Excerpts from Annual Report:

“ICICI Bank’s objective is to grow the core operating profit in a Risk calibrated manner, based on the principles of ‘Fair to Customer, Fair to Bank’ and ‘One Bank, One ROE’.”

“We are investing in strengthening our technological capabilities, with key priorities being technology platforms, embedded banking, cloud adoption, and data platforms and analytics.”

“ICICI Bank aims to continuously evaluate the various risks impacting its business, and develop strategies to monitor and manage these risks while meeting the objective of risk-calibrated growth and long-term sustainability.”

“One of the shifts in ICICI Bank’s operating model in recent times has been the adoption of ‘One Bank, One Team' as a guiding factor. The strategic focus on risk-calibrated growth in core operating profit is based on a comprehensive assessment of opportunities in the market, and strengthening the teams’ competencies for capturing market share, serving customers, and growing profitably within the guardrails of risk and compliance.”

Source: Annual Report

Business Performance (Standalone):

| (INR Cr) | YoY Growth | |

| Advances | 859,020 | 17.1% |

| Total Income | 104,892 | 6.9% |

| Net Interest Income (NII) | 47,466 | 21.7% |

| Gross NPA (%) | 3.6% | -1.36% (vs. 4.96 in FY21) |

| Net Profit | 23,339 | 44.1% |

| Deposits | 1,064,572 | 19.7% |

Current & Savings Accounts (CASA) Deposits grew by 20.1% to Rs 518,437 Cr and Term Deposits grew by 9% to 546,135 Cr. CASA Ratio improved to 44.5% vs. 41.4% in FY21.

Branches & ATMs - 5,418 & 13,626.

Net Interest Margin (NIM) – 3.96% improved by 0.27% vs. 3.69% in FY21.

Yield on Advances – 7.21% decreased by 0.28% vs. 7.49% in FY21.

Cost of Funds – 3.71% decreased by 0.54% vs. 4.25% in FY21.

Share of Profits from Associates at 1,770.6 Cr, Consolidated PAT at 25,110 Cr.

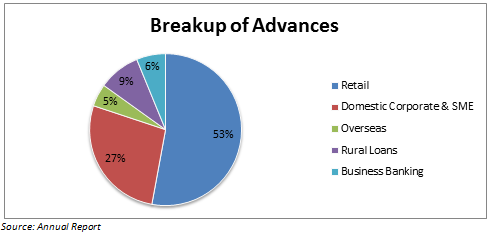

Loan Book Mix-

Retail Loans grew by 19.6% to 454,421 Cr.

Domestic corporate & SME loans grew by 12.9% to 233,653 Cr.

Overseas Advances grew by 10.2% to 41,232 Cr.

Rural Loans grew by 6.3% to 76,452 Cr.

Business banking segment grew by 42.3% to 53,259 Cr.

Highlights & Future Prospects from Management:

Digital Banking Solutions

Bank has launched Digital Platforms for catering various services to Individuals, Merchants/MSMEs, NRIs, and Corporates. It helps bank provide personalised solutions, enables data-driven cross-sell and up-sell, on-board new customers, enable self-service, and provide value-added features.

Digital channels account for over 90% of financial and non-financial savings account transactions. Bank has also forayed into a digital lending solution for mortgages which covers all facets of the loan life cycle starting from sales till disbursement including property appraisal, reducing transaction cycle, and allowing real-time tracking.

ICICI has also partnered with Amazon Pay and Makemytip to offer co-branded credit cards. Bank’s market share in credit card transactions by value increased to 20.1% in FY22 vs. 14.6% in FY21.

Focus on Micro Market

Bank has been working on creating a customer-centric and service-oriented approach to develop a granular perspective in different markets, growing assets & liability through micro-market analysis than having set a pre-determined goal for the loan mix.

Bank uses research and knowledge from analytics to understand the markets in which they operate, and plan localised strategies. These insights are used to plan, source, channel and align product, and marketing accordingly. Localised market insights allow ICICI to expand strategically in different locations, tailoring staff, branch layout, and products based on analytics to grow in diverse markets.

Retail Franchise

Bank has maintained its retail deposit base and CASA franchise, allowing it access to low-cost of deposits. Bank grew its liability franchise with a healthy mix, with retail advances having a bigger share. ICICI has been able to achieve a competitive advantage due to the lower cost of deposits.

SME & Business Banking

ICICI has focused on growing its SME & business loan book, which now comprises of 11% of the total book. Bank has grown this segment at 39% on yearly basis with help of various digital platforms and offering to increase efficiency and remove bottlenecks. This segment has huge growth potential and demand, whereby ICICI is trying to build a platform for ease of banking process for merchants at various stages.

Asset Quality & Credit Cost improvement

Bank has improved its asset quality has improved, with NPA having a decline in trend from 2.06% in FY19 to 0.76% in FY22. The cost of credit has come down to 1.12% in FY22 from 1.75% in FY21. Retail loans which are a majority of total advances, the NPA portion has come down from 28.8% in FY21 to 23.8% in FY22. Risk-weighted asset (RWA) density has come down to 68% in FY22, as per management’s focus on lending better-rated corporates. Bank has reduced its exposure to the top 20 non-bank borrowers as a percentage of total exposure from 12.1% at FY21 to 9.6% at FY22.

Risk

ICICI has been actively review and evaluating risks affecting its operations. It has placed effective credit risk and stress testing policies for decreasing effect of non-performing assets and maintaining sufficient regulatory capital to safeguard from external shocks (covid, Russia Ukraine crises). The bank faces various market and liquidity risks, changes in credit spreads, exchange rates, and interest rates affect banks' margins as well other income. Providing digital solutions to customers, Bank faces technology and cyber security risks which can affect its ability to onboard new clients and face regulatory inspections.

Annual Reports is a very elaborate document and shares a lot of information; at times doesn’t necessarily help to form an opinion about a company or its potential. We carve out only important information about the company’s strategy and future prospects for your benefit.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: