Gopal Snacks Limited IPO Details:

Opening Date: March 06, 2024

Closing Date: March 11, 2024

Listing: BSE and NSE

Number of Shares: ~12.60 Cr shares

Face Value: Rs 1 per share

Price Band: Rs 381-401 per equity share

Issue Size: Rs 650 crore

Lead Managers: Intensive Fiscal Service Pvt. Ltd, Axis Capital, JM Financial

About the Gopal Snacks Ltd Company:

Gopal Snacks Limited, established in December 2009, is a prominent fast-moving consumer goods company primarily operating in Gujarat. It offers a diverse array of savory products under its renowned brand 'Gopal.' The company boasts an extensive product portfolio, comprising 84 products with 276 SKUs across multiple categories. Operating six manufacturing facilities, including three primary and three ancillary units located in Nagpur, Rajkot, and Modasa, it focuses on producing finished products as well as besan, raw snack pellets, seasoning, and spices for captive consumption. In FY 2023, Gopal Snacks emerged as the fourth largest brand in the organized ethnic snacks market in India, ranking as the largest manufacturer of Gathiya and snack pellets by production volume and revenue. Additionally, it stood as the second-largest organized producer of ethnic namkeen in Gujarat and the fourth-largest in India in terms of revenue.

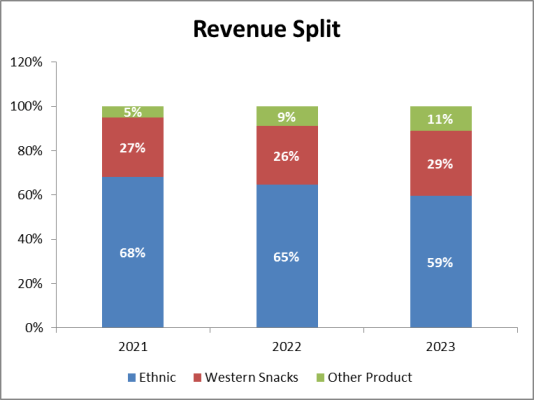

Under the 'Gopal' brand, the company offers a broad range of products, encompassing ethnic snacks like namkeen and gathiya, Western snacks such as wafers and extruded snacks, as well as fast-moving consumer goods like papad, spices, besan, noodles, rusks, and soan papdi. Leveraging its consumer insights and market understanding, Gopal Snacks has expanded its product range over the years, solidifying its position in the Indian snacks industry.

Objects of issue

The issue will be solely conducted as an Offer for Sale. The objective of the issue is to address promoter Bipinbhai’s debt which he had taken while he acquired his brother Prafulchandra stake in November 2022. To raise Rs. 650 crore from the offering, promoters Gopal Agriproducts and Bipinbhai Vithalbhai Hadvani will be divesting equity shares worth Rs 520 crore and Rs 80 crore, respectively, in the OFS. Additionally, Harsh Sureshkumar Shah will be selling shares worth Rs 50 crore.

Positives

Lower costs compared to competitors: The Company produces in-house besan (gram flour) and essential spices like chili powder, cumin powder, coriander powder, and turmeric powder, all crucial ingredients for snacks. This reduces its dependence on suppliers, resulting in reduced production expenses.

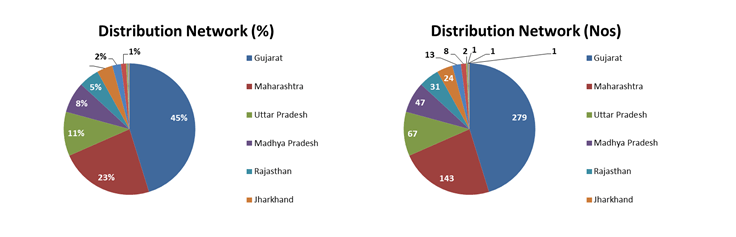

Distribution Channel: Unlike many competitors, Gopal Snacks does not incorporate a layer of super stockists within its supply chain. Instead, its products are directly delivered to retailers through its 617 distributors. The company plans to onboard more than 200 additional distributors next year.

Future Plans:

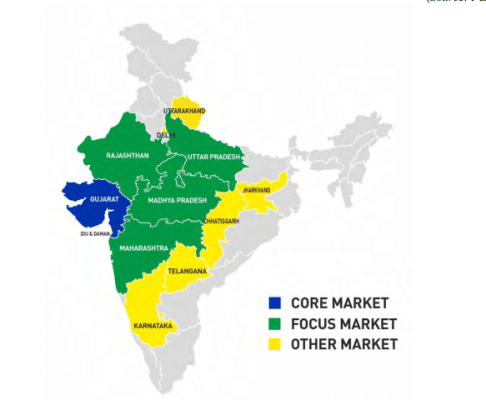

Gopal Snacks Limited holds the position of the second-largest snack manufacturing company in Gujarat. The company is strategically expanding its footprint across India, with a specific focus on Northern states such as Uttar Pradesh, Rajasthan, Haryana, and Delhi, as well as Southern states like Karnataka and Telangana. Alongside its stronghold in Gujarat, Gopal Snacks has established a significant presence in Maharashtra, Uttar Pradesh, Madhya Pradesh, and Rajasthan. The company maintains a targeted product portfolio that caters to metropolitan tastes while also addressing the unique preferences of diverse cultures and regions. Furthermore, Gopal Snacks aims to enhance its market presence by bolstering direct access, targeting rural consumers, and optimizing cost and capital efficiencies. As stated by management company doesn't need fresh capex at this point in time. The utilisation is about 35-40% of the installed capacity, so the company can double its revenue without a major capex outlay.

Concerns

Regional concentration risk: The sale of products is concentrated in the core market of Gujarat.

Any unfavorable developments affecting operations in such regions could negatively impact the company's business, financial condition, results of operations, and cash flows.

Distribution Network:

The company's business relies heavily on its distribution network. Any challenges in expanding or efficiently managing the distributor network, or disruptions in the distribution network, could adversely affect the company's business, results of operations, financial condition, and cash flows.

Regulatory Issue: The Company has received eight notices under the relevant provisions of the Food Safety and Standards Act, 2006, declaring products to be allegedly substandard, adulterated and misleading advertisements.

Key Management

Bipinbhai Vithalbhai Hadvani is one of the Promoters and is currently the Chairman and Managing Director of the Company. He has completed his matriculation from the Gujarat Secondary Education Board, Gandhinagar and has been associated with the Company since incorporation. He has experience in the food industry including in the field of business operations since 1994. He is currently also on the board of Gopal Agriproducts and Gopal Snacks Foundation.

Raj Bipinbhai Hadvani is the full-time director and Chief Executive Officer of the Company. He holds an MBA degree from SVKM’s Narsee Monjee Institute of Management Studies, Mumbai, upon completion of which he joined the Company in April 2017. He has experience in the field of marketing.

Dakshaben Bipinbhai Hadvani is one of the Promoters of the Company and is currently the Executive Director of the Company. She holds a BA degree in sociology from Saurashtra University, Rajkot, Gujarat. She has been associated with the Company since November 18, 2015. She has experience in the field of human resources. She is also on the board of Gopal Agriproducts and Gopal Snacks Foundation.

Moneyworks4me Opinion

For Gopal Snacks, Gujarat is the core market that contributed 76% of its revenue in the first half of fiscal 2024. It had a 20% share in ethnic savouries and 8% in western snacks in the state as of March 2023 the company now aims to expand its presence nationally, targeting regions such as Maharashtra, Madhya Pradesh, Rajasthan, and Uttar Pradesh. This expansion strategy necessitates the development of the company's distribution network, a crucial aspect for growth. Despite its historically modest advertising expenditure, predominantly focused on the local market, we anticipate a potential increase in advertising spend as the company ventures into new regions, potentially impacting operating margins.

The price/earnings ratio based on diluted EPS for FY 2023 at the cap price is 44.46 times from a valuation standpoint, the company appears fully priced. However, we advocate for a cautious approach until the financial figures begin to align with the anticipated growth narrative.

Gopal Snacks Limited IPO Tentative Timetable:

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 37 | Rs. 14,837 |

| Maximum | 13 | 481 | Rs.192,881 |

Gopal Snacks Limited IPO FAQs:

When will the Gopal Snacks Ltd IPO open?

Gopal Snacks IPO will open for subscription on Wednesday, 06th March 2024, and closes on Monday, 11th March 2024.

What is the price band of Gopal Snacks Ltd IPO?

The price band for Gopal Snacks Ltd IPO is Rs. 381-401/share.

What is the lot size for the Gopal Snacks Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 37 shares, up to a maximum of 13 lots i.e. Rs. 1,92,881/-.

What is the issue size of Gopal Snacks Ltd IPO?

The total issue size is ~ Rs. 650Cr.

When will the basis of allotment be out?

Allotment will be finalized on March 12th and refunds will be initiated by March 13th. Shares allotment will be credited in Demat accounts by March 13th.

What is the listing date of Gopal Snacks Ltd’s IPO?

The tentative listing date of the Gopal Snacks IPO is March 14th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: