In our last blog, we got an understanding of the General Insurance Industry in India. In this Blog, we shall understand the Indian Life insurance Sector.

Insurance, in simple terms, means the sharing of risk. In Life Insurance, policyholders come together to contribute small amounts of money in the form of premiums to compensate those who need the money in the event of their demise. This premium is also invested to pay for any claims arising in the future. The premium income and investment income should be greater than the claims that arise and for other expenses that arise in the life insurer’s business for it to generate profits.

In India, Life insurance companies can be segregated into 2 types- Public and private. LIC (Life Insurance Corporation) which is a public sector company is the biggest player, although private sector players are rapidly eating away the market share since the sector was opened to private players in the year 2000.

The Indian Life Insurance Industry:

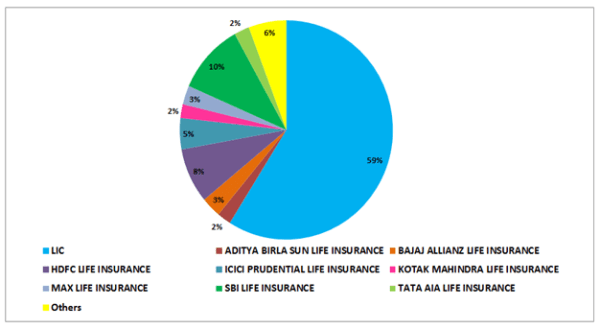

The Indian Life insurance industry is mainly dominated by LIC, which in the calendar year 2023 had a new business premium market share of ~59%.

Market Share of New Business Premium (NBP)

(Source: Life Insurance Council of India)

There are mainly 4 listed life insurers in the country, LIC is the sole public sector life insurer, with major listed private sector players being HDFC Life, SBI Life, and ICICI Prudential. Also, there are 2 more life insurers indirectly listed via their holding companies; they are Max Life, through its holding company, Max Financial Services, and Bajaj Allianz, through its holding company Bajaj Finserv.

Understanding terms used in the Life insurance sector:

APE (annualized premium equivalent):

Generally, when insurance is sold, the policyholder can choose to pay in every defined interval or simply pay a lump sum amount at the start of the policy. This lump sum payment is known as a single premium. To make it easier for investors to compare the different insurers, the insurers report this APE metric. APE is the sum of the regular annual premiums and 10% of the single premium received. This metric assumes that the single premium policy is in force for ten years only, which may not be the case.

New Business Premium:

The total of New Business premiums, including yearly and single premiums written by the insurer in a reporting period. This excludes premiums on renewal.

Value of New Business (VNB):

Present value of future profits of new policies sold during the reporting period.

Value of new business margin:

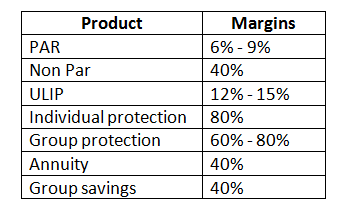

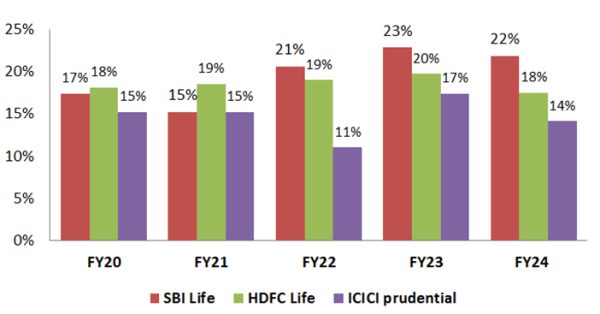

VNB Margin is the Profitability margin on new products sold by the Insurer. VNB margin indicates the company’s product mix. Protection policies have the highest margins whereas market-linked products like ULIPs have one of the lowest margins.

Persistency:

The persistency ratio refers to the percentage of policyholders who pay their renewal premium. It is a benchmark for the quality of sales made by the insurer. Moreover, it highlights the commitment of a customer to renew the policy every year. The persistency ratio is measured at different stages like the 13th & 61st month.

Embedded Value:

Given that life insurance is a long-term product, where the policyholder generally pays premiums for several years, accounting profitability is not a reliable metric to measure the performance of the company. It is rather measured by the Embedded Value of the company. An embedded value is the present value of the future profits from existing policies along with the shareholder’s net worth.

Embedded value has 2 components -

- The adjusted net worth of the company, which includes the assets attributable to the shareholders and is generally the shareholder’s funds adjusted to bring the shareholder’s assets to market value basis, net of tax.

- Value in force: This is the discounted value of future expected post-tax profits from the policies that have already been written and the anticipated renewals of the policies.

Embedded Value includes adjustment for future non-renewal of policies based on actuarial assumptions which would be measured and reported through the persistency ratio. If Insurance firms' actual experience (number of deaths, interest rate, investment income, etc.) is different than actuarial models, the insurance firm would see EV value downgrade. It is considered a conservative estimate of value because it does not factor in the value of potential new policies the life insurance company may sell.

Industry Participants:

1. HDFC Life:

HDFC Life is known for its high-margin business and superior product mix, HDFC Life focuses on high-margin individual protection and annuity products. The company has significantly reduced its reliance on low-margin ULIP business, improving profitability. The parentage of HDFC Bank is a big advantage for HDFC.

2. SBI Life:

SBI Life benefits from low acquisition expenses due to its distribution arrangements with SBI, providing a competitive edge in pricing and margins. Thus, it has been able to show the highest VNB margins amongst peers and also has been able to grow the fastest even on the large scale that it operates.

3. Life Insurance Corporation:

LIC is a dominant force in India’s life insurance industry, commanding a market share of 65% in NBP. LIC’s NBP market share has remained above 60% over the past decade despite stiff competition from private peers.

Product wise Margins:

Margins in Insurance products are determined by the proportion of Insurance in the overall product. Term Insurance is a pure insurance product and thus has the highest margins of ~80%. Participating policies are pseudo-asset management products and thus command the lowest margins.

Let us understand each of these products in detail:

There are 3 main types of insurance products namely Participating, Non-Participating, and Linked Products-

- Participating Products: These are the products where the policyholder also participates in the surplus during the tenure of the policy. These are savings products that provide a guaranteed sum assured & returns, if any. The policyholder is entitled to at least 90% of the surplus generated with the remaining belonging to the shareholders. These surpluses are generally distributed by way of bonuses.

- Non-Participating Products: As the name indicates, these policies do not payout their surpluses to the policyholder. Further to this, there are three types of sub-segments in the non-participating products:

1. Individual savings: Comprises of an endowment, variable, and immediate annuity product.

- An endowment product pays the assured sum to the beneficiary in the event of the unfortunate demise of the policyholder before the maturity date. In case the policyholder survives the tenure of the policy, the assured sum is paid to the policyholder.

- Variable Insurance plan: Here benefits are partially or wholly dependent on a benchmark that is linked to the product.

- Immediate annuity: This product guarantees a defined income which is known as pension, for the entirety of the policyholder’s life. The pay-outs begin immediately upon the purchase of the product.

2. Group savings: This consists of group fund management products and an immediate annuity product. Fund-based group products cater to the need of employers to fund the employees’ benefits like gratuity, superannuation, and leave encashment. The immediate annuity product is again for corporate clients who wish to purchase an annuity to provide for their annuity liability.

3. Protection: These are Pure Insurance products. Protection Policies give a guaranteed pay-out which is dependent on an event happening during the term of the insurance. However, the policyholder gets nothing back if they complete the tenure of the policy.

- Linked Segment (ULIPS): ULIPS have been held by Indian households for a long time. These types of products combine investment as well as protection. They provide returns linked to the performance of the underlying fund and risk on these products is borne by the policyholder.

Distribution channels:

Life Insurers distribute their policies in 3 major ways.

- Agency model: The Agency is the primary distribution channel for Life Insurance policies in India. An agent is sort of an independent representative of a specific Insurance company and is authorised to sell only the policies of the representing insurer.

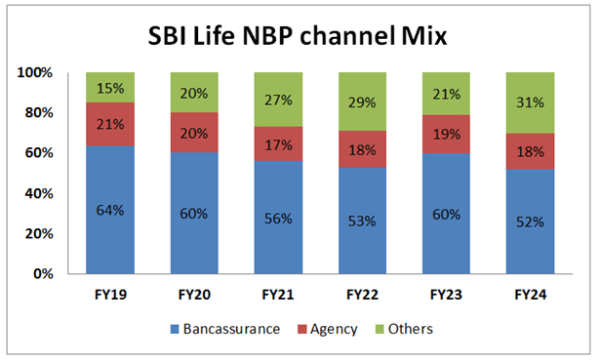

- Bancassurance model: In this model, banks sell the potential customers life insurance policies through their branch network. Bancassurance relies primarily on the relationship the bank has with its clients. Selling via bancassurance is a lowest cost method of selling policies for the Life Insurers. SBI Life has a competitive advantage in this area as it has access to the vast network of branches of its parent, State Bank of India.

- Broker Model: Brokers are similar to Agents, but can advise the customer on different insurers and as per IRDAI guidelines. This also includes composite online brokers like Policybazaar.

Here is a snapshot of SBI Life’s New Business Premium (NBP) Channel mix.

(Source: SBI Life)

Growth Drivers:

- Mortality Protection Gap in India: A substantial protection gap of 87% presents a significant business opportunity for life insurers in India, potentially reaching a premium volume of US$106.8 billion by 2030 (Swiss Re, 2021). To capitalize on this opportunity, insurers must dissect the protection gap across age groups, income levels, and occupations.

- Low Product Knowledge: Despite perceiving life insurance primarily as an investment product, 67% of customers still prefer savings for the future, tax benefits, and safety. Many do not opt for mortality protection coverage, leading to a high protection gap.

How to Value life Insurers:

Life insurers are valued as a multiple of their Embedded Value. Embedded Value is the Present value of future profitability from in-force policies. New business as a % of value in force reflect growth in embedded value and the higher this ratio, higher would be the Price to Embedded Value (P/EV).

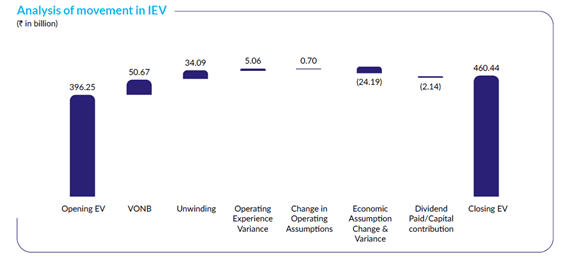

Let us understand the flow-through of Embedded Value through an example of SBI Life in FY24:

Embedded Value (EV) = Present Value of Future Profits (PVFP) + Adjusted Net Asset Value (ANAV)

FY24 closing IEV (Indian Embedded Value) shall be calculated as: Embedded Value for FY23 + Value of new business (VONB) + Unwinding (Adjustment for time value of Money) +- Changes in operating assumptions +- Change in Economic assumptions.

The profitability of Life insurers is understated, primarily because even though the insurer will be receiving the premium over the course of the next years, maybe even decades, the costs incurred by the company for acquiring new customers cannot be annualized and have to be loaded upfront in the reporting period of the company. Thus, optically PEs and P/B metrics are overstated.

Peer Comparison:

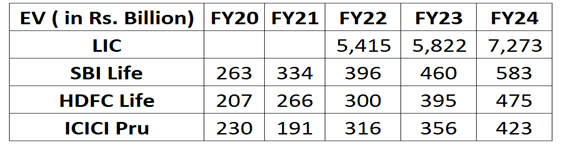

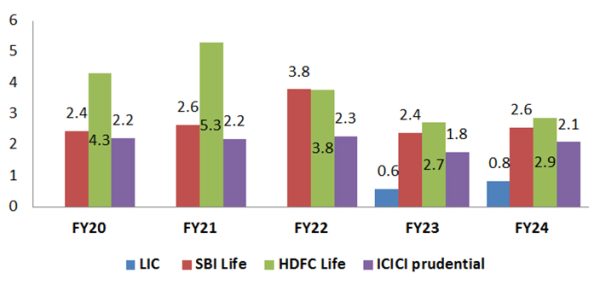

Embedded Value (EV)

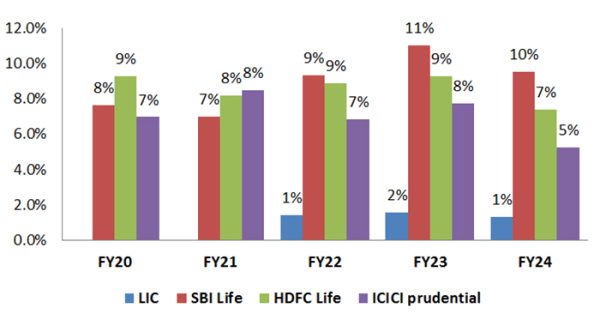

Return on Embedded Value (RoEV)

(Numbers rounded off)

What derives higher Valuation?

- Insurers with parentage of a bank are valued richly due to their access to distribution via their parent which becomes an inherent advantage. This also brings in confidence in the consumer about the claim settlement capability of the Insurer.

- Insurers with high share of pure protection policies which carry the highest margins command a higher valuation.

- Private insurers are valued highly as historically a lot business has shifted to private insurers with PSU losing their market share.

- Embedded value is calculated by discounting future profits which may be discounted at interest rates as per actuarial assumptions. Lower rate of discounting shall mean more profits and more valuation which might be due to aggressive actuarial assumptions.

- When VNB market share is shifting, in future embedded value market share will also shift due to margin differences. This makes investors assign higher multiples for insurers changing their Product mix to better margin products.

Value of New Business (VNB)/ Embedded Value (EV)

(Numbers rounded off)

Peer Valuation:

LIC doesn’t get a higher multiple over Embedded value as its VNB over its large embedded value base is a mere 2-3%, this number is significantly higher for SBI Life and HDFC Life.

Price/ Embedded Value (EV)

(Numbers rounded off)

Regulatory risks: IRDAI’s Dec'23 draft proposing an increase in surrender value for non-linked savings (likely impacting products VNB margins by 400-500 bps) has not been incorporated in the recent new regulations and the status quo is largely maintained. This removes key overhangs on the sector. As it is correct that higher surrender value reduces product profitability for Insurers but more importantly it increases the incentive to stay in the insurance products and reduces persistency which is against the interest of Consumers.

IRDAI has done a remarkable balancing act, while protecting the interests of policyholders, has also considered feedback from industry participants. Any proposal which materially impacts the growth of the sector should be done after a lot of deliberation before implementation. Further growth in the sector should come from planned reforms in the sector like grant of composite license, allowing companies to distribute financial products & simplifying investment rules.

To Conclude:

Insurance is a great business to run after reaching a certain scale as the ability to anticipate and diversify risks becomes very high. The life insurance sector in India offers significant growth opportunities driven by low penetration and substantial protection gaps. With the right strategies and regulatory support, life insurers can capitalize on these opportunities, driving long-term profitability and growth. Check out our valuations of SBI Life and HDFC Life to analyse whether they are good investments.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: