Inox India Limited IPO Details:

Estimated Pre-listing Market Cap:~Rs. 5,940 Cr

IPO Date: 14th December to 18th December

Total shares: ~9.07 Cr

Price band: Rs. 627 - Rs. 660 per share

IPO Issue Size: ~ Rs. 1,459 Cr

Lot Size: 22 shares and multiples thereof

Purpose of Issue: Offer for Sale

About Inox India Limited:

INOX India Limited was established in 1976 and has more than 30 years of experience in the development, design, manufacture and installation of equipment and systems for cryogenic conditions. The company's offerings include standard cryogenic tanks and equipment, beverage drums, customised technologies, equipment and solutions, and large-scale turnkey projects used in various industries such as industrial gases, liquefied natural gas (LNG), green hydrogen, energy, steel, medical and healthcare, chemicals and fertilizers, aerospace, pharmaceuticals, and construction. In addition, the company manufactures a range of cryogenic systems that are used in scientific research projects worldwide.

Industry

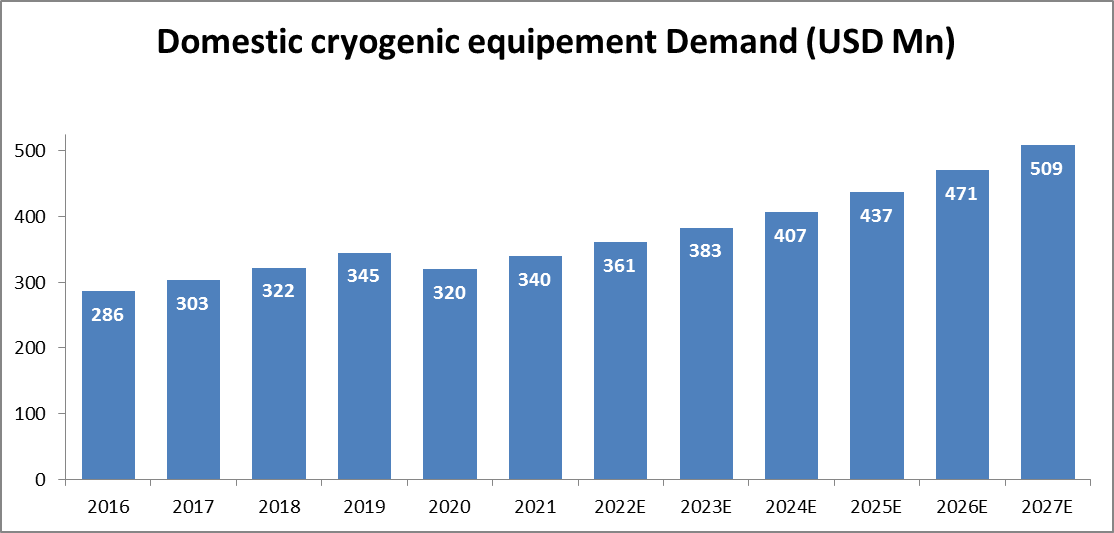

The Indian cryogenic equipment market size was estimated to be USD 340 bn in CY21. The demand for cryogenic equipment in India grew at a steady CAGR of 6.5 % between CY16-19. The lockdown and travel restrictions resulting from the COVID-19 pandemic saw the global demand growth for cryogenic equipment stall for two years between CY19-21. Going forward, demand for cryogenic equipment in India is expected to grow at a CAGR of 7.1% between CY22-27. The growth is expected to be driven by an increase in industrial output, an increase in investments in the electronics and space sectors and a shift towards cleaner fuel sources such as LNG and hydrogen in the industrial and transport sector.

Source: Company Data, Moneyworks4me Research)

Business Model

Inox India designs, manufactures and installs cryogenic storage, distribution and transportation equipment and systems (both standard and engineered for customers). Their equipment and systems are used in industries such as energy, industrial gases, LNG and LCNG steel, medical and healthcare, chemicals and fertilizers, aviation and aerospace, pharmaceuticals and construction.

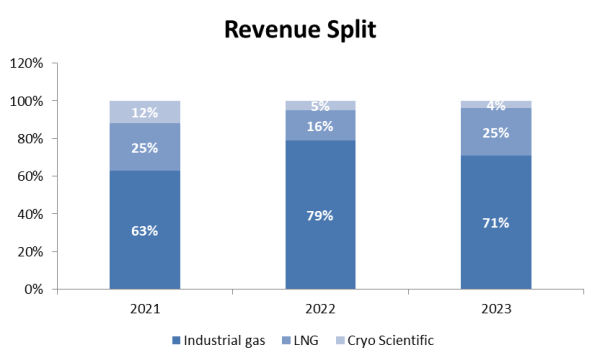

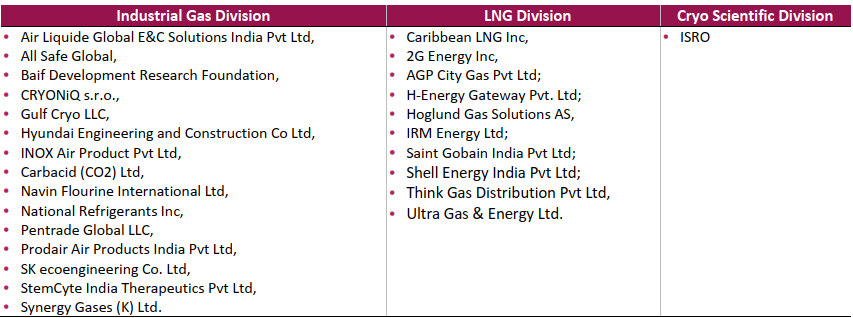

The company’s business is comprised of 3 divisions: Industrial Gas, LNG and Cryo Scientific

Industrial Gas

In the Industrial Gas Division, the company design, manufacture, supply and install storage tanks, transport tanks, microbulk units, vaporizers, cryo bio tanks, refrigerant cylinders, and beverage kegs. Their solutions focus on cryogenic tanks and systems for liquid industrial gases including liquid hydrogen, liquid nitrogen, liquid oxygen, liquid argon, liquid carbon dioxide, LNG, and ethylene oxide.

LNG Division

LNG division manufactures, supplies and installs standard and engineered equipment for LNG storage, distribution, and transportation as well as small-scale LNG infrastructure solutions suitable for industrial, marine, and automotive applications. LNG plants are typically located near natural gas sources, and LNG is carried in large bulk carriers worldwide to receiving terminals located in different countries. Their product range starts from taking the cryogenic LNG at the receiving terminal for small-scale and mobile users to transportation and then distribution to the end-user.

Cryo Scientific Division

The company’s Cryo Scientific Division supplies specialized engineered equipment to support scientific applications. Their Cryo Scientific Division offers product development initiatives, applications, and turnkey solutions for scientific and industrial research. Their activities are focused on satellite and launch facilities, cryogenic propulsion systems and research and fusion and superconductivity.

(Source: Company Data, Moneyworks4me Research)

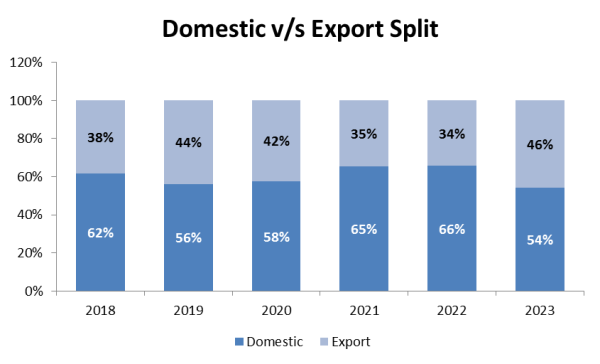

Inox India has built a strong international customer base. Currently, they are exporting their products and delivering their services to 66 countries. Some of the key geographies for their products and services include the United States, Saudi Arabia, the Netherlands, Brazil, Korea, the United Arab Emirates, Australia, and Bangladesh.

(Source: Company Data, Moneyworks4me Research)

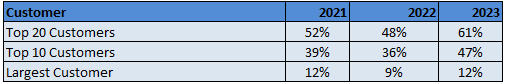

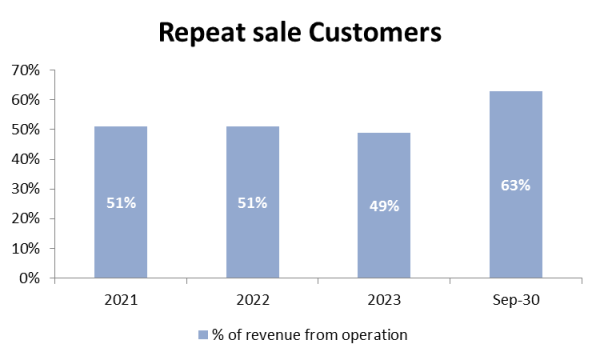

The company has a history of high customer retention. The consolidated revenue from the repeat customers is as follows:

(Source: Company Data, Moneyworks4me Research)

Key Customers:

(Source: Company Data, Moneyworks4me Research)

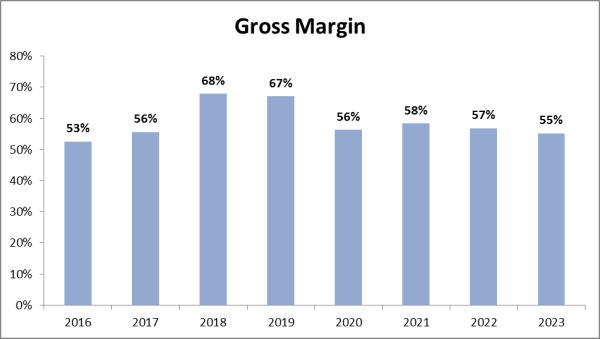

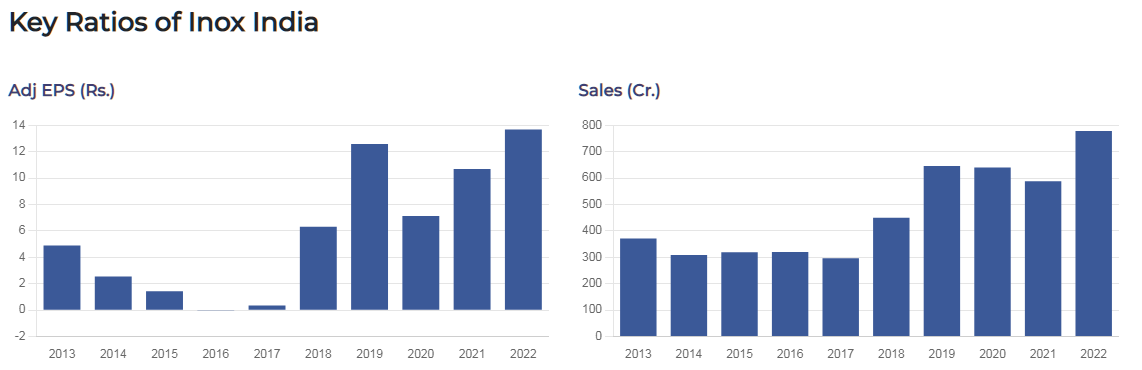

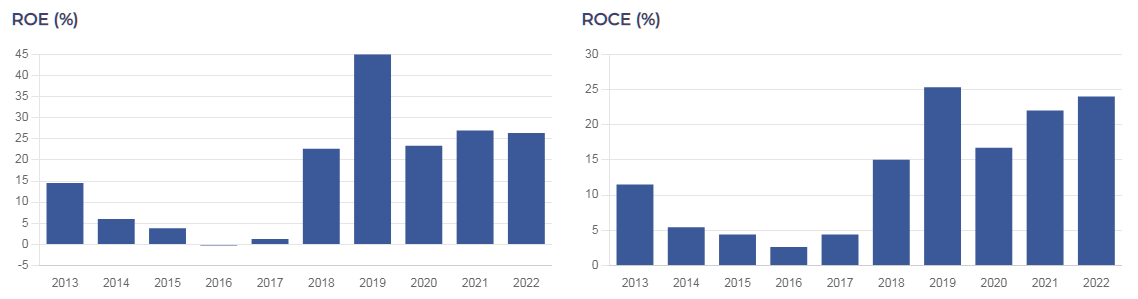

Financials

(Source: Company Data, Moneyworks4me Research)

The objective of the issue

The issue is entirely an offer for the sale of 2.21 crore shares.

Risk Factors

- Cost and availability of raw materials: Inox India financial condition and results of operations are significantly impacted by the availability and cost of major raw materials and components, particularly aluminum products, stainless steel products, palladium oxide, carbon steel products, valves and gauges and fabricated metal components. Volatility in commodity prices can significantly affect raw material costs.

(Source: Company Data, Moneyworks4me Research)

- Customer Concentration: The company has a high customer concentration risk. In FY23 top 20 customers accounted for ~61% of the revenue.

Management

Pavan Kumar Jain is the Promoter, Chairman, and Non-Executive Director of the company. He has been associated with the company since 1979. He has approximately 30 years of experience in the cryogenic engineering and high vacuum technology industry.

Siddharth Jain is the Promoter and non-executive Director (Non-Independent) of the company. He has been associated with the company since 2004. He has ~18 years of experience in the cryogenic engineering and high vacuum technology industry.

Parag Kulkarni is the Executive Director of the company. He has been associated with the company since 1992. He has approximately 30 years of experience in the cryogenic engineering and high vacuum technology industry.

Ishita Jain is the Non-Executive Director of the company. She has been associated with the company since 2021.

Valuation

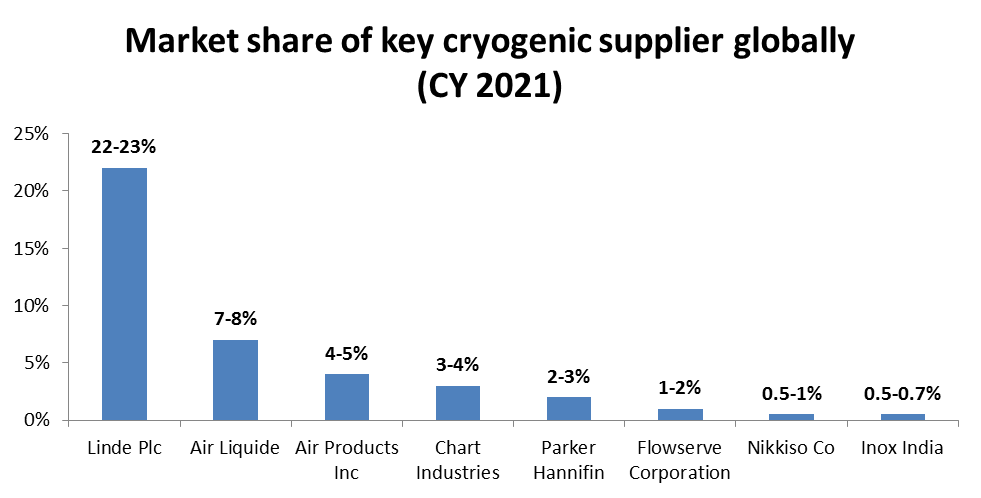

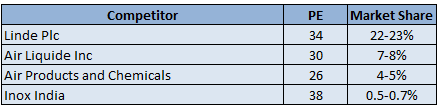

A comparative analysis of Inox India's trailing twelve-month Price-Earnings ratio against global counterparts suggests an apparent overvaluation.

Opinion:

The surge in demand for cryogenic equipment worldwide is propelled by the escalating need for cleaner energy sources like LNG and hydrogen, in line with the global initiative to curtail carbon emissions from traditional energy reservoirs. Operating in the cryogenic industry necessitates specialized handling and technologically advanced solutions, making it a sector with high entry barriers.

Inox India is strategically positioned to harness this potential, boasting a global market share of 0.5-0.7% among cryogenic equipment suppliers. However, the current IPO price makes us uncomfortable regarding valuation. A comparative analysis of Inox India's trailing twelve-month Price-Earnings ratio against global counterparts suggests an apparent overvaluation. Additionally, the entire issue being offered for sale prompts us to advise against participation in this offering. Investors can avoid this IPO for subscription.

Recommendation: Avoid, Expensive player in niche industry

Inox India Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | Dec 14, 2023 |

| IPO Close Date | Dec 18, 2023 |

| Basis of Allotment Date | Dec 19, 2023 |

| Refunds Initiation | Dec 20, 2023 |

| A credit of Shares to Demat Account | Dec 20, 2023 |

| IPO Listing Date | Dec 21, 2023 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 22 | Rs. 14,520 |

| Maximum | 13 | 286 | Rs. 188,760 |

Inox India Limited IPO FAQs:

When will the Inox India Ltd IPO open?

Inox India IPO will open for subscription on Thursday, 14th December 2023, and closes on Monday 18th December 2023.

What is the price band of Inox India Ltd IPO?

The price band for Inox India Ltd IPO is Rs. 627-660/share.

What is the lot size for the Inox India Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 22 shares, up to a maximum of 13 lots i.e. Rs. 1,88,760/-.

What is the issue size of Inox India Ltd IPO?

The total issue size is ~ Rs. 1,459 Cr.

When will the basis of allotment be out?

Allotment will be finalized on December 19th and refunds will be initiated by December 20th. Shares allotment will be credited in Demat accounts by December 20th.

What is the listing date of Inox India Ltd’s IPO?

The tentative listing date of the Inox India IPO is December 21st, 2023.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: