services, which enhances its offerings and market position. This strong backing from Airtel underscores the company's robust foundation and promising outlook.

- Focused distribution in Rajasthan & Northeast: BHL has an extensive distribution and service network across the regions it operates in and during the H2FY24 it has set up 18 retail outlets and 8 small format stores to reach 88 cities. The distribution network comprises of 617 distributors and 88,586 retail touch-points.

Capex:

The Company needs to continuously invest in network expansion, technology advancement and judicious spectrum investments. As of Q2 FY24, it has invested Rs. 20,000 Cr in capital expenditure for its future ready digital infrastructure. As a majority of capex is already done, going forward capex outflow shall moderate.

Concerns:

- Geographical Concentration: BHL derives 97% of its revenues from providing mobile telephone services in Rajasthan and the North East circle and any unfavourable developments in such regions could adversely affect its business, results of operations and financial condition.

- Dependence on Bharti Airtel: All the Key Managerial Personnel and Senior Management except Rajesh Chhatani are permanent employees of Promoter Bharti Airtel. Ownership by Bharti Airtel is a double-edged sword as the company is dependent on Airtel for its Infrastructure, Technological needs, and supply of skilled talent pool.

Key Managerial Personnel

- Marut Dilawari is the CEO of the Company since 2022. He holds a master’s degree in business administration from Maharshi Dayanand University, Rohtak. He holds a postgraduate certificate in business management from XLRI, Jamshedpur. Prior to joining the Company, he was associated with Escotel Mobile Communications Ltd, Bharti Cellular Ltd, Aditya Birla Retail Ltd and Tata Teleservices Ltd.

- Akhil Garg is the CFO of the Company since November 2023. He holds a master’s degree in business administration from the University of Melbourne. He is an associate member of the ICAI. Prior to joining the Company, he was associated with PepsiCo India Holdings Private Ltd and ECS Ltd.

MoneyWorks4Me Opinion

Telecom is a very high entry barrier industry because of the capital intensive nature. After entry of Jio, this industry has shifted towards a virtual duopoly. Majority of the Capex for the industry is done for now and thus we shall see significant free cash flows conversion in these companies. Even though we expect margins to improve from here on, the current valuation ask is high at 11x FY24E EV/EBITDA, exceeding the 9-10x multiple that parent company Bharti Airtel trades at.

Recommendation: AVOID

Bharti Hexacom Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | April 03, 2024 |

| IPO Close Date | April 05, 2024 |

| Basis of Allotment Date | April 08, 2024 |

| Refunds Initiation | April 10, 2024 |

| A credit of Shares to Demat Account | April 10, 2024 |

| IPO Listing Date | April 12, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 26 | Rs. 14,820 |

| Maximum | 13 | 338 | Rs. 192,660 |

Bharti Hexacom Limited IPO FAQs:

When will the Bharti Hexacom Ltd IPO open?

Bharti Hexacom IPO will open for subscription on Wednesday, 3rd April 2024, and closes on Friday, 5th April 2024.

What is the price band of Bharti Hexacom Ltd IPO?

The price band for Bharti Hexacom Ltd IPO is Rs. 542-570/share.

What is the lot size for the Bharti Hexacom Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 26 shares, up to a maximum of 13 lots i.e. Rs. 1,92,660/-.

What is the issue size of Bharti Hexacom Ltd IPO?

The total issue size is ~ Rs. 4,275Cr.

When will the basis of allotment be out?

Allotment will be finalized on April 8th and refunds will be initiated by April 10th. Shares allotment will be credited in Demat accounts by April 10th.

What is the listing date of Bharti Hexacom Ltd’s IPO?

The tentative listing date of the Bharti Hexacom IPO is April 12th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: