| Assets Under Advice | Fees for 3years | |

| 35 lacs to 99 lacs | 3% + GST | |

| 1 Cr to 2.99 Cr | 2.5% + GST | |

| 3 Cr to 9.99 Cr | 2% + GST | |

| 10 Cr + | Customised Fees | |

| GST @ 18% | ||

|

|

||

| Please contact us for details | ||

|

|

||

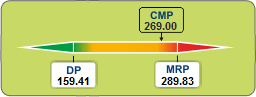

Let us first understand what each of these terms means. MRP refers to the intrinsic value of the stock. Just as each product comes with an MRP, a stock also has an intrinsic value which is its true worth, derived from the financial performance of the company. At MoneyWorks4me, every stock comes with an MRP. The MRP is the logical sell-price for a stock because if the stock is above MRP, it means it is overvalued and the price is likely to fall.

Similar to normal discounts, a stock is said to be at discount when it is priced below the MRP. Hence you would ideally want to BUY a stock when it is below MRP. The more the stock is below MRP, the higher is the return you can get. Hence we say that the heftier the discount, the better are the profits you will make in the long term.

Of course, it is essential to define the minimum level of discount which is expected to get good returns. Hence we derive a ‘Discount Price’ by deducting the Margin of Safety from the MRP. Margin of Safety is the safety net you have to keep to ensure that you don’t suffer losses. The Margin of Safety is directly proportional to the inherent risk of investing in a company. Hence we keep the Margin of Safety higher for a risky company and lower for a risk-free company. The best situation would be if you could BUY a company which is well below Discount Price and SELL it well above MRP.

This price spectrum explains the relation between Current Market Price (CMP), Discount Price (DP) and MRP.

Thus to get the best returns in stock investing, we have to make sure we follow this Golden Rule – BUY the stock when it is below Discount Price and SELL when it goes above MRP.