The Indian diagnostic sector is going through a rapid transition with acquisitions by existing players, new business models, and recent IPOs. Over the past few years, the industry has experienced robust growth, showing a healthy upward trend. Between FY12-21, the industry clocked a CAGR of ~13%. By FY26, it is expected to reach a market size of Rs 1,360 bn, logging a CAGR of 14%+ on the back of favorable macros.

Low entry barriers, historically high return ratios, and sustained demand (increased awareness, low penetration) has attracted competition. In this evolving landscape with diverse market participants, we want to see who is best placed to capture value. Before that let’s understand the industry structure and services offered.

Industry:

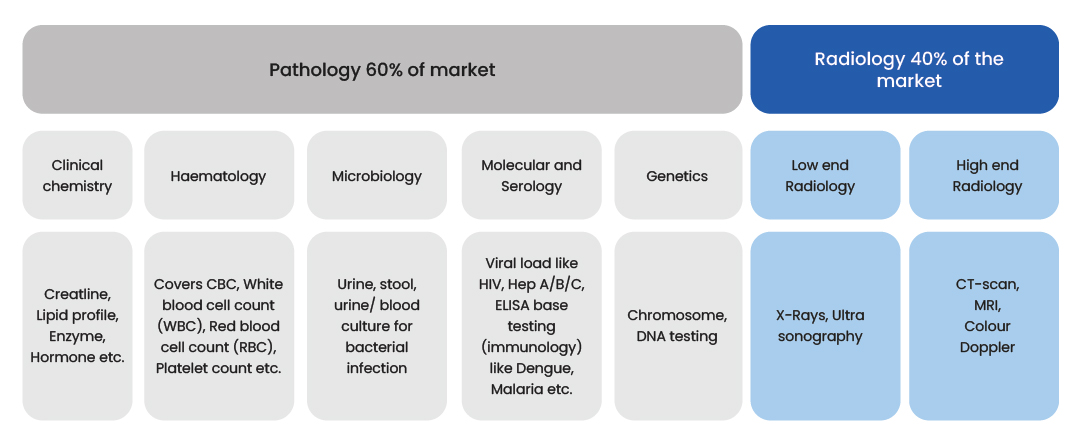

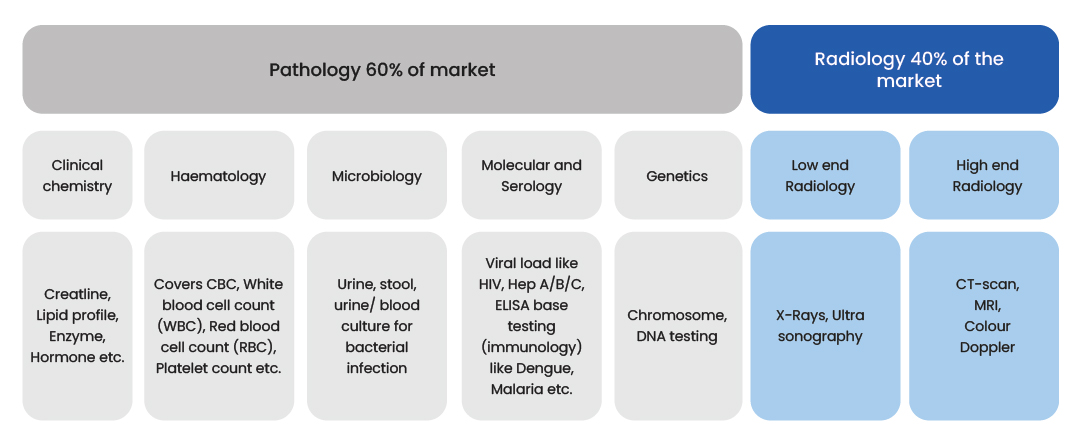

The diagnostic industry can be bifurcated based on services offered-

- Pathology testing involves reporting diagnostic information based on collected samples (blood, urine so on) and analysing them in a laboratory to arrive at useful clinical information.

- Radiology involves procedures ranging from simple X-rays and ultrasounds to specialized tests such as CT and PET-CT scans, which help diagnose diseases by marking anatomical and physiological changes in a patient’s body.

Services offered in the diagnostic industry:

Source-DRHP, Annual reports, Moneyworks4me research

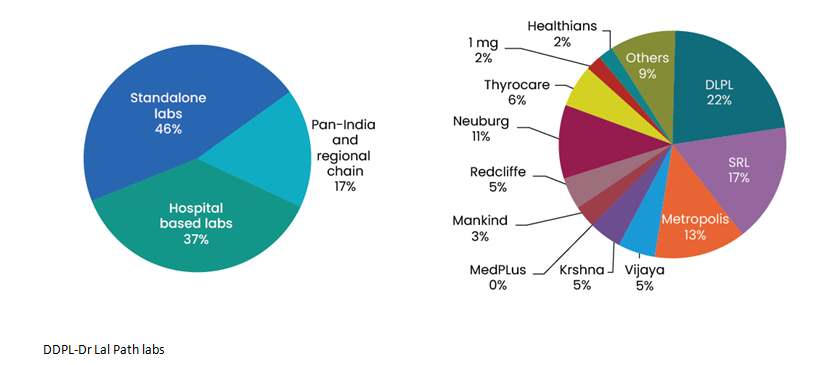

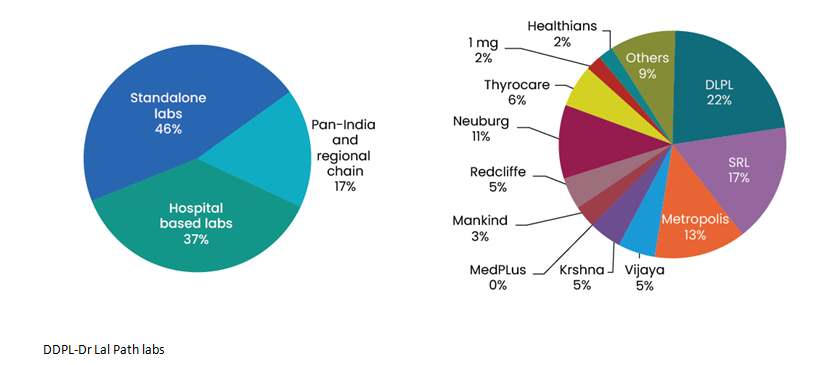

While standalone players contributed 42-46% of the total diagnostics industry, diagnostic chains possess better accreditations and cater to a larger set of population through their brand reputation and operational efficiency. This has led to an increase in their share from 13-17% to 16-20% of the overall diagnostics industry between FY20-23.

Diagnostic industry breakup and market share in revenue terms

Source-DRHP, Annual reports, Moneyworks4me research. Note- market share numbers are approximate.

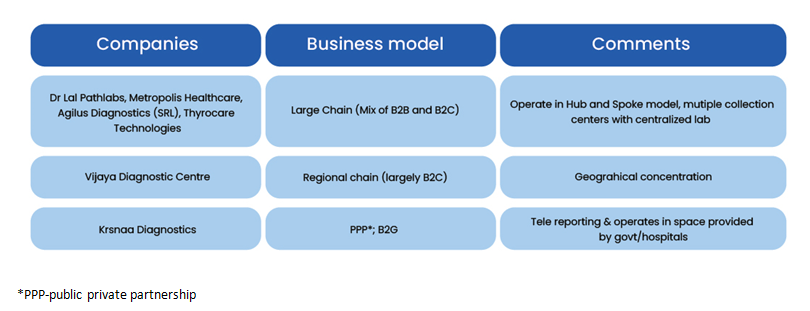

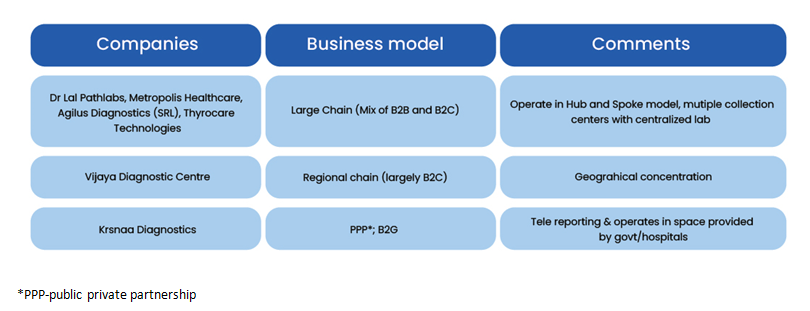

Amongst the major listed players, the business model difference is highlighted below-

Source-DRHP, Annual reports, Moneyworks4me research.

Competitive intensity rises as new players enter

Over the last few years, online players, aggregators, pharma companies, and hospital-based labs have entered the market increasing competition and putting pressure on prices. Notable online players are Tata 1mg (healthcare platform including e-pharmacy etc) and Healthians (tests at home). Pharma companies like Lupin and Mankind Pharma have also ventured into diagnostics. Torrent Pharma and Adani Health are also expected to launch soon.

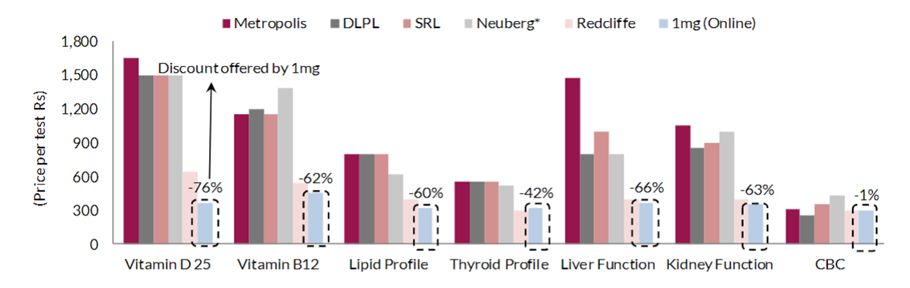

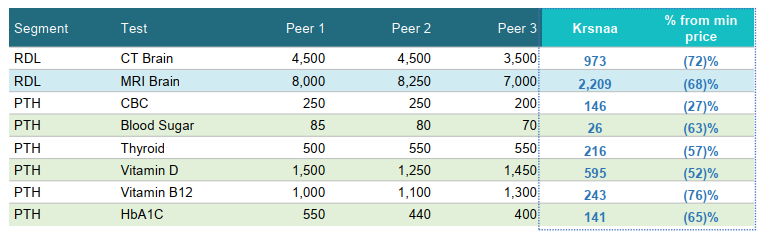

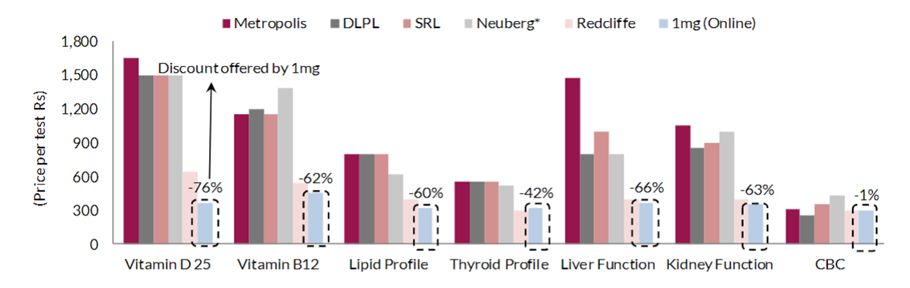

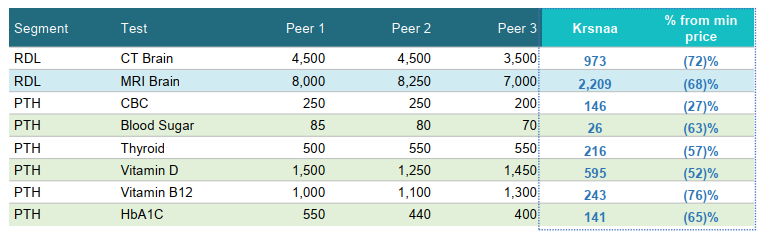

Aggressive pricing - Diagnostics companies often compete on prices to gain volume.

Price range for tests and comparison between peers

Source-DRHP, Annual reports, Moneyworks4me research.

Krsnaa Diagnostics stands out because of its differentiated business model (B2G/PPP) and is able to offer competitive prices given the low cost of setup and volume stability. While few online players adopted disruptive pricing early to gain market share, they are now dialing them back given high customer acquisition costs and funding constraints.

Acquisitions for growth

Few listed players have expanded their regional presence via acquisitions. Dr. Lal Pathlabs Ltd (DLPL) set up a subsidiary for smaller regional acquisitions and acquired a stake in Suburban Diagnostics (Western region presence). Metropolis Healthcare acquired a stake in Hitech Diagnostics (presence in the southern part of India). Agilus Diagnostics Ltd (IPO filed; formerly SRL) acquired a stake in DDRL (also having a presence in the southern region). These acquisitions put some pressure on margins, hurting ROEs. While this may be a short-term phenomenon, the debt-fueled acquisition could backfire as competitive intensity rises.

Conclusion:

The Indian diagnostic industry is expected to be supported by various fundamental growth drivers like the ageing population, rising awareness for healthcare, increase in preventive healthcare, penetration in rural areas, as well as increasing investment by both government and private players. We have been bullish on this segment, check out our recommendation here.

...

Comment Your Thoughts: