The consumer electricals sector has witnessed a mixed bag performance over the last few quarters, with some players reporting healthy growth while others have experienced subdued demand. This performance necessitates a closer look to identify the factors driving demand, assess the product portfolios of key players, and determine which incumbents are best positioned for the future.

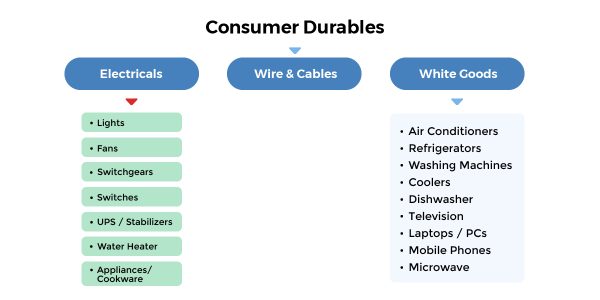

The consumer durables sector is segmented into three major categories based on usage: electricals, wires and cables, and white goods. Within the electricals segment, the major products based on market size are lights, fans, and switches.

Source: Industry reports, Moneyworks4me research

Fans are further categorized as ceiling fans, table fans, pedestal fans, wall (TPW) fans, exhaust fans, and industrial fans. The lighting portfolio consists of General Lighting Service (GLS), Fluorescent Tube Lights (FTLs), Compact Fluorescent Lamps (CFLs), and Light-emitting Diodes (LEDs). Switchgears are classified into Low Voltage (LV), Medium Voltage (MV), and High Voltage (HV) types, while switches can be categorized as traditional and modular.

Among these segments, fans, switchgears, modular switches, and appliances are largely organized, with participants forming approximately 60% of the UPS and stabilizer segment. India serves as a net exporter of fans and switchgears. Replacement demand supports the fan market, with ceiling fans holding a higher share domestically compared to TPW fans. Within the lighting segment, LED prices have been under pressure, showing no signs of revival yet.

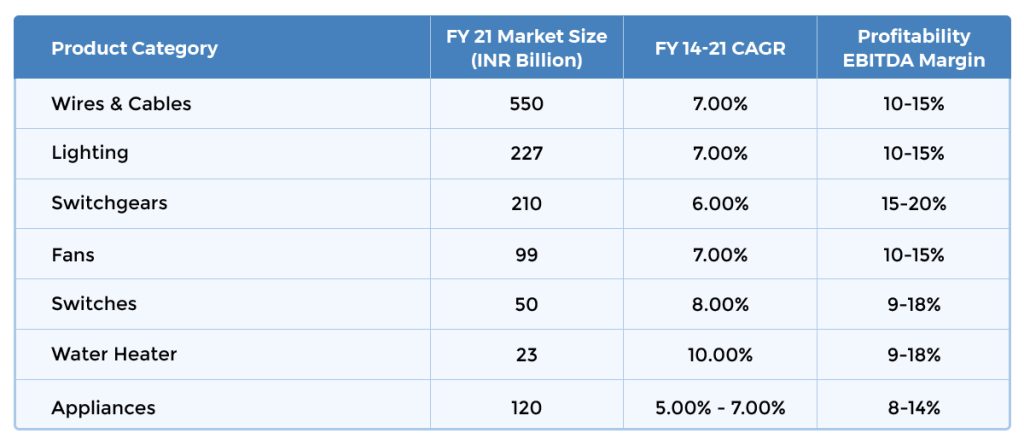

Market size:

The Wires & Cables segment boasts the largest market size, supported by infrastructure spending by both government and private players. Tailwinds in the real estate sector also contribute to growth across segments. Historically, switches have been the fastest-growing segment.

Source: Industry reports, Moneyworks4me research

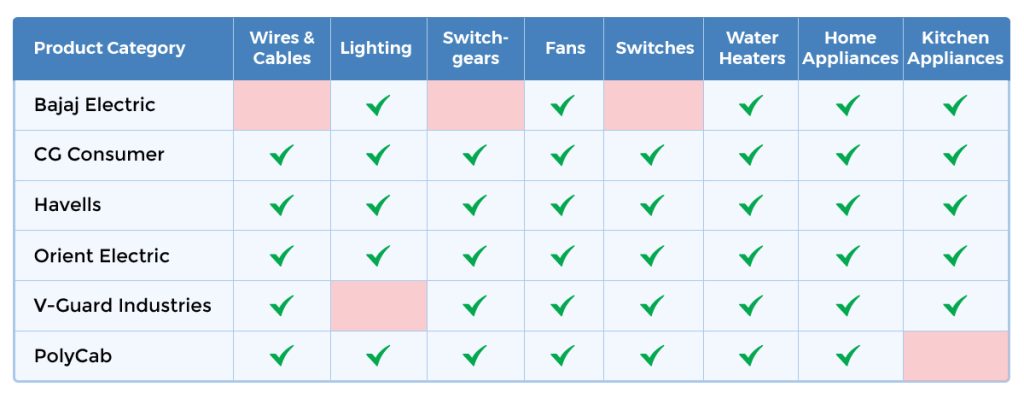

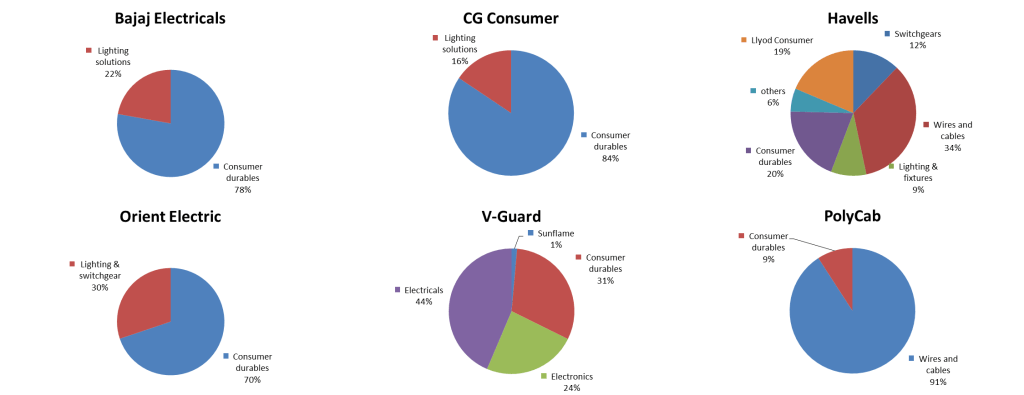

Most players have a presence across product categories, but they often outsource their non-core products. Havells is the largest player in terms of revenue and has a substantial presence across all product categories.

Presence of key players across products:

Source: Company website, presentation, industry reports, Moneyworks4me research

Detailed segment-wise revenue mix of key listed players

Source: Company presentation/annual report, Moneyworks4me research; Note based on company, consumer durables includes fans, home appliances etc.

Factors to monitor in this sector:

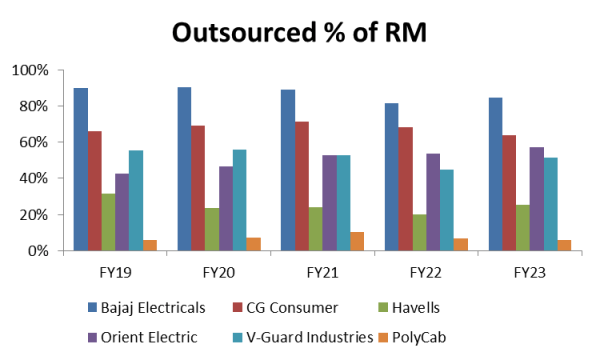

Contribution of Outsourced Manufacturing

Industry participants often outsource their manufacturing to smaller players or contract manufacturers. The higher the percentage of outsourced manufacturing, the lower the margins. Outsourced manufacturing presents a double-edged sword scenario as it can benefit from a temporary surge in demand and favorable pricing.

Source: Company presentation/annual report, Moneyworks4me research

Distribution Network

Such channels are crucial in business as they facilitate a structured flow of products to the market, offering opportunities for market expansion and contributing to high levels of customer service. These channels encompass warehousing and transportation functions, along with inventory management, to efficiently move products from the manufacturer to the consumer. Some participants have opened their own stores or display centers. Additionally, some companies are taking a different route by going direct to market, effectively owning the distribution network to better serve customers.

Source: Company presentation/annual report, Moneyworks4me research

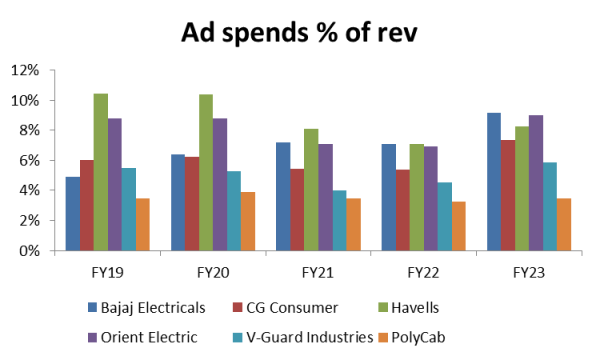

Advertising Spends

Brand building is a continuous exercise, and companies in this sector need to maintain ongoing spending on advertising and promotions. While some brands allocate a lower percentage of revenue to advertising, others must consistently invest to retain their market share. Capturing the mindshare of consumers is challenging, and competitive intensity is evident from the increasing industry advertising spend in absolute terms.

Source: Company presentation/annual report, Moneyworks4me research

Recent trends in the sector:

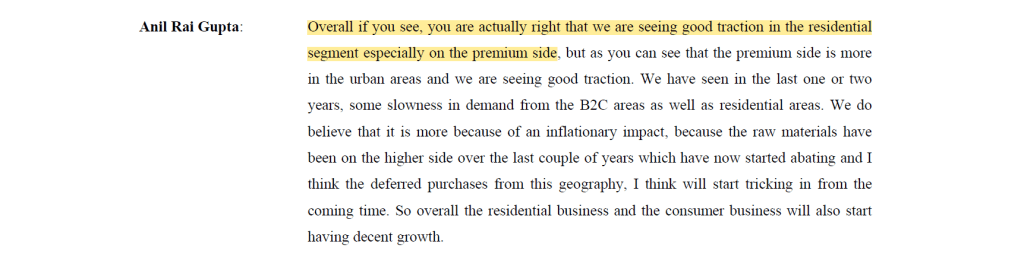

Premiumization- In line with the trend of premium products experiencing high demand, a similar pattern is observed in the consumer electrical sector. All players are focusing on premium products, but only a few of them can sustain continued price hikes. In select cases, market participants have been comfortable sacrificing some volume while catering to premium categories.

Source: Havells conference call

Standardization

- The Bureau of Energy Efficiency (BEE), a government agency, ensures that all electronic appliances meet certain energy efficiency guidelines. These guidelines result in appliances being awarded star ratings to indicate their energy efficiency. The BEE's star rating system applies to 28 types of consumer products, such as air conditioners, refrigerators, and ceiling fans. For 10 of these product categories, displaying star ratings is mandatory, while for the other 18, it is voluntary. The guidelines are designed to transition products from voluntary to mandatory star ratings gradually. From January 2023, every ceiling fan model must meet the mandatory BEE star rating requirements. The impact of this change is significant and far-reaching.

- The government is planning to bring all electrical appliances intended for household and commercial applications under mandatory quality norms. The move is aimed at containing the import of sub-standard goods and boosting the domestic industry. The Department for Promotion of Industry and Internal Trade (DPIIT) has floated a draft control order for these products after consulting the Bureau of Indian Standards (BIS).

Extended Producer Responsibility (EPR)

The OECD champions a policy framework that broadens the producer's responsibility to include the post-consumer phase of a product's lifecycle. This approach aims to transfer waste management duties from local governments to the producers themselves and encourages the incorporation of environmental considerations right from the product design stage. Only one player has started providing for the same, and still, rules are unclear. This would mean additional costs for manufacturers and could hurt players with lower margins and weak balance sheets. At the same time, unorganized players would be at a disadvantage.

Export Opportunity

While the majority of revenues are domestic, companies are targeting exports to markets like the UAE and Africa for additional growth. The low cost of production coupled with decreasing dependency on China positions India as an attractive manufacturer. However, companies have not been able to truly crack that market yet.

MoneyWorks4me Opinion:

In this sector, companies with a presence across multiple product categories with established brands, who are able to take calibrated price hikes, are the ones best placed. While concerns arise from costs related to standardization or EPR, export opportunities and a long runway for growth pose a good risk-reward. Check the valuation of companies like Havells, Polycab, V-Guard, Orient Electric, to make an informed decision about which is the most attractive company to invest right now.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: