India’s fourth-largest electric 2-wheeler manufacturer Ather Energies has recently filed its prospectus and would be coming up with its IPO soon. In this blog, we shall understand the company, the industry structure and would also learn the competitive positioning of players in the industry.

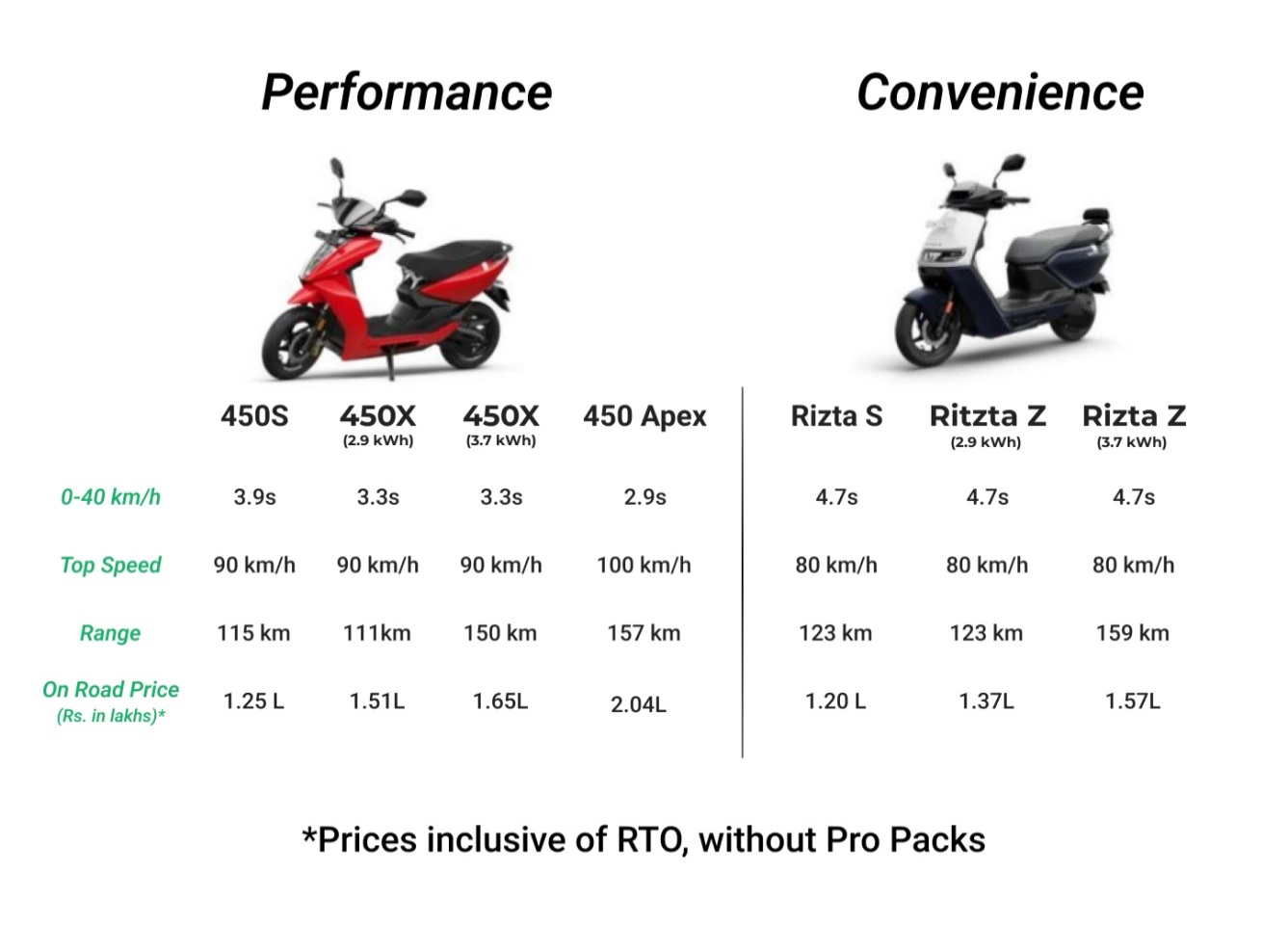

Ather Energy Ltd. was founded by Tarun Mehta and Swapnil Jain from IIT Madras in 2013. Hero MotoCorp Ltd. is one of the largest shareholders and one of the promoters of the company owning ~35% of the shares. Ather Energy offers a wide range of performance electric scooters like the Ather 450X and convenience electric scooters like the Ather Rizta. Ather has earned its name as one of the premium, high-quality manufacturers of electric vehicles in India. It is also a pioneer in producing innovative software features, which it sells under the brand name Ather Pro Pack for its electric two-wheelers. Ather holds a market share of 11.5% of electric two-wheeler volumes in FY24.

Company Snapshot:

Ather Energy has two revenue streams, one is from selling products like scooters and the other is from services like Ather Stack. In FY24, 89% of Ather’s E2W owners purchased advanced Atherstack features, while 61% of its users engaged with the connected software features at least once a week. Some of the Software features include Regenerative Braking, Magic Twist, Google map integration, Auto hold, Trip Planner, etc. The Pro pack Ranges from Rs.13,000 to Rs.20,000 depending on the variant. The Company has partnered with Hero Motocorp. Through this, the company's customers are leveraging more than 2400 fast chargers across 233 cities in India and Nepal. However, with only 208 Experience Centres and 191 Service Centres, it falls behind its competitors like OLA and TVS.

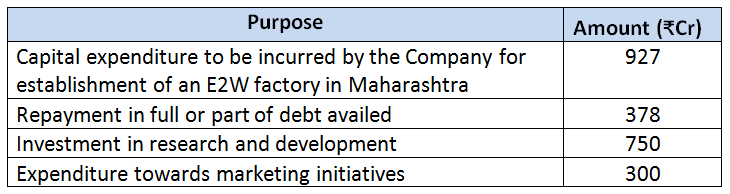

The Company manufactures these vehicles in the Hosur Factory which is located in Tamil Nadu. The factory has an effective annual unit production capacity of 3,79,800 for both battery packaging and vehicle manufacturing. The company is currently utilizing only 29% of its factory's effective capacity, whereas its peer like OLA (read detailed coverage here) is utilizing around 49% of its effective capacity. The company plans to expand its capacity by half a million by FY27 by constructing Future Factory 3.0 in Maharashtra, which the company refers to as a phase 1 plan. Upon completing the two phases, its capacity will increase to 1.42 million units.

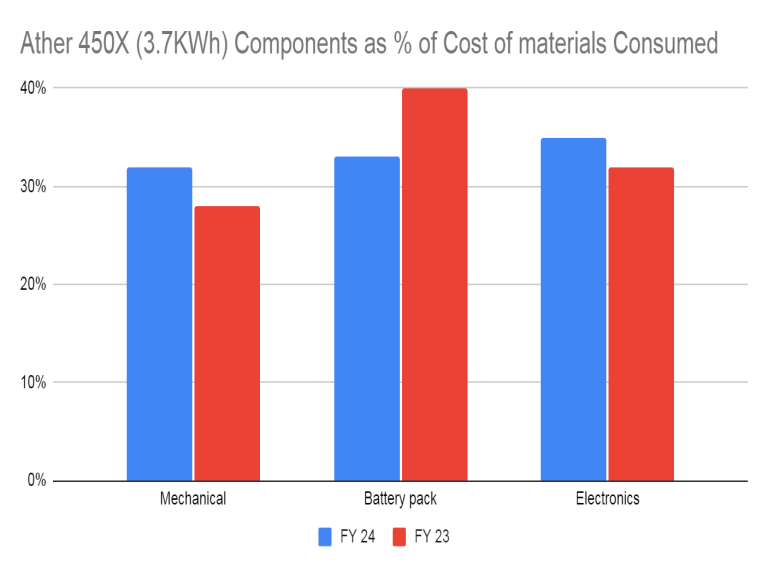

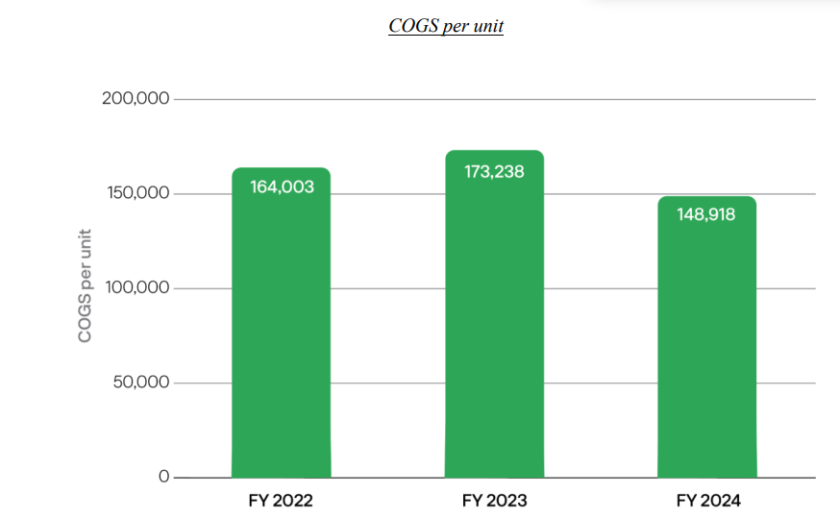

The majority of the company's costs are attributed to the battery pack, electronics, and mechanical parts. In FY24 the cost of materials consumed accounted for 88% of the revenue compared. In ICE vehicles this number ranges to about 75-77% of the revenue. The company packages the battery pack in-house, while the remaining parts are imported from China. The company has announced a partnership with Amara Raja Advanced Cell Technologies Private Limited (“ARACT”), which is in the initial stages of battery cell manufacturing. The company is continuously enhancing its battery composition. The company is experimenting with different compositions, such as LFP (Lithium iron phosphate), to manufacture its battery cells. It is anticipated by the company that the LFP composition may reduce battery costs by 15%-23%. The company is also optimizing costs through vertical integration.

In FY24, the company sold 109,577 units. The company launched its much-anticipated Ather Family Scooter "Ather Rizta" in FY24, however, the model is not contributing much to the overall sales growth rather it is cannibalizing the sales of the existing Ather 450X.

| Ather Unit Sales | Jul-24 | Jun-24 |

| Rizta | 6765 | 1363 |

| 450X | 2923 | 4189 |

| 450S | 1159 | 2117 |

| 450 Apex | 241 | 274 |

| Total | 11088 | 7943 |

In FY24, 90% of revenue came from product sales, while the remaining 10% was contributed by the service division. This is a change from FY23, where 80% of revenue came from the product division and 20% from the service division. The service division achieved an EBITDA margin of 56% in FY24.

Industry Overview

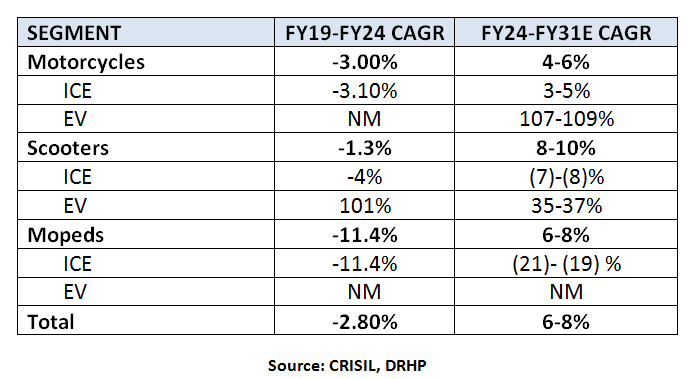

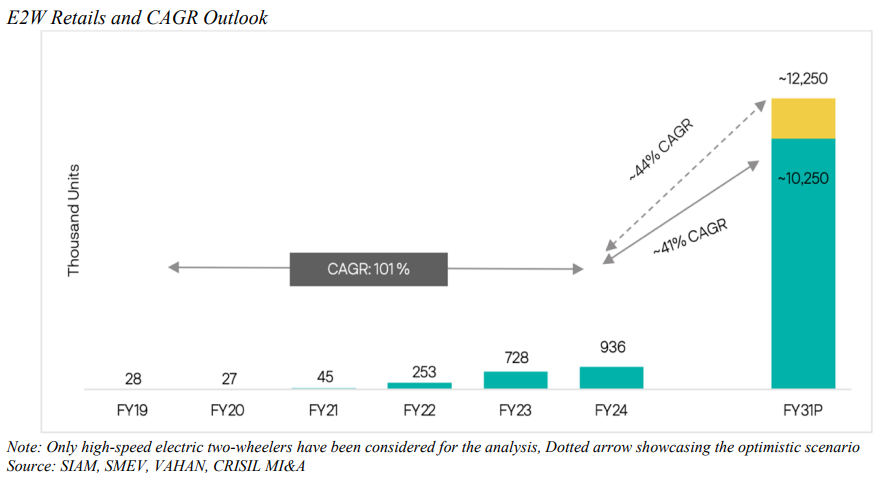

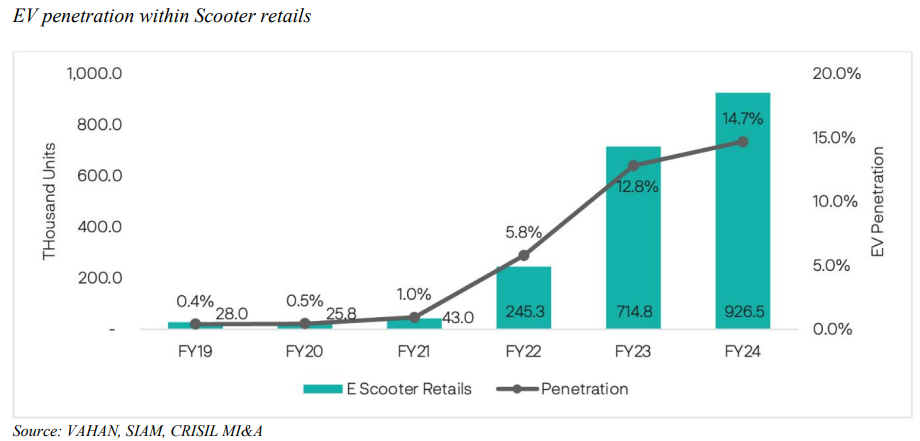

The 2-wheeler market in India has grown at a modest 5% CAGR over the past 5 years. However, the electric 2-wheelers have shown a remarkable growth of 102% CAGR during the same period, while the traditional ICE (Petrol) 2-wheelers have seen a decline in growth. The Indian 2-wheeler market is mainly divided into three segments: motorcycles, scooters, and mopeds (~50CC scooters). Together, motorcycles and scooters make up over 90% of the market. Interestingly, the contribution of motorcycles has decreased from 78% in 2009 to 63% in 2024, while the contribution of scooters has increased from 15% in 2009 to 34% in 2024, indicating a trend of customers preferring more utility and convenience-focused vehicles.

Growth estimates:

The sale of 2-wheelers in India is closely linked to the country's GDP growth. For instance, India's GDP grew at a rate of 7% CAGR from 2009 to 2019, resulting in an 11% CAGR growth in the 2-wheeler industry. According to CRISIL, India is projected to grow at a 7% CAGR from FY24 to FY31, and the 2-wheeler market is expected to grow between 7-8% CAGR in terms of volumes until FY31.

According to CRISIL, the scooter segment is projected to grow at a CAGR of 8-10% until FY31. Scooters are expected to be at the forefront of the electrification of the 2W market in India, with electric scooters anticipated to constitute about 70% of the market by FY31, and electric motorcycles expected to make up around 10% of the market by FY31. The electric two-wheeler (E2W) segment is anticipated to expand at a CAGR of approximately 41% to 44% in terms of volume, reaching a market size of roughly 10.2 million to 12.2 million units by FY31. For E2Ws, the number of public chargers in fiscal 2024 was 18,326 and is expected to grow at a CAGR of 35- 38% from fiscal 2024 to fiscal 2031. This shows the immense demand E2W industry is going to witness in the coming years.

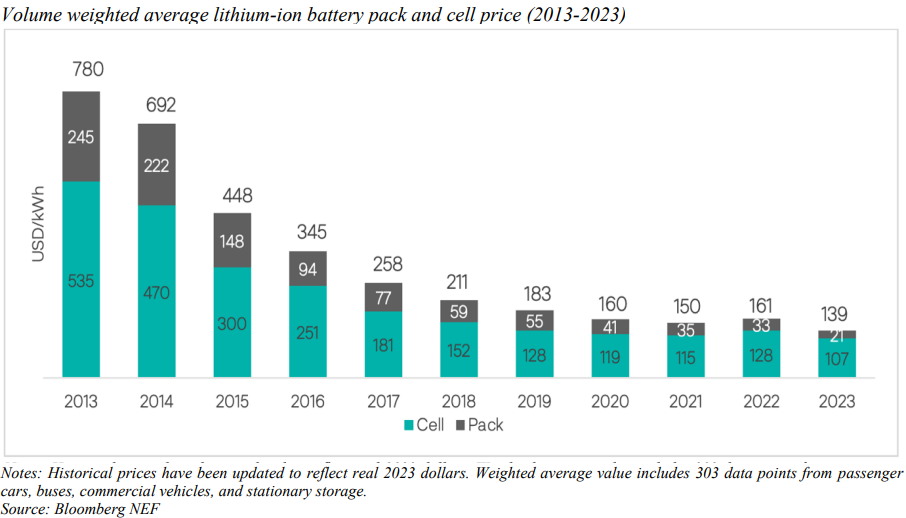

Key Value Driver: The main driver for transitioning from traditional internal combustion engine (ICE) vehicles to electric vehicles (EVs) is to lower the total cost of ownership (TCO), which has been made possible with the assistance of government subsidies aimed at combating pollution. Additionally, the significant decrease in battery prices has also played a crucial role in the widespread adoption of EVs as battery costs amount to 1/3rd of the total cost for EVs.

Outlook on Battery costs: BNEF expects average battery pack prices to drop again by the end of 2024, reaching USD133/kWh due to decreasing raw material costs for metals like lithium, nickel, and cobalt. In the medium to long term, advancing technological innovations along with manufacturing improvement should further drive a decline in battery pack prices, to USD113/kWh in 2025 and USD80/kWh in 2030. Manufacturing process improvements, continued R&D investment, and capacity expansion across the battery value chain would help improve battery technology and reduce costs over the next decade.

Additionally, ICE vehicles witnessed a steep rise in prices in FY21 due to BS VI implementation and a further hike during FY22 amidst the hike in raw material prices. This price hike was much higher than the normal 3-4% annual hike undertaken by the industry. Over and above, this increase in vehicle acquisition costs, the sharp rise in petrol prices (prices crossing Rs. 100 mark) during the year provided an additional incentive to customers to shift from ICE vehicles to E2Ws. During FY22, amidst the severe COVID-19 second wave, pressure on incomes, and increased medical expenses; limiting other expenses was a priority for most of the customer base.

Geographical Concentration:

According to the CRISIL Report, the south zones accounted for just 37% of the total E2W sales in India, while 48% of the company experience centres are located in the south zones, which contributed to 68% of its sales in FY24. This gives the company an Opportunity to grow in other parts of the country. With the launch of the Ather Rizta, the company aims to expand its distribution network and partner with additional third-party retail partners to grow its customer base. This would drive sales in a cost-effective manner. Additionally, the company plans to increase its market penetration by opening more experience and service centres in regions where it already has its presence.

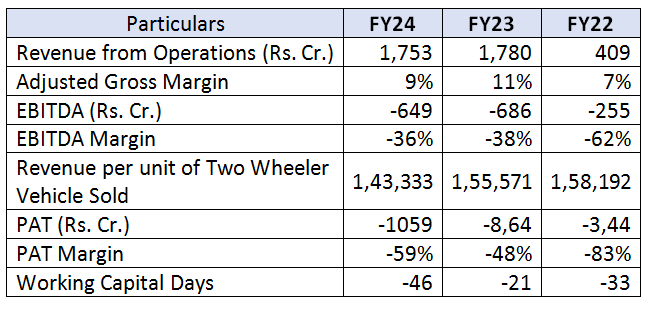

Financial snapshot

Even though the company is scaling up its revenue at a significant pace, being in a growth phase, the company incurred a loss of Rs. 1059 Cr in FY24. The path to profitability for the company remains to be tracked.

Key governmental initiatives enabling electric 2-wheeler adoption in India:

- National Electric Mobility Mission Plan 2020 was launched in 2013. This plan also includes the FAME (Faster Adoption and Manufacturing of Electric Vehicles in India) subsidy introduced by the central government and Current EMPS (Electric Mobility Promotion Scheme) Subsidies.

- Production-linked Incentive Scheme for Auto sector and cell chemistry

- State subsidies on EVs

- Charging Infra co-development initiatives

Purpose of the Offer

Positives:

- Boosting brand visibility and positive word-of-mouth.

- Large electric charging infrastructure compared to peers.

- E2W is a high growth Industry and the Company is planning to move to other segments like Motorcycles.

Vertical Integration is helping Ather reduce costs and focus on core products, instead of venturing into new sectors like cell manufacturing. This results in building more efficient and effective products.

- Ather has a lower cash burnout ratio of 0.8 compared to OLA which has a cash burnout ratio of 1.3 (Cash burn is calculated as the sum of net cash flow from operations and outflow of capital expenditure on plant, property and equipment and intangibles). The cash burn rate is calculated as - the total cash burn during the selected period / total revenue accrued during the period.

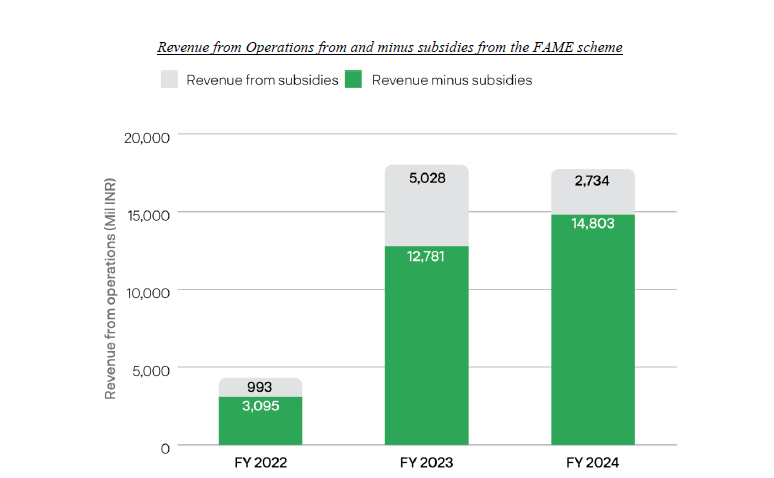

- The revenue without the FAME Subsidy has increased year over year from Rs. 1,278 Cr to Rs. 1,480 Cr. The percentage of revenue without FAME subsidy rose from 71% in FY23 to 84% in FY24, indicating that the company is capable of sustaining its revenue even if the government stops providing subsidies.

Challenges & Concerns:

- Capacity: One of the purposes of the IPO is to expand the capacity. However, the current capacity is underutilized. To completely utilize the plant in the next 2 years the volume should grow at a pace of more than 100% CAGR, which looks over-optimistic.

- Support: The current EMPS subsidies may not be sustainable and might hit its top line. The revision of RTO charges on EVs may also increase the prices of its products. PLI benefit does not apply to Ather. The lack of PLI benefit can be observed in the adjusted gross margins. For Instance, In FY24 Ather has an adjusted gross margin of 9% whereas OLA has an adjusted gross margin of 16% due to PLI.

- Competition: The Company is competing with some of the well-established players. The legacy players have a good brand image and a huge distribution network. For example, Bajaj Chetak has progressively scaled with a significant market share gain, moving from 5% by the end of the previous year to 13% by the end of FY24. This was majorly due to the steady progress made by the company on network expansion, innovation, and branding activities. It took 5 years for Ather to build 200 experience centres while Bajaj did it in 1 year.

- Alternative Fuels: If alternative fuels like CNG, hybrid, or hydrogen become popular, the demand for EVs will reduce, and the company may not achieve economies of scale.

- Promoter in competing business: Hero Motorcycle Corporation Ltd. owns more than 35% of the company and has a significant influence on the company’s operations. On the positive side, it brings experience and capital but it might limit the company’s growth as its scale-up might impede growth for Hero’s Vida. Hero also sells electric Scooters under the brand name Hero Vida which is below the price range of Ather products and sometimes on par with the price range of Ather. This leads to Ather not having much flexibility to operate in the price range of Hero’s Electric Scooters.

Management Snapshot:

- Tarun Mehta is the CEO of the Company. He holds a bachelor’s and master’s degree in technology in engineering design from the Indian Institute of Technology, Madras under the dual degree program. He has over 10 years of experience in the electric vehicles sector.

- Swapnil Jain is the CTO of the Company. He holds a bachelor’s and master’s degree in technology in engineering design from the Indian Institute of Technology, Madras under the dual degree program. He also has over 10 years of experience.

Conclusion:

The electric two-wheeler market has gained significant momentum, driven by aggressive product launches from both new entrants and established players like Bajaj and TVS, who are leveraging their strong brand and extensive distribution networks. A key difference between pure E2W players like Ola Electric and Ather Energy lies in their strategic positioning. Ola aims to build a business focused on scale, acquiring Etergo BV to gain the technical expertise needed to launch its own products. However, Ola has faced backlash due to customer complaints about faulty products, and its rapid growth has resulted in inadequate service capabilities. On the other hand, Ather has developed its products in-house, prioritizing quality and building a strong reputation. How Ather creates value for its shareholders will be a key aspect to track moving forward.

It is important to note that the final IPO price has yet to be announced. We are closely tracking the company’s performance and market conditions. Once the final IPO price is disclosed, we will provide further analysis and guidance on whether investors should invest in the IPO.

Stay tuned for updates as we continue to monitor this significant event in the Indian automotive sector.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: