Hyundai Motor India Limited IPO Details:

IPO Date: 15th to 17th October, 2024

Total Issue Size: ~14.22 Cr shares

Offer for Sale: ~14.22 Cr's

Price Band: Rs. 1865 – Rs. 1960 per share

IPO Issue Size: ~ Rs. 27,870.16 Crores

Lot Size: 7 shares and multiples thereof

Overview of Hyundai Motors India Limited:

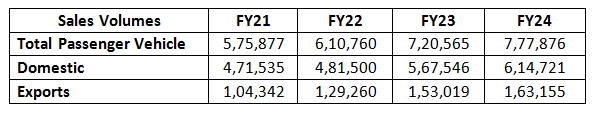

India is set to witness it’s largest-ever IPO as Hyundai Motor India, the country's second-largest carmaker has filed its prospectus. Hyundai India sold 6.14 Lakh cars in India and exported ~1.63 lakh cars in FY24. Over the past 4 years, Hyundai India maintained 15-18% share within the domestic market amidst continued demand for its popular models aided by frequent upgrades.

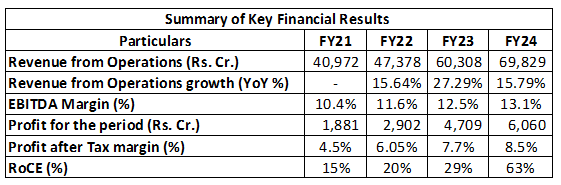

In FY24, Hyundai India clocked a Revenue / PAT of Rs. 69,829 Cr / 6,060 Cr with an impressive return on capital employed (ROCE) of 62.9%. In comparison, Maruti Suzuki India reported revenue of Rs 1.41 lakh Cr; the Passenger vehicle division of Tata Motors and M&M reported revenues of Rs. 52,353 Cr and Rs. 73,150 Cr respectively.

With this listing, Hyundai aims to capitalise on India’s growing market potential and enhance its valuation by listing its Indian counterpart. The IPO is an offer for sale (OFS) of existing promoters, which will unlock value in the Indian business.

Hyundai’s Model for Success in India:

Hyundai has achieved significant success in India by emphasizing quality and brand strength over mere affordability. The company's value proposition lies in manufacturing passenger vehicles that are feature-rich, reliable, and innovative, all while maintaining a competitive price point. This blend of high quality and value has resonated well with Indian consumers.

Hyundai's dedication to customer satisfaction is evident in its consistently increasing net promoter score (NPS) ratings. According to research by NielsenIQ (India), Hyundai's NPS for passenger vehicle sales was an impressive 97% for sales and 92% for services in CY23. Such high NPS ratings reflect Hyundai's strong customer-centric approach.

Furthermore, Hyundai's extensive sales and service network, which was the second largest in India in terms of customer touchpoints, enhances customer accessibility and support, contributing to Hyundai's robust market presence.

Model Basket:

Summary of Key Financial Results:

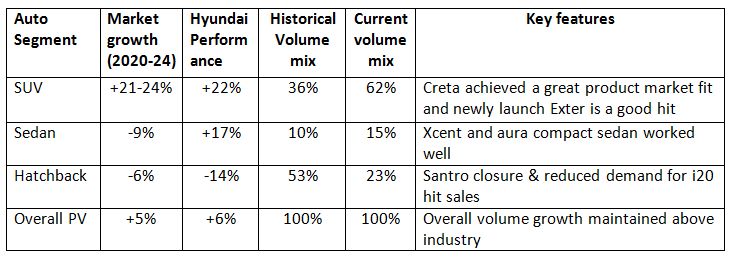

Segmental performance:

With the increasing demand for SUVs, Hyundai has successfully maintained industry growth rates. The company has outperformed the industry in the Sedan segment but has lagged in the hatchback segment. As a result, there has been a significant shift in Hyundai's volume mix, with the share of SUVs rising from 36% to 62% in FY24. The key features of this shift in segment mix are as follows:

Domestic/Export Volumes:

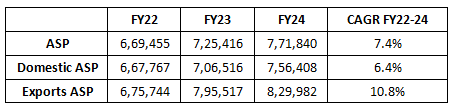

Increasing Average Selling Prices led by higher compliance costs:

The adoption of new emission norms like Bharat Stage (BS) VI has significantly increased costs for vehicle manufacturers in India. These norms necessitate substantial investments in technology and R&D, causing vehicle prices to rise by 2-4%. Diesel vehicles, in particular, saw higher price hikes due to additional exhaust components. Future standards, like the anticipated BS-VII, are expected to continue driving up costs.

Enhanced safety norms have also raised manufacturing costs. The Bharat New Car Assessment Program (BNCAP), launched in August 2023, mandates higher safety standards, including technologies like Electronic Stability Control and pedestrian protection. This has led to increased vehicle prices as manufacturers invest in these safety features. On-going and future safety regulations are likely to further elevate costs.

Domestic PV Industry Outlook: Under penetration and replacement demand to keep long-term CAGR of 4.5-6.5% intact

The automotive industry is poised for significant growth due to evolving consumer dynamics and various supportive factors. A key driver is the changing consumer base, which is becoming younger and more inclined towards premiumisation and electrification. Additionally, the replacement cycles for vehicles have shortened from 7-8 years a decade ago to 4-5 years currently. This shift is further encouraged by government initiatives aimed at scrapping old vehicles, thereby accelerating the demand for new vehicles.

The industry's capacity expansion by leading manufacturers such as Maruti Suzuki, Hyundai Motor India, and Tata Motors is set to bolster the growing demand for vehicles. This growth is further supported by the development of infrastructure, including the expansion of EV charging stations and CNG pumps, which offers consumers a wider range of choices.

CRISIL MI&A projects that these factors will contribute to the industry achieving a compound annual growth rate (CAGR) of 4.5-6.5% between FY24 and FY29, ultimately reaching domestic vehicle sales of 5.2-5.7 million units.

Competitive Landscape:

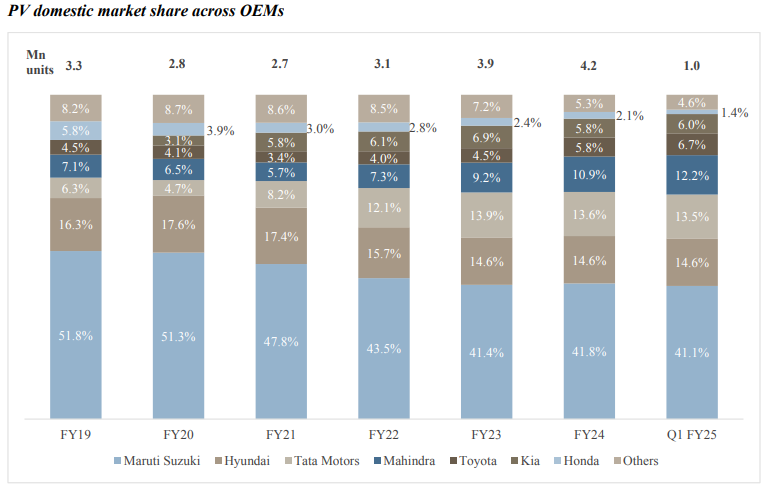

The domestic PV industry is an oligopolistic market with few players dominating the entire industry. Maruti Suzuki leads the PV industry in terms of domestic sales volumes. Hyundai India is the second largest contributor to domestic sales, followed by Tata Motors and Mahindra & Mahindra. These 4 players together contribute approximately 80% of the market.

Source: SIAM, CRISIL

In the last 5 years, the competition has intensified amidst competitively priced feature-rich vehicle launches by all players as well as recent entrants such as Kia and MG grabbing sizeable shares.

The share of Maruti Suzuki contracted from a high base of 52% in FY19 to 41.4% in FY23 due to the shift in customer preference from hatchbacks towards SUVs and its focus on the small cars segment. However, the success of their recent launches like Grand Vitara, Fronx, and continued traction for Ertiga and Brezza helped Maruti Suzuki regain some lost ground during FY24, bringing their market share up to 43%.

Hyundai has a good history of adapting to competition:

Hyundai Motor India dominates the mid-size SUV sub-segment. With its flagship model Creta, Hyundai commanded a leading 68% share of the sub-segment during FY19. Intermittent upgrades to Creta helped it maintain a notable share in the next 4 years as well and had a market share of 30% in FY24. It faced stiff competition from new entrants in the sub-segment restricting its share, but with expansion in the overall segment, Hyundai’s sales have also grown over the years.

The entry of Kia in the Indian market with Seltos helped it garner a sizeable 43% share during FY20. On the other hand, Urban Cruiser Hyryder and Rumion backed Toyota’s expansion in the mid-size SUV sub-segment in the last 2 years. The launch of Grand Vitara helped Maruti Suzuki expand its share during FY24. In the last 2 years, the launch of models like the Honda Elevate, Skoda Kushaq, Volkswagen Taigun, and Mahindra XUV400 has intensified the competition further within the sub-segment. Many OEMs like Honda, VW, Toyota entered this sub-segment in the last 2 years while few OEMs like Renault and Nissan discontinued their offerings as well.

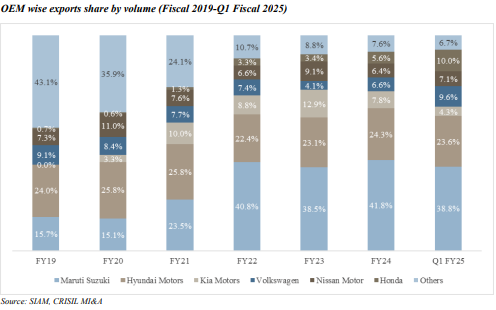

Outlook for Exports: Expected growth higher than domestic demand

Major original equipment manufacturers (OEMs) in India are actively expanding their production capacities with the strategic aim of transforming India into an export hub for regions such as Africa, the Middle East, and Asia. This expansion is significantly supported by policies like the Production Linked Incentive (PLI) scheme, which provides substantial momentum to domestic OEMs for the manufacturing and export of electric vehicles (EVs) from India. The government is offering incentives through the PLI scheme for the entire EV ecosystem, including automobiles, auto components, and advanced chemistry cell (ACC) batteries.

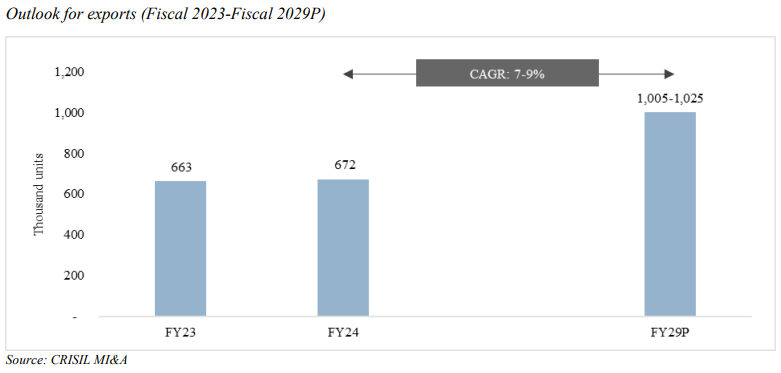

Several major OEMs in India have already announced their plans to begin exporting EVs from India starting in the 2025-26 period. This move is expected to drive a notable increase in passenger vehicle exports from India, which is projected to grow by 3.1% in FY24 and achieve a compound annual growth rate (CAGR) of 7-9% between 2024 to 2029. The anticipated economic stability and growth, combined with an increased push from OEMs and India's advantageous trade agreements, are expected to further enhance the overall export landscape from India.

Hyundai is the second largest car exporter from India. In 9M FY24, Hyundai's exports stood at 1.5 lakh units. This was driven by demand from African and Latin American markets. Key export models include Verna, Grand i10, Aura, Creta, Alcazar, and Venue. Hyundai's strong performance in export markets highlights its strategic role as a production and export hub for Hyundai Motor Company (HMC).

EV Shift and Future Prospects:

Hyundai is actively participating in the electrification trend in the Indian PV market. The company supports the government's initiatives for EV adoption, which include the FAME II subsidy and various infrastructure development programs. The EV segment is expected to grow significantly, with CRISIL projecting EV penetration to reach 17-20% by FY29. Hyundai’s focus on introducing new EV models and leveraging government support will be crucial for its future growth in this segment.

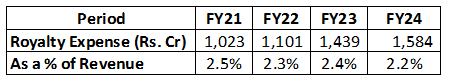

Royalty to HMC Korea:

Until June 10, 2024, Hyundai India had separate technology and royalty agreements with HMC for each passenger vehicle model it manufactured and sold. Under the current Royalty Agreement with HMC, Hyundai India has a non-exclusive, non-transferable license to manufacture and sell passenger vehicles and parts in India, using HMC’s trademarks. For this, Hyundai India shall pay HMC 3.5% of its sales revenue, calculated as per the Royalty Agreement, on a quarterly basis. Historically, the royalty cost ranged from 2.25% to 2.5%. In comparison, peer company Maruti Suzuki pays Suzuki a royalty cost of 2.5% to 3% of its actual revenue.

Key Growth Drivers and Challenges:

a) Growth Drivers:

- New product development aided by HMC parentage and frequent upgrades to existing models.

- Expansion in export markets, particularly Africa and Latin America.

- Increased focus on the high growth segments like SUV and EV.

- Government support for EV adoption and infrastructure development.

b) Challenges:

- Intense competition in the domestic market, particularly in the SUV and EV segments.

- Pricing pressures from competitors offering discounts to stimulate demand.

- The need to achieve economies of scale for new models and upgrades.

MoneyWorks4me Opinion

Hyundai Motors India remains a dominant force in the Indian automotive market, excelling in both domestic sales and exports. Its reputation is built on strong build quality and reliable service, which have anchored its success in India. The company’s strategic focus on electrification and its adaptability to market trends and customer needs position it well for future growth, despite increasing competition.

Hyundai has set an IPO price band of Rs. 1,865-1,960 per share, with the parent company diluting 17.5% of its stake. The IPO, valued at Rs. 27,870 Cr, is the largest since the LIC IPO of Rs. 21,000 Cr. Adjusting for a lower other income due to a higher dividend payout this year, Hyundai is expected to report a PAT of around Rs. 6,000 Cr in FY25. At the upper price band, this implies a valuation of Rs. 1.59 Lakh Cr, translating to a PE of 27x FY25e PAT. While Hyundai has delivered strong double-digit growth in revenue and profitability over recent years, the auto industry is currently facing demand pressures due to elevated dealer inventory levels, potentially leading to slower profit growth in the medium term.

Moreover, the large size of the Hyundai IPO could absorb significant market liquidity, as investors reallocate funds to participate in this offering. This may temporarily tighten overall market liquidity, leading to lower incremental returns in other stocks until liquidity stabilizes post-listing. As a result, we expect limited potential returns from the IPO at the current price band and recommend investors AVOID subscribing to it.

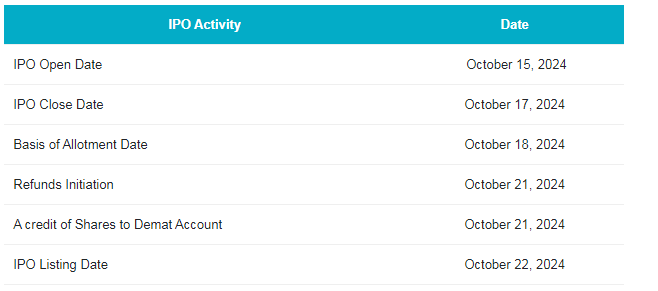

Hyundai Motor India Limited IPO Tentative Timetable:

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 7 | Rs. 13,720 |

| Maximum | 13 | 98 | Rs. 192,080 |

Hyundai Motor India Limited IPO FAQs:

When will the Hyundai Motor India Ltd IPO open?

Hyundai Motor India IPO will open for subscription on Tuesday, 15th October 2024, and closes on Thursday, 17th October 2024.

What is the price band of Hyundai Motor India Ltd IPO?

The price band for Hyundai Motor India Ltd IPO is Rs. 1865-1960/share.

What is the lot size for the Hyundai Motor India Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 7 shares, up to a maximum of 13 lots i.e. Rs. 1,92,080/-.

What is the issue size of the Hyundai Motor India Ltd IPO?

The total issue size is ~ Rs. 27,870.16 Cr.

When will the basis of allotment be out?

Allotment will be finalized on October 18th and refunds will be initiated by October 21st. Shares allotment will be credited in Demat accounts by October 21st.

What is the listing date of Hyundai Motor India Ltd.'s IPO?

The tentative listing date of the Hyundai Motor India IPO is October 22nd, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: