The stock market is a device for transferring money from the impatient to the patient.

-Warren Buffett

However, being patient in the stock market is easier said than done. You can only be patient with holding a stock for a long time if you have confidence about the quality of the company and if you buy it at a reasonable price.

Therefore, “Quality at a Reasonable Price” is the way of investing at MoneyWorks4Me.

But how do you decide whether the stock is undervalued or not? There are multiple ways to value a stock – Absolute Valuation methods like discounted cash flow (DCF) method, and dividend discount model (DDM) that give an estimate of the Intrinsic Value of a stock and Relative Valuation (comparing the company’s multiples like P/E, EV/EBITDA, etc. with those of its peers).

However, there are multiple variables involved such as the cost of capital, forecasting the cash flows, the difference between the positioning of companies within the same industry, etc. which require expert judgement and analysis. It is not possible for the majority of retail investors to use the models and identify undervalued stocks.

For more than a decade now we have made it simple for our Superstars subscribers to know when a stock is undervalued, fair, or overvalued. We cover the best 200 stocks and enable our customers to invest in them confidently and successfully. However, such a solution comes at a cost.

But now with the launch of MoneyWorks4Me DeciZen, we have made it easy for an investor to make a decision about the reasonable price he/she can pay. We use a statistical framework that uses valuation multiples (e.g. EV/EBITDA, P/B, P/E, etc.) over a long period of time, mostly 10 years, and compares it with the current valuation to conclude if the stock is undervalued, somewhat undervalued, fair or overvalued. This comparison with its own history across the different business, market, and economic cycles provides a good anchor for valuation. The reason for comparison with its own historical valuation is that it is a more reliable benchmark, provided the company has not changed structurally over time.

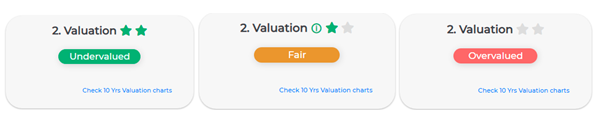

Sounds like a lot of work, doesn’t it? But users need not worry as all this is done in the background and the user has to just check the DeciZen Valuation rating.

Companies with Green colour or 2 stars on Valuation are undervalued and present a good opportunity, those with Orange colour or 1 star can be considered for investment as they are fairly valued and Red colour or 0 stars are somewhat overvalued or overvalued and should not be invested in at current prices.

It is very important to remember that a Valuation rating comes after a Quality rating and the stock that you invest in should be a good consistent performer, again over 10 years – i.e Green colour or 2 stars on Quality. This will give you the confidence to stay invested in the stock, be patient and enjoy success as said in the Buffett quote. The added benefit is that such good quality stocks also have more reliable Valuation ratings. Check out our Video on How to Identify Good Quality Stocks and invest confidently using MoneyWorks4Me DeciZen Rating.

Now how do you find very good quality stocks that are currently undervalued? On MoneyWorks4me Screener you find them with amazing ease. Use the Predefined Screeners or make your own using the smart DeciZen Filters on any Index, Sector, or Industry. Check Best From Nifty 50 for starters.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: