Let's embark on a fascinating thought experiment to unravel the secrets of selecting the right fund for your systematic investment plan (SIP). Picture this: you're on a quest to select the best, most suitable mutual fund to invest in. You’re zoomed into one but re torn between an actively managed mutual fund and its benchmark index. To settle the dilemma, you decide to invest an equal amount in both every month. This way, you can closely observe and compare their performance.

Curiosity fuels your motivation as you reach out to the Fund Manager seeking guidance on the ideal investment duration for a fair assessment. After a discussion, you both agree that a period of 3 years would provide an adequate basis for comparison. So, armed with enthusiasm, you commence this financial experiment on the 1st of January 2023. Every month thereafter, like clockwork, you diligently invest the same amount in both the active fund and the Benchmark Index Fund.

Fast forward to the 1st of January 2026, and three years have elapsed since the commencement of your experiment. Two deposits grace your bank account, one from the Fund Manager and the other from your SIP in the Benchmark Index Fund. Naturally, your curiosity intensifies as you eagerly check which deposit is higher and keep score. Let's assume the score is 1-0 in favor of the active fund manager.

Month after month, the deposits continue to pour in, and you faithfully update the scorecard. As time passes, the active fund manager seems to gain an edge, with the score reaching 10-2 in their favor after one year. At this point, you start contemplating whether the active fund is indeed the superior choice. However, the landscape changes as the second year concludes, leaving the score at 18-6. Finally, at the end of the third year, all the checks are in, and the final score stands at 24-12, signifying that the active fund outperformed the benchmark index in two out of three instances.

Initially, you might feel content with your fund's performance, but a closer examination reveals that the total return delivered by the active fund is only marginally higher than the Index investments. Doubts begin to creep in, and you question which investment approach is truly superior. The competition seems to be neck-and-neck, leaving you uncertain about the right course of action.

Fortunately, there's no need to undertake such a costly and time-consuming experiment to find the answer. With MoneyWorks4Me Alpha MF, the solution is remarkably simple. You can easily identify funds that have consistently outperformed their benchmarks over 90% of the time, perhaps with a remarkable score of 32-4 or even a perfect 36-0. These exceptional funds are color-coded Green for Performance Consistency. By selecting such a fund, you can enjoy the confidence of investing in a vehicle that consistently outperforms its benchmark, regardless of the timing of your investments, as long as you maintain a reasonably long investment duration of 3 years. Isn't that reassuring?

So, the Most Important Criterion for selecting a mutual fund for SIP is whether it has consistently outperformed its benchmark, preferably more than 90% of the time on a 3-year rolling basis.

Relying on past returns as most investors do, or are advised, can be misleading as it depends on the start and end periods. For example, the past returns over a 3-year period at the time of writing this is substantially higher for all funds since the start is during Covid times in 2020 when the market was low.

However, the average 3-year rolling returns remove such biases and provide a more realistic assessment. That’s because this approach involves calculating the 3-year rolling returns of a fund, with the starting date shifting by a month, and then computing the average over a 10-year period. By comparing these rolling returns to the benchmark's returns over the same period, investors can determine if a fund has consistently beaten the benchmark.

Now, when choosing between funds in the same category that has proven to be consistent outperformers, focus on selecting the ones with the highest average 3-year rolling returns. This way, you can narrow down your options and delve deeper into these funds only to find the most suitable fund.

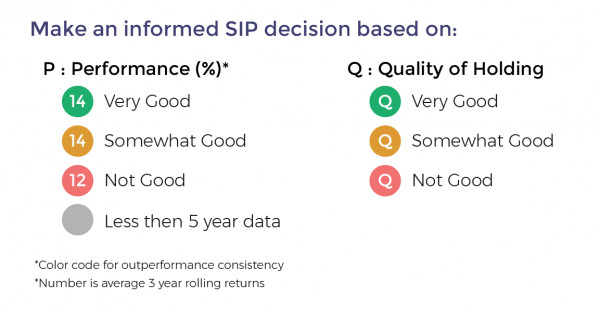

All this valuable information is conveniently available at your fingertips through the color-coded buttons or FastTag that Moneyworks4me provides for every fund. In particular, the Performance FastTag offers a wealth of insights. The color indicates the level of consistency with which a fund has outperformed its benchmark index, as explained earlier. The Green tag represents Consistent Outperformers (over 90% of the time), Orange indicates Somewhat Consistent Performers (beating the benchmark between 80% and 90% of the time), and Red signifies inconsistency. Additionally, you may come across Grey-coloured funds, which have been around for less than 5 years, making them ineligible for the assessment using this parameter.

You also see a number displayed within the Performance FastTag. This is the Average 3-year rolling return. It is very easy to shortlist the best funds for SIP investments.

For a more in-depth analysis, you can explore the Fund 10-year X-ray, which provides a concise Fund Review. Armed with this comprehensive information, you can make an even better-informed decision.

If you desire recommendations based on your age and other factors and you can use the Funds4me feature offered by MoneyWorks4Me. It employs the same methodology described above to curate recommendations for you.

In conclusion, selecting the right mutual fund for your SIP is a crucial task, but it doesn't have to be daunting. By following the principles outlined above and leveraging the tools and insights provided by MoneyWorks4Me, you can confidently navigate the vast landscape of funds and find the one that consistently outperforms its benchmark by a wide margin.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: