At some point, we've all indulged in a slice of pizza or ate a burger from a Quick-Service Restaurant (QSR). While we've pondered over recipes, have we ever delved into their business model or their worth in the market? In this blog, let's unravel the Indian QSR scene, dissect their strategies, explore the key metrics defining their business, and uncover what growth prospects are baked into their valuation.

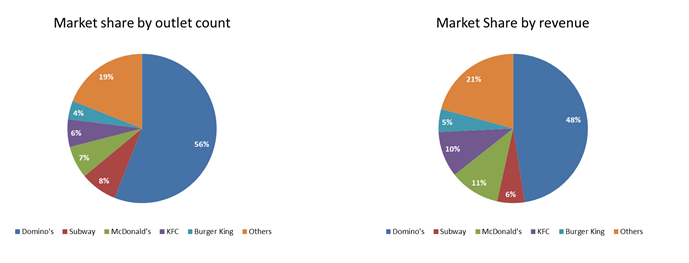

In India, the QSR segment is dominated by international players such as McDonald’s (Westlife Foodworld), Burger King (Restaurant Brands Asia), Dominos (Jubilant Foodworks), KFC, Pizza Hut (Devyani International, Sapphire Foods), and the likes.

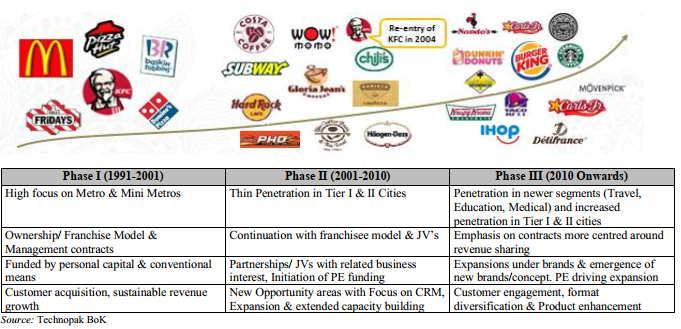

The QSR market in India has evolved and has gone through many phases during the last three decades. The transition phase of the chain market can be divided into 3 stages as set out in the table below:

McDonald's, Domino's Pizza, KFC, Pizza Hut, and Burger King, these global titans have carved their niche in India's QSR domain by implementing the following steps:

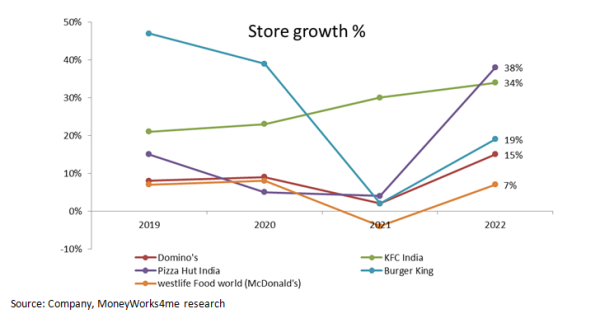

Store Networks: These players have rapidly expanded their footprints across India's urban and semi-urban landscapes. The focus has been on establishing a strong physical presence, with multiple outlets in high-traffic locations.

Marketing & Localization: Understanding local tastes and preferences, global players have adeptly tailored their menus. From spiced-up burgers to Indian-flavored pizzas, these adaptations cater to the diverse Indian palate. Some have also ventured into healthier menus to cater to changing consumer preferences.

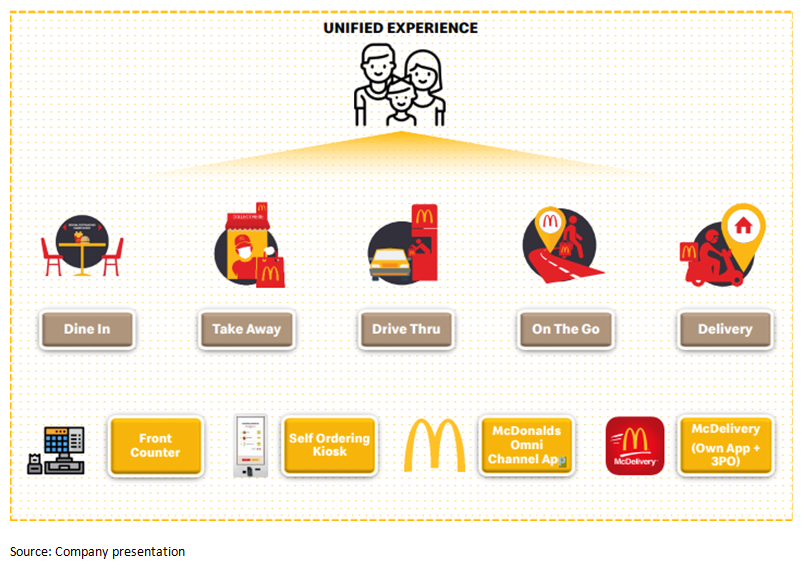

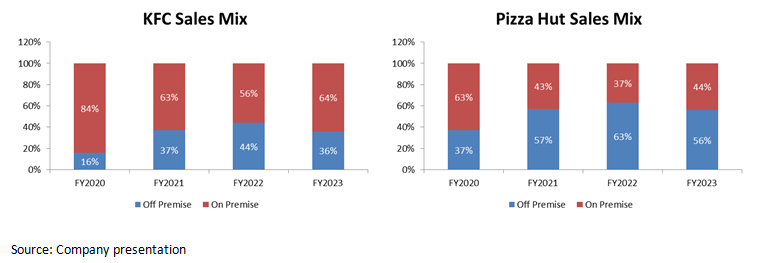

Delivery & Digitalization: Embracing technology, these QSRs have leveraged online ordering platforms, apps, and efficient delivery systems, providing convenience to consumers.

Cloud Kitchens & Delivery Focus: With the rise of cloud kitchens and delivery-based models, several Indian QSRs have optimized their operations. By focusing on delivery rather than dine-in experiences, they've tapped into the growing trend of convenience.

When diving into the Quick-Service Restaurant (QSR) segment, the following are the vital parameters worth exploring and analyzing:

1. Store addition: Key driver for revenue growth

Expanding store networks is the lifeblood of Quick-Service Restaurants (QSRs) in India, driving their growth and reach across the diverse landscape of the country. It's all about strategically planting flags in busy city centres, buzzing neighbourhoods, and even quieter corners where people crave a quick bite.

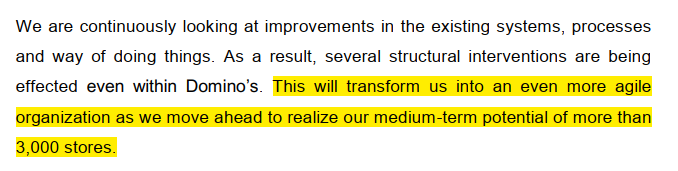

Aggressive store addition plans:

Jubilant Foodworks Ltd (Q2FY24 earning call)

Devyani International Ltd ((Q2FY24 earning call)

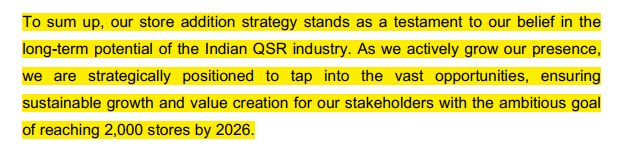

2. Same Store Sales Growth (SSSG): The Barometer of QSR Performance

This metric evaluates the organic growth of QSRs, reflecting their ability to retain and attract customers to existing stores. It's a pivotal indicator of a brand's strength. This metric serves as a fundamental indicator, illuminating a brand's resilience and performance trajectory within the market.

Despite aggressive expansions, many Indian QSRs have faced challenges with declining same-store sales growth. Factors contributing to this decline include market saturation in some areas, increased competition, and changing consumer preferences for healthier options.

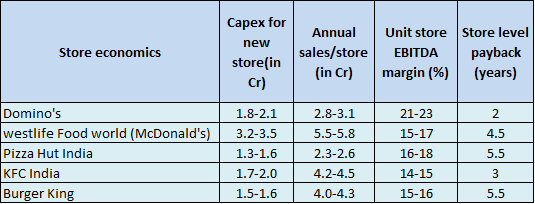

3. Store economics

In the competitive landscape of quick-service restaurants (QSRs) in India, store economics play a pivotal role in determining the profitability and viability of each chain's expansion strategy. Examining the capital expenditure (Capex) required for new store setups reveals varying investment ranges across major players. Domino's leads with a Capex range of Rs. 1.8-2.1 Cr, while McDonald's requires a higher investment of Rs. 3.2-3.5 Cr. However, these differences in investment are met with corresponding variations in anticipated annual sales per store. McDonald's boasts higher sales in the range of Rs. 5.5-5.8 Cr per store annually, surpassing Domino's range of Rs. 2.8-3.1 Cr. Despite lower Capex, Domino's achieves an impressive unit store EBITDA margin of 21-23%, while McDonald's maintains a margin of 15-17%.

Interestingly, this financial analysis also highlights diverse payback periods for new stores, with Domino's and KFC demonstrating shorter payback periods of 2 and 3 years, respectively, compared to Pizza Hut and Burger King, which face longer payback periods of 5.5 years. These metrics underline the intricate balance between investment, revenue generation, and profitability within the QSR sector, influencing strategic decisions in expansion and operational management for each chain.

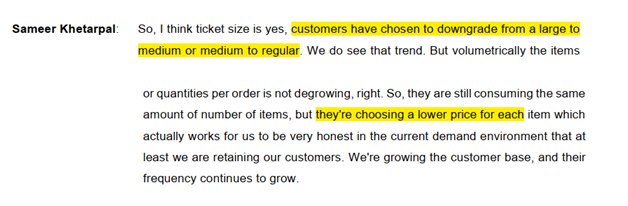

4. Average Ticket Size

Understanding the average amount spent by customers is crucial for revenue and profitability analysis. It helps in strategizing menu pricing and marketing campaigns. Additionally, the intense price competition among QSRs has impacted margins, affecting the same-store sales growth negatively. As consumers become more value-conscious, maintaining growth in existing stores has proven to be a hurdle for several players. For instance, in the most recent earnings call (Q2FY24), Sameer Khetarpal, the CEO of Jubilant FoodWorks, highlighted the following points:

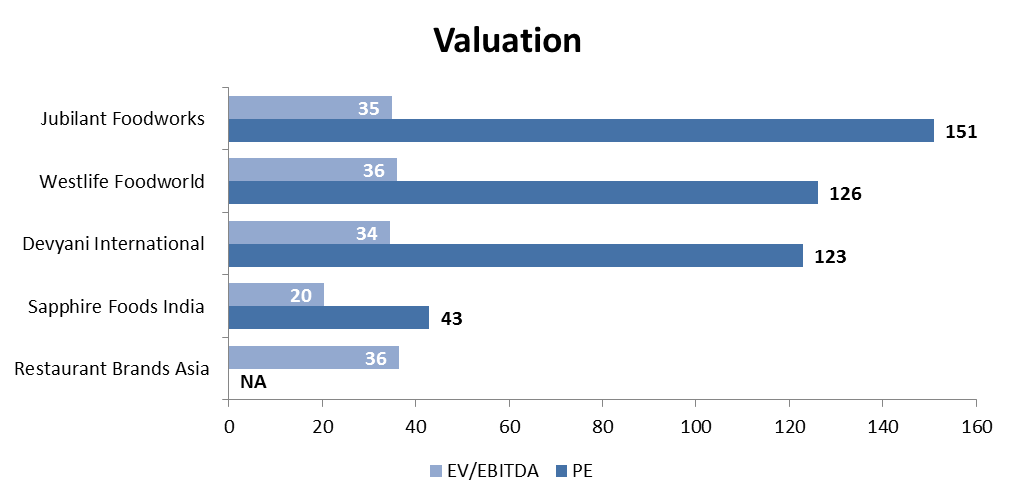

High Growth Embedded in Valuations

The quick-service restaurant (QSR) sector in India heavily relies on the broader narrative of the country's rapidly growing ecosystem. This momentum stems from various factors, including the surge in internet and mobile usage, the country's youthful population, diverse demographics, and the increasing emphasis on hygiene preferences. Collectively, these elements serve as driving forces behind the nationwide expansion and integration of QSRs.

Performing a reverse discounted cash flow (DCF) for Jubilant FoodWorks (Domino’s) using a 3-year average Price-to-Earnings (PE) ratio as the exit PE after 10 years reveals an implied earnings growth of ~16%. This indicates that the market is valuing these companies with high growth expectations, considering their aggressive expansion plans and potential for dominating the market.

MoneyWorks4me research; values as on 24 Nov. 23

The decrease in same-store sales growth presents a significant challenge to these anticipated expectations. It's crucial for investors to evaluate whether the growth already factored into valuations is sustainable or merely a short-term phase influenced by the ongoing expansion strategies. Understanding the underlying factors contributing to this decline and discerning its potential long-term impact is essential for investors to make informed decisions regarding their investments in this sector.

Conclusion: Balancing Expansion, Growth, and Market Realities

The quick-service restaurant (QSR) sector in India has not only pleased the taste buds of millions but has also enticed investors aiming to be part of this fast-food trend. With its flexibility in adapting to evolving trends, catering to diverse preferences, and embracing digital advancements, India's QSR landscape is poised to maintain its momentum. While the industry demonstrates ambitious expansion strategies and promising growth prospects (factored into their prices), it grapples with challenges concerning same-store sales growth and operational efficiencies that necessitate attention.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: