Stanley Lifestyles Ltd IPO Details:

Opening Date: June 21, 2024

Closing Date: June 25, 2024

Listing: BSE and NSE

Number of Shares: 1.45 Cr shares

Face Value: Rs 2 per share

Price Band: Rs 351-369 per equity share

Issue Size: Rs 537.02 Cr

About the Stanley Lifestyles Ltd:

Stanley is an Indian super-premium and luxury furniture brand that handles the manufacturing and retailing aspects of operations. It is the 4th largest player in the home furniture segment in India in terms of revenue. Stanley is one of the few Indian companies present across various price points within the super-premium, luxury and ultra-luxury furniture segment. The company retails their furniture products under the “Stanley” brand. It has a 6.25% market share in the luxury furniture market in India.

Stanley commenced operations by providing car seat leather upholstery (soft padded furniture) services for leading global automotive brands and later transitioned to luxury furniture retail by opening its first retail store in Bengaluru, Karnataka in the year 2011. Stanley transformed from sales driven model into a comprehensive provider of home solutions. Stanley designs, manufactures and retails its products through its network of company owned & operated (COCO) and franchise owned & operated (FOFO) stores with 38 COCO and 24 FOFO stores across 25 cities in the country.

Industry Overview:

The Furnishing Market is directly linked to the growth in real estate. Premium/ Luxury house sales are witnessing a surge in sales due to rising disposable income and increasing number of HNIs (High Net-worth Individuals) and UHNI (Ultra High Net-worth Individuals). Since the year 2019 till 2023, Luxury and Premium housing units witnessed a growth rate of 17% and 25% respectively. In FY21, this market was worth about US$ 10 billion and was estimated to be worth US$19 billion in FY23. This is forecasted to increase 27% CAGR to reach US$49 billion by FY27.

In India, organised sales of furniture & home goods are done primarily through 4 channels:

- Exclusive Brand Outlets, which exclusively sell products from a specific brand or portfolio

- Multi Brand Outlets, which sell products from multiple brands across various categories

- Experience centres, which offer customers immersive and interactive experiences with the products

- Online: Brands have started selling through their own websites or through online marketplaces such as Amazon.

In FY21, the organised market share of the total furniture and home goods market was 23% which has increased to 26% in FY23 and is expected to be 35% of the total market by FY27, which shows an annual growth rate of 34%. This will be driven primarily due to the changing consumption patterns of wealthy and aspirational households, who now prefer products with better quality, comfort, designs and are prepared to spend more to be in sync with the latest trends. The contribution of branded furniture in the overall market has increased from ~6% in FY17 to ~12% in FY23 and is expected to hit ~15-20% by FY27.

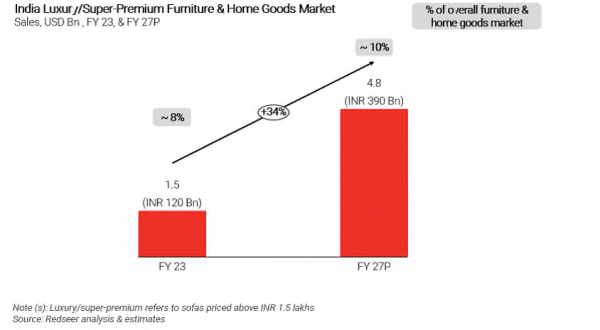

The luxury/ super-premium furniture and home goods market is estimated to be worth US$1.5 billion in FY23 and is projected to triple to US$4.8 billion by FY27.

Challenges in the luxury/ super-premium furniture market:

- A fragmented market characterised by large number of small scale and independent players, which includes individual artisans, craftsmen and boutique manufacturers, thus resulting in a lack of a centralized and organized industry framework.

- Limited brand Consistency, which exhibits greater variation in the product offerings.

- Limited Retail Presence: The products in the luxury/ super-premium segment are offered primarily through exclusive showrooms, which are often owned and operated by the brands themselves or by a small number of authorized dealers, thus leading to a restricted retail presence further adding to the unorganized nature of the market.

- Large number of small importers: A large number of small importers are present in the country which operate on a smaller scale and contribute to the overall unorganized nature of the market.

Key Competitors:

Stanley competes with Boconcept, Roche Bobois, Poltrona Frau in the Ultra-Luxury segment, with Royal Zig, Mobel Grace and West elm in the Luxury segment and Dash Square, Vivana, Mor Décor, Natuzzi and Sarita Handa in the Super-Premium segment.

Key Segments:

The company operates in mainly 2 segments of manufacturing furniture under which it has multiple product lines, and automotive upholstery solutions.

Primary Products under furniture:

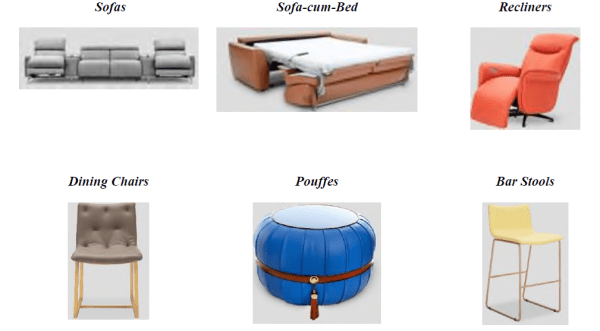

1. Seating (~56% of revenues): Under this division, Stanley manufactures and sells seating products, with majority of them being customizable according to the consumer’s requirement. These are generally upholstered products.

(Source: RHP)

2. Cased Goods: Cased goods are tables or storage products, generally made of wood offering durability and while keeping its aesthetic functionality. Under this segment, Stanley offers tables and their ancillaries.

(Source: RHP)

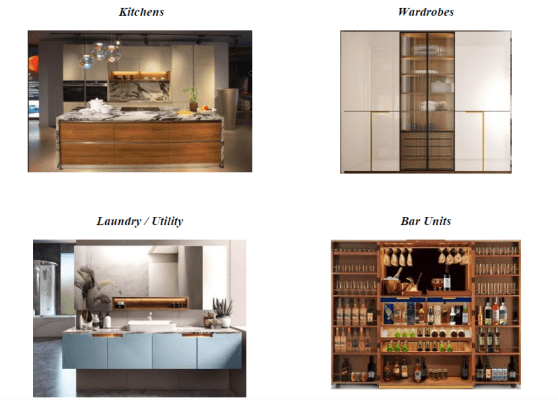

3. Kitchen & Cabinetry: Under this product segment, Stanley offers a variety of materials, finishes and styles for kitchen and cabinetry products.

(Source: RHP)

4. Mattresses & Beds: Stanley manufactures and sells a range of bed frames and mattresses, with additional accessories such as pillows.

(Source: RHP)

5. Automotive & Others:

Under this product category, Stanley offers upholstery solutions for Global automotive brands like Toyota and also customizes interiors for cars and also offers customized leather products such as shoes.

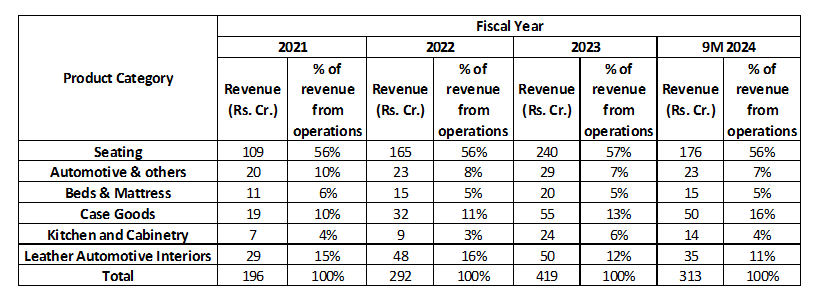

Revenue from these product categories are as follows:

Prices for its products can range between Rs. 50 thousand for a chair to Rs. 20 lakh for a dining table.

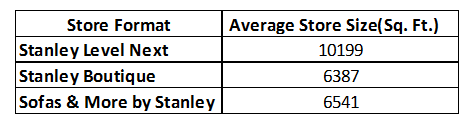

The average sizes of its stores in terms of square feet are as follows:

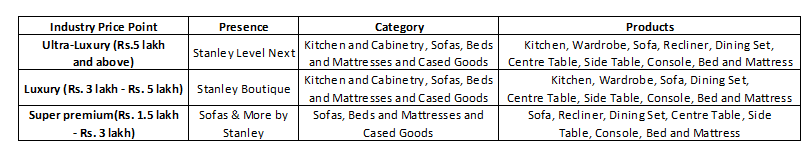

Stanley retails its products in the furniture market primarily through its three format stores, which cater to different segments of the market.  Almost all products under Stanley Level Next and Stanley Boutique are handcrafted. The company has also launched two additional format stores “Stanley Living” for handcrafted shoes, bags and other lifestyle products and “Stanley Living” which is an Anchor Store format that will enable its customers to explore all of the store formats under one roof. The company has 2 manufacturing facilities located in Bengaluru, Karnataka.

Almost all products under Stanley Level Next and Stanley Boutique are handcrafted. The company has also launched two additional format stores “Stanley Living” for handcrafted shoes, bags and other lifestyle products and “Stanley Living” which is an Anchor Store format that will enable its customers to explore all of the store formats under one roof. The company has 2 manufacturing facilities located in Bengaluru, Karnataka.

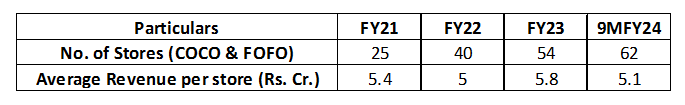

Store count and Revenue per store:

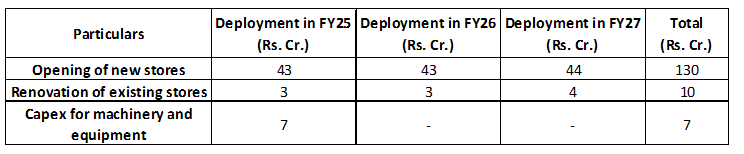

Objects of the offer: Out of the total issue size of Rs. 537 crores, the fresh issue comprises roughly Rs. 200 crores, which the company plans to utilize toward investing in its subsidiaries to open new stores across all three formats, as well as anchor stores and renovation of existing stores. The company also plans to fund its capital expenditure requirements for purchase of new machinery and equipment and to fund other general corporate purposes.

Other selling shareholders are both the promoters (Sunil Suresh and Shubha Sunil), Oman India Joint Investment fund (A private equity Fund) and two individual shareholders, namely Kiran Vuppalapati and Sridevi Vuppalapati

Concerns:

Competitive Intensity: This sector is highly fragmented with little pricing power. According to a report by Indian Furniture Manufacturers Association, there are roughly 45,000+ furniture manufacturers in India, comprising a wide range of manufacturers, ranging from small, family-owned businesses to large, multinational corporations. Also, the competitions from small-scale importers pose a challenge to Stanley.

Geographical concentration: Around 48% of the revenues from retail sales in the B2C business came from Bangalore in FY23 and ~2/3rd of the sales came from Karnataka alone, thus leading to high geographical concentration risk.

High store closures: The company had closed a store in Mumbai as it was not accessible to customers resulting in no profitability and by December 2023, they closed a company-owned and operated Stanley Boutique in Delhi, One COCO Sofas and More in Hyderabad on 31st May 2024 and are in the process of closing one FOFO “Sofas & More” in Bengaluru.

High inventory days and high Cash Conversion Cycle: The Company’s cash conversion cycle stood at a significantly large 185 days as of 31st December 2023, with its inventory days constantly above 200 days.

Financials:

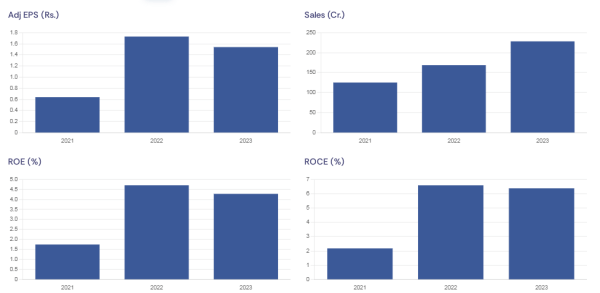

The Company grew its sales by a CAGR of ~46% from Rs. 196 to Rs. 419 crores from FY21 till FY23 and the company had an EBITDA of ~Rs. 30 crores in FY21 which stood at Rs. 83 crores in FY23, representing a CAGR of 67%. PAT increased from Rs. 1 crore to ~Rs. 33 crores in the period from FY21 – FY23.

Key Management Personnel:

Sunil Suresh: He is the Promoter & MD of the company. He passed the S.S.L.C. exams conducted by Karnataka Secondary Education Examination Board. He has been associated with the company since its incorporation in October 2007. Prior to this, he was associated with Stanley Seating, which manufactured seat upholstery for automotive applications.

Shubha Sunil: She is the Co-promoter and Whole Time Director of the Company. She holds a Bachelor's degree in Science from Bangalore University, Karnataka, and has completed her INSEAD Leadership Programme for Senior Executives. She has been associated with the Company as a director since the incorporation of the Company in October 2007.

MoneyWorks4Me Opinion

Stanley Lifestyle operates in a competitive, but fast-growing industry and thus has a huge runway for growth. Stanley is a play on the growing theme of premiumisation for products in India. We like that Stanley has plans to further expand by opening new stores in newer geographies in a cluster model as right now it is majorly focused on Karnataka. The issue is aggressively priced considering a post-issue market cap of Rs. 2,100 Cr for an estimated TTM Revenue / PAT of ~450Cr/40 Cr. The company needs to maintain a strong growth trajectory to justify the valuation. We recommend aggressive investors to subscribe for listing as well as long-term investment.

Recommendation: Subscribe

Stanley Lifestyles Limited IPO Tentative Timetable:

| IPO Activity | Date |

| IPO Open Date | June 21, 2024 |

| IPO Close Date | June 25, 2024 |

| Basis of Allotment Date | June 26, 2024 |

| Refunds Initiation | June 27, 2024 |

| A credit of Shares to Demat Account | June 27, 2024 |

| IPO Listing Date | June 28, 2024 |

Retail Individual Investor IPO Lot Size:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Minimum | 1 | 40 | Rs. 14,760 |

| Maximum | 13 | 520 | Rs. 191,880 |

Stanley Lifestyles Limited IPO FAQs:

When will the Stanley Lifestyles Ltd IPO open?

Stanley Lifestyles Ltd IPO will open for subscription on Friday, 21st June 2024, and closes on Tuesday, 25th June 2024.

What is the price band of Stanley Lifestyles Ltd IPO?

The price band for Stanley Lifestyles Ltd IPO is Rs. 351-369/share.

What is the lot size for the Stanley Lifestyles Ltd IPO?

Retail investors can subscribe to the IPO minimum lot size is 40 shares, up to a maximum of 13 lots i.e. Rs. 1,91,880/-.

What is the issue size of Stanley Lifestyles Ltd IPO?

The total issue size is ~ Rs. 537.02 Cr.

When will the basis of allotment be out?

Allotment will be finalized on June 26th and refunds will be initiated by June 27th. Shares allotment will be credited in Demat accounts by June 27th.

What is the listing date of Stanley Lifestyles Ltd’s IPO?

The tentative listing date of the Stanley Lifestyles Ltd IPO is June 28th, 2024.

What if I do not get the allotment?

If you do not get an allotment of this IPO we recommend you to check out our MoneyWorks4me Core Superstars which helps you build a strong portfolio right away. It offers a Model Portfolio of high-quality stocks Buy/Sell alerts on Quality stocks at a reasonable price and SIP recommendations on stocks. With the help of MoneyWorks4me Core Superstars, you would have picked winners like Asian Paints, Divis Labs, Titan, Pidilite, Cipla, Bharti Airtel, and ICICI Bank.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: