Emcure Pharmaceuticals Ltd IPO Details:

Estimated Pre-listing Market Cap: ~Rs. 19,000 Cr

IPO Date: 3rd July to 5th July, 2024

Total Issue Size: ~1.9 Cr shares

Fresh Issue: ~0.79 Cr shares

Offer for Sale: ~1.14 Cr shares

Price band: Rs. 960 - Rs. 1008 per share

IPO Issue Size: ~ Rs. ~1,952 Cr

Lot Size: 14 shares and multiples thereof

Purpose of Issue: Offer for Sale by Promoter and Investors & Fresh Issue

About Emcure Pharmaceuticals Ltd:

Emcure Pharmaceuticals is a global pharmaceutical company based in Pune, India, established in 1981. The company focuses on developing, manufacturing, and marketing a wide range of pharmaceutical products, including formulations, active pharmaceutical ingredients (APIs), and biotechnology. Emcure operates in several therapeutic areas such as gynecology, cardiovascular, vitamins, minerals and nutrients, HIV antivirals, blood-related and oncology.

Financials

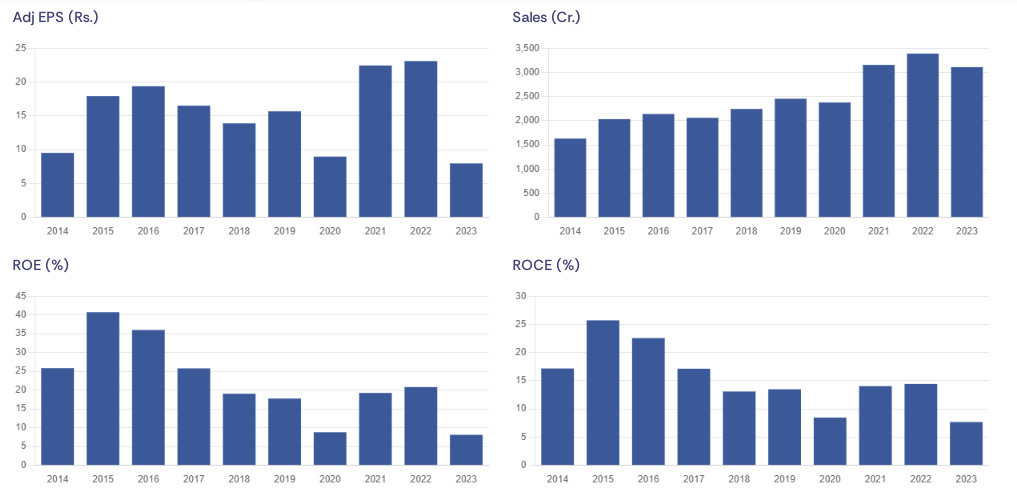

The company’s profitability has taken a significant hit over the last two years, falling annually by 13%, and revenues have grown at a slow pace of 7% annually. However, these factors miss important nuances. The gross profit margins are stable at 62% of revenue, which suggests that the company has not faced material challenges from competition.

The decrease in profit can be attributed to the recent capacity expansion undertaken by the company. Employee costs & depreciation have grown at 13% annually which can be attributed to the recent expansion undertaken. The interest cost has grown at a slightly faster rate of 16% annually, a large portion of which is denominated in foreign currency. The increase in other expenses is attributable to increases in advertisement, legal and travelling expenses which have grown at 31%, 16% and 29% annually.

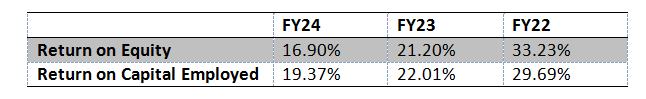

Despite the recent challenges in profitability and increase in fixed assets that are yet to be fully utilised, the company has maintained healthy ROEs and ROCEs over the last 3 years.

Sales by Geography

- Sales in India and RoW have been flat since FY22.

- North America and Europe are the main contributors to growth growing at 17% and 26% respectively.

- The 2 year Sales CAGR is 6.6%.

Domestic MAT (Moving Annual Total) Sales Value by Therapy

- Growth in the domestic market is subdued due to poor performance in gynecology, cardiovascular, anti-infectives, vitamins, mineral and nutrients which make up 60% of the therapy portfolio.

- Growth remains strong in oncology, hormones, pain and analgesics and anti-diabetic therapies, but the low revenue contribution from these segments does not add any material growth to the overall domestic sales.

Utilisation of Funds:

- Offer for Sale: Shares worth Rs. 1,152 Crore shares will be sold, of which Bain Capital is the largest seller at Rs. 729 crores, followed by members of the promoter group.

- Fresh Issue: Rs. 800 crores will be used to repay debt which will reduce interest cost and improve the debt to equity.

Positives:

- Profitability will improve: It is estimated that the lower profitability is growth related as depreciation, interest, employee costs and advertising expenses have grown. The margins are expected to revert to mean over time as capacity utilisation from new facilities improves. Moreover, the reduction in interest cost would lead to an increase in net profits.

- Growth in North America and Europe: North America and Europe have shown stellar growth over the last two years. Penetration in these markets is expected to increase.

- Strong Domestic Positioning: The company’s strong positioning in its therapeutic areas as a leader showcases strong distribution, brand recall and product quality.

Concerns:

- Growth: The company has grown at a rate of 6.6% for the past 2 years, mainly due to a lack of growth from India and RoW markets, which together constitute 64% of the total revenue. Strong growth from North America and Europe are highly commendable, but the low contribution to the overall pie makes the overall growth unremarkable.

Management:

Satish Mehta serves as the Managing Director and Chief Executive Officer of Emcure Pharmaceuticals. He has been involved with the company since its establishment in 1981, as one of its founding directors. Mehta possesses a master's degree in science with a focus on chemistry from the University of Pune and a postgraduate diploma in business administration from the IIM Ahmedabad. He has extensive experience in the pharmaceutical sector.

Namita Thapar is a Whole-time Director at Emcure Pharmaceuticals. She has been part of the company since 2006, and has previously held the position of CFO. Thapar is a Chartered Accountant, having completed her final ICAI examination in 1998. She earned her bachelor's degree in commerce from the University of Pune and a master's degree in business administration from the Fuqua School of Business at Duke University, USA.

MoneyWorks4Me Opinion

Emcure Pharmaceuticals is a well-established and reputable player in the pharmaceutical industry, known for its robust portfolio and strong global presence. The company’s consistent diverse range of products across various therapeutic areas underscores its solid operational foundation and quality. However, despite these strengths, Emcure's recent performance indicates a lack of significant growth. At a P/E of 36 post-listing, the valuations are quite expensive. These valuations are not well justified as the proceeds from the IPO are majorly used to provide an exit to Bain Capital and repay debt, the latter one merely substituting one source of capital for another, without adding growth. The slow growth, coupled with the current valuation, positions Emcure as an expensive investment.

We recommend our investors to avoid subscribing to the IPO.

Emcure Pharmaceuticals Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | July 3, 2024 |

| IPO Close Date | July 5, 2024 |

| Basis of Allotment Date | July 8, 2024 |

| Refunds Initiation | July 09, 2024 |

| A credit of Shares to Demat Account | July 09, 2024 |

| IPO Listing Date | July 10, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 14 | Rs. 14,112 |

| Maximum | 14 | 196 | Rs. 197,568 |

Emcure Pharmaceuticals Limited IPO FAQs:

When will the Emcure Pharmaceuticals Ltd IPO open?

Emcure Pharmaceuticals Ltd IPO will open for subscription on Wednesday, 3rd July 2024, and closes on Friday, 5th July 2024.

What is the price band of Emcure Pharmaceuticals Ltd IPO?

The price band for Emcure Pharmaceuticals Ltd IPO is Rs. 960-1008/share.

What is the lot size for the Emcure Pharmaceuticals Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 14 shares, up to a maximum of 14 lots i.e. Rs. 1,97,568/-.

What is the issue size of Emcure Pharmaceuticals Ltd IPO?

The total issue size is ~ Rs. 1952.03 Cr.

When will the basis of allotment be out?

Allotment will be finalized on July 8th and refunds will be initiated by July 9th. Shares allotment will be credited in Demat accounts by July 9th.

What is the listing date of Emcure Pharmaceuticals Ltd’s IPO?

The tentative listing date of the Emcure Pharmaceuticals Ltd IPO is July 10th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: