Asking this question, when investment in Equity Mutual Funds in 2017 far exceeded what was done during 2000-2016, it may seem as irrelevant to many. And, the answer is obvious…' Kyunki Mutual Fund Sahi Hai.'

And, it’s precisely this reason, mouthing the words from an advertisement campaign run by the industry that should worry us. Especially when the follow-up campaign sounds like a qualifier…' Lekin patience is required.'

This reminded me of the first and last Wealth Manager I met who sold me a ULIP and MFs way back in 2006 or should I say conned me into it. But, then one can’t blame the individual when the entire industry was scamming left, right and center.

And, the mistake is all mine because I had entered a market that has a huge sign-board, hidden in plain sight, that says'Caveat emptor-Buyers beware', but I missed it. But never again, not me, not anyone I can reach.

Since starting MoneyWorks4me, 10 years ago, I am a committed investor in Direct Stocks. Before that, I made all the mistakes Retail Investors make. The biggest mistake is not understanding the difference between 'Putting your money into stocks and Mutual Funds' versus 'Investing in it.'

When you put in money, you also take it out and one does it with very little commitment. It’s still happening! It appears that every month about 3% of investors exit from a fund. This means in a short time most of the investors in a fund are new.

More than 50% seem to hold a fund for less than 2 years, most seem to hold it for 1.5 to 2 years. Perhaps, they came into Mutual Funds for the wrong reasons, lured by high returns, influenced by very good marketing or a salesperson, the ease of buying Mutual Funds, peer pressure, feeling they have missed the bus, etc.

These are not the reasons, 'Why you should invest in MFs?' So, first let's understand, 'What is a Mutual Fund?' and 'How does it work?'

How do Mutual Funds work?

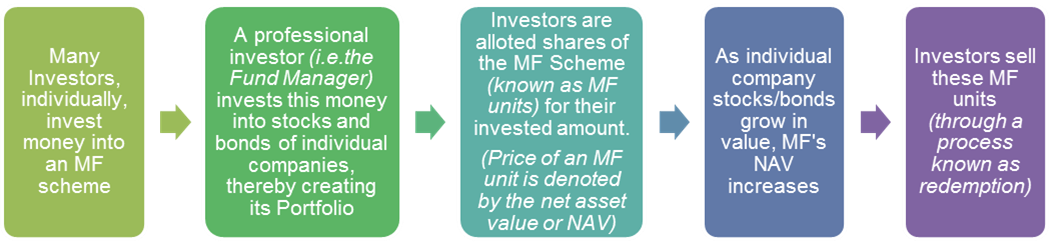

A Mutual Fund (MF) is an investment vehicle that pools money from many investors and invests in different assets like stocks, bonds, etc.

An MF is managed by a Fund Manager who is required to follow the mandate or the stated objective of the fund and of-course all statutory regulations.

So, Equity MFs invest in stocks and investing in an MF is an alternate route to investing in stocks. The most compelling reason for investing in stocks through MFs is that you don’t have a large amount to invest.

You need to buy a min of 15-20 stocks to ensure you have a diversified portfolio, and hence, lower risk. You can’t buy this directly unless you have a reasonable amount of money say 5 -10 lacs. However, you can buy a well-diversified MF having even 50 stocks with as little as Rs. 500.

So, MFs certainly make sense for Retail Investors with a small Investable Surplus. But, what if you have a large amount to invest, would you still invest in MF or prefer to invest in stocks directly? To answer this you need to answer the next question.

What does it take to invest in stocks and succeed?

Investing in stocks is all about buying good company-stocks at a reasonably attractive price, holding them for some length of time, allowing them to grow in value.

To do this part well, you would need to have a set of stocks that are investment-worthy, and know their Fair Price, so that you can buy at an attractive price below the Fair Price, and sell when they are well above it.

However, you would be running a big risk, if you were to put all your money in only a couple of stocks. What you need to build is a portfolio of investment-worthy stocks in a manner that you earn healthy high risk-adjusted returns, CAGR on the portfolio.

How does someone do this? Essentially one follows some rules, principles, and strategies. For simplicity of understanding think of these as

- Risk-reducing rules: E.g. don’t put more than 10% in one stock, not more than 25% in one sector or in small/mid caps, etc. that ensure you hold a diversified portfolio and

- Returns generating rules: Investment strategy, selection criteria or process that helps enhance returns e.g. Value, Growth, Momentum strategy, that tell us which types of stocks from the list of investment-worthy stocks one should select

Now, all of this can sound pretty complicated and time-consuming. So, what are your options?

- Invest in Mutual Funds i.e. out-source the above job to an honest, competent expert - A Fund Manager - who actively manages a portfolio, doing all the things good investing requires i.e. makes choice/decisions about what to buy, when, how much, etc. These are called Actively Managed Funds

- Invest in an Index Fund which is a portfolio that mimics an Index e.g. Nifty 50 or the Nifty Next 50. They are called Passive Funds, they don’t require an expert Fund Manager, and hence, they cost substantially less

But, avoiding complexity and chasing easy solutions should not be driving your investment decisions, especially, if they also come at a substantial cost.

Very true, Actively Managed MFs are expensive and come with a recurring cost every year. And, everything is complicated, until someone explains it to you, and even easier to do if they also provide tools (something that is happening rapidly thanks to the internet.) So, we think everybody should use to learn 'How to invest in stocks directly?'

Those with a substantial portfolio should invest at least a small portion of their Investable Surplus directly into stocks (this is exactly what MoneyWorks4me has been doing now for the last 10 years). It will certainly make you better at investing in MFs.

But, then does invest in Mutual Funds make sense for the savvy stock investor?

Yes, it does. The reason lies in the choices of rules/strategies/processes that you use to enhance returns. There are different investment strategies possible, and not all of them work as effectively all the time. Some work best in a bear market, some in a volatile market, and others in a bull market.

People who consider themselves knowledgeable and savvy investors are really good at or have a preference for one strategy. But, we need to stay invested for at least 10 years, the time during which the markets and economies would go through different cycles.

You, therefore, need the services of another expert investor who uses a different, complementing investment strategy than yours, but does that well. A combination of Direct Stock +Equity MF will also make you more confident about committing a larger portion of your Investable Surplus to equity. This will enable you to reach your financial goals much faster.

Does it mean that buying only one Mutual Fund is not right?

Absolutely, Fund Managers like every competent investor choose a strategy, and hence, the Fund that works best only in some market situations.

So, when investing in stocks through Mutual Funds, you need to select a combination that will work better together, in the present and future.

Now, you may realize that Investing in stocks through MFs is not as simple and straight forward as it is made out to be. And, you cannot invest in MFs, and then forget about it like you do when you invest in an FD.

You need to be invested in it, not just putting your money into it. And, for that, you need to learn a lit bit more about 'How to select the right MF beyond looking it their past returns?'

We know it could be a little daunting for many of you. But, remember Caveat emptor-Buyer Beware. At the cost of sounding like promoting ourselves, we hope you will read this series of blogs and use our free features to become a savvy MF investor.

So, should you invest in Mutual Funds?

Yes, to earn much better returns than an FD, and reach your financial goals faster. And, if you already investing in stocks directly, Yes, to complement your investment strategy/style/biases and also be confident about committing a larger portion of your Investable Surplus to equities.

But, you need to know the right way of selecting an MF and reviewing its performance. And, you certainly can’t be a passive partner when you are investing your money…simply because yeh paise ka mamla hai!

Read the article to know:'What are the different types of Mutual Fund Schemes?'

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: