Buy stocks having low Price/Book Value (P/BV), they will give you better returns! – You’ve heard this time and again, right? Book value is the total value available to the shareholders if the company is liquidated. So, if a stock is quoting at less than book value itself, isn’t it a great bargain? The logic here is that over time such stocks can be expected to at least quote at their book values.

Sounds logical, so why are we calling this a myth?

To understand this let’s look at some examples. Given below is a list of companies’ along with their corresponding P/BV and stock prices at the end of 2003 and 2010.

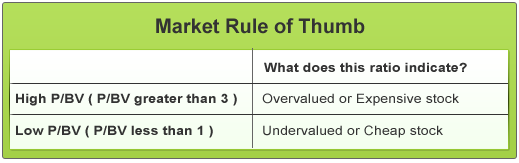

Going by the market rule of thumb, we would have invested in MTNL, Indage Vintners, and Cinevistaas in 2003 as they were trading below their corresponding book values. Let’s take a look at what our situation would be today.

Seven years later, in 2010, we would have been in losses in all of these investments as can been seen from the table. On the other hand investing in companies with high P/BV like Cadila Healthcare, Colgate Palmolive, and Nestle India, would have yielded positive returns.

Baffled by the data? Do not be. These were handpicked cases by us. In fact, it is quite possible that investing in low P/BV stocks can give you good returns and you can also find examples to prove this. What we’re trying to say however, is that we cannot invest in a stock just because it is a low P/BV stock! We need to analyse the stock further, without fail!

First, let’s understand why some stocks trade at low P/BV

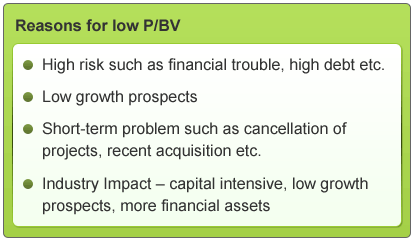

There are many stocks that trade below their book values because of their fundamentals. Many times the stock trades at low P/BV because of some financial troubles, a history of frauds, high debt, etc. All these increase the possibility of the company going out of business. For instance, Indage Vintners is a highly debt ridden company. The company raised substantial amount of debt for three acquisitions and is currently facing problems in restructuring its debt!

There are many stocks that trade below their book values because of their fundamentals. Many times the stock trades at low P/BV because of some financial troubles, a history of frauds, high debt, etc. All these increase the possibility of the company going out of business. For instance, Indage Vintners is a highly debt ridden company. The company raised substantial amount of debt for three acquisitions and is currently facing problems in restructuring its debt!

One of the most common reasons for firms trading at low P/BV is their low growth prospects indicated by their low returns on equity; this trend is also expected to continue in the future. In such cases the low P/BV may be well justified as these stocks won’t give investors much returns. This was the the case for MTNL and Cinevistaas which witnessed a declining trend in ROE from 2003 to 2010.

Sometimes, a low P/BV could be the result of a short-term problem like cancellation of projects. Also, recent acquisitions may increase the book value and lower the P/BV, because the new assets go on the balance sheet at the full price paid. However, a huge part of the book value may be in goodwill or intangibles. In this case it is prudent to subtract goodwill from book value, resulting in a “tangible book value” and thereby giving a more meaningful P/BV ratio.

A low P/BV can also occur because the industry at large has a low P/BV. As with most ratios, be aware that P/BV varies by industry. Industries that require higher infrastructure capital such as shipping industries, industries that have most of the assets which are financial in nature such as banking and finance industries, usually trade at low P/BV. Also, industries with low growth prospects tend to trade at lower PBV for e.g. textile industry. Whereas, industries having more intangible assets and those considered to be in the growth industries e.g. IT and Biotech will generally trade at higher P/BV. For example, the book value of Infosys will not factor in the intangible value of its intellectual assets. Such companies can have high P/BV ratios and still be good investments. The examples given above viz. Cadila Healthcare, Colgate Palmolive, and Nestle India fit the bill here.

Once we analyse the stock fundamentals and confirm that our stock does not fall into any of the above categories, we can go ahead and use the P/BV valuation metric.

Using the P/BV valuation metric

You can use P/BV ratio to value banks and finance companies. As most assets and liabilities of banks are constantly valued at market values, P/BV for these companies gives a fairer picture on the value of assets.

A low P/BV stock with a high ROE can prove to be a good investment. We should eliminate low P/BV stocks with low ROE from our list, as these stocks may well deserve to trade at lower P/BV.

While evaluating the industry P/BV, it is better to calculate the median P/BV for the industry instead of an average P/BV. The average P/BV gets affected by extremely high or low values whereas the median P/BV does not and hence it gives a better picture.

Comparing a company P/BV to the index average P/BV will not give us a good measure of value. As in the case of PE ratio, it makes much more sense to compare stocks P/BV to its peers. Also, looking at the past trends of P/BV for the company would give us a fairer picture.

Do you know of any such low P/BV stocks with good fundamentals & growth prospects?

If you liked what you read and would like to put it in to practice Register at MoneyWorks4me.com. You will get amazing FREE features that will enable you to invest in Stocks and Mutual Funds the right way.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: