TBO Tek Limited IPO Details:

Opening Date: May 08, 2024

Closing Date: May 10, 2024

Listing: BSE and NSE

Number of Shares: 1.68 Cr shares

Face Value: Rs 1 per share

Price Band: Rs 875-920 per equity share

Issue Size: Rs 1,550.81 Cr

About the TBO Tek Limited Company:

TBO (Travel Boutique Online) Tek Limited was founded in 2006 and is a leading global travel distribution platform. Its platform enables the large and fragmented base of suppliers (hotels, airlines, car rentals) to display and market their inventory to a large and fragmented global buyer base (tour operators, travel management companies, online travel agencies). It offers an integrated, multi-currency, and multi-lingual one-stop solution that assists buyers in discovering and booking travel for destinations worldwide, catering to various travel segments including leisure, corporate, and religious travel. Currently, they have about 7,000 suppliers and 160,000 buyers in more than 100 countries.

Industry

The global travel and tourism market stood at US$ 1.9 trillion in 2023 (+18.2% YoY), and is expected to grow at a CAGR of 8.2% to reach US$ 2.6 trillion in 2027.

There are about 275,000 travel buyers in India, and this market is expected to grow at a CAGR of 13.9% from 2023 to 2027 and reach a market size of US$ 63.2 billion. The Indian aviation market is on a high growth path with total passenger traffic to, from and within India growing every year. The Indian domestic air market was US$ 16.3 billion in 2023 and is expected to grow by CAGR of 15.8% between 2023 and 2027 to reach US$ 29.3 billion by 2027.

Revenue model

Revenue is bifurcated in two major streams, income from Air segment and income from Hotel and ancillary services. It can be segmented geographically between domestic and international. Major markets abroad include Middle East & Africa, Europe and Latin America (26/19/9% respectively of 9M FY24 revenue).

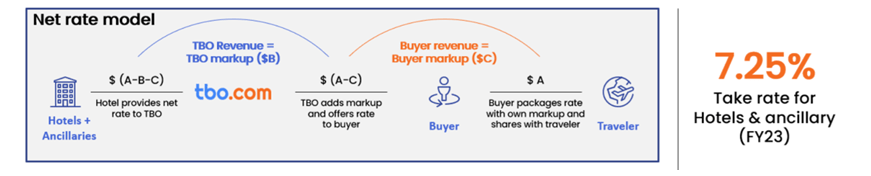

The company earns take rate (markup fee or commission) charged on GTV (Gross transaction value). The B2B Rate Model involves receiving inventory from suppliers, applying a mark-up, and then passing it on to the buyers.

In the Commission Model, suppliers set the prices at which they want to sell to the end traveller, and TBO earns a commission on these sales, part of which is retained and part shared with the buyer. This strategic approach allows TBO to adapt to different market needs and enhance its service offerings in the travel industry.

Competitors

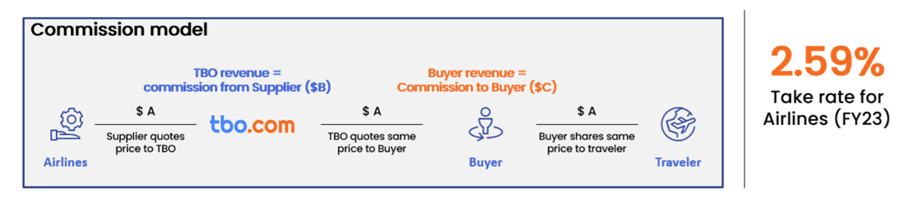

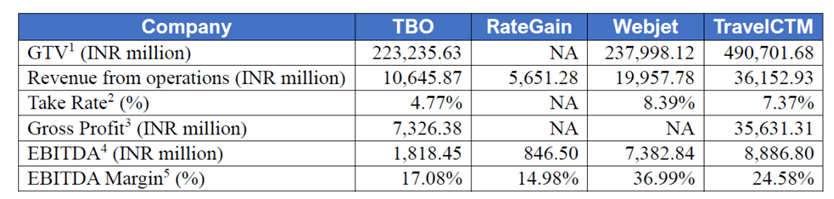

TBO does not have any exact comparable listed peers in India or abroad. But we can compare it with companies working in the similar domain.

Webjet, is a company listed in Australia and offers one or more feature-wise similar products and services and also runs an OTA business. Apart from that, TravelCTM is a global leader in business travel management services. There are channel managers like RateGain, which solves for the specific needs of hotels and accommodation providers. Set out below is certain information in relation to TBO compared with that pertaining to Rategain, Webjet and TravelCTM for FY23.

Objects of issue

TBO Tek IPO is a book built issue of Rs.1,550 crores. The issue is a combination of offer for sale of Rs.1,150 crores and fresh issue of Rs.400 crores which will be used for the following purposes:

- Expansion of the Supplier and Buyer base

- Amplification of value of the platform by adding new lines of businesses

- Inorganic growth through selective acquisitions and building synergies with their existing platform

- Leveraging data procured to offer bespoke travel solutions to their Buyers and Suppliers.

Major business factors

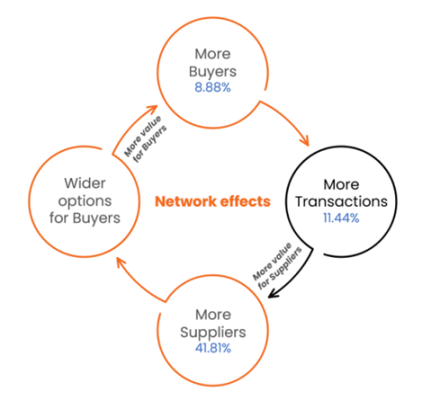

- Platform creating network effect with interlinked flywheels to enhance value proposition for partners: One of the key value propositions of TBO’s platform for both, suppliers and buyers is providing them instant access to a global network of partners on the other side of the transaction. As their buyer base grows, they channel additional demand and therefore conduct more transactions through their platform. This attracts more suppliers, which in turn, enables them to offer better pricing, wider range, and higher volume of supply across both, existing and new products.

- Concentration risk: The business depends on relationships with a limited range of suppliers which may generally involve several risks. TBO’s relationship with suppliers enables it to offer their buyers access to travel services and products. Any adverse change in their relationships with major suppliers, including the complete withdrawal of inventory by them or their inability to fulfil payment obligations to TBO for refunds in a timely manner, could have a major impact on TBO’s business. TBO does not enter into any long-term or exclusive arrangements with majority of their suppliers and their current arrangements may not remain in effect, or on similar terms, or at all.

Financials

Revenues have scaled up at a healthy pace of 25% CAGR over FY19-23, driven by Hotels & ancillary segment (39% CAGR). In the same period margin has expanded to 18% from ~10% in FY19. This increase in aided by growth in Hotels & ancillary segment which has higher margin. Company has done acquisitions in FY24, while the impact of these is still not fully realised in revenue, return ratios going ahead would normalize (RoE expected to be 15%+; RoCE expected to be 20%+).

Acquisitions

In addition to the organic growth of the company’s platform, they have a track record of growing inorganically through strategic acquisitions that supplement their operations and help them expand their partner base.

- TBO had acquired Island Hopper and Gemini Tours and Travels, in 2019 and 2021 respectively which target travellers visiting island destinations such as Maldives, leading them to consolidate their position in that market.

- United Experts for Information Systems Technology LLC which was acquired in April 2022, is engaged in the business of providing booking and search engine services to B2B and B2C clients of the company for inbound tourism in Saudi Arabia.

- TBO fully acquired BookaBed through its material subsidiary, Tek Travels DMCC, with effect from April 2022, for a total consideration of ~Rs. 90 crores, giving it access and presence in the Irish and the United Kingdom markets. Subsequent to such acquisition, they were able to provide their offerings to Bookabed buyers and integrate those buyers and suppliers on their platform.

- TBO’s material subsidiary, Tek Travels DMCC entered into a share purchase agreement in October 2023 with Jumbo Tours Espana S.L.U. to acquire its online business. Jumbo Tours is based out of Spain holding more than 40 years of experience in the tourism sector. Jumbo Tours primary lines of businesses include online business which comprises of bedbank platform for travel agents and tour operators, distribution platform with direct connection to suppliers and channel managers and transfers platform.

Management team

Gaurav Bhatnagar is the Joint MD of the company. He holds a bachelor’s degree of technology in computer science and engineering from the IIT Delhi and worked at Microsoft Corporation. He is member of the executive committee of World Travel & Tourism Council (WTTC) and is one of the co-founders of TBO.

Ankush Nijhawan is the Joint MD and co-founder of the company. He holds a bachelor’s degree of science in business administration, with a major in marketing and a minor in psychology from Bryant University. He is the chairperson for FICCI’s Outbound Tourism Committee.

MoneyWorks4Me Opinion

TBO tek operates in a growing industry, which benefits from network effects, creating a competitive advantage. Recent acquisitions have given it reach in new geographies. We like that company is raising capital for growth, has strong balance sheet and has sector tailwinds. At FY24 annualized P/E of ~48x there are growth expectations built in, we like the business model and would slowly scale up position when we get a discount. Right now aggressive investors can apply.

Recommendation: Aggressive investors can apply

TBO Tek Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | May 08, 2024 |

| IPO Close Date | May 10, 2024 |

| Basis of Allotment Date | May 13, 2024 |

| Refunds Initiation | May 14, 2024 |

| A credit of Shares to Demat Account | May 14, 2024 |

| IPO Listing Date | May 15, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 16 | Rs. 14,720 |

| Maximum | 13 | 208 | Rs. 191,360 |

TBO Tek Limited IPO FAQs:

When will the TBO Tek Ltd IPO open?

TBO Tek Ltd IPO will open for subscription on Wednesday, 8th May 2024, and closes on Friday, 10th May 2024.

What is the price band of TBO Tek Ltd IPO?

The price band for TBO Tek Ltd IPO is Rs. 875-920/share.

What is the lot size for the TBO Tek Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 16 shares, up to a maximum of 13 lots i.e. Rs. 1,91,360/-.

What is the issue size of TBO Tek Ltd IPO?

The total issue size is ~ Rs. 1550.81 Cr.

When will the basis of allotment be out?

Allotment will be finalized on May 13th and refunds will be initiated by May 14th. Shares allotment will be credited in Demat accounts by May 14th.

What is the listing date of TBO Tek Ltd’s IPO?

The tentative listing date of the TBO Tek Ltd IPO is May 15th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: