In our last blog, we analysed the dynamics of the diagnostic sector. Now let’s broaden our perspective and delve deeper into the Hospital industry. Post Covid, people understood the significance of having adequate healthcare infrastructure. Hospitals play a pivotal role in providing essential services. In this blog, we shall understand the key performance indicators (KPIs), unique competitive advantages, market sizes, and geographical positioning of different hospitals. This shall aid investors in getting a comprehensive overview of the hospital sector.

Market Size and Growth Potential:

The Indian healthcare industry is estimated to be around Rs.5.5 to Rs.5.7 trillion in FY23, driven by increasing insurance coverage, higher requirement for surgeries, and outpatient services (OPD), along with an expanding Average Revenue Per Occupied Bed (ARPOB) and growth in medical tourism.

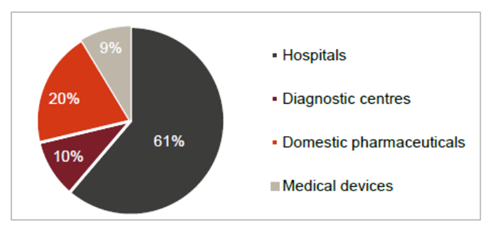

Structure of the Indian healthcare industry:

(Source: Jupiter Hospitals DRHP, Crisil)

In the healthcare market, In-Patient Department (IPD) services are expected to constitute nearly 70% of the value, while Out-Patient Department (OPD) services make up the rest, despite OPD having higher volumes.

Private sector involvement in healthcare is dominant due to low government spending on healthcare infrastructure. Private players are expected to increase their share from 60% in FY18 to almost 70% in FY27.

The healthcare industry is projected to grow at a CAGR of 10% to 12% from FY22 to FY27, reaching around Rs.8.6 trillion by FY27.

Factors contributing to this growth include long-term structural factors, increased focus from the government (e.g., PMJAY and Ayushman Bharat schemes), rising lifestyle-related ailments, medical tourism, growing incomes, and changing demographics.

Government initiatives, such as the creation of Health and Wellness Centers under Ayushman Bharat, aim to strengthen primary and secondary healthcare infrastructure. However, private sector expansion remains crucial until government infrastructure is adequately established.

Hospital Segmentation:

Classification of hospitals based on services offered -

1. Primary Care / Dispensaries: These are basic clinics that provide routine check-ups and cover minor medical issues. These act as the first contacts in healthcare that refer serious cases for secondary care.

2. Secondary Care: These are general hospitals that treat common ailments within a limited area.

3. Specialty Hospitals: These focus on specific medical areas. E.g. Tata Cancer Hospital, Sancheti Hospital in Pune (Orthopedics), HCG (Cancer care).

4. Multi-specialty Tertiary Care Hospitals: These Hospitals offer comprehensive services covering various specialties. They can handle complex cases and can draw patients from across regions. (E.g. Fortis, Max, Nanavati).

(Source: MoneyWorks4Me Research)

Key Tracking Variables:

Given below is the typical cost structure for a hospital:

(Source: Jupiter Hospitals DRHP)

As capital costs are significant in building hospitals due to land costs, the most imperative part that affects hospital profitability is getting volumes. Geographical edge gives a lot of visibility for the same. Post getting the requisite volumes, the focus shifts to increasing throughput in the same bed capacity. Charges that patients pay for surgery, which is a one-day thing, are much higher than the charge they pay for the stay in the hospital (~4-6 days). Thus, decreasing the required number of days of stay for the patient shall mean more surgeries and higher revenue. As profit-motivated as it sounds, this mentality also saves patients the costs of staying for those extra days.

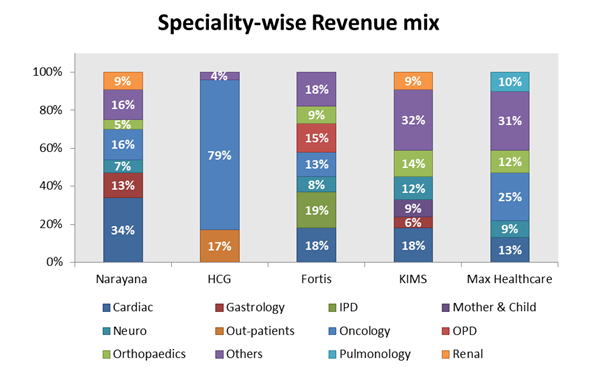

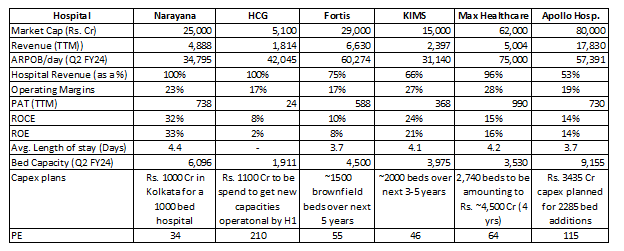

Details of major listed hospitals:

(Source: MoneyWorks4Me Research)

Companies mentioned above trade at significantly different price multiples because of the segments they cater to and the phase of growth they are going through. PE multiple for HCG looks high as it is a small player and is in an expansionary mode. Max Healthcare operates in Urban centric areas which is reflected in its ARPOB and thus can command a higher PE multiple. Apollo Hospitals get 53% of revenues from hospital services whereas 40% from Pharmacy chains and 7% from Diagnostic services. It operating margins are 19% in the hospital segment and -4% in the Pharmacy segment, thus the PAT was low in the current year.

Geographical Positioning:

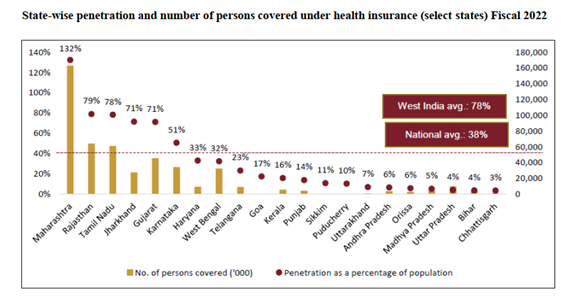

It is important to understand the geographical mix of hospitals as it significantly affects their pricing power. Apart from income level, insurance penetration also significantly impacts pricing. As seen from the below chart, Health insurance coverage is significantly tilted towards specific states, especially the West. Thus, having a significant presence in the Western regions gives higher visibility of patient footfall, helps in capability building by better availability of specialized doctors and thus affects pricing.

(Source: Jupiter Hospitals DRHP, Crisil, UIDAI)

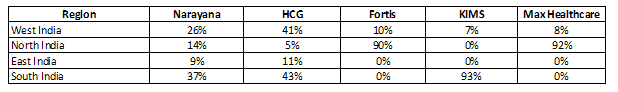

The geographical concentration of Hospitals is as below:

(Source: MoneyWorks4Me Research)

Conclusion:

In conclusion, each hospital operates within a unique landscape and places itself to cater to a distinct patient base, and faces its own specific challenges. Investing in the healthcare sector requires a comprehensive understanding of the competitive edge, effective addressable market, and geographical positioning of each company. By analyzing these factors, investors can make informed investment decisions and track the company's performance effectively. We are interested in the Indian Healthcare theme and have recommended investment in hospital and diagnostic companies.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: