Selection based only on past returns is misleading, inadequate and risky. Misleading, because it has the biases of when you started and how the markets are doing at the time of measuring the performance.

It’s inadequate because it does not tell us how much risk the fund manager is taking and whether it provides meaningful diversification in your portfolio.

It’s risky because funds that give the highest returns today have stocks that are overvalued and hence more likely to correct or stagnate.

So it if not just past returns then how do you select the right mutual fund? We wrote this blog post to give you a better way of selecting and investing in mutual funds and recommend you read it.

The purpose of this post is to answer why you should pay attention to the fund’s portfolio and how it leads to better decisions.

Generating Alpha is now difficult. With SEBI’s new categorization and more strictly defined baskets of stocks from which a fund can pick stocks, it has become even more difficult for an active fund to beat its benchmark.

No, longer can a fund manager outperform the benchmark by picking large portions of his portfolio from outside the fund’s stated category.

We are also entering into the era of shrinking alpha. As the economy develops, security markets become more efficient. The participation of a large number of skilled professionals leads to the closing of the gap between price and value.

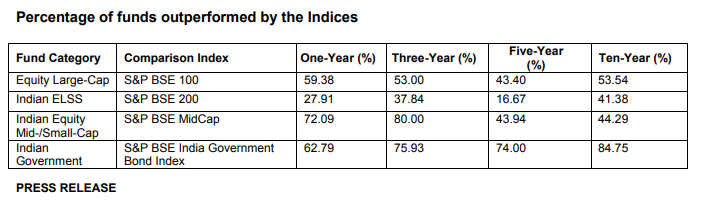

Based on S&P Indices management research1, over the last 5Y & 10Y periods, close to 43.4% & 53.54% Large Cap funds have underperformed their benchmarks. This has come down to nothing less than the toss of a coin to determine which particular fund will outperform in the future.

At the start of the 10Y study, there were 127 large cap funds. Almost 38 funds were either merged or shutdown. So Survivorship bias is just 70%. This implies that even lesser funds would have outperformed the benchmark in reality.

In the mid and small cap on 5Y and 10Y period, 16.67% & 41% have underperformed the benchmark. Though the 5Y record looks quite good, 10Y performance is far from impressive. Even here just 70% of funds survived over the 10Y period. The rest were either merged or liquidated.

Source: http://www.indexologyblog.com/2018/03/28/takeaways-from-the-spiva-india-year-end-2017-scorecard/

So how does an investor have faith investing in actively managed mutual funds when the probability of beating the benchmark has come down to just 50:50?

So should one move to Passive Index Funds which simply tracks the benchmark performance? Probably this may make sense in the near future and even more sense in the medium/long term.

Right now there is still some juice left in actively managed funds. While edge in stock picking is definitely going away, there is still enough room left in factor based investing to beat the benchmark.

A portfolio of stocks having similar characteristics like value or momentum or small cap i.e. factor can still exhibit outperformance in the long term albeit not all at the same time.

There is empirical data2 which supports factor based investing across asset classes and geographies. “Value and Momentum Everywhere” Jun.13, CLIFFORD S. ASNESS, TOBIAS J. MOSKOWITZ, and LASSE HEJE PEDERSEN

Most good funds follow a process and a fund manager has an inclination/expertise to pick stocks having a particular characteristic i.e a factor. If one is able to ascertain the process a fund follows, one can safely diversify into 2-3 such processes and ride them for 10-15 years.

There will be bouts of underperformance in the short term, but over the long term, one can generate returns higher than the benchmark. A fund that sticks to a process irrespective of short term underperformance stands a good chance to beat its benchmark over the long term.

The purpose of studying the fund’s portfolio should not be to outguess the fund manager but assess what is the predominant factor he is relying on and to include at least three factors in your portfolio.

So how does studying the fund’s portfolio help select mutual Funds?

1) Select a fund that is right for your portfolio and thus achieve the right diversification:

While investors understand the importance of diversification they often pile onto recent performers. It often happens that funds following a similar process tend to outperform at the same time.

Like growth, funds tend to do well in rising markets. Many investors end up buying funds having more or less the same set of stocks in their portfolio. This works against diversification.

We recommend that one must diversify across funds with different processes and have a portfolio as different as possible to achieve the benefit of diversification. Knowing underlying stocks in a portfolio helps do this.

You can do a quick check whether your shortlisted fund has significantly different holding than what you hold currently and whether it adds any risk at MoneyWorks4me.com

2) Outperform by Process:

As mentioned above you need to have at least three factors working in your portfolio. To do this you need to determine which particular process/factor a fund follows.

This is done by studying their past and present portfolio holdings and purchase/selling patterns. At MoneyWorks4me, we use our equity research ability to do this.

We do not second guess funds’ future but label it by its process. If we do not find any pattern, we do not assign any label but keep it under observation.

3) Reduce risk by knowing the reasons for past outperformance:

Yes, past performance is important after all it says something about the fund manager’s track record. However, it is important to understand the reasons for past performance.

Random luck could have contributed to outperformance rather than any particular attribute. Hence we check rolling performance rather than point to point performance to remove dumb luck in the short term. Also taking higher risks could have led to higher returns which may be undesirable.

By studying portfolio we try to see if a particular fund, say a large cap fund, has beaten the benchmark by investing in riskier small cap stocks. Market Cap is one measure of risk. At MoneyWorks4me we further categorize companies as Green/Orange/Red based on the past 10 Year performance.

This helps to determine and compare whether past performance came at reasonable and comparable risk. This is only possible for studying present and past portfolio holdings.

Conclusion: Buying any fund based on just past returns may not ensure long term performance, nor buying 5-10 funds ensure your portfolio is diversified. Buying looking at past performance leads to inefficient churning of a portfolio as one would hope from one fund to another chasing performance.

Even while studying past performance better to look at Average Rolling Returns and not just past returns to check how consistently the fund performed.

Studying the portfolio of funds has become extremely important and necessary now than it was in the past. Use this to check if the outperformance was achieved without taking higher risks.

Then ensure you hold or add only those funds that have significantly different stocks than your current portfolio and more importantly follow different processes/factors to deliver outperformance.

1 http://spindices.com/documents/spiva/spiva-india-year-end-2017.pdf

2 http://pages.stern.nyu.edu/~lpederse/papers/ValMomEverywhere.pdf

2http://thebamalliance.com/blog/the-long-term-evidence-on-factor-based-investing/

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Comment Your Thoughts: