Happy Forgings Limited IPO Details:

Estimated Pre-Listing Market Cap: ~Rs. 7,990Cr

IPO Date: 19th December to 21th December

Total shares: ~9.37 Cr

Price band: Rs. 808 - Rs. 850 per share

IPO Issue Size: ~ Rs. 1,008 Cr

Lot Size: 17 shares and in multiples thereof

Purpose of Issue: Offer for Sale & New issue

About Happy Forgings Ltd

Happy Forgings - a top Indian producer of heavy forgings and precision parts, serves car and other equipment makers globally. It boasts a diverse portfolio for industries like autos, farm machinery, and wind turbines.

Industry

Forging is a manufacturing process involving the shaping of a metal using compressive, localized forces delivered through hammering, pressing, or rolling. These compressive forces are delivered with a hammer or die. Many automotive and non-automotive components are manufactured using the forging process. In automotive and truck applications, forged components are commonly found at points of shock and stress. Cars and trucks may contain more than 250 forgings, most of which are produced from carbon or alloy steel.

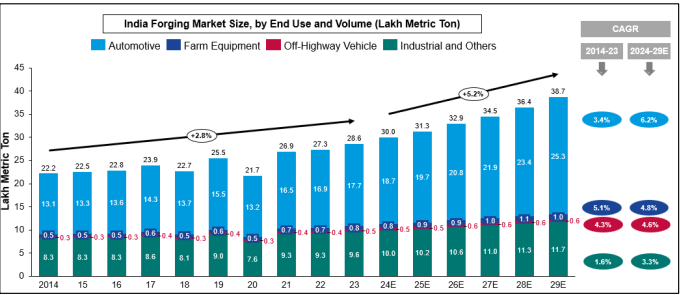

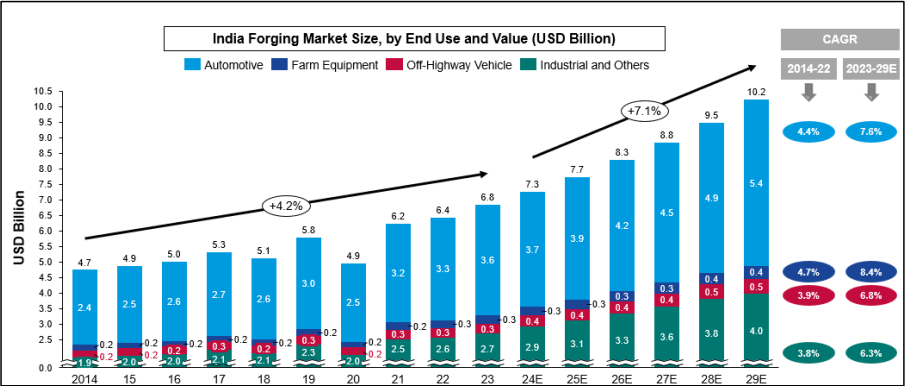

As of FY 2023, the automotive sector holds about 61.8% forged components market share within India. In terms of value, the automotive sector's contribution to forged components was about US$ 3.6 billion in Fiscal 2023 and it is estimated to grow to US$ 5.4 billion in 2029 with a CAGR of 7.6%. The market is expected to grow to 38.7L MT (US$ 10.2 billion) by Fiscal 2029 with the rise in demand of automotive backed by a rise in the working population and an increase in per capita income.

India contributes to about 5% of global forged components exports. All-time high exports were registered in Fiscal 2023. India exports about US$ 1.5 billion worth of forged components primarily to North America and European regions each year Fiscal 2020 consistently. Exports vary from 21% to 25% of the total production volume in the country.

Business Model

Happy Forging is a manufacturer of complex and safety-critical, heavy forged, and high-precision machined components. Company through its vertically integrated operations, is engaged in engineering, process design, testing, manufacturing, and supply of a variety of components that are both margin accretive and value-additive.

Product Portfolio

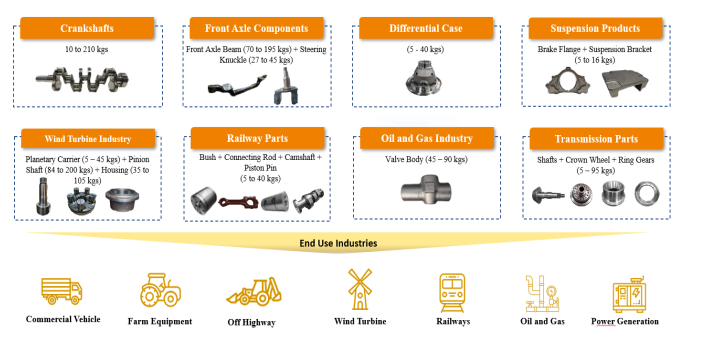

Automotive Sector:

The company primarily caters to domestic and global original equipment manufacturers (“OEMs”) manufacturing commercial vehicles in the automotive sector.

Non-Automotive Sector:

In the non-automotive sector, the company caters to manufacturers of farm equipment, off-highway vehicles, and manufacturers of industrial equipment and machinery for oil and gas, power generation, railways, and wind turbine industries.

Customers:

The company’s customers include some of the leading Indian and global OEMs. It has strong and long-standing relationships with most of their customers. Some of the customers across the end-use industries it supplies to are as follows:

Financials

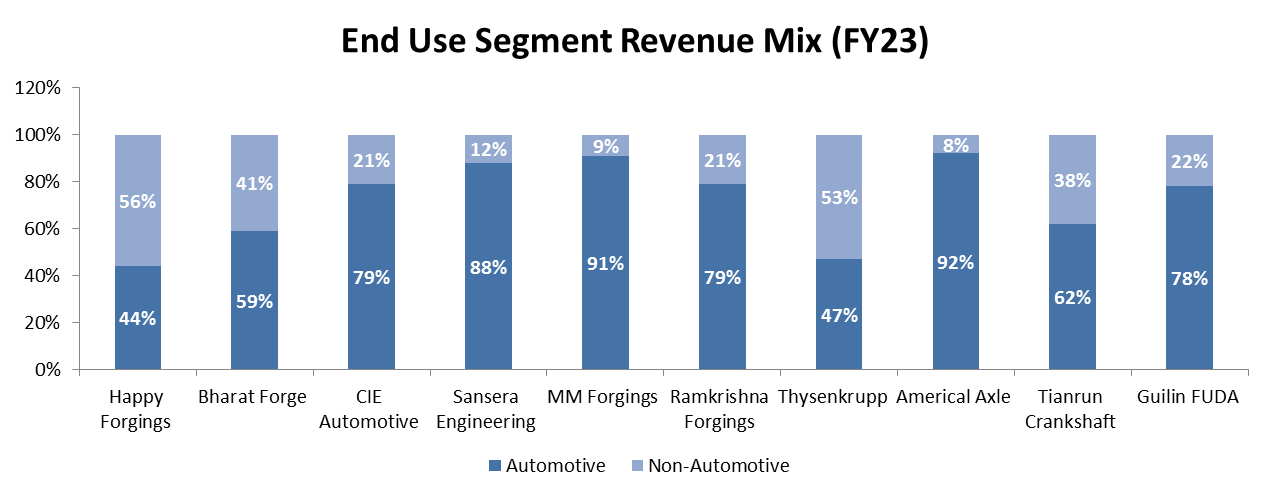

Peers

(T-Total capacity, F-Forging capacity, M-Machining capacity, C-Casting capacity.)

Objective of the issue

The Offer comprises a fresh issue of Equity Shares aggregating up to Rs. 400 Cr and an offer for sale of up to ~7.159 Cr Equity shares by the selling shareholders.

The Net Proceeds from the Fresh Issue will be utilized towards funding the following objects:

- Purchase of equipment, plant and machinery;

- Prepayment of all or a portion of certain outstanding borrowings availed by the Company

- General corporate purposes.

Risk Factors

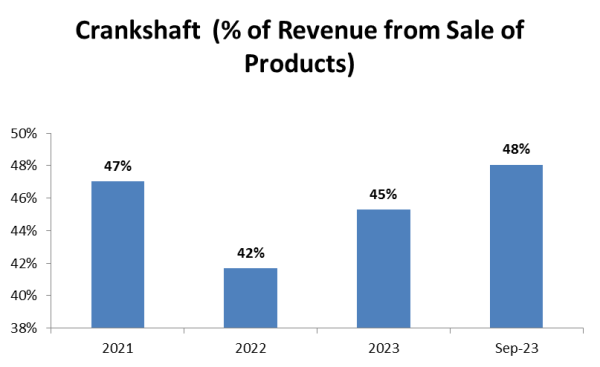

High Product Concentration Risk: The company relies heavily on revenue generated from the sale of crankshafts, which are not currently utilized in battery-electric vehicles.

Customer Concentration risk: Businesses depend on their top 10 customers and they don’t have a commitment on the part of their customers to purchase or place orders with the company. Because of this company may face pricing pressure from the customer.

Geographical Risk: All three manufacturing facilities of the company are located in Ludhiana, Punjab which exposes company operations to potential risks arising from local and regional factors such as adverse social and political events, weather conditions, and natural disasters.

Management

Paritosh Kumar is the Chairman and Managing Director of the Company. He holds a bachelor’s degree in arts from S.C. Dhawan Government College, Ludhiana, Panjab University. He has been associated with the company since incorporation and accordingly has over 44 years of experience in the industrial sector.

Ashish Garg is the Managing Director of the Company. He holds a bachelor’s degree in science (accounting and finance), and a master’s degree in science (manufacturing systems engineering) from the University of Warwick, United Kingdom. He has ~17 years of experience in the industrial sector.

Megha Garg is a full-time director of the Company. She holds a bachelor’s degree in science (economics) from the University of Nottingham, United Kingdom. She has ~8 years of experience in the industrial sector. She currently handles the online digital marketing of the Company.

Narinder Singh Juneja is the Chief Executive Officer and full-time director of the Company. He holds a post-diploma in mechanical engineering.

Opinion:

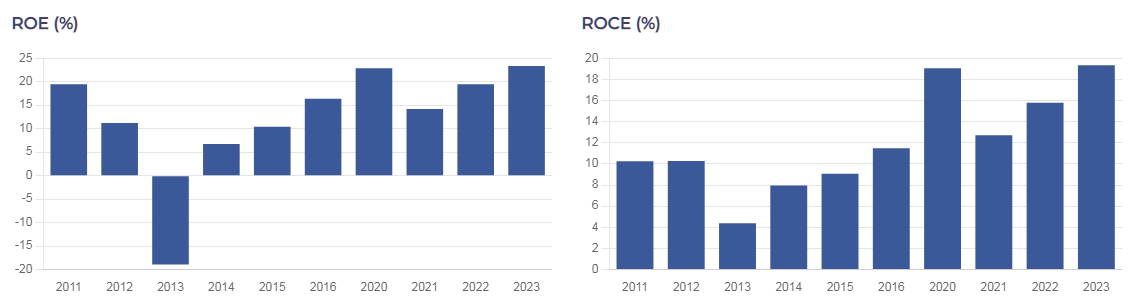

HFL is a leading and critical, complex, and precision machined components company catering to a good mix of Auto and Non-Auto end-user industries. It supplies its products to renowned global OEMs. The company has posted steady growth in its top and bottom line with high growth seen in the last 2-3 years on back of industry upcycle. Even though revenue growth is high, the end-user industry for HFL is cyclical and the valuation of these companies should reflect that. At the given price band, the company seeks a valuation of 38x FY23 PE. Based on FY24 annualized earnings the issue appears fully priced. Investors may choose to avoid this company at this valuation.

Recommendation: Avoid

Happy Forgings Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | Dec 19, 2023 |

| IPO Close Date | Dec 21, 2023 |

| Basis of Allotment Date | Dec 22, 2023 |

| Refunds Initiation | Dec 26, 2023 |

| A credit of Shares to Demat Account | Dec 26, 2023 |

| IPO Listing Date | Dec 27, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 17 | Rs. 14,450 |

| Maximum | 13 | 221 | Rs. 187,850 |

Happy Forgings Limited IPO FAQs:

When will the Happy Forgings Ltd IPO open?

Happy Forgings IPO will open for subscription on Tuesday, 19th December 2023, and closes on Thursday 21st December 2023.

What is the price band of Happy Forgings Ltd IPO?

The price band for Happy Forgings Ltd IPO is Rs. 808-850/share.

What is the lot size for the Happy Forgings Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 17 shares, up to a maximum of 13 lots i.e. Rs. 1,87,850/-.

What is the issue size of Happy Forgings Ltd IPO?

The total issue size is ~ Rs. 1,008.59 Cr.

When will the basis of allotment be out?

Allotment will be finalized on December 22nd and refunds will be initiated by December 26th. Shares allotment will be credited in Demat accounts by December 26th.

What is the listing date of Inox India Ltd’s IPO?

The tentative listing date of the Happy Forgings IPO is December 27th, 2023.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: