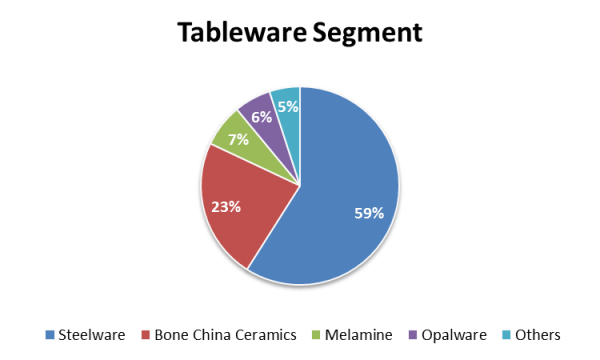

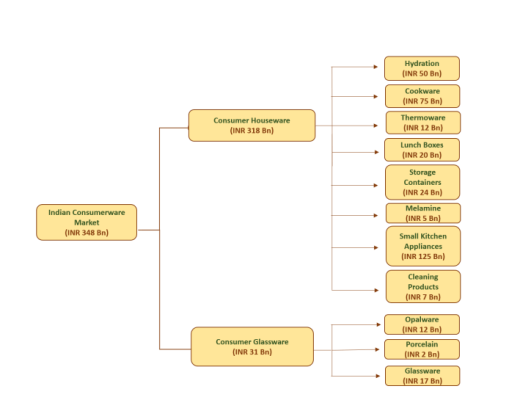

The dining room in India has transformed over the years from merely a place for meals into a center of grace and elegance, especially evident in the evolution of tableware. In India, this shift in tableware is not just about functionality; it has become a lifestyle statement that mirrors the changing attitudes and evolving lifestyles of consumers. Today, there is an increasing consumer preference for branded tableware, which is favored for its aesthetic appeal, affordability, and microwave-friendly attributes. This trend underscores the dynamic nature of the tableware market in India, which, despite its fragmented structure, continues to grow steadily. Particularly noteworthy is the opalware market, which, due to its superior quality compared to alternatives, stands out and shows consistent growth. This growth in specific segments like opalware reflects broader trends in the Indian Consumerware Market, which is divided into two principal categories: Consumer Houseware and Consumer Glassware. These categories are further broken down into an array of segments. Consumer Houseware includes a variety of products such as hydration items, cookware, insulated ware, lunchboxes, storage containers, melamine products, small kitchen appliances, and cleaning products. On the other hand, the Consumer Glassware category features opalware, other types of glassware, and porcelain items. This diverse product range meets a variety of household needs, showcasing the market's ability to adapt and flourish amid India's evolving consumer preferences.

Market Size

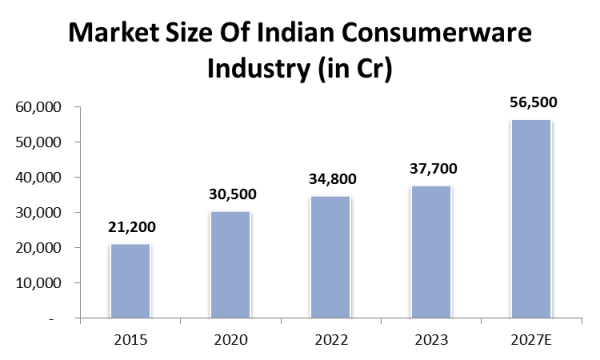

The Indian consumerware market reached a value of Rs. 34,800 Cr in FY 2022, marking steady growth over the years. From FY 2020 to FY 2022, the market expanded from Rs. 30,500 Cr representing a CAGR of 6.9%. Looking ahead, it is projected to reach Rs. 56,500 Cr by FY 2027, growing at a CAGR of 10.2% during the period FY 2022-2027. This growth can be attributed to factors such as increasing disposable income, the trend toward smaller nuclear families, and rising demand for organized and functional kitchen spaces.

Introduction

Consumer Glassware Market:

The Indian glassware market reached a value of Rs. 3,100 Cr in FY 2022, marking significant growth from its valuation of Rs. 1,500 Cr in FY 2015. Over the period from FY 2015 to FY 2020, the market experienced a robust CAGR of 11.6%, reaching Rs. 2,500 Cr by FY 2020. By FY 2027, the market is forecasted to expand to Rs. 6,300 Cr representing a CAGR of 15.5% over the five-year period.

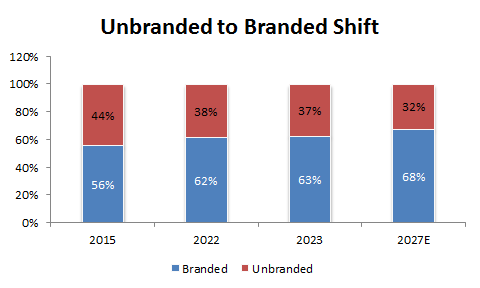

Branded Unbranded Shift:

In FY 2022, branded products accounted for approximately 62% of the Indian glassware market, amounting to nearly Rs. 1,800 Cr. This marks a substantial increase from the approximately 56% share, equivalent to around Rs. 800 Cr observed in FY 2015, demonstrating a notable CAGR of 12.7% for the branded segment. It is projected that branded products will further expand their market share to approximately 68% (Rs ~4,300 Cr) by FY 2027. The branded segment is experiencing faster growth compared to the unbranded market, driving overall market growth.

Industry

Opalware:

Opalware a glass-like ceramic dinnerware, is crafted from a blend of natural materials like quartz, feldspar, and bone ash. Renowned for its robustness and resistance to chipping, it's a preferred choice for everyday dining. Its microwave and dishwasher compatibility enhance its appeal. Opalware encompasses various items such as plates, bowls, cups, and saucers, enjoying widespread usage across India. Notable brands in the Opalware segment include La Opala, Corelle, Cello, and Luminarc. In FY 2022, Opalware contributed approximately 39% to the Indian Consumer Glassware Industry. Key players like Cello, La Opala, and Borosil dominate the Opalware market in India.

Glassware:

Glassware encompasses a diverse range of glass products like tumblers, wine glasses, and serving glasses. Known for its clarity, glassware enhances the visual appeal of beverages by showcasing their colour and texture. Its microwave-safe nature adds to its versatility, making it suitable for heating liquids. Available in various designs and shapes, glassware is often preferred for special occasions or when entertaining guests. Leading brands in the Indian Glassware segment include Borosil, Milton, Cello, and Ocean Glassware. In FY 2022, the Glassware market commanded the largest share, accounting for approximately 53% of the Indian Consumer Glassware Industry.

Porcelain:

Porcelain is a type of ceramic dinnerware that is known for its strength, translucency, and delicate appearance. It is made from a mixture of kaolin, feldspar, and quartz, and is fired at high temperatures to achieve its hardness and resistance to chipping. Porcelain dinnerware is often decorated with intricate designs and patterns and is a popular choice for formal occasions and events. The category includes a range of products such as plates, bowls, and tea sets. Players in the Porcelain category in India include brands such as Noritake, Ariane, Cello, Hitkari etc. The Porcelain market constituted a share of approximately 5% of the Indian Consumer Glassware Industry in FY 2022 and is expected to grow at a CAGR of 15.6% from FY 2022 till FY 2027 to reach a market value of Rs, 400 Cr.

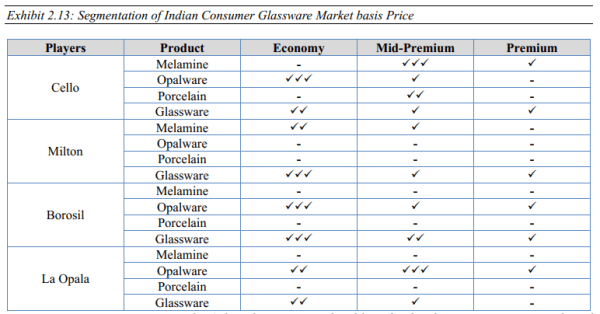

Price Segmentation in Consumer Glassware Industry

The Consumer Glassware Industry can be classified into three distinct price segments - economy, mid-premium and premium - based on price points. Effective segmentation strategies based on the various raw materials used can help companies create more targeted product offerings and pricing structures, thereby better serving their customer base and capturing greater market share.

Key Players in Industry

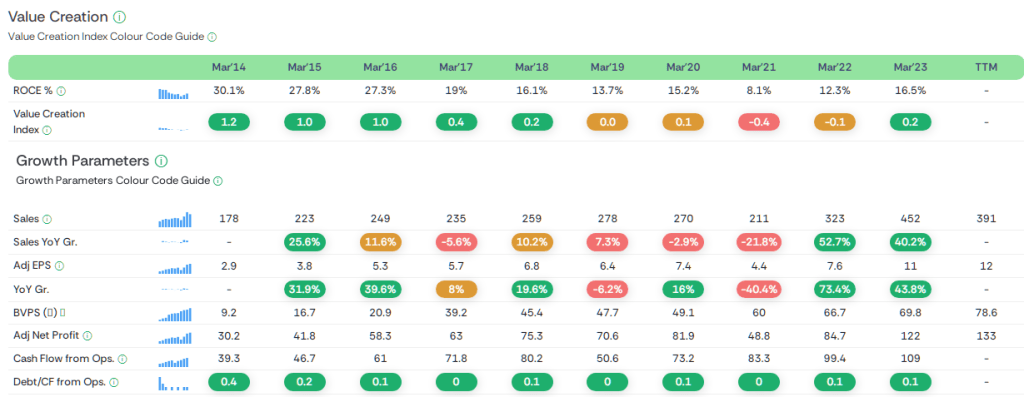

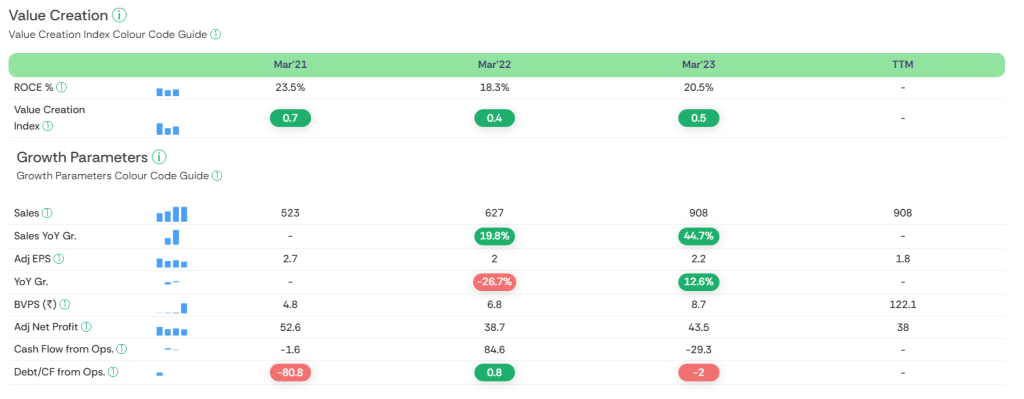

LaOpala

La Opala RG is a leading manufacturer and marketer of tablewares (opal and glass) in India. The product portfolio of the company includes Opal glassware which includes Plates, Bowls, Dinner sets, Cup-saucer Sets, Coffee mugs, Coffee cups, Tea sets, Soup sets, Pudding, Dessert sets, etc, and Crystalware which includes Barware, Vases, Bowls, Stemware, etc. The flagship brand of the company is LA Opala and other brands that the company offers are Diva, Solitaire Crystal, and Cook Serve Store.

Cello

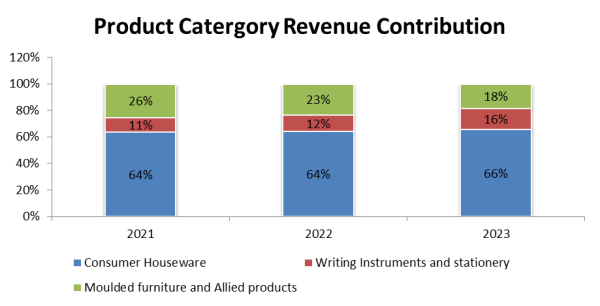

Cello World is a leading Indian consumer product company, company offers its consumer products across three categories.

-

- Consumer Houseware: Houseware, Insulatedware, Electronic appliances and cookware, cleaning aids, Opalware, Glassware products

- Writing Instruments and Stationery : Ballpoint pen, Gel pen, Roller pen, Fountain pen, Metal pen, Mechanical pencil, Highlighters, Markers, Correction Pens

- Moulded furniture and Allied products : Chairs, Tables, Trolleys, Stools, Cabinets, Ladders, Moulds, Bubble-guards, Crates, Pallets, Dustbin, Storage items

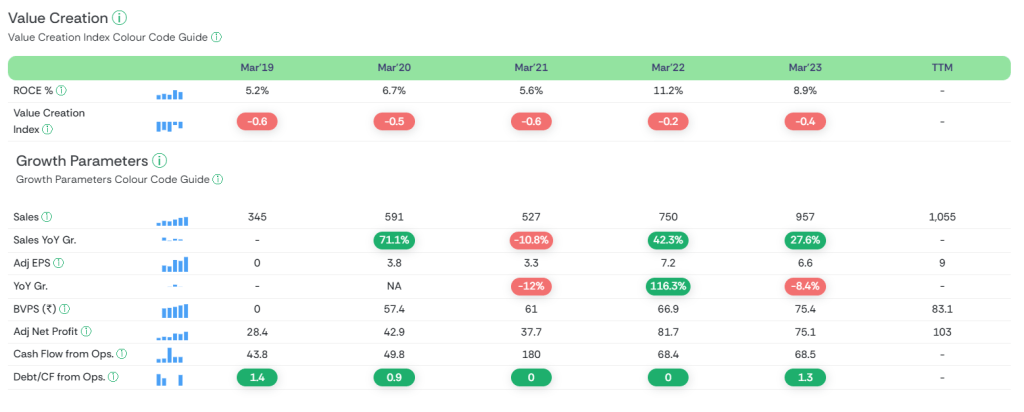

Borosil :

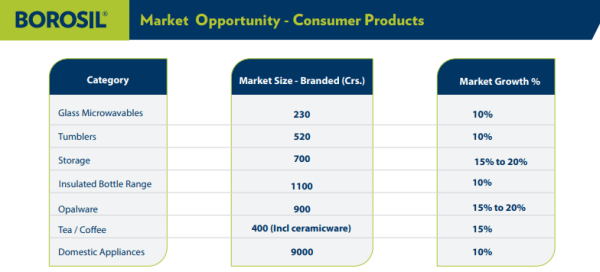

Borosil Limited is a supplier of laboratory glassware, microwaveable kitchenware and opal ware in India. It sells and markets microwavable and flameproof kitchenware and glass tumblers through more than 15,000 retail outlets, and has three manufacturing facilities. The company conducts its operations in two business segments—namely, scientific & industrial products and consumer products.

Headwinds:

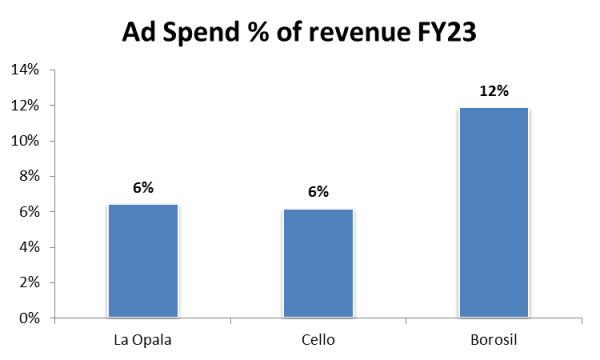

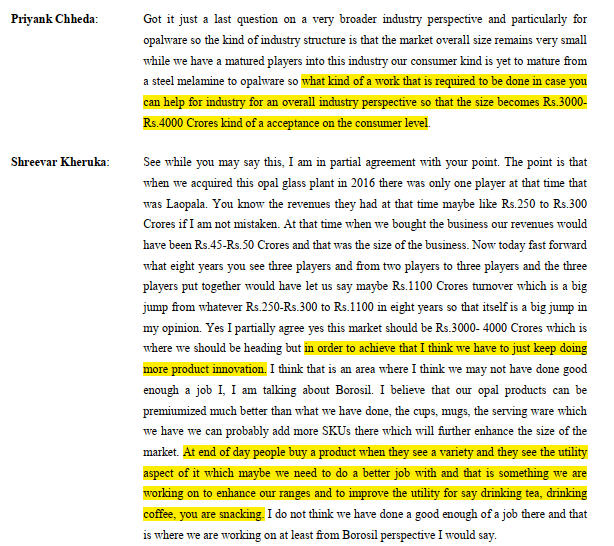

Despite having many tailwinds opalware remains relatively underpenetrated in India, indicating ample room for growth. Currently, opalware is struggling for growth as establishing opalware as a distinct product category requires substantial advertising investments across the industry to educate consumers about its utility.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: