Industry Overview

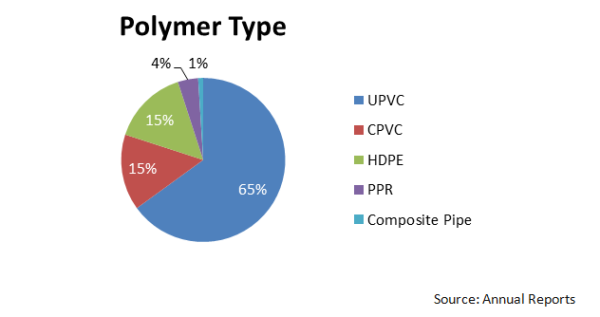

The pipe sector is a vital part of the infrastructure and construction industry, as pipes are used for various applications such as water supply, drainage, sewerage, irrigation, plumbing, oil and gas, fire protection, cable protection, and more. Plastic pipes are made of different types of polymers. The four key types of polymer are unplasticized polyvinyl chloride (UPVC), which represents 65% of industry demand, chlorinated polyvinyl chloride (CPVC) – 15%, HDPE –15%, and polypropylene (PPR) – 4%. Composite pipes, which have a mix of metal and plastic layers, are also used for similar applications.

The choice of material depends on the properties, performance, cost and durability of the pipes for different end-use segments.

Types and Applications

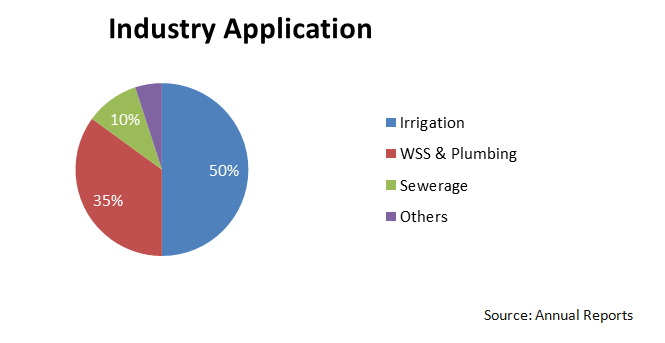

The pipe sector in India can be broadly classified into four types based on its end-use:

a) Agriculture and Irrigation,

b) Plumbing,

c) Sewerage and Drainage, and

d) Industrial.

Each type has different applications and requirements for pipes.

A) Agriculture and Irrigation:

Agriculture and irrigation pipes are used for supplying water to crops and fields. They are also used for drip irrigation systems that conserve water and increase crop yield. Agriculture and irrigation pipes are made from materials such as PVC, HDPE, PE, and metal. The agriculture and irrigation segment accounts for about ~50-65% of the total pipe Consumption in India.

B) Plumbing:

Plumbing pipes are used for water supply and distribution in residential and commercial buildings. They are also used for hot and cold water plumbing systems in bathrooms, kitchens, and other areas. Plumbing pipes are made from materials such as PVC, CPVC, PP, and metal. The plumbing segment accounts for about ~35-40% of the total pipe consumption in India.

C) Sewerage and Drainage:

Sewerage and drainage pipes are used for collecting and disposing of wastewater from buildings and other sources. They are also used for stormwater management and rainwater harvesting systems. Sewerage and drainage pipes are made from materials such as PVC, HDPE, PP, and metal. The sewerage and drainage segment accounts for about ~10 -15% of the total pipe consumption in India.

D) Industrial:

Industrial pipes are used for transporting fluids such as oil, gas, chemicals, steam, and others in various industries such as power generation, petrochemicals, fertilizers, pharmaceuticals, and others. They are also used for fire protection systems in industrial buildings. Industrial pipes are made from materials such as metal, CPVC, PP, and others. The industrial segment accounts for about ~5% of the total pipe consumption in India.

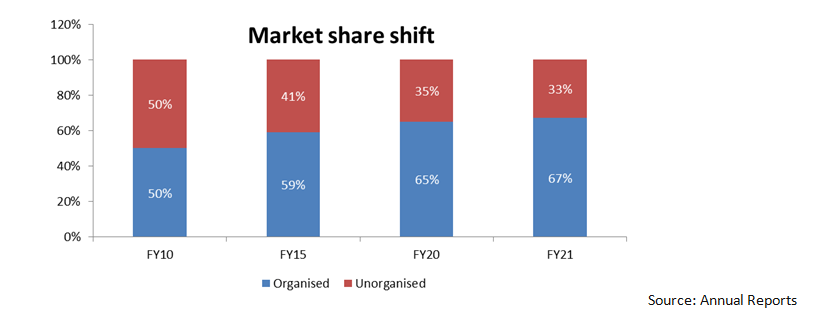

Industry Analysis: Unorganised to Organised Shift

The share of organized players in the piping industry has increased from ~50% in FY10 to ~67% in FY21.

The market share of top-5 organized players has increased from 22% in FY12 to ~43% in FY21.

Demand Drivers for Industry

According to industry reports, per capita consumption of pipes in India is estimated to be around 11 kg per annum, which is much lower than the global average of 17 kg per annum. This indicates a huge potential for growth in the pipe sector in India driven by the rising population, urbanization, income levels, and infrastructure development in the country.

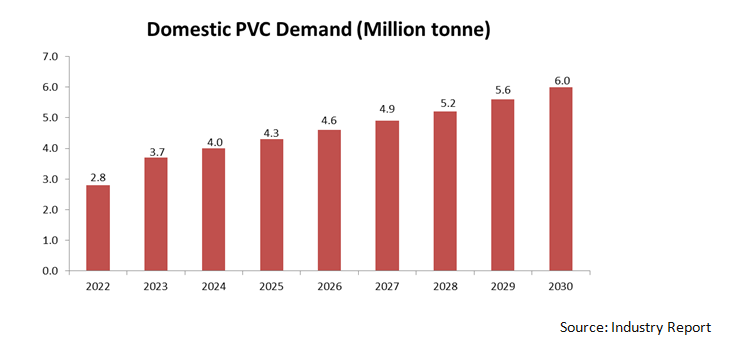

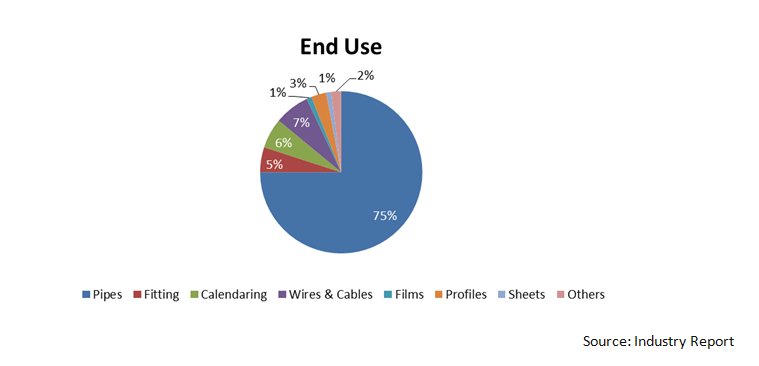

The polyvinyl chloride (PVC) demand in India stood at 3.7 Million Ton Per Annum (MTPA) in 2023 and is expected to reach 6 MTPA by 2031, growing at a CAGR of 6% between 2022 and 2030.

Pipes & fittings form a large part of the end consumer segment for PVC markets.

The demand for pipes in India is driven by various factors such as:

- Government Initiatives: The government has launched several schemes and projects to improve the water supply, sanitation, housing, and urban infrastructure in the country. Some of these initiatives are the Jal Jeevan Mission, which aims to provide piped water supply to every rural household by 2024; Smart Cities Mission, which aims to develop 100 smart cities with modern amenities; Swachh Bharat Mission, which aims to achieve universal sanitation coverage; Pradhan Mantri Awas Yojana, which aims to provide affordable housing to all and others. These initiatives are expected to create a huge demand for pipes in the country.

- Water Conservation and Management: The increasing scarcity of water and the need for water conservation and management have led to the adoption of efficient and sustainable piping solutions in the country. The use of pipes for drip irrigation systems, rainwater harvesting systems, wastewater treatment and reuse systems, and leak detection and prevention systems is expected to increase in the coming years.

- Quality: The consumers and end-users of pipes are becoming more quality-conscious and demanding better performance, durability, and reliability of pipes. The pipe manufacturers are also investing in research and development, innovation, and technology to meet the changing needs and expectations of the customers. The introduction of new products such as lead-free pipes, low-noise pipes, composite pipes, fire-resistant pipes, and others are expected to enhance the quality and value proposition of pipes in the country.

Industry Dynamics:

Organized brands are gaining market share. Factors driving this are-

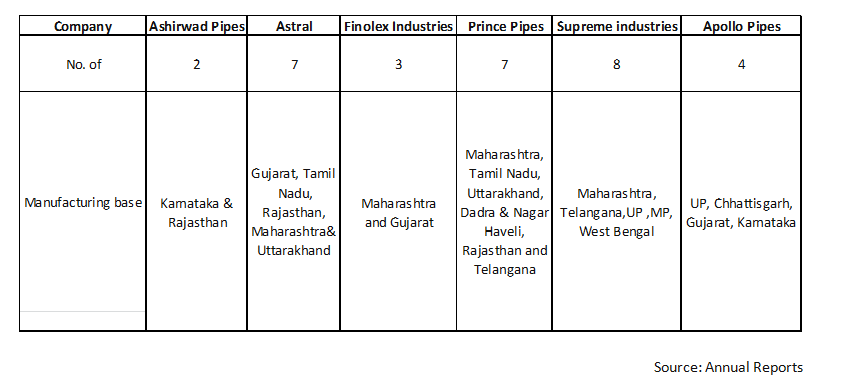

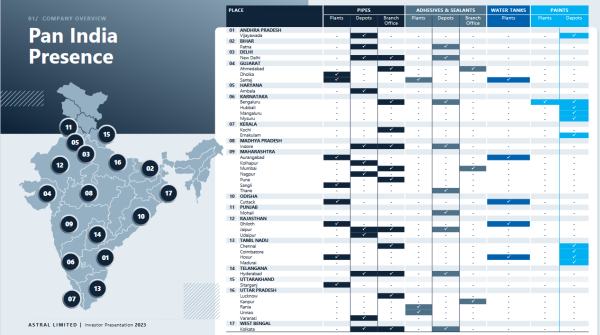

- Pan-India presence: Pipes are bulky products that require high transportation costs. Therefore, it is important to have manufacturing plants close to the sources of raw materials and the markets of customers. This can help reduce costs, improve working capital and inventory management, and increase dealer returns. The transportation costs can vary from 4-6% depending on the distance, but they can be lowered to 2-3% by having local production and supply. This is why the big players in the industry are expanding their capacity. Most of the top players have multiple manufacturing locations across the country. The regional and unorganized players have not followed this strategy, and as a result, they have lost their market share to the larger players in the last few years.

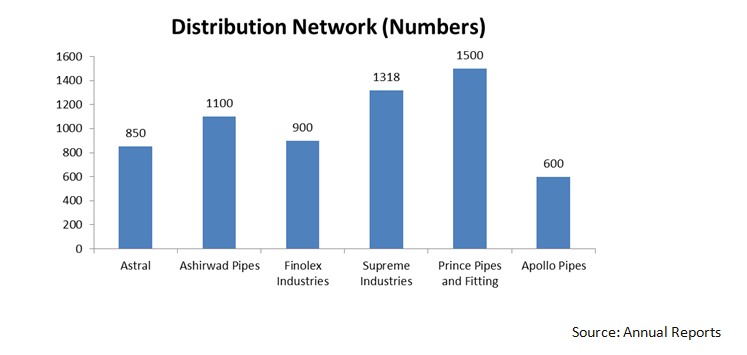

- Distribution network: Organized players are strategically expanding their distribution networks, adding more dealers and retailers in regions traditionally controlled by unorganized and regional players, providing them with a competitive edge and access to untapped markets.

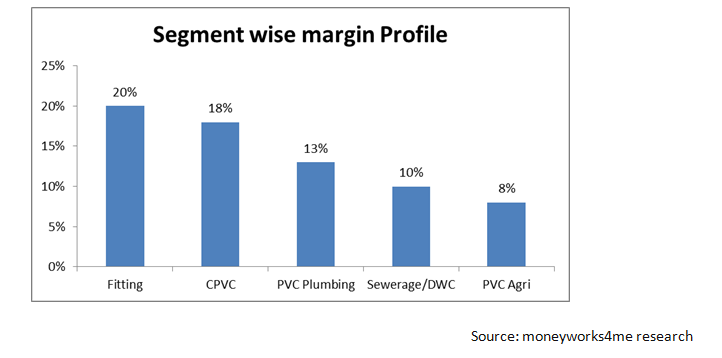

- Specialized nature leading to a difference in margin profile: The pipe sector in India is highly fragmented and competitive, with a large number of players operating at different levels of the value chain. Their margin profile also varies according to that Margins in fittings are the highest in the piping industry (~20%) due to the specialized nature of work and number of SKUs to be maintained Margins in CPVC are the second best ~16-18% due to specialized usage of this product (for hot and cold-water applications), its consumer positioning and raw material sourcing being mostly organized and imported, leading to lower presence of unorganized players. Margins in PVC plumbing range between ~12-13% and that in sewerage/DWC between ~9-12%. PVC Agri has the lowest margin ~6-9% due to its commoditized nature, pricing sensitivity of farmers, and the presence of several unorganized players. Given the intricate and specialized nature of the product, unorganized players encounter significant difficulties when attempting to enter the fittings and CPVC markets. These segments demand a high level of technical knowledge and expertise, which often acts as a barrier to entry for players without the necessary resources and experience.

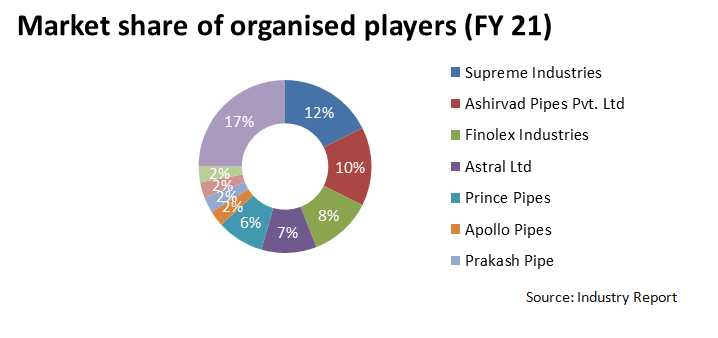

The following is a brief intro of four leading pipe manufacturers in India: Supreme Industries, Astral, Finolex, and Prince Pipe.

Supreme Industries

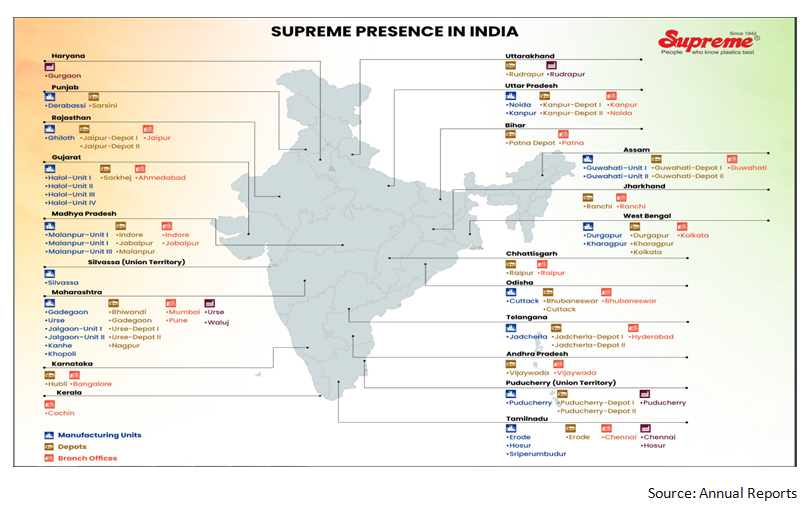

Supreme Industries is one of the largest plastic processors in India, with a product range of over ~10,000 SKUs across various categories such as plastic piping, water tanks, industrial products, packaging products, consumer products, and others. Manufacturing facilities of supreme Industry is spread across the country.

The total installed capacities of the Plastic Piping division of Supreme Industries will reach to about 7,50,000 MTPA by the end of FY24.

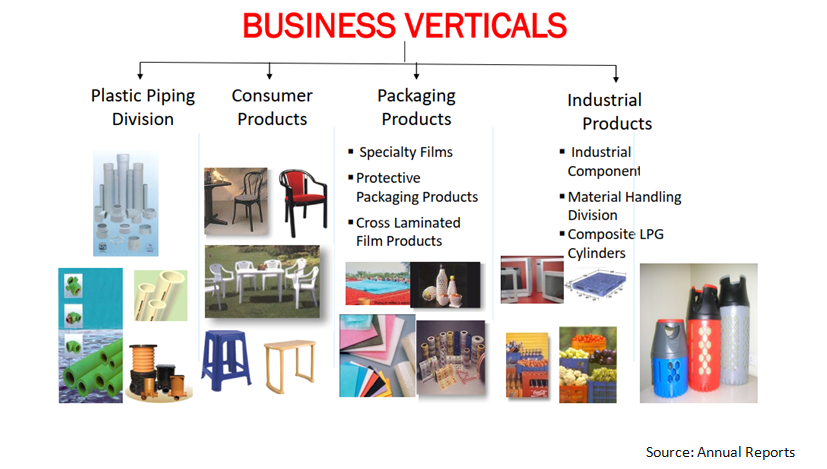

Supreme operates in four business verticals Plastic Pipes, Consumer products, Packaging products, and Industrial Products.

Financial Performance:

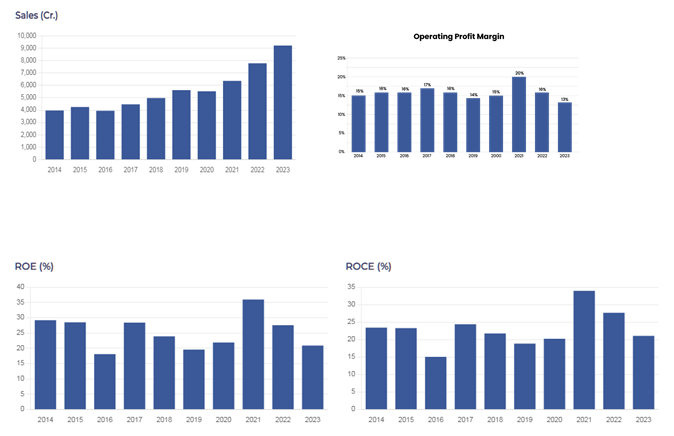

Over the past 10-year company has delivered sales and Profit growth of CAGR 12% and 14% respectively.

Supreme Industry is the largest plastic pipe manufacturer in India with ~12% market share in the organized domestic plastic piping market (as of FY21). The company’s strengths include its diversified product portfolio, strong distribution network, established brand image, innovation capabilities, quality standards, and customer loyalty. The company’s challenges include its exposure to raw material price fluctuations, competition from unorganized players, regulatory uncertainties, and environmental issues.

The company expects to benefit from the increasing demand for plastic piping solutions from various end-use segments. The company plans to expand its capacity by adding new plants and upgrading existing ones. The company also plans to launch new products such as lead-free PVC pipes, low-noise pipes, composite CPVC pipes, and others. The company also plans to increase its market penetration by strengthening its distribution network and brand visibility.

Astral

Astral is the market leader in the domestic niche market of CPVC pipes and fittings with a total manufacturing capacity of 4,27,611 MT. It is the first company that enjoys the advantage of being a pioneer in introducing such products to the Indian market. The manufacturing facilities of Astral are spread across the country.

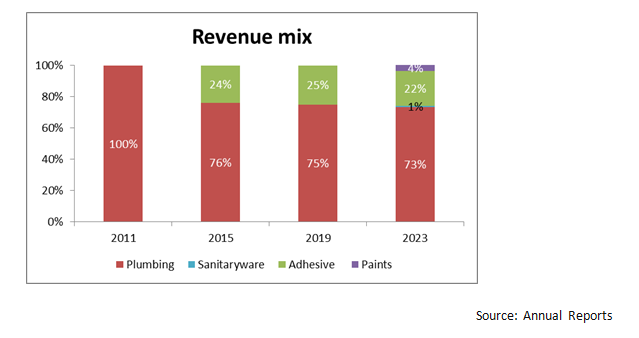

From being a producer of plumbing pipes, Astral has over time expanded its product range into adjacent categories like drainage pipes, fire sprinkler pipes, adhesives, sanitaryware & faucets, and storage water tanks, in order to create new markets and gain market share.

Finacial Performance:

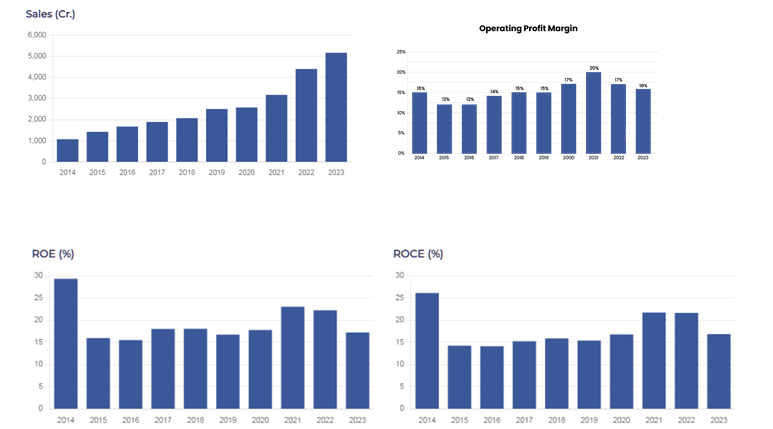

Astral has consistently delivered strong growth both in terms of Sales and profit delivered; with a CAGR of 20% and 22% respectively.

Astral is committed to building brands and identifying growth prospects where it can leverage robust operating cash flow, fostering sustainable growth. This commitment is evident in Astral's successful establishment of the Astral brand in CPVC pipes and its achievements in the adhesive business through the Astral Adhesive and Resinova brands. This strategic approach ensures a promising future for the company.

Finolex Industries

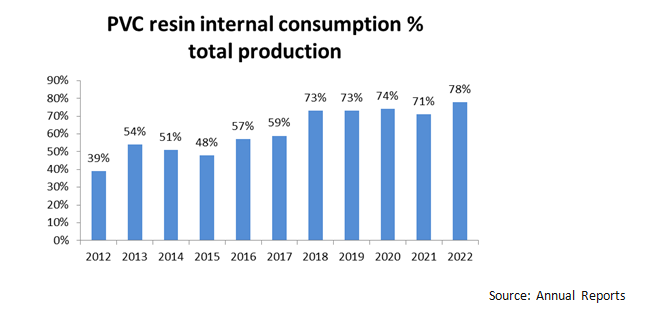

Finolex industry is the only backward integrated PVC Pipes and Fittings manufacturer with an annual production capacity of 4,00,000 ton per annum (TPA) for pipes and fittings and 2,72,000 TPA of PVC resin.

The company has continuously reduced external sales of PVC resin and increased its captive consumption, which benefited in terms of a) cost advantage, b) assured better quality, and c) reduced logistics cost.

Financial Performance

Finloex industries' margins are sensitive to PVC- Ethylene Chloride Dichloride(ECD) spreads. During FY21-22, PVC-ECD spreads were volatile due to supply-demand dynamics, leading to volatile margins.

Finolex industry has high exposure to rural markets which has low margin product mix because of this it has lower profitability as compared to other players in the industry. Finloex’s margin is dependent on PVC-EDC spread as it is also into the resin manufacturing business; a healthy spread results in an improvement in profitability for the company.

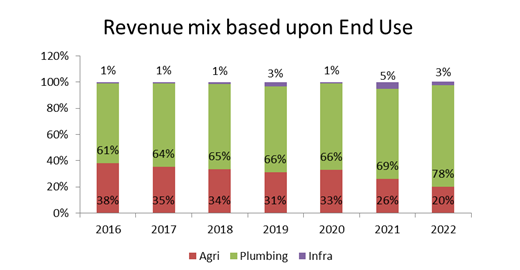

Prince Pipe and Fitting

Prince Pipe is the only company in the plastic pipe sector, whose majority of revenue comes from the pipe segment.

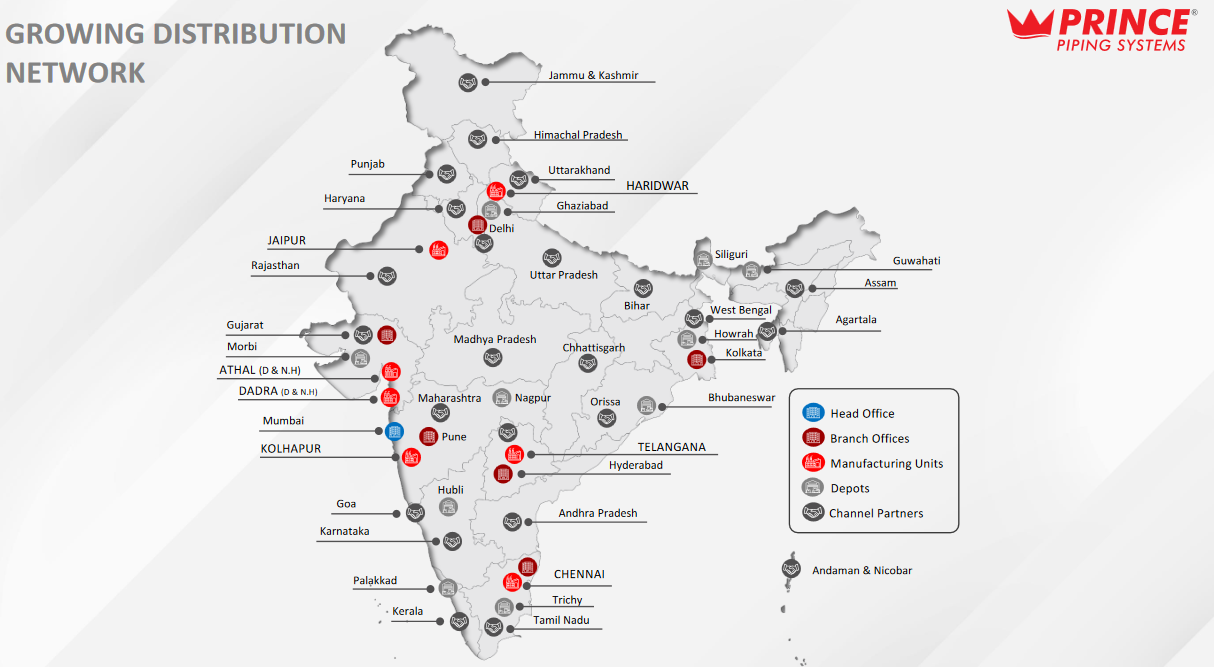

Prince Pipe is focusing on capturing a wide market of plastic pipe & fittings through its exhaustive product basket and Pan India Presence.

As the majority of revenue is coming from the Plumbing and piping division, any slowdown in real estate and infrastructure will directly impact demand for plumbing and sewerage infrastructure piping system (contributing ~77% to its revenue).

Outlook

The Indian plastic pipes industry has historically outpaced GDP growth due to several driving factors, including real estate development, irrigation projects, urban infrastructure initiatives, and sanitation programs. Additionally, increased awareness, adoption, and the replacement of metal pipes with plastic ones have further fueled this growth.

Looking ahead, the pipe industry is poised for continued growth, thanks to various tailwinds. These include robust expansion in the real estate sector, increased government expenditure on irrigation, water supply, and urban infrastructure, the advantages of industry consolidation, and the shift from an unorganized market to an organized one due to the geographical expansion of major players.

As a result, the domestic pipe industry is expected to achieve a higher Compound Annual Growth Rate (CAGR) compared to the past. In the period from FY09 to FY21, the industry experienced a growth rate of 10%-12% CAGR, and demand is anticipated to expand at a rate of 12%-14% CAGR between FY21-25.

While the future of plastic pipe companies appears promising, it's worth noting that the market has already priced in the industry's growth prospects. Most of these stocks currently trade at a premium compared to their long-term averages. While we hold a positive outlook on the industry's growth potential, our approach to valuation remains cautious.

Already have an account? Log in

Want complete access

to this story?

Register Now For Free!

Also get more expert insights, QVPT ratings of 3500+ stocks, Stocks

Screener and much more on Registering.

Download APP

Download APP

Comment Your Thoughts: