What triggered the new categorization and rationalization of Mutual Fund Schemes?

In October 2017, SEBI issued the rules for categorization and rationalization of Mutual Fund Schemes (MFS). The objective is to make it easier for investors to evaluate options before taking an informed decision. It hopes to do this by having a clear distinction between Funds (their asset allocation and investment strategy etc.) and better uniformity. Further, each AMC can have only one Fund per category. Simply put, you can expect more discipline in Fund Managers sticking to the category rules and better comparisons.

Types of Mutual Funds in India

Choosing a type of Mutual Fund, that is right for you, primarily depends on the following parameters:

- Investment horizon, or how long you intend to hold it

- Risk Appetite

- Investment Goal

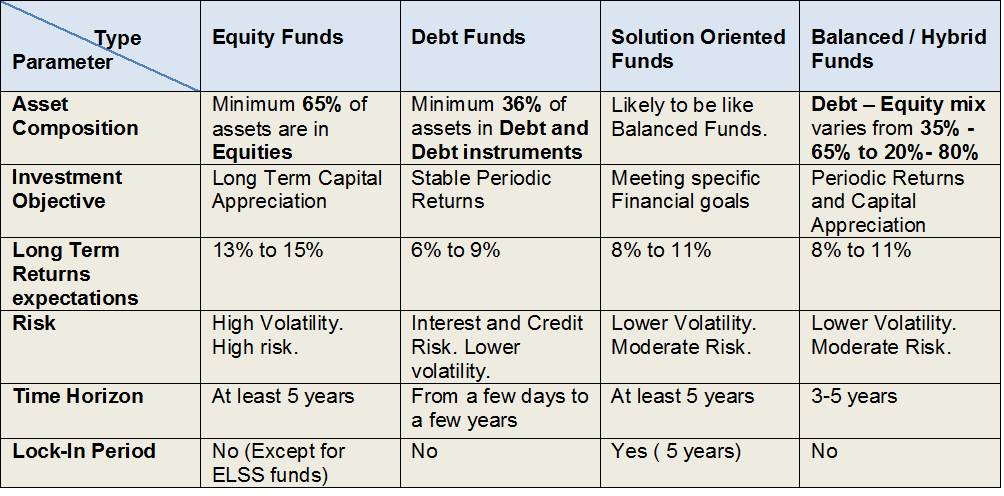

SEBI has classified Funds into 4 broad types – Equity, Debt, Balanced/Hybrid and Solution Oriented.

In the rest of the blog-post, we will cover the different types of Equity and Solution-Oriented MFs.

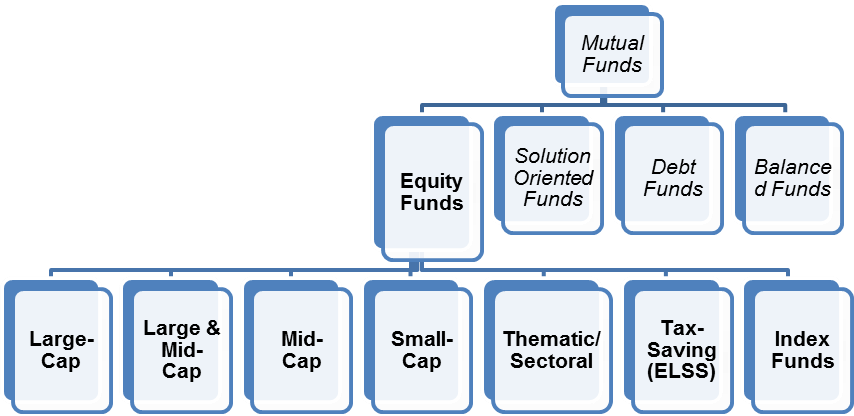

Equity Mutual Funds

These MFs invest the majority (>70%) of their corpus (investor’s money pooled together) in stocks, with an objective of capital growth. Different Fund Managers invest in different stocks based on their outlook on those companies’ future. These are suited for investors with a long-term horizon (usually more than 5 years). These MFs include

- Large-Cap Funds: Invest in Top 100 companies according to average market capitalisation (past 6 months). Investment in Equity & Equity-related instruments of Large-Cap companies is a minimum of 80% of total assets.

- Mid-Cap Funds: Invest in the next 150 (101-250) companies according to average market capitalisation (past 6 months). The minimum investment in Equity & Equity-related instruments of Mid-Cap companies is 65% of total assets.

- Large & Mid-Cap Funds: Minimum investment in Equity & Equity-related instruments of Large-Cap companies is 35% of total assets and minimum investment in Equity & Equity-related instruments of Mid-Cap companies is 35% of total assets.

- Small-Cap Funds: Invest in companies beyond Top 250 according to average market capitalisation (past 6 months). The minimum investment in Equity & Equity-related instruments of Small-Cap companies is 65% of total assets.

- Multi-Cap Funds: Invest in stocks across Large, Mid & Small market cap. The minimum investment in Equity & Equity-related instruments is 65% of total assets.

- Thematic Funds: Invest in stocks from a specific sector. E.g. Healthcare Fund will only invest in Healthcare/Pharma stocks. The minimum investment in Equity & Equity-related instruments of a particular sector/ particular theme is 80% of total assets.

- Index Funds: These Funds replicate/track a particular Index, such as the Sensex or Nifty. The portfolio of such a Fund will have the same stocks, and in the same proportion as the Index. NAVs of such schemes would rise or fall in line with the rise or fall in the Index, though not by exactly the same percentage. The minimum investment in securities of a particular Index (which is being replicated/ tracked) is 95% of total assets.

- Tax-Saving or ELSS Funds: Tax-saving Funds are similar to Multi-Cap MFs. They offer a tax deduction, in addition to capital appreciation. However, unlike other MFs, they have a lock-in period of 3 years i.e. one cannot sell the Fund before 3 years from the investment date. The minimum investment in Equity & Equity-related instruments is 80% of total assets (in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance)

Who should invest in Equity Mutual Funds?

- Equity MFs provide higher returns but come with a lot of volatility. The returns may not be linear like a Fixed Deposit. Hence, only if you have an investment horizon of at least five years or longer, you may pick Equity Mutual Funds.

- Since Equity MFs generate good returns only over the long term, one may invest in these MF for long term goals like child’s education/marriage, retirement, etc.

- One must not invest aggressively in an Equity MF when market valuations are high, as there is a high chance of a drop in value in the short term. We have discussed this topic further in the Diversification of Mutual Funds.

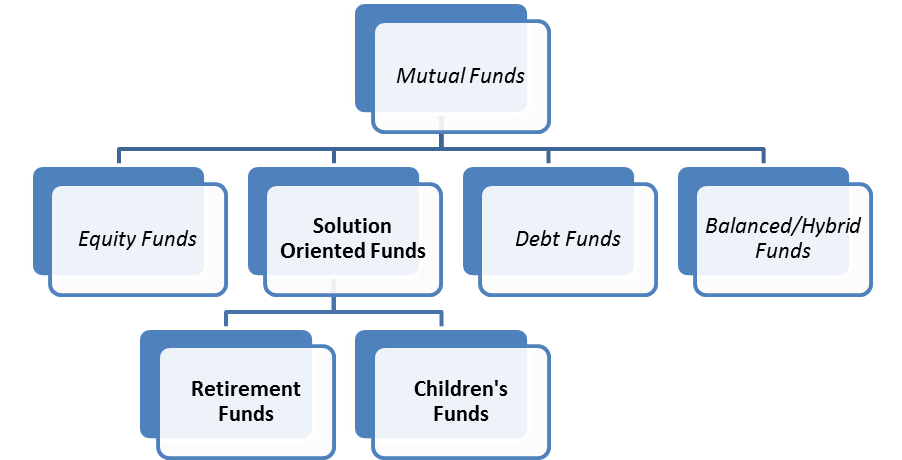

Solution Oriented Funds

Solution Oriented schemes are typically meant for meeting a particular financial goal in life.

These schemes don’t really offer any specific benefit as compared to the Equity Mutual Schemes. The said goals can also be met by redeeming the units of typical Equity MF Scheme (Growth-Option). Though, selling of these traditional schemes is rampant under the guise of best solution to ‘Achieving Financial Goals’, the bitter truth is that they hardly add any value to the portfolio. They also come with a 5 year lock-in.

- Retirement Funds: There are open-ended retirement solution-oriented schemes, having a lock-in of 5 years or till retirement age (whichever is earlier).The Debt-Equity mix is likely to be like that of a Balanced Fund (SEBI circular doesn’t mention the mandate for the asset allocation of these funds).

- Children’s Funds: These are open-ended funds for investment for children, having a lock-in for at least 5 years or till the child attains the age of majority (whichever is earlier). The Debt-Equity mix is likely to be like that of a Balanced Fund (SEBI circular doesn’t mention the mandate for the asset allocation of these funds).

Also Read: "What are the Different Types of DEBT and Balanced Mutual Funds?"

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: