Bansal Wire Industries Ltd IPO Details:

Opening Date: July 3, 2024

Closing Date: July 5, 2024

Listing: BSE and NSE

Number of Shares: 2.91 Cr shares

Face Value: Rs 5 per share

Price Band: Rs 243-256 per equity share

Issue Size: Rs 745 Cr

Recommendation: Avoid

About Bansal Wire Industries Ltd:

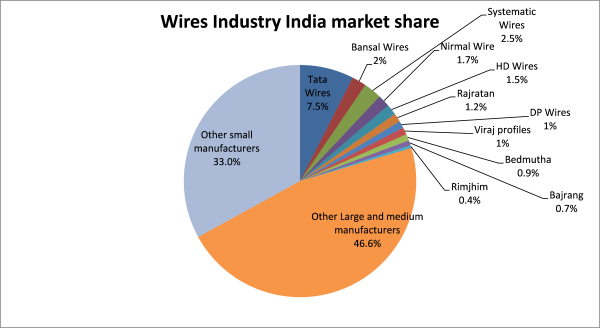

Bansal Wire Industries are producers of steel wires with a market share of roughly 2% in the steel wire industry. Their products are used in applications such as the manufacturing of springs, cutting tools, fencing, construction, hardware and automotive, among others.

Bansal Wires operates from four established manufacturing facilities located in the National Capital Region, three manufacturing facilities in Ghaziabad and one manufacturing facility in Bahadurgarh with a combined manufacturing capacity of 2,59,000 metric tonnes per annum (MTPA). The company is also setting up a manufacturing facility spreading across 32 acres at Dadri and are present in 22 states and 6 union territories through their dealer network.

Bansal wires also exports their products to countries such Bangladesh, Brazil, France, Germany, Israel, Italy, Netherland, South Korea, South Africa, Turkey, United Kingdom, USA and Vietnam.

Industry Overview:

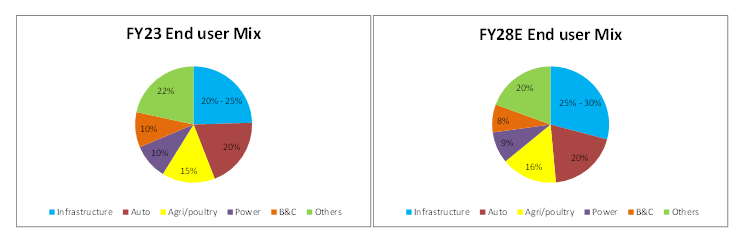

India produced 74 lakh Tonnes of wire rods in FY23, thus registering an 8.6% CAGR during FY19- FY23. Out of this 74 lakh figure, 56 lakh Tonnes of wires was consumed during FY23, registering a 6.9% CAGR during the period of FY19-FY23. This growth was largely driven by increased Infrastructure spends and growing automobile production. This demand is forecasted to grow by 8-10% between FY23-FY28 to 80-90 lakh Tonnes.

The demand for steel wires is primarily driven by end-use sectors such as auto, construction, electricity and agriculture. Infrastructure drives the major demand for wires, with their applications in the building and construction industry being limited to fencing.

Demand Drivers:

a) Building and Construction (B&C):

The B&C industry corners ~10% of total demand for steel wires, with a forecasted growth of ~6.5% CAGR between FY23 –FY28. This growth is expected to be driven by a governmental focus on affordable housing and increasing demand in rural housing, along with expected improvement in urban housing demand due to increasing commercialisation in Tier 3 and 4 cities. The demand is also forecasted to grow on the back of the growing fencing market.

b) Infrastructure:

The infrastructure segment is the largest consumer of steel wire demand and constituting 20-25% of the total wire demand in India. Within the infra space, roads, highways and railways which include the metros are accounting for majority of wire demand. Furthermore, Increasing awareness and adoption of prestressed concrete in the construction industry is poised to accelerate the LRPC (Low Relaxation Pre-Stressed Concrete) wire industry.

c) Auto:

The automobile industry in India is forecasted to grow at a CAGR of 7.5%-8.5% from FY23 to FY28 and 5.5%-6.5% in FY28-FY33. This demand for steel wires is expected to be supported by spring and steel cord wires used in tyres.

d) Power cables:

This segment, between FY23 to FY28 will grow at 5%-6% CAGR, led by power distribution-led investments, which are expected to be driven by reforms in the power distribution segment.

Customer Segments:

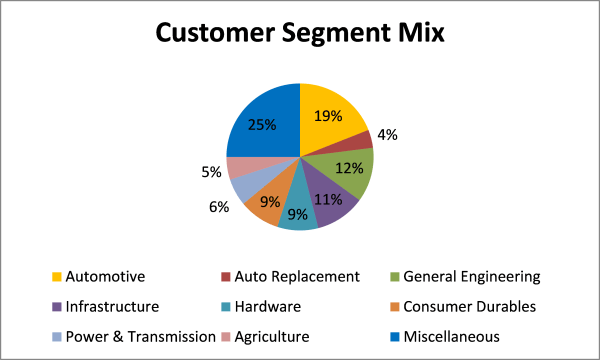

Bansal Wire Industries produces steel wire and offers over 3000 SKUs (Stock Keeping Units) across its 3 segments. Major customer segments are the Automotive and auto replacement sectors, which contributed a total of 23% of the total sales volume to the company.

The company markets and sells its products under the brand name “BANSAL” which commands a strong reputation in the market.

Business Segment:

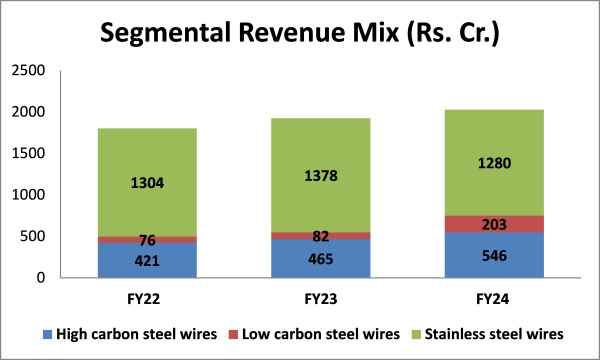

The company is present in mainly 3 wire segments namely- High carbon wires, low carbon wires and stainless steel wires.

High-carbon steel wire: This refers to wires which are made from high-carbon steel, which has 0.3% to 1% carbon. These wires are known for their strength, hardness and durability. These are utilized in the manufacturing of springs, cutting tools and other industrial components requiring resilience as well as resistance to wear and fatigue.

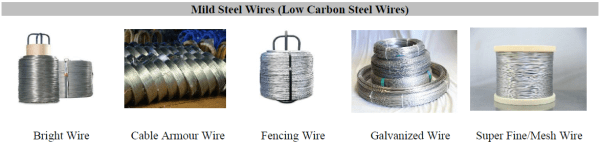

Low carbon steel wire: Also known as Mild steel wire, this wire is made out of low carbon steel which has 0.05% to 0.25% carbon. These wires are known for their ductility, malleability, weldability and are commonly utilized in industries such as power and transmission, agriculture, poultry and construction.

Stainless steel wire: This refers to wires made from anti-corrosive alloys which are a combination of iron, chromium, nickel and other elements and are commonly utilized in consumer durables, hardware, automotive, agriculture and other engineering products.

The revenue from these segments are given below

The company derived 16.57%, 14.82% and 11.49% of its revenue from overseas in FY22, FY23 and FY24 respectively

Purpose of the issue:

The issue is entirely a fresh issue amounting to Rs. 745 Crs. Out of the proceeds, Rs. ~546 Crs. will be utilized to pay off debt on the books of the company and its subsidiaries, which were availed primarily for its working capital requirements as well as for setting up its plant in Dadri. Rs. 60 Cr is proposed to be utilized for funding the working capital requirement of the company, which the company has estimated to be Rs. ~627 crs in FY25.

Positives:

- Established market position supported by diversified product and customer profiles: The group is one of the largest players in North India with a well-entrenched presence owing to large manufacturing capacities, an established brand and longstanding relationship with customers. The company's customer retention stood at above 64% during FY22, FY23 and FY24.

Concerns:

- Competitive Intensity & Fragmented Industry Structure: The industry is extremely competitive and highly fragmented with little pricing power.

- Working capital requirements: Operations are working capital intensive as reflected in gross current assets of 120-140 days seen over the past few fiscals and expected to remain the same going forward as well. The Company had a working capital requirement exceeding 500 crores in the past 3 financial years and forecasts this number to be in excess of Rs. 600 crores in FY25.

- Susceptibility to steel prices and freight cost: Operating margins and realisations are susceptible to volatility in steel prices and freight cost.

Financials:

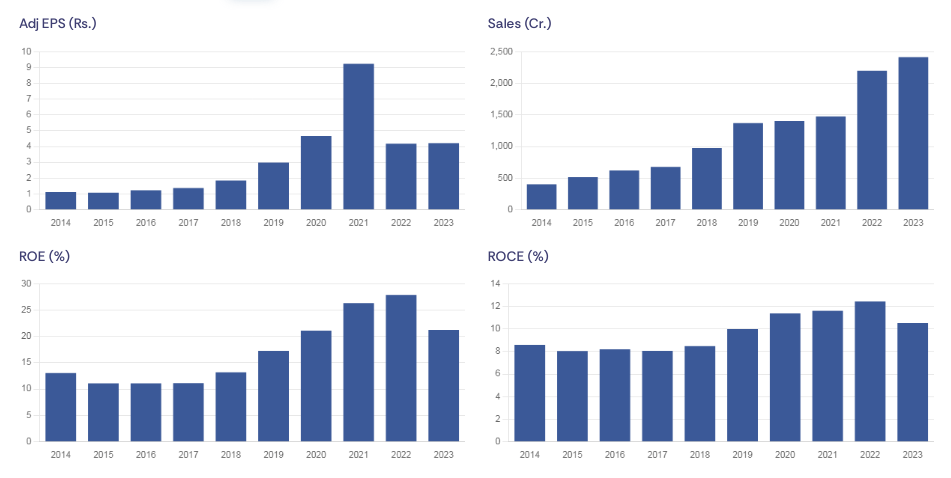

The Company grew its revenue from Rs.2198 Cr. to Rs.2466 Cr., registering a CAGR of ~6% in the period from FY22-FY24.

Management:

Arun Gupta: He is the Chairman and Whole-Time Director of the company. He completed his schooling from Dhanpatmal Virmani Sr. Secondary school, Delhi, and has over 38 years of experience in the steel wire industry.

Pranav Bansal: He is the managing director and CEO of the company. He cleared his senior secondary schooling from Manav Sthali School, new Delhi. He has over 5 years of experience in the steel wire industry.

Umesh Gupta: He is the Whole-Time Director and Chief Operating Officer of the company. He completed his bachelor in Arts in Hindi from Zakir Hussain College (evening classes) from University of Delhi. Previously, he was associated with Bansal High Carbons Private Ltd and has over 9 years of experience in the steel wire industry.

MoneyWorks4Me Opinion

The company operates in a highly competitive and fragmented segment of metal wires. It has demonstrated steady growth in both its revenue and profits over the reported periods. The reduction in debt post-IPO is expected to improve its profitability. The issue appears aggressively priced discounting all near term positives.

Recommendation: Avoid

Bansal Wire Industries Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | July 3, 2024 |

| IPO Close Date | July 5, 2024 |

| Basis of Allotment Date | July 8, 2024 |

| Refunds Initiation | July 09, 2024 |

| A credit of Shares to Demat Account | July 09, 2024 |

| IPO Listing Date | July 10, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 58 | Rs. 14,848 |

| Maximum | 13 | 754 | Rs. 193,024 |

Bansal Wire Industries Limited IPO FAQs:

When will the Bansal Wire Industries Ltd IPO open?

Bansal Wire Industries Ltd IPO will open for subscription on Wednesday, 3rd July 2024, and closes on Friday, 5th July 2024.

What is the price band of Bansal Wire Industries Ltd IPO?

The price band for Bansal Wire Industries Ltd IPO is Rs. 243-256/share.

What is the lot size for the Bansal Wire Industries Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 58 shares, up to a maximum of 13 lots i.e. Rs. 1,93,024/-.

What is the issue size of Bansal Wire Industries Ltd IPO?

The total issue size is ~ Rs. 745 Cr.

When will the basis of allotment be out?

Allotment will be finalized on July 8th and refunds will be initiated by July 9th. Shares allotment will be credited in Demat accounts by July 9th.

What is the listing date of Bansal Wire Industries Ltd’s IPO?

The tentative listing date of the Bansal Wire Industries Ltd IPO is July 10th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: