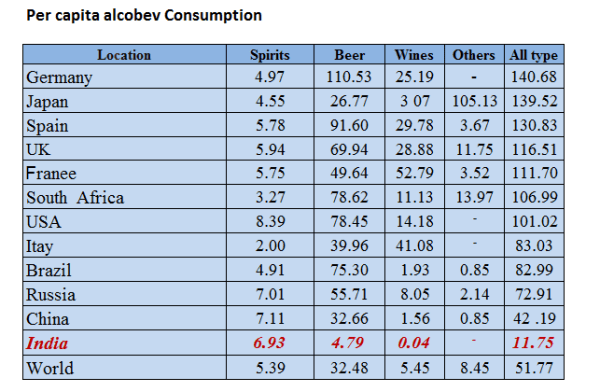

India is the third largest and one of the fastest growing alcoholic beverages markets globally. This growth is attributed to various factors, including rapid urbanisation, evolving consumer preferences, a burgeoning middle-class population with increased purchasing power and a more aware younger consumer profile. While there have been challenges with respect to supply chains and inflation, the industry is capitalising on the opportunities that are emerging. In this blog, we'll dive into the present state of the Indian liquor industry, evaluate its potential for growth, look at its advantages and disadvantages, and explore the major companies influencing its path.

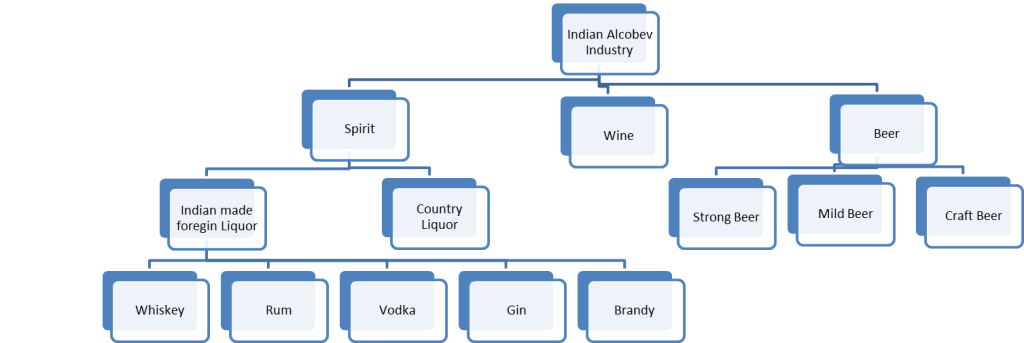

The Indian Alcobev industry is segmented into IMFL (Indian Made Foreign Liquor), IMIL (Indian Made Indian Liquor), Wine, Beer and imported alcohol. Whiskey dominates the Indian spirits industry by a very wide margin. Alcohol consumption is divided in three major product categories including spirits, beer and wine.

Industry Tailwinds

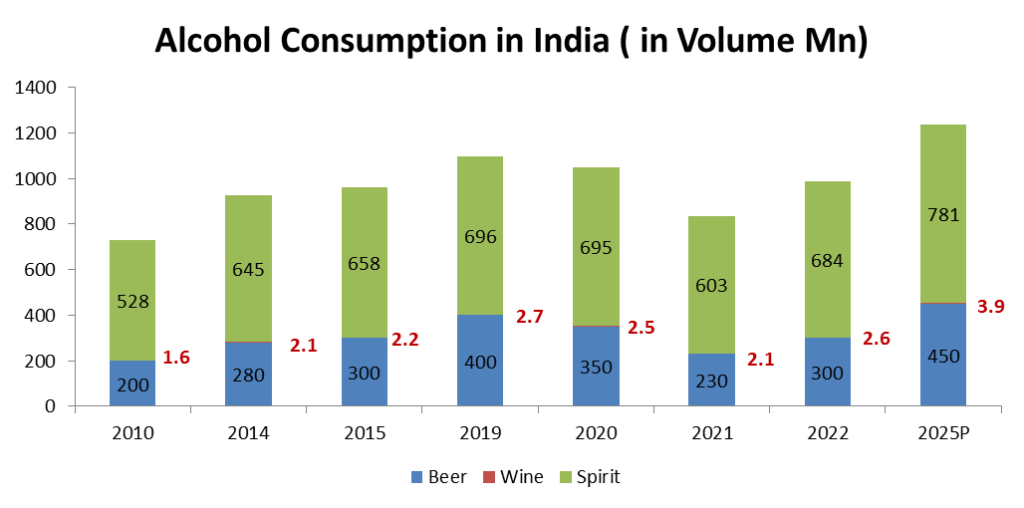

India is one of the fastest growing alcohol markets among the top economies in the world. Growth in urban population coupled with the increasing disposable income is projected to propel the market growth of alcohol. The recorded per capita consumption of pure alcohol in India has moved from 0.9 liter in 2000 to 3 liter in 2015 at a CAGR of more than 8%. India’s percentage of drinking population is projected to be close to ~33% in FY 2021 and 39% in 2025.Volumes are dominated by spirit but wine is showing high growth rate.

Source: Sula DRHP

Change in demographics as well as the change in lifestyle is another major factor expected to foster the market of alcohol. The legal drinking age in India varies from state to state (from 18 years to 25 years), further indicate that India is ideal for the high growth of the alcohol market. Both domestic and international players are vying for a larger slice of the pie. From traditional spirits like whiskey and rum to emerging segments such as craft beer and premium spirits, the industry showcases a remarkable diversity that caters to a wide spectrum of consumers.

Key Players & their Financial Performance

The liquor industry presents significant entry barriers, as companies must navigate through numerous regulatory requirements before they can begin selling alcohol.

Source: Sula DRHP

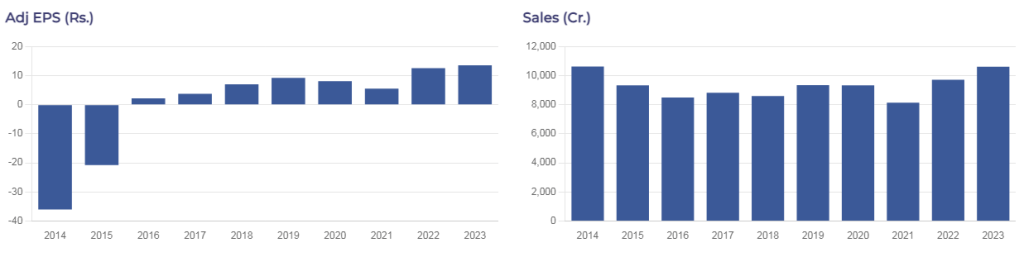

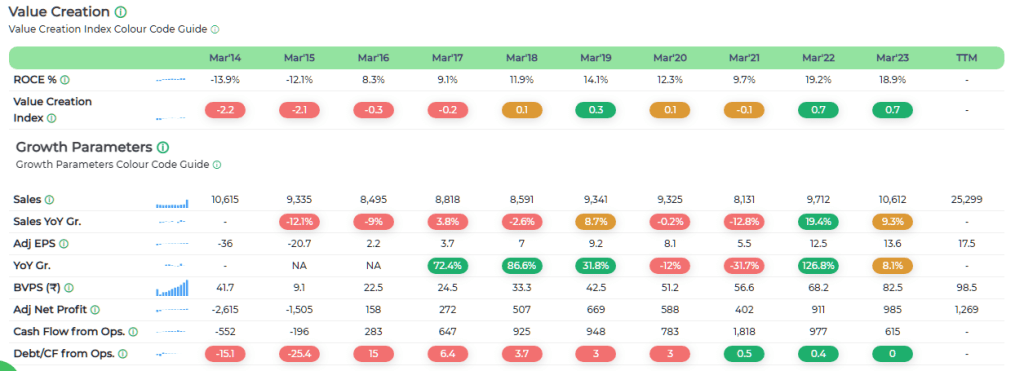

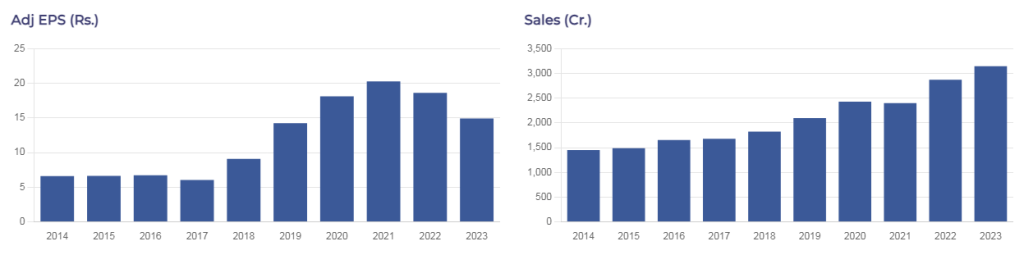

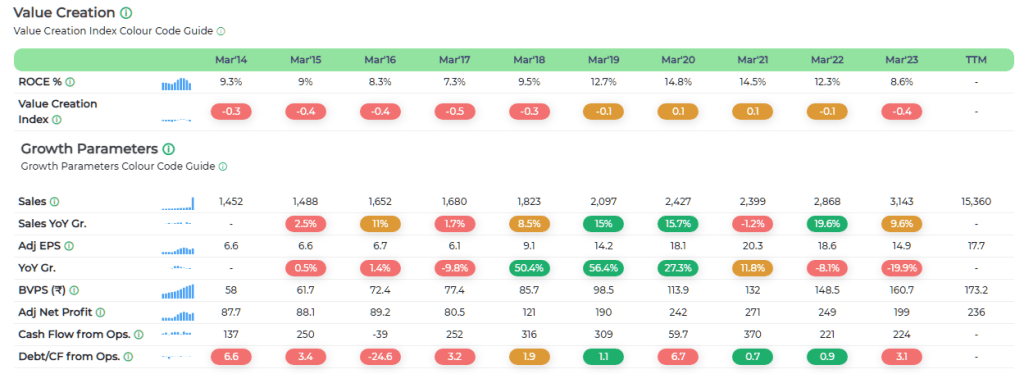

United Spirit Limited

Diageo India incorporated in India as United Spirits Ltd (USL) is the country’s leading beverage alcohol company and a subsidiary of global leader Diageo PLC. The company manufactures, sells, and distributes a wide portfolio of premium brands such as Johnnie Walker, Black Dog, Black & White, VAT 69, Antiquity, Signature, Royal Challenge, McDowell’s No.1, Smirnoff and Captain Morgan. Despite having strong brands and being present in India for a decade united spirit has shown stagnant growth in revenue and profit.

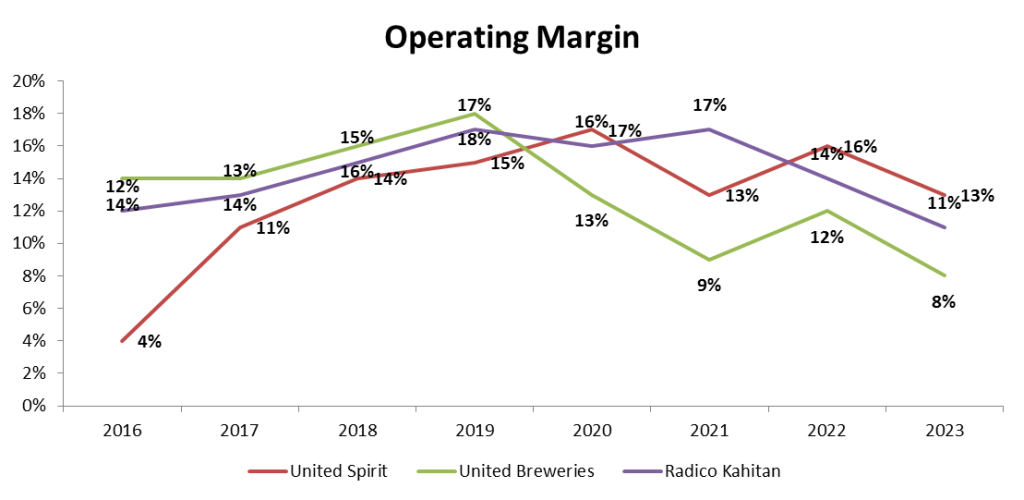

Over the past ten years, the USL has barely managed to generate returns that meet its cost of capital.

United Breweries Limited

United Breweries Limited (UBL) is engaged in the business of manufacture and sale of beer and non-alcoholic beverages. The Company markets its products under the flagship brands Kingfisher and Heineken. Some of the most popular brands in its portfolio include Kingfisher Premium, Kingfisher Ultra, Kingfisher Strong, Kingfisher Ultra Max, UB Export Lager, London Pilsner etc. The Company has a market share of 54% in the Indian beer market as of March 2022.

UBL is also facing challenges in maintaining a consistent Return on Equity over an extended period.

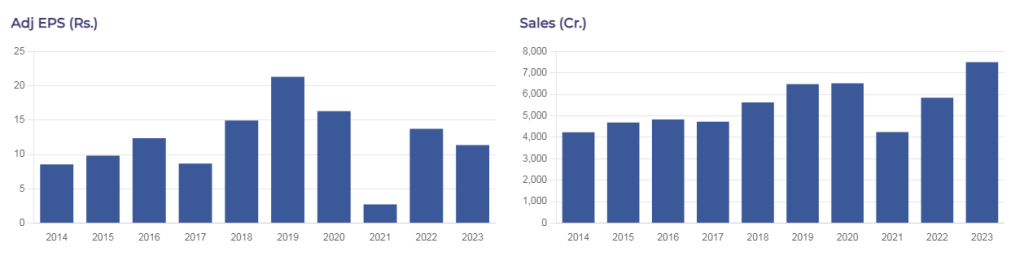

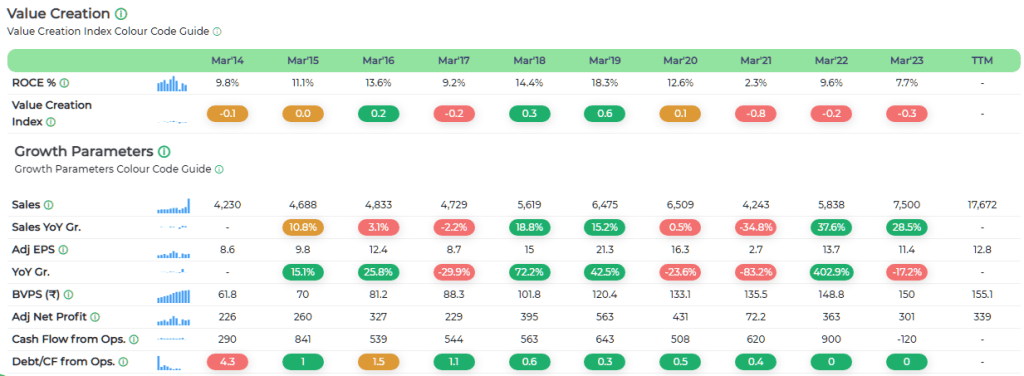

Radico Khaitan

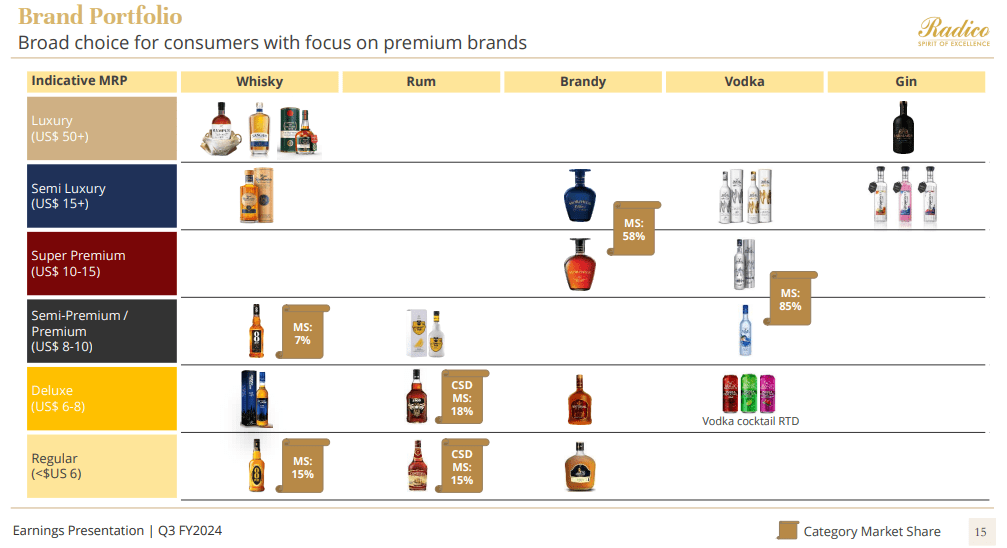

Incorporated in the year 1943, Radico Khaitan is one of the most recognised IMFL (Indian Made Foreign Liquor) brands in India. The company was initially known as Rampur Distillery Company and was focussed on distillation and bottling for branded players and canteen stores of armed forces. Some of the most popular brands in its portfolio include 8PM Whisky, Contessa Rum, Jaisalmer Indian Craft Gin, Magic Moments Vodka, Magic Moments Dazzle Vodka (Gold & Silver), Magic Moments Verve Vodka etc. Magic Moments leads the vodka Industry in India with over 58% market share whereas Morphues Brandy leads the premium brandy category with over 56% market share.

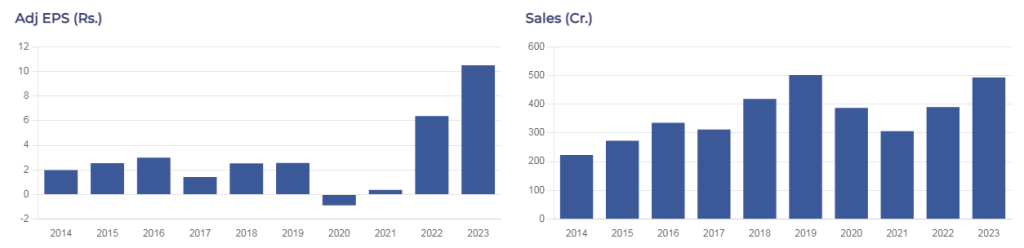

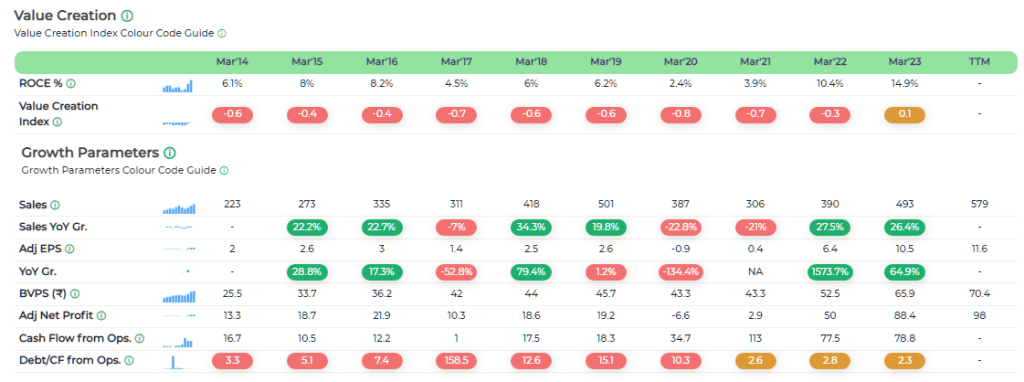

Sula Vineyards

Incorporated in 2003, Sula Vineyards Limited is India's largest wine producer and seller. The company distributes wines under a bouquet of popular brands including RASA, Dindori, The source, Satori, Madera & Dia with its flagship brand "Sula" being the category creator of wine in India.

Industry Headwinds

Even with favourable conditions, key industry players are finding it difficult to increase their revenue and cover their cost of capital due to tight controls on alcohol consumption and distribution, along with stringent regulations.

- Distribution: The distribution of alcoholic beverages in India is heavily regulated by state governments, which exercise control over both wholesale and retail channels. This state-level regulation creates a complex and varied landscape across the country, with some states having fully government-controlled distribution systems, while others allow private participation to varying degrees.

- Taxes: Liquor serves as a major source of tax revenue for state governments, with tax rates differing by state. High excise taxes mandated by the government lead to higher retail prices for alcoholic beverages and regulated pricing, presenting obstacles for companies trying to sustain their operating margins. The challenge is intensified for the companies' by limited capacity to offset increasing costs of raw materials by adjusting their prices.

- Regulation: Extensive regulations govern the industry, affecting everything from production and distribution to advertising and sales. For instance, direct and indirect advertising of alcohol is prohibited in India, with permissible marketing only at the point of sale. Furthermore, the process of launching a new alcohol brand is cumbersome and time-consuming, requiring numerous government approvals.

Business Strategy of Players

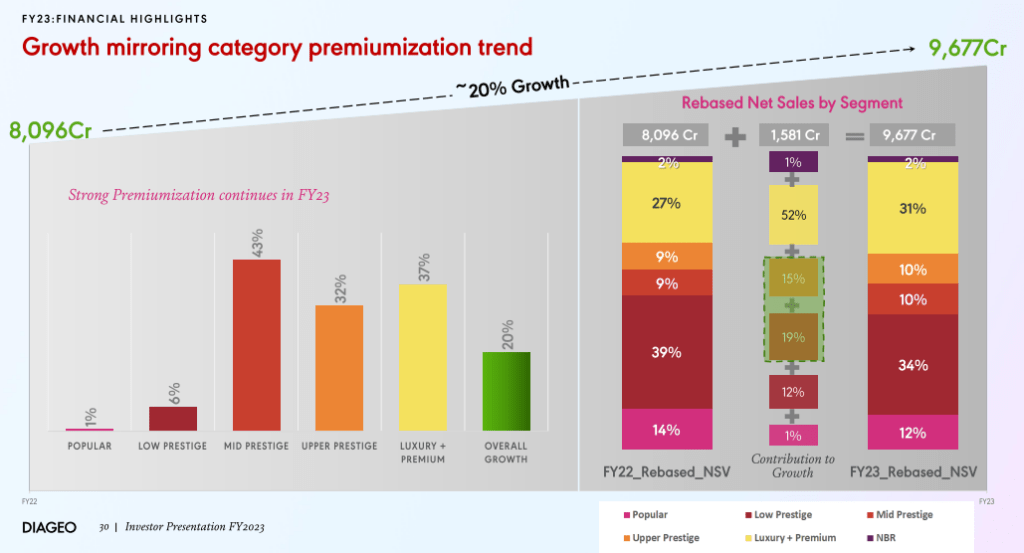

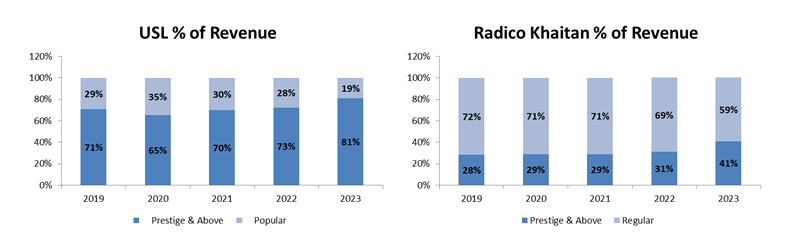

Companies are navigating these hurdles by tapping into the unique pricing sensitivity of standard and premium liquors. By harnessing the trend towards premiumization, they aim to enhance their sales volume and revenue.

Source : Radico Khaitan PPT

By focusing on premium offerings, these players aim to mitigate the impact of escalating costs while catering to the preferences of consumers who exhibit relatively inelastic demand for high-end spirits.

Source: USL PPT

This strategic shift towards premiumization allows liquor companies to not only offset the effects of taxation and rising input costs but also leverage the perceived value and brand loyalty associated with premium liquor brands. Moreover, by enhancing the quality and exclusivity of their products, key players are carving out a niche in the market, insulating themselves from the price sensitivity characteristic of regular liquors. Thus, amidst regulatory challenges and cost pressures, the adoption of a premiumization strategy emerges as a prudent approach for liquor companies seeking to navigate the complexities of the Indian market while sustaining growth and profitability.

MoneyWorks4Me Opinion

The future of the Indian liquor industry appears to be on a trajectory of continued growth, driven by demographic shifts, rising incomes, and changing consumer behaviours. Frequent and ad-hoc changes in the route to market makes it challenging to conduct business in the Beverage Alcohol Industry. Moreover, controlled pricing proves to be a significant headwind in an inflationary environment which necessitates continuous adaptation and innovation by industry players. The valuation of these companies assumes a seamless transition to a favorable business environment, a factor that prompts us to adopt a cautious stance.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: